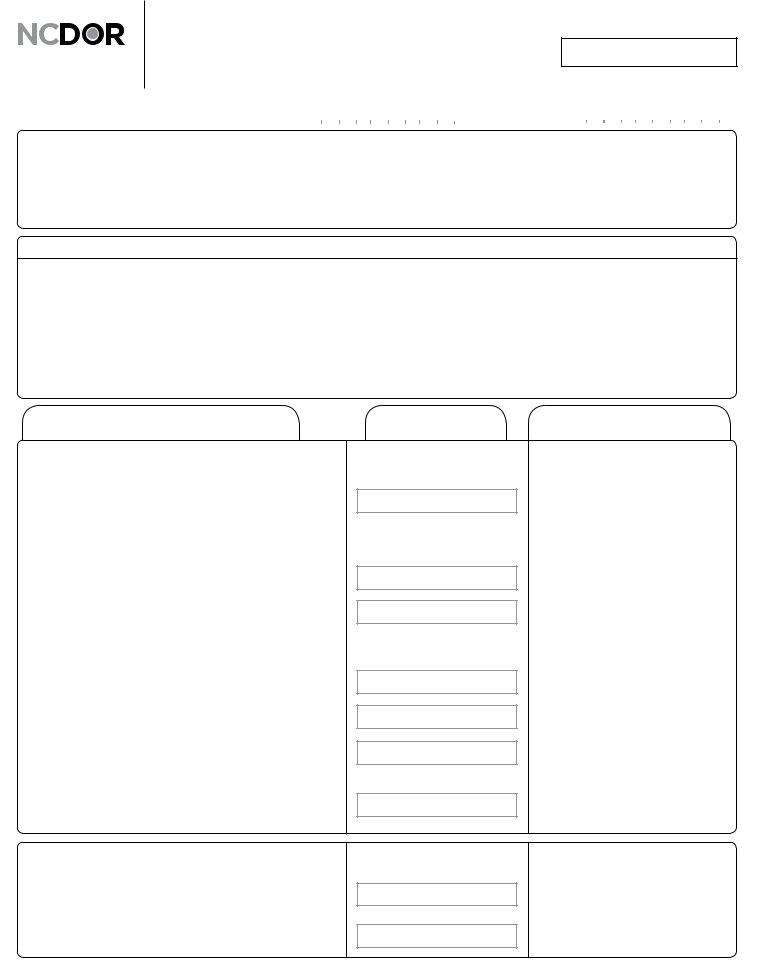

Navigating the intricacies of tax forms can often be a daunting task. Among the various forms that individuals and entities in North Carolina may encounter is the D-403 NC K-1, known as the Partner’s Share of North Carolina Income, Adjustments, and Credits for the 2020 tax year. This form plays a crucial role for partners in a partnership, as it outlines each partner's share of income, losses, adjustments, and credits that are to be reported on their individual tax returns. It requires meticulous attention to detail to ensure accuracy, from adhering to specific instructions on ink color to avoiding common errors like mixing different form types or using incorrect page scaling settings. For partners residing in North Carolina, information from the D-403 NC K-1 form contributes directly to several sections of the D-400 State Income Tax Return, including schedules related to income adjustments, tax credits, and withheld nonwage compensation. Furthermore, it outlines the unique reporting requirements for nonresidents, detailing how to account for their share of North Carolina taxable income and net tax paid. Given the complexity of state tax laws and the potential for costly mistakes, understanding every aspect of the D-403 NC K-1 form is essential for partners in North Carolina to ensure compliance and optimize their tax positions.

| Question | Answer |

|---|---|

| Form Name | D 403 K 1 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Sales and Use Tax Division - ncdor.gov |

Do Not Include This Page

Guidelines

::::==·

. •• ··=!!!:::!:•

Instructions

For Handwritten

Forms

NCD(i)• R

Before Sending

I NORTH CAROLINA DEPARTMENT OF REVENUE

Do not use red ink. Use blue or black ink.

®

Do not use dollar signs, commas, or other punctuation

marks.

, 1 t®I

Printing

Set page scaling to

"none." The

1�

ocopies of returns. Submit originals only.

,,___(8)

Do not mix form types.

Do not select "print on bothc;sides of paper."

;�1

Web

2020 Partner’s Share of

North Carolina Income,

Adjustments, and Credits

DOR

Use

Only

|

|

For calendar year 2020, or fiscal year beginning |

|

|

|

|

|

|

|

|

|

2 0 |

and ending |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

Information About the Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Partnership’s Federal Employer ID Number |

|

Partnership’s Name, Address, and Zip Code |

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information About the Partner

|

Partner’s Identifying Number |

|

Partner’s Name, Address, and Zip Code |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If the partner is a disregarded entity, enter the name and taxpayer identification number of the disregarded entity below:

Name of Disregarded Entity |

|

Taxpayer Identification Number of Disregarded Entity |

|

|

Partner’s Pro Rata Share Items |

|

Amount |

Individuals Filing Form |

|

|

||||

All Partners

1.Share of partnership income (loss)

(Add Lines 1 through 11 of Schedule

2.Additions to income (loss)

(From Form

a.Addition for bonus depreciation

b.Other additions to income (loss)

3.Deductions from income (loss)

(From Form

a.Deduction for bonus depreciation

b.Other deductions from income (loss)

4.Share of tax credits

(From Form

5.Share of tax withheld from nonwage compensation paid for personal services performed in N.C.

(Not included on Form

(This amount should already be included in federal adjusted gross income)

(See Form

(See Form

Form

Nonresidents Only

6.Nonresident’s share of N.C. taxable income (loss)

(From Form

7.Nonresident’s share of net tax paid by the manager of the partnership (From Form