Small businesses are the backbone of the American economy. In order to be successful, small businesses need to take advantage of all the available tax breaks and deductions. The D 403 K 1 form is one such deduction that small business owners should be aware of. This form allows small business owners to claim a charitable contribution deduction for donations made to certain types of qualified charities. To qualify for this deduction, donations must meet certain requirements, so it is important to understand what these are. In this blog post, we will provide an overview of the D 403 K 1 form and explain how small business owners can take advantage of it. Stay tuned for more information!

| Question | Answer |

|---|---|

| Form Name | D 403 K 1 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Sales and Use Tax Division - ncdor.gov |

Do Not Include This Page

Guidelines

::::==·

. •• ··=!!!:::!:•

Instructions

For Handwritten

Forms

NCD(i)• R

Before Sending

I NORTH CAROLINA DEPARTMENT OF REVENUE

Do not use red ink. Use blue or black ink.

®

Do not use dollar signs, commas, or other punctuation

marks.

, 1 t®I

Printing

Set page scaling to

"none." The

1�

ocopies of returns. Submit originals only.

,,___(8)

Do not mix form types.

Do not select "print on bothc;sides of paper."

;�1

Web

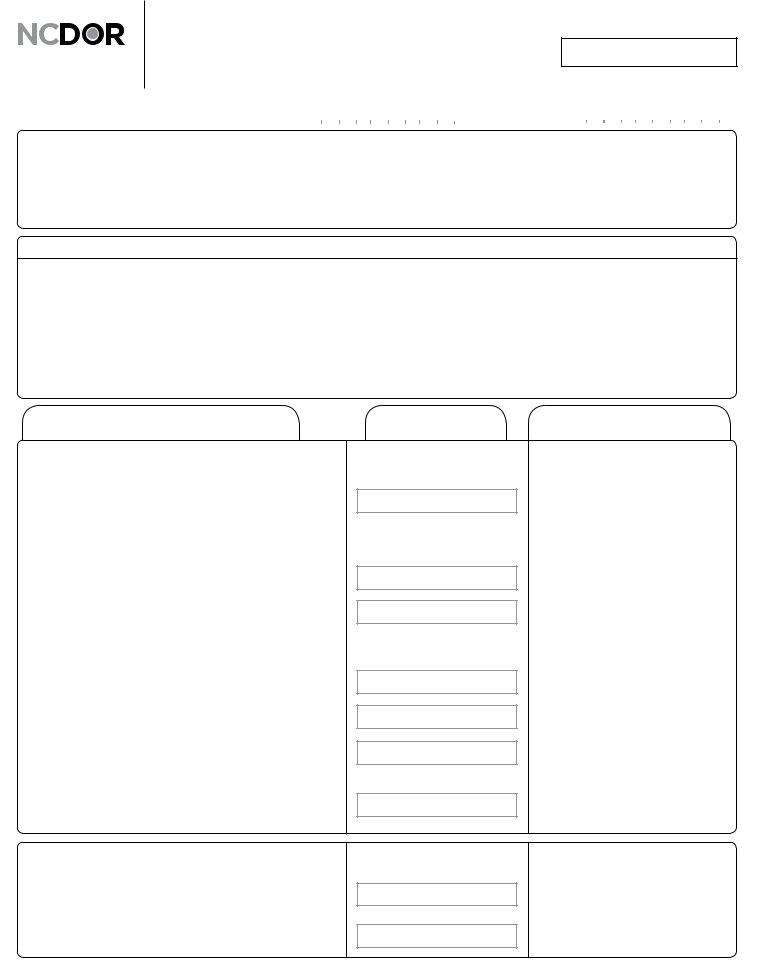

2020 Partner’s Share of

North Carolina Income,

Adjustments, and Credits

DOR

Use

Only

|

|

For calendar year 2020, or fiscal year beginning |

|

|

|

|

|

|

|

|

|

2 0 |

and ending |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

Information About the Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Partnership’s Federal Employer ID Number |

|

Partnership’s Name, Address, and Zip Code |

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information About the Partner

|

Partner’s Identifying Number |

|

Partner’s Name, Address, and Zip Code |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If the partner is a disregarded entity, enter the name and taxpayer identification number of the disregarded entity below:

Name of Disregarded Entity |

|

Taxpayer Identification Number of Disregarded Entity |

|

|

Partner’s Pro Rata Share Items |

|

Amount |

Individuals Filing Form |

|

|

||||

All Partners

1.Share of partnership income (loss)

(Add Lines 1 through 11 of Schedule

2.Additions to income (loss)

(From Form

a.Addition for bonus depreciation

b.Other additions to income (loss)

3.Deductions from income (loss)

(From Form

a.Deduction for bonus depreciation

b.Other deductions from income (loss)

4.Share of tax credits

(From Form

5.Share of tax withheld from nonwage compensation paid for personal services performed in N.C.

(Not included on Form

(This amount should already be included in federal adjusted gross income)

(See Form

(See Form

Form

Nonresidents Only

6.Nonresident’s share of N.C. taxable income (loss)

(From Form

7.Nonresident’s share of net tax paid by the manager of the partnership (From Form