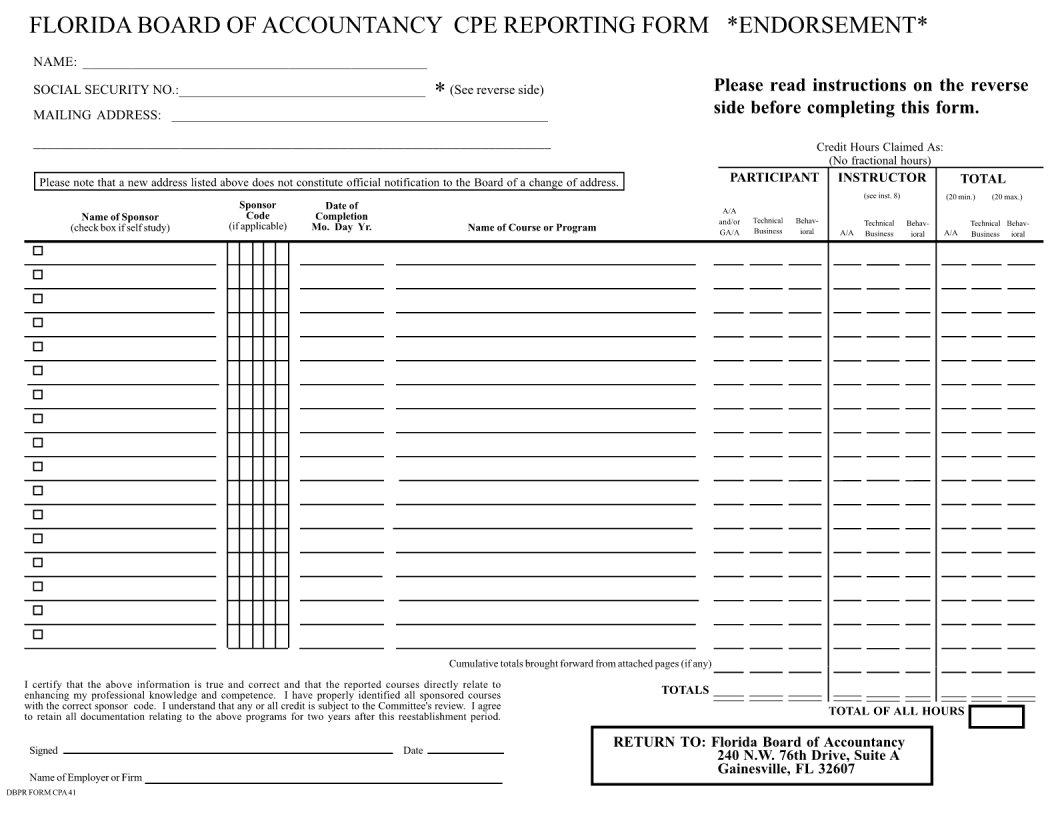

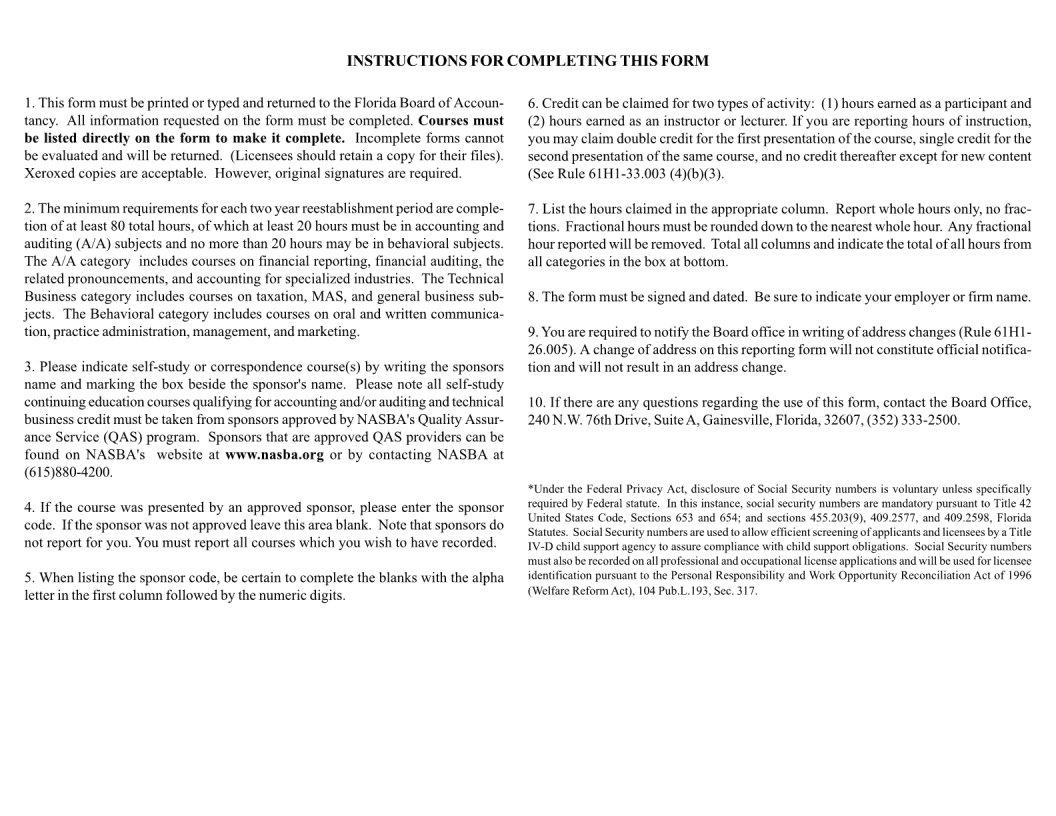

Navigating the path to becoming a certified public accountant (CPA) in the United States involves various steps and requirements, one of which includes the completion of the DBPR CPA41 form. This particular document serves as a critical component in the application process for CPA licensure, managed by the Department of Business and Professional Regulation (DBPR). It is designed to streamline the verification of an applicant's educational background, work experience, and ethical standing, ensuring that all candidates meet the high standards set for accounting professionals. The form requires detailed information regarding an individual's academic achievements, including transcripts and credit hours, alongside a comprehensive review of their practical experience in the field of accounting. Additionally, it addresses the character and fitness aspects necessary for the responsibility associated with the CPA designation. Completing the DBPR CPA41 form accurately is indispensable for aspiring CPAs, as it is a step that facilitates the state board's evaluation process to grant or deny licensure, making it a linchpin in the journey towards achieving this prestigious credential.

| Question | Answer |

|---|---|

| Form Name | Dbpr Form Cpa41 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | WKH, RU, RI, IRUP |