Our finest software engineers worked hard to obtain the PDF editor we are delighted to present to you. This application allows you to effortlessly create ca de 147 form and saves precious time. You need to simply follow this guideline.

Step 1: Choose the button "Get Form Here".

Step 2: Now you can change your ca de 147 form. Our multifunctional toolbar enables you to include, delete, change, and highlight text as well as carry out other commands.

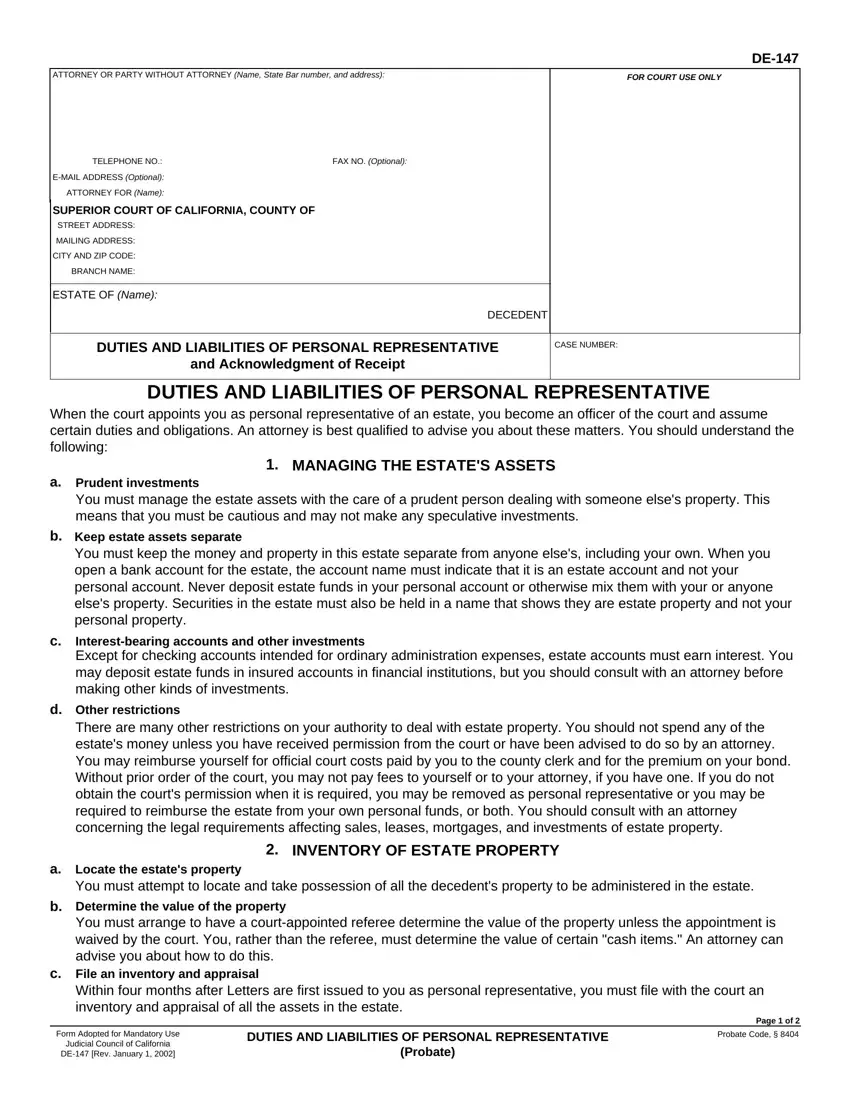

Type in the data demanded by the platform to prepare the file.

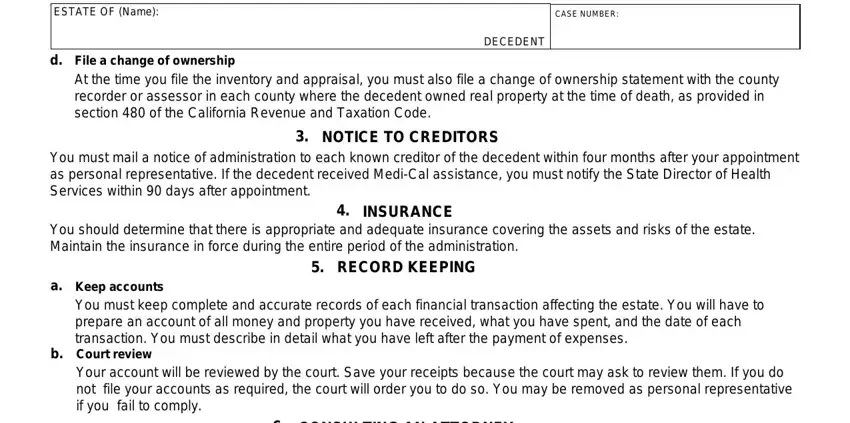

In the segment ESTATE OF Name, CASE NUMBER, DECEDENT, File a change of ownership At the, NOTICE TO CREDITORS, You must mail a notice of, INSURANCE You should determine, RECORD KEEPING, and Keep accounts You must keep provide the particulars which the program requests you to do.

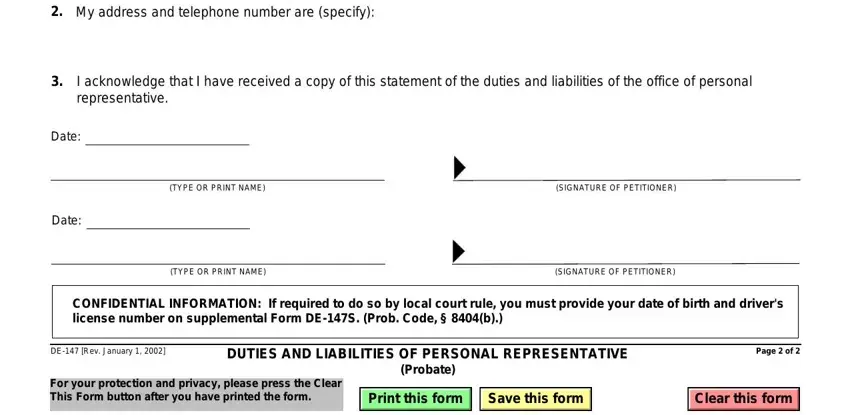

You may be required some fundamental information so you can prepare the I have petitioned the court to be, I acknowledge that I have received, Date, Date, TYPE OR PRINT NAME, SIGNATURE OF PETITIONER, TYPE OR PRINT NAME, SIGNATURE OF PETITIONER, CONFIDENTIAL INFORMATION If, DE Rev January, DUTIES AND LIABILITIES OF PERSONAL, and Page of box.

Step 3: Select the Done button to save your document. Then it is obtainable for transfer to your device.

Step 4: Generate copies of your form. This may protect you from potential future misunderstandings. We do not look at or reveal your data, for that reason be certain it will be secure.