The Delaware Form 1027 is a form that is used to report the ownership interest of a company in another company. This form must be filed with the Secretary of State of Delaware and it is used to provide information about the companies that are involved in the transaction. The Form 1027 must be filed within fifteen days of the transaction taking place. There are certain specific requirements that must be met in order for this form to be filing correctly, so it is important to consult with an attorney before completing it.

| Question | Answer |

|---|---|

| Form Name | Delaware Form 1027 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | TY09_1027 delaware form 1027 instructions |

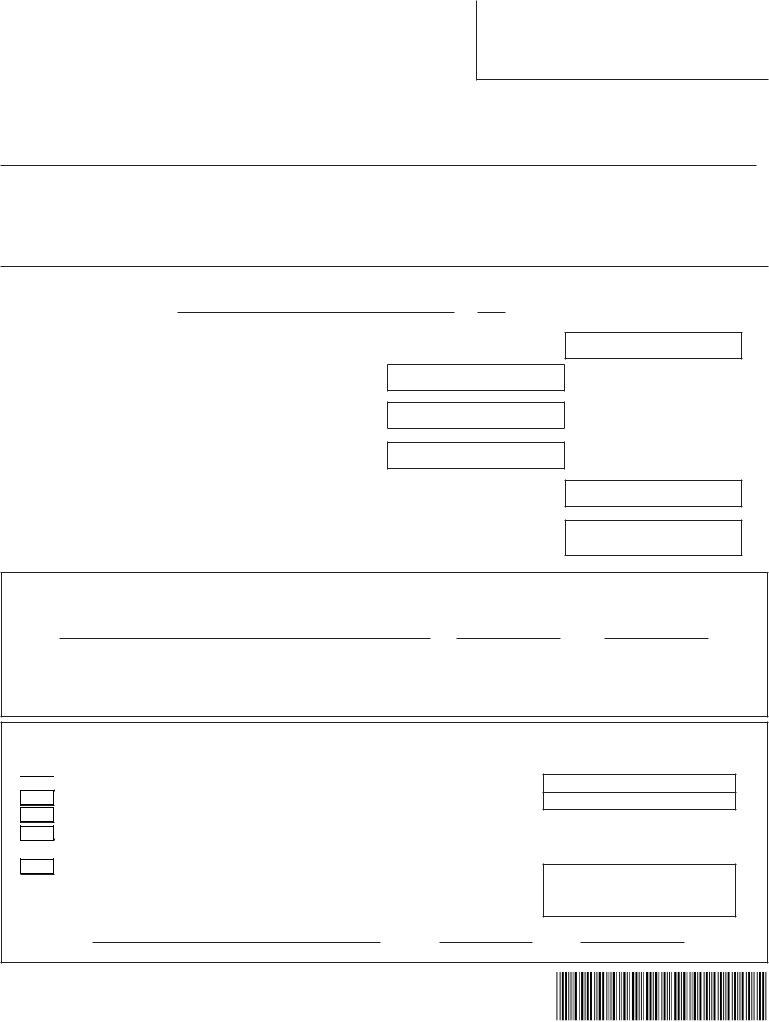

DELAWARE |

TAX YEAR |

FORM 1027 |

2009 |

|

DO NOT WRITE IN THIS BOX

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO FILE A DELAWARE INDIVIDUAL INCOME TAX RETURN

NOTE: PREPARE THIS FORM IN DUPLICATE. THE AMOUNT SHOWN ON LINE 6 BELOW.

FILE THE ORIGINAL WITH THE DIVISION OF REVENUE, STATE OF DELAWARE ON OR BEFORE THE DUE DATE AND PAY ATTACH THE DUPLICATE TO YOUR DELAWARE PERSONAL INCOME TAX RETURN.

PLEASE

OR

TYPE

NAME, (IF JOINT RETURN, GIVE FIRST NAMES AND INITIALS OF BOTH) |

LAST NAME |

YOUR SOCIAL SECURITY NUMBER |

|

|

|

PRESENT HOME ADDRESS (NUMBER & STREET, INCLUDING APT. NUMBER OR RURAL ROUTE) |

SPOUSE’S SOCIAL SECURITY NUMBER |

|

|

|

|

CITY, TOWN OR POST OFFICE |

STATE |

ZIP CODE |

|

|

|

AN AUTOMATIC EXTENSION OF TIME UNTIL OCTOBER 15, 2010 IS HEREBY REQUESTED IN WHICH TO FILE A DELAWARE PERSONAL INCOME

TAX RETURN FOR THE CALENDAR YEAR 2009 (OR IF A FISCAL YEAR RETURN UNTIL |

|

|

, 20 |

|

FOR THE |

|

|

|

|

||||

TAXABLE YEAR BEGINNING |

, 20 |

). |

|

|

|

|

|

|

|

|

|

|

|

1.TOTAL INCOME TAX LIABILITY YOU EXPECT TO OWE FOR 2009....................................................................

2.DELAWARE INCOME TAX WITHHELD....................................................

3.TAX YEAR 2009 ESTIMATED TAX PAYMENTS (INCLUDE PRIOR YEARS OVERPAYMENT ALLOWED AS A CREDIT)...............................

4.OTHER PAYMENTS & CREDITS..............................................................

5.TOTAL (ADD LINES 2, 3, AND 4)..............................................................................................................................

6.BALANCE DUE (SUBTRACT LINE 5 FROM LINE 1). PAY IN FULL WITH THIS APPLICATION

........................................................................................................................................................BALANCE DUE>

SIGNATURE AND VERIFICATION

IF PREPARED BY TAXPAYER: UNDER PENALTY OF PERJURY, I DECLARE THAT TO THE BEST OF MY KNOWLEDGE AND BELIEF, THE

STATEMENTS MADE HEREIN ARE TRUE AND CORRECT.

YOUR SIGNATURE |

|

DATE |

|

DAYTIME PHONE N0. |

|

|

|

|

|

SPOUSE’S SIGNATURE |

|

DATE |

|

DAYTIME PHONE NO. |

(IF FILING JOINTLY, BOTH MUST SIGN EVEN IF ONLY ONE HAD INCOME) |

|

|

|

|

IF PREPARED BY SOMEONE OTHER THAN TAXPAYER: UNDER PENALTIES OF PERJURY, I DECLARE THAT TO THE BEST OF MY KNOWLEDGE AND BELIEF, THE STATEMENTS MADE HEREIN ARE TRUE AND CORRECT, THAT I AM AUTHORIZED BY THE TAXPAYER TO PREPARE THIS APPLICATION, AND THAT I AM:

A MEMBER IN GOOD STANDING OF THE BAR OF THE HIGHEST COURT OF (SPECIFY JURISDICTION)....

A CERTIFIED PUBLIC ACCOUNTANT DULY QUALIFIED TO PRACTICE IN (SPECIFY JURISDICTION)..........

A PERSON ENROLLED TO PRACTICE BEFORE THE INTERNAL REVENUE SERVICE

A DULY AUTHORIZED AGENT HOLDING A POWER OF ATTORNEY WITH RESPECT TO FILING AN EXTENSION OF TIME. (THE POWER OF ATTORNEY NEED NOT BE SUBMITTED UNLESS REQUESTED)

A PERSON STANDING IN CLOSE PERSONAL BUSINESS RELATIONSHIP TO THE TAXPAYER, WHO IS

UNABLE TO SIGN THIS APPLICATION BECAUSE OF ILLNESS, ABSENCE, OR OTHER GOOD CAUSE. MY

RELATIONSHIP TO THE TAXPAYER AND THE REASON WHY THE TAXPAYER IS UNABLE TO SIGN THIS

APPLICATION ARE:

YOUR SIGNATURE |

DATE |

DAYTIME PHONE N0. |

SEE INSTRUCTIONS ON REVERSE SIDE

INSTRUCTIONS

1.This application is to be used by an individual to request an automatic five and half (5 ½) month extension of time to file Form

An extension will be granted upon the timely and proper filing of this form with payment of any required amount shown on Line 6. If an extension is not filed timely (see #4 below), it will be denied.

CAUTION: This is not an extension of time for the payment of tax. Interest will accrue at the rate of

2.An application for extension is not required if the balance due on the return will be zero or less and an extension has been filed with the Internal Revenue Service. If when the return is filed and a balance due is owed, a penalty will be assesssed for filing the return late. If you have a doubt as to whether the final return will be a balance due, file Form 1027 for an extension.

3.If you and your spouse will be filing Separate (filing status 3) Delaware personal income tax returns, a separate Application for Extension, Form 1027, MUST BE filed for each spouse.

4.File this application on or before April 30th, OR before the original due date of Form

5.Complete this form in duplicate. Entries must be made on Lines 1 through 6. File the original with the Division of Revenue and pay the amount shown on Line 6. Attach the duplicate to the FACE of Form

6.When filing Form

7.Any unpaid portion of the final tax will bear interest at the rate of

8.Penalty - The law imposes a penalty of five percent (5%) per month (or fractional part thereof) of the tax for failure to file a timely return, unless you can show reasonable cause for failure to file. If the return is not filed within the period of the extension granted (i.e.: by October 15th), the penalty will be assessed unless reasonable cause is established.

9.Blanket Requests - Blanket requests for extensions will not be granted. You must submit a separate application for each return.

Subsequent Extensions

To extend your due date beyond October 15, file a photocopy of your approved Federal extension with the Delaware Division of Revenue on or before the expiration granted on Form 1027. An approved additional federal extension will extend the due date of your Delaware return to the same date as your additional federal extension due date. A photocopy of the approved Federal extension must be attached to the final return when filed.

MAKE CHECK PAYABLE AND MAIL TO: DELAWARE DIVISION OF REVENUE, P.O. BOX 508, WILMINGTON, DE

REVISED 11/19/2009