The State of Delaware offers a variety of income tax credits designed to stimulate economic growth, support green industries, foster research and development, conserve land and historic resources, preserve historic sites, mitigate traffic through the Travelink program, and encourage investment in community-based programs. These incentives, outlined in the Delaware 700 Income Tax Credit Schedule, are available for different types of entities, including C corporations, S corporations, partnerships, sole proprietors, estates/trusts, and decedent estates. Each section within the form accommodates the computation of credits, starting with carryovers from previous years and adding in the current year's approved credits. For those qualifying, these credits can significantly reduce the Delaware income tax liability, subject to specific limitations. For instance, economic development, green industries, and research and development credits are limited to 50% of the tax liability, while other credits can offset up to 100% of the liability. It is critical for taxpayers to understand the form's instructions for accurately claiming their eligible credits, considering their entity type and ownership percentage in pass-through entities. The final tally from this form directly impacts what is claimed on Delaware income tax returns, demonstrating the form's essential role in Delaware's fiscal landscape.

| Question | Answer |

|---|---|

| Form Name | Delaware Form 700 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | A-1, Wilm, form 700, MITIGATION |

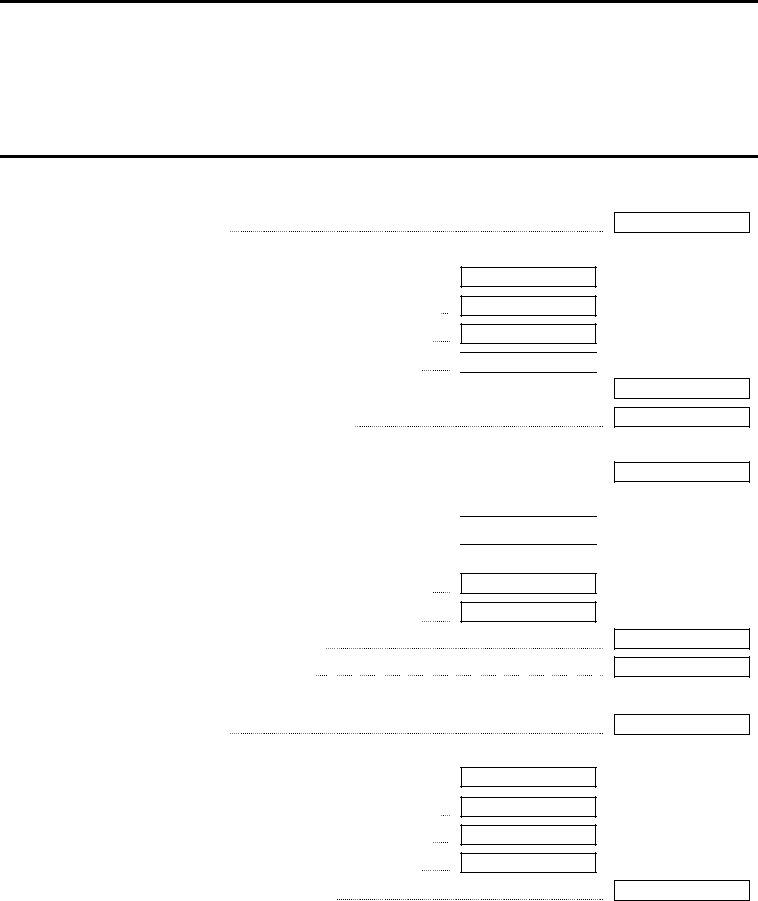

STATE OF DELAWARE FORM 700

DELAWARE INCOME TAX CREDIT SCHEDULE

DIVISION OF REVENUE

820 North French St.

P.O. Box 8911

Wilm., DE

PART A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1. |

Enter Federal Employer Identification Number or Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

Tax Period Ending Date |

||||||||||

|

Federal Employer Identification Number: |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( MM / DD / YY ) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Social Security Number: |

2 |

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______ / _______ /_______ |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Name of Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART B – DELAWARE INCOME TAX CREDIT COMPUTATION

ECONOMIC DEVELOPMENT CREDITS

1. Credit carryover from previous year

2.Current year credits approved for a qualified:

(a)C corporation (Enter the total amount of approved current year credit)

(b) S corporation (Multiply total credit by percentage of stockholder ownership)

(c) Partnership (Multiply total credit by percentage ownership of partnership)

(d) Sole Proprietor (Enter the total amount of approved current year credit) 3. Total current year credits (Add Lines 2(a) through 2(d)) 4. Total Economic Development Credits (Add Line 1 and Line 3)

GREEN INDUSTRIES CREDITS

5.Credit carryover from previous year

6.Current year credits approved for a qualified:

(a)C corporation (Enter the total amount of approved current year credit)

(b)S corporation (Multiply total credit by percentage of stockholder ownership)

(c) Partnership (Multiply total credit by percentage ownership of partnership)

(d) Sole Proprietor (Enter the total amount of approved current year credit)

7.Total current year credits (Add Lines 6(a) through 6(d))

8. Total Green Industries Credits (Add Line 5 and Line 7)

RESEARCH & DEVELOPMENT CREDITS

9. Credit carryover from previous year

10. Current year credits approved for a qualified:

(a) C corporation (Enter the total amount of approved current year credit)

(b) S corporation (Multiply total credit by percentage of stockholder ownership)

(c) Partnership (Multiply total credit by percentage ownership of partnership)

(d) Sole Proprietor (Enter the total amount of approved current year credit)

11. Total current year credits (Add Lines 10(a) through 10(d))

12.Total Research & Development Credits (Add Line 9 and Line 11)

13.Add Lines 4, 8 and 12

14.Enter 50% of the current year Delaware income tax liability

15.Enter the smaller of Line 13 or Line 14

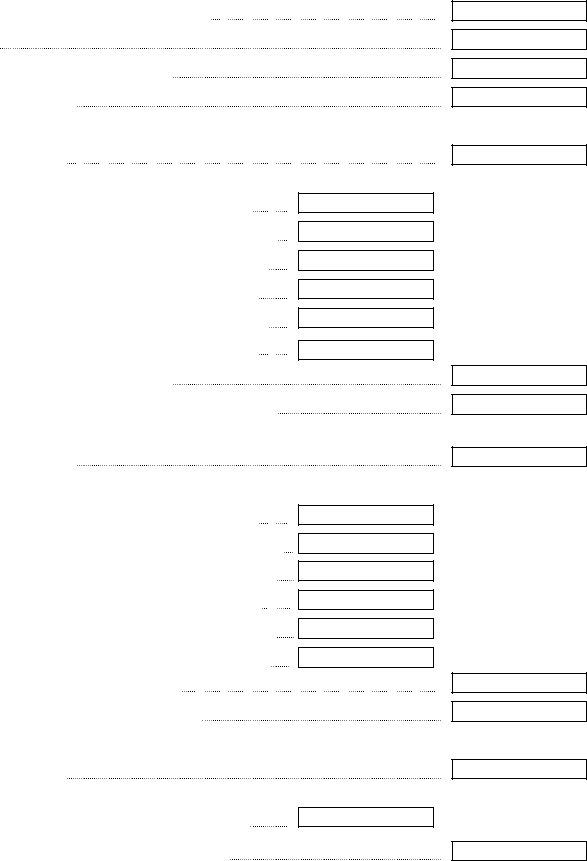

LAND & HISTORIC RESOURCE CONSERVATION CREDITS

16.Credit carryover from previous year

17.Current year credits approved for a qualified:

(a)C corporation (Enter the total amount of approved current year credit)

(b)S corporation (Multiply total credit by percentage of stockholder ownership)

(c)Partnership (Multiply total credit by percentage ownership of partnership)

(d)Sole Proprietor (Enter the total amount of approved current year credit)

(e)Estate/Trust (Multiply total credit by percentage of beneficiary ownership)

(f)Decedent Estate (Enter the total amount of approved current year credit)

18.Total current year credits (Add Lines 17(a) through 17(f))

19.Total Land & Historic Resource Conservation Credits (Add Line 16 and Line 18)

HISTORIC PRESERVATION CREDITS

20.Credit carryover from previous year

21.Current year credits approved for a qualified:

(a)C corporation (Enter the total amount of approved current year credit)

(b)S corporation (Multiply total credit by percentage of stockholder ownership)

(c)Partnership (Multiply total credit by percentage ownership of partnership)

(d)Sole Proprietor (Enter the total amount of approved current year credit)

(e)Estate/Trust (Multiply total credit by percentage of beneficiary ownership)

(f)Decedent Estate (Enter the total amount of approved current year credit)

22.Total current year credits (Add Lines 21(a) through 21(f))

23.Total Historic Preservation Credits (Add Line 20 and Line 22)

TRAVELINK TRAFFIC MITIGATION CREDITS (Corporate Income Tax Credit Only)

24.Credit carryover from previous year

25.Current year credits approved for a qualified:

(a)C corporation (Enter the total amount of approved current year credit)

26.Total Travelink Traffic Mitigation Credits (Add Line 24 and Line 25(a))

NEIGHBORHOOD ASSISTANCE TAX CREDITS (Corporate Income Tax Credit Only)

27. Credit carryover from previous year

28. Current year credits approved for a qualified:

(a)C corporation (Enter the lesser of $100,000 or 50% of the amount invested in a

29. Total Neighborhood Assistance Credits (Add Line 27 and Line 28(a))

30. Add Lines 19, 23, 26 and 29

31. Enter 100% of the current year Delaware income tax liability

32. Subtract Line 15 from Line 31

33. Enter the smaller of Line 30 or Line 32

34.TOTAL DELAWARE INCOME TAX CREDITS. Add Line 15 and Line 33.

(Read the general and specific instructions to determine proper placement of credits on your Delaware income tax return)

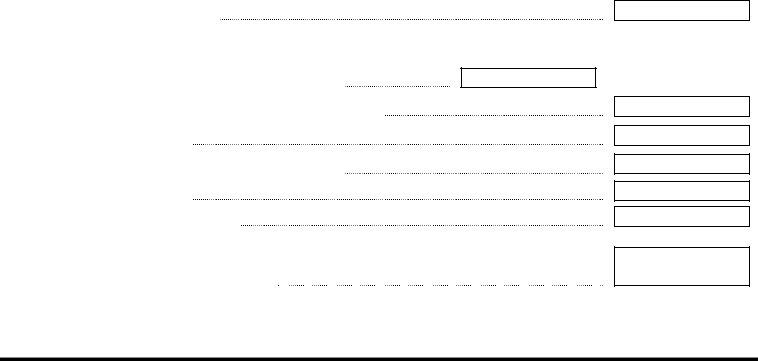

SPECIFIC INSTRUCTIONS

Delaware Form 700 must be completed by the person actually claiming the credits on the Delaware income tax return. A qualified and approved C corporation or Sole Proprietor will claim the credit directly on their respective Delaware income tax return. A Partnership or S corporation does not directly claim the Delaware income tax credits because the entities are classified as

Enter the credit carryover and the current year credits on the appropriate lines for the Economic Development, Green Industries and Research & Development credits. Enter the aggregate of the three credits on Line 13. Enter on Line 14 50% of the Delaware income tax liability of the entity actually claiming the credits. Enter on Line 15 the smaller of Line 13 or Line 14. These credits are limited to 50% of the Delaware income tax liability.

Enter the credit carryover and the current year credits on the appropriate lines for the Land & Historic Resource Conservation, Historic Preservation, Travelink Traffic Mitigation and Neighborhood Assistance credits. Enter the aggregate of the four credits on Line 30. Enter on Line 31, 100% of the Delaware income tax liability of the entity actually claiming the credits. Enter on Line 32 the remainder of the Delaware income tax liability not used to claim the Economic Development, Green Industries or Research & Development credits. Enter on Line 33, the smaller of Line 30 or Line 32. These credits are limited to 100% of the Delaware income tax liability. To determine the aggregate of the approved Delaware income tax credits to be claimed during the current year, add Line 15 and Line 33 and enter the result on Line 34. Enter the amount from Line 34 on the appropriate Delaware income tax credit line based upon your filing requirement. IF THE ENTITY CLAIMING THE DELAWARE INCOME TAX

CREDITS IS A:

1.C corporation - Enter the amount from Line 34 on Form 1100, Page 1, Line 17.

2.S corporation - Enter the amount from Line 34 on Form 1100S, Schedule

3.Partnership - If a resident partner, enter the amount from Line 34 on Form

4.Resident Individual/Sole Proprietor - Enter the amount from Line 34 on Form

5.Nonresident Individual/Sole Proprietor - Enter the amount from Line 34 on Form

6.Resident & Nonresident Estate/Trust - If a resident beneficiary, enter the amount from Line 34 on Form

7.Resident & Nonresident Decedent Estate - Enter the amount from Line 34 on the appropriate line of Form 900.