With the help of the online tool for PDF editing by FormsPal, it is easy to fill out or edit Dr 0021W Form here. Our tool is continually developing to present the best user experience attainable, and that's thanks to our resolve for continual development and listening closely to user feedback. Getting underway is effortless! Everything you should do is follow the next simple steps below:

Step 1: Just click the "Get Form Button" above on this page to start up our pdf form editor. Here you will find all that is required to fill out your document.

Step 2: After you access the online editor, you will notice the form prepared to be filled in. In addition to filling in different fields, you may as well do several other things with the form, specifically putting on custom text, modifying the original text, adding illustrations or photos, signing the document, and a lot more.

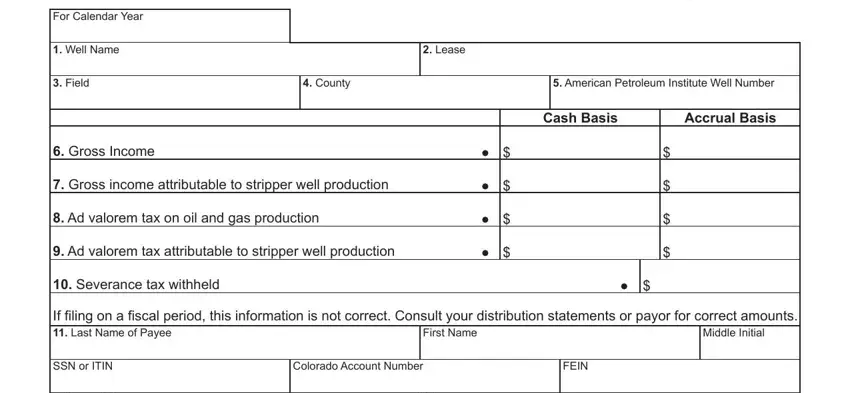

As for the blank fields of this precise PDF, this is what you want to do:

1. It is recommended to fill out the Dr 0021W Form properly, hence take care while filling out the sections that contain all these blanks:

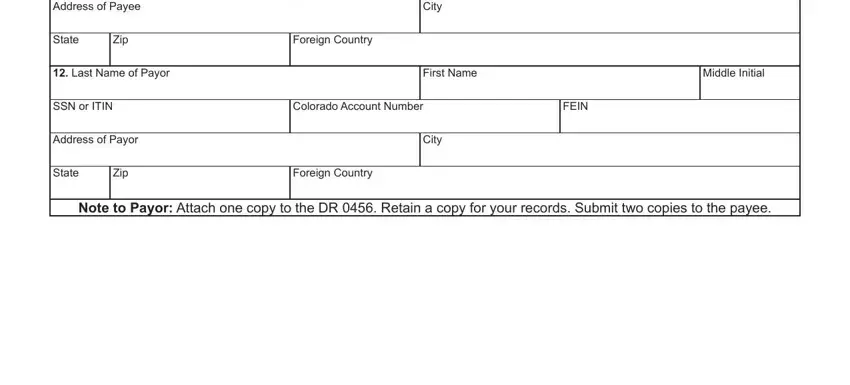

2. After this section is done, proceed to enter the relevant details in these: Address of Payee, Last Name of Payor, SSN or ITIN, Address of Payor, State, Zip, Foreign Country, City, First Name, Middle Initial, Colorado Account Number, FEIN, City, State, and Zip.

Always be very attentive while completing First Name and Middle Initial, since this is where a lot of people make some mistakes.

Step 3: After you've glanced through the information entered, click on "Done" to conclude your FormsPal process. Right after getting a7-day free trial account with us, it will be possible to download Dr 0021W Form or send it via email promptly. The PDF form will also be readily accessible from your personal account page with all of your edits. FormsPal offers safe form editor devoid of data recording or distributing. Feel comfortable knowing that your details are secure here!