Should you wish to fill out colorado dr 0026, you don't have to download any software - just use our online PDF editor. To retain our editor on the forefront of convenience, we strive to put into action user-oriented capabilities and improvements on a regular basis. We are routinely pleased to receive suggestions - play a vital role in remolding how we work with PDF docs. To get the ball rolling, take these basic steps:

Step 1: Press the orange "Get Form" button above. It will open up our pdf editor so you could start filling in your form.

Step 2: Once you access the editor, you will see the form all set to be completed. Other than filling out different fields, it's also possible to do many other actions with the Document, such as writing your own textual content, editing the original textual content, adding images, placing your signature to the document, and more.

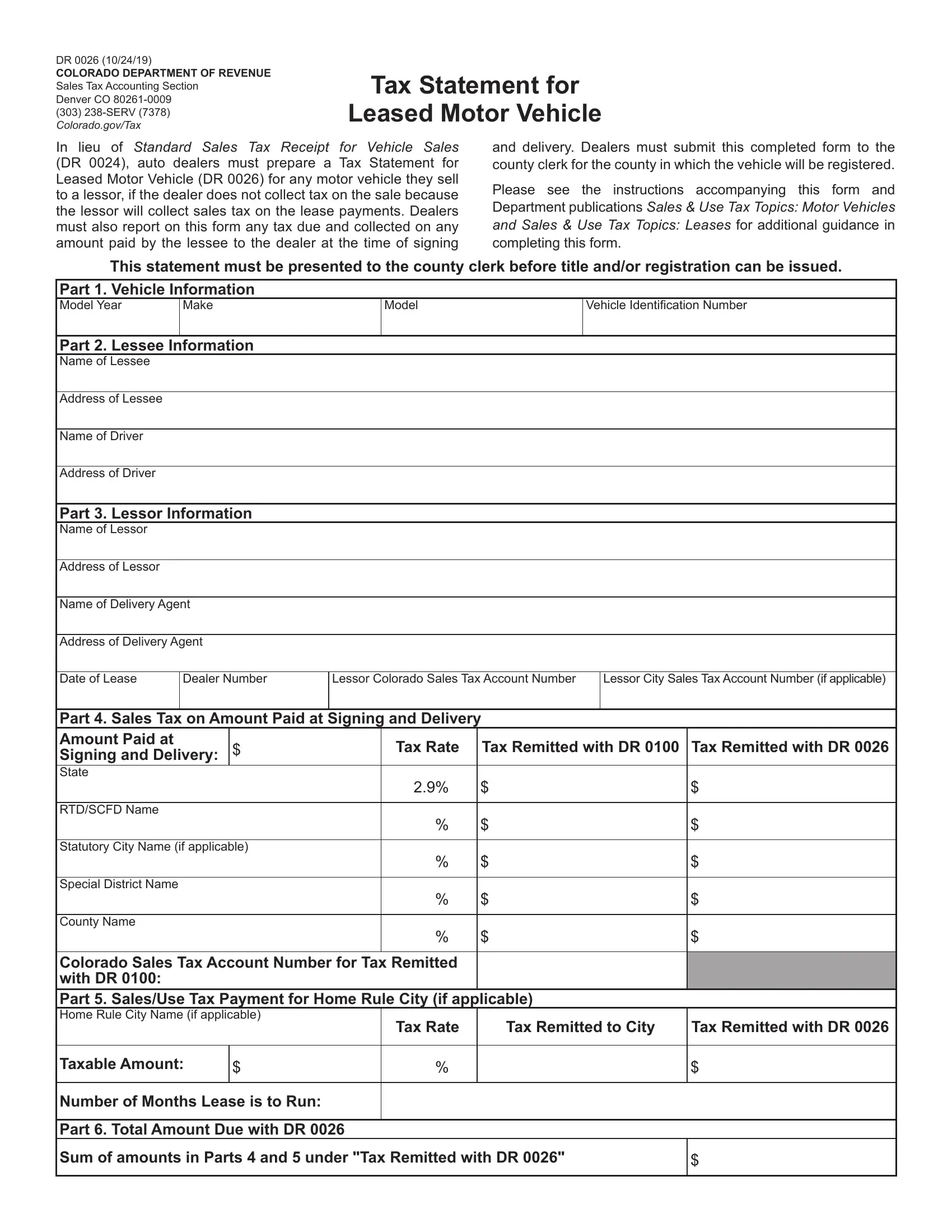

This document will require some specific information; to ensure consistency, you need to adhere to the tips below:

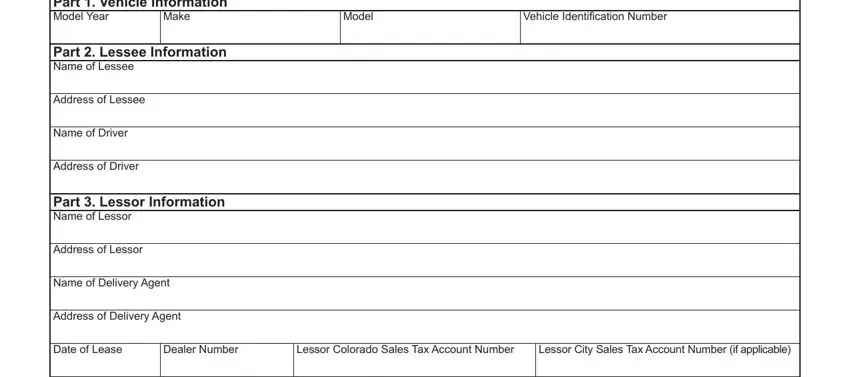

1. When filling out the colorado dr 0026, be certain to include all important fields in their relevant area. It will help to hasten the work, enabling your information to be handled quickly and properly.

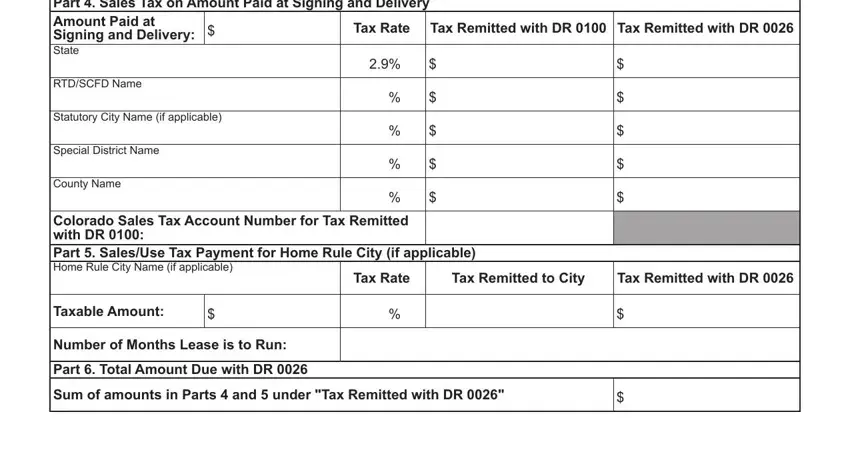

2. The third part would be to submit the following fields: Part Sales Tax on Amount Paid at, Tax Rate, Tax Remitted with DR Tax Remitted, RTDSCFD Name, Statutory City Name if applicable, Special District Name, County Name, Colorado Sales Tax Account Number, Tax Rate, Tax Remitted to City, Tax Remitted with DR, Taxable Amount, Number of Months Lease is to Run, Part Total Amount Due with DR, and Sum of amounts in Parts and.

Be very attentive while filling in Taxable Amount and Tax Remitted to City, since this is where a lot of people make some mistakes.

Step 3: Look through what you've typed into the form fields and click on the "Done" button. Sign up with us right now and easily gain access to colorado dr 0026, all set for downloading. All alterations made by you are saved , helping you to edit the pdf further as needed. FormsPal is devoted to the confidentiality of our users; we ensure that all personal information used in our tool stays confidential.