Making use of the online editor for PDFs by FormsPal, you may fill in or change fl dr 452 here and now. Our team is devoted to giving you the best possible experience with our tool by consistently releasing new features and improvements. With all of these updates, using our tool gets better than ever! With some basic steps, you'll be able to begin your PDF editing:

Step 1: First of all, open the tool by clicking the "Get Form Button" at the top of this page.

Step 2: Using our advanced PDF tool, you may accomplish more than merely fill in forms. Express yourself and make your documents appear perfect with customized text added in, or modify the original input to perfection - all that comes along with an ability to insert your personal photos and sign the document off.

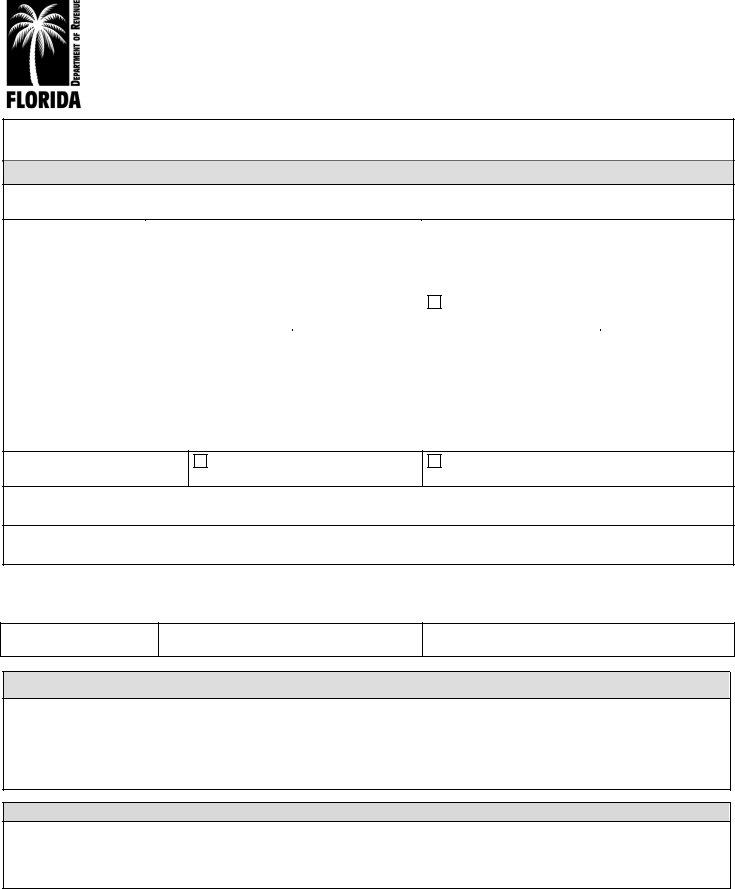

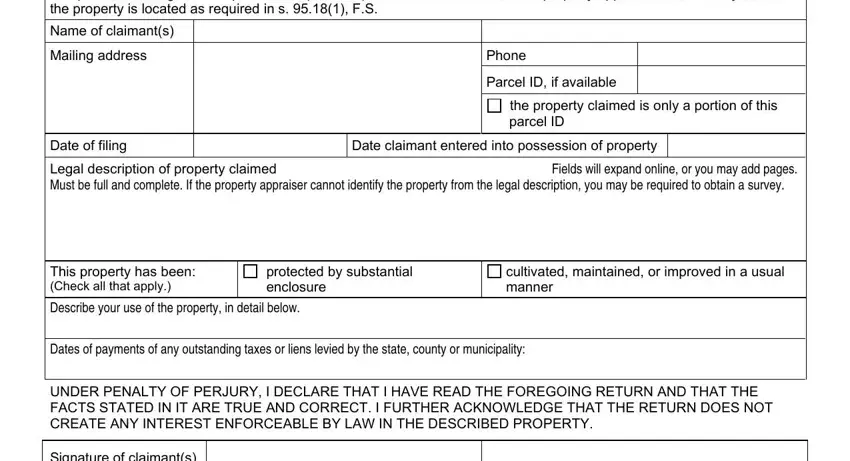

This PDF form requires specific information; in order to ensure correctness, please take note of the following steps:

1. Start completing the fl dr 452 with a number of essential fields. Gather all of the necessary information and make sure not a single thing missed!

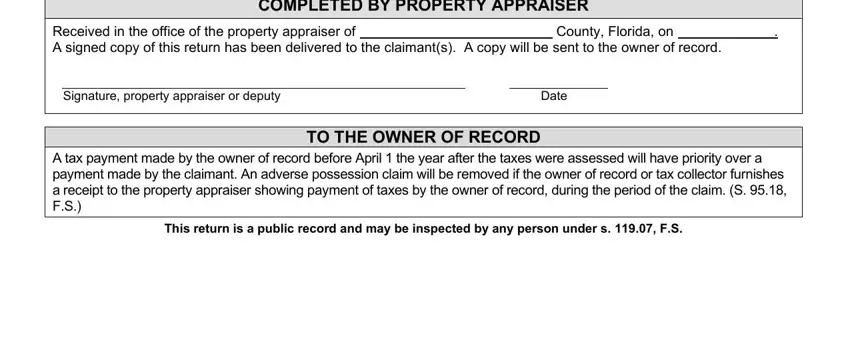

2. Once your current task is complete, take the next step – fill out all of these fields - Received in the office of the, County Florida on, COMPLETED BY PROPERTY APPRAISER, Signature property appraiser or, Date, TO THE OWNER OF RECORD, A tax payment made by the owner of, and This return is a public record and with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be very mindful when filling in County Florida on and A tax payment made by the owner of, since this is where many people make errors.

Step 3: Spell-check all the details you have typed into the blank fields and press the "Done" button. Go for a 7-day free trial account with us and gain direct access to fl dr 452 - downloadable, emailable, and editable from your personal cabinet. FormsPal ensures your data confidentiality by having a protected system that never records or shares any type of private data involved in the process. Be confident knowing your paperwork are kept confidential any time you use our editor!