colorado tax form dr 6596 can be filled out online without difficulty. Just open FormsPal PDF editing tool to perform the job right away. Our professional team is constantly endeavoring to expand the editor and insure that it is even better for clients with its cutting-edge functions. Uncover an ceaselessly revolutionary experience now - check out and uncover new possibilities along the way! With just a few simple steps, it is possible to begin your PDF editing:

Step 1: Press the orange "Get Form" button above. It will open our editor so you could begin filling in your form.

Step 2: With the help of our handy PDF tool, it is easy to do more than simply complete blanks. Express yourself and make your docs seem perfect with custom text put in, or fine-tune the original input to perfection - all comes with an ability to add any photos and sign the file off.

This document will need specific details; in order to ensure accuracy and reliability, be sure to adhere to the suggestions hereunder:

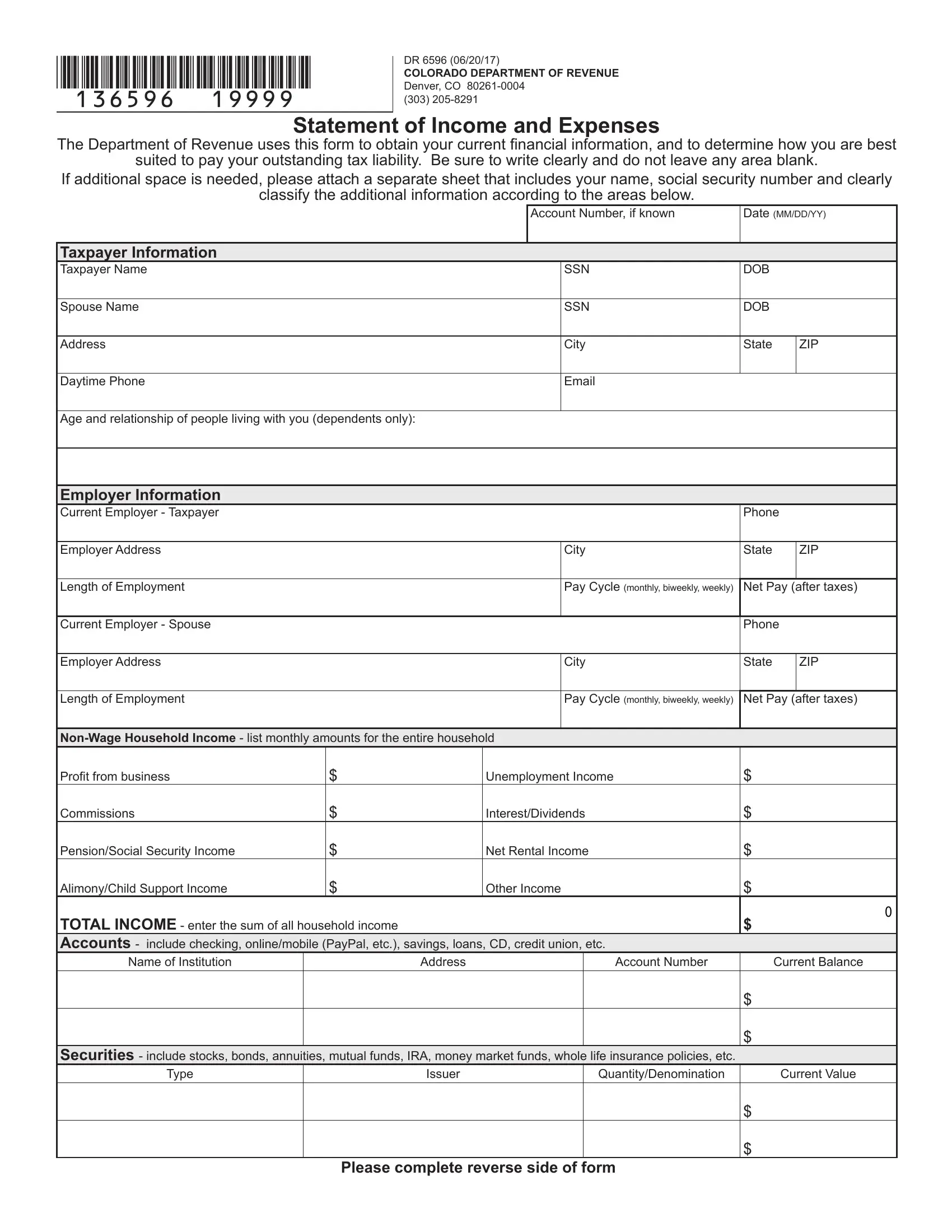

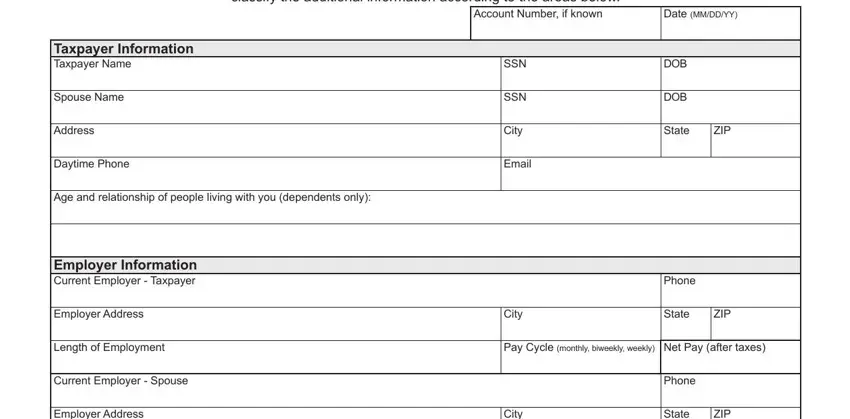

1. To start off, once filling out the colorado tax form dr 6596, start in the part that has the subsequent fields:

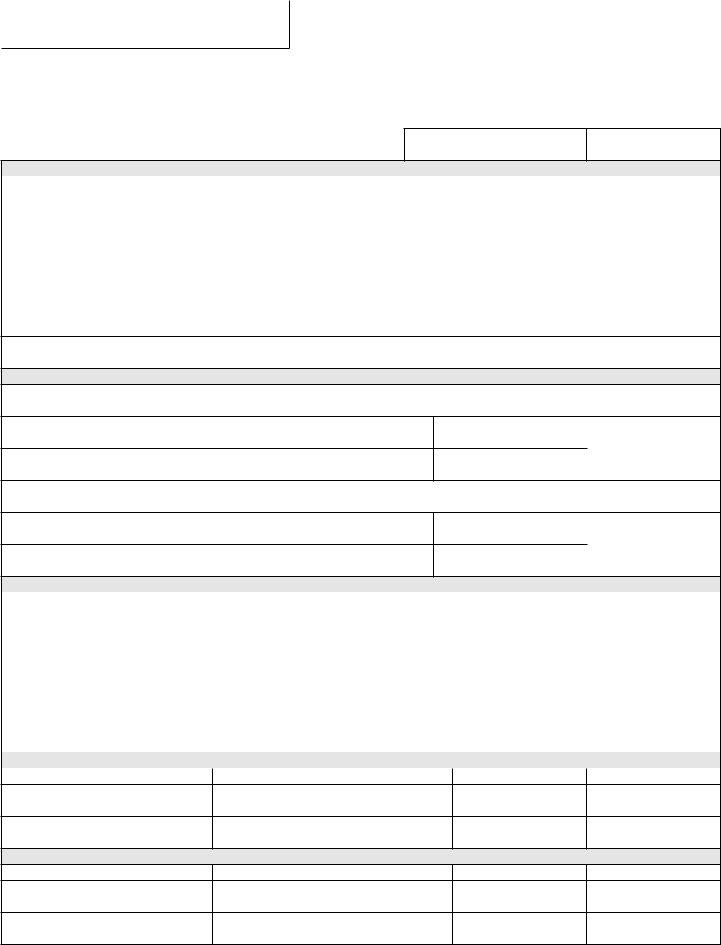

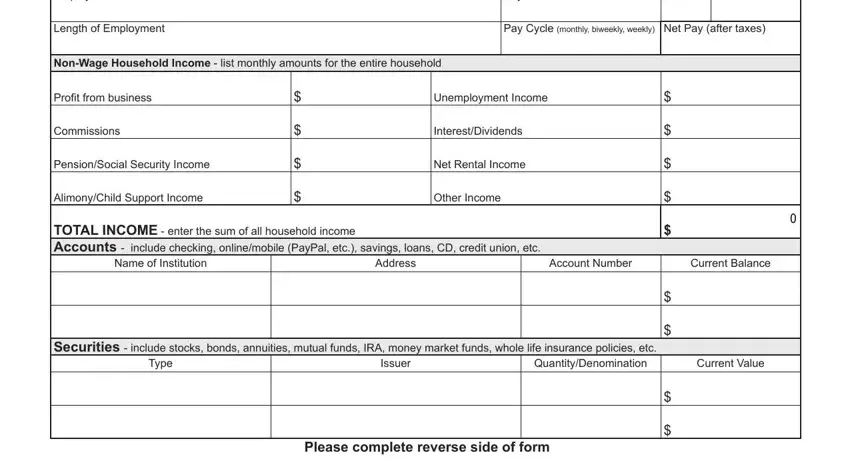

2. Given that the last section is complete, you're ready to add the required specifics in Employer Address, Length of Employment, City, State, ZIP, Pay Cycle monthly biweekly weekly, NonWage Household Income list, Proit from business, Commissions, PensionSocial Security Income, AlimonyChild Support Income, Unemployment Income, InterestDividends, Net Rental Income, and Other Income allowing you to move on further.

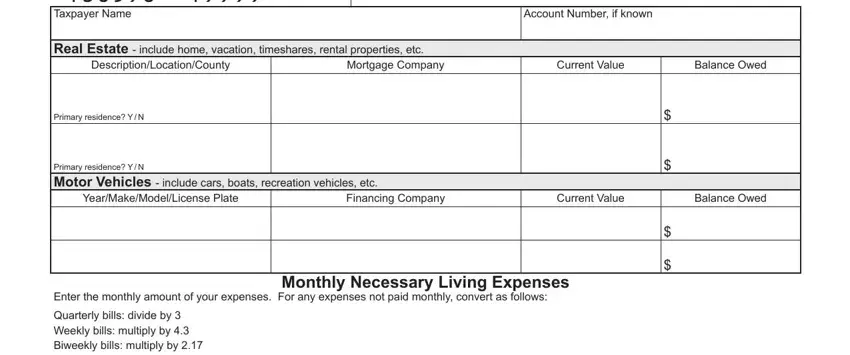

3. Completing Taxpayer Name, Account Number if known, Real Estate include home vacation, DescriptionLocationCounty, Mortgage Company, Current Value, Balance Owed, Primary residence Y N, Primary residence Y N Motor, YearMakeModelLicense Plate, Financing Company, Current Value, Balance Owed, Monthly Necessary Living Expenses, and Enter the monthly amount of your is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

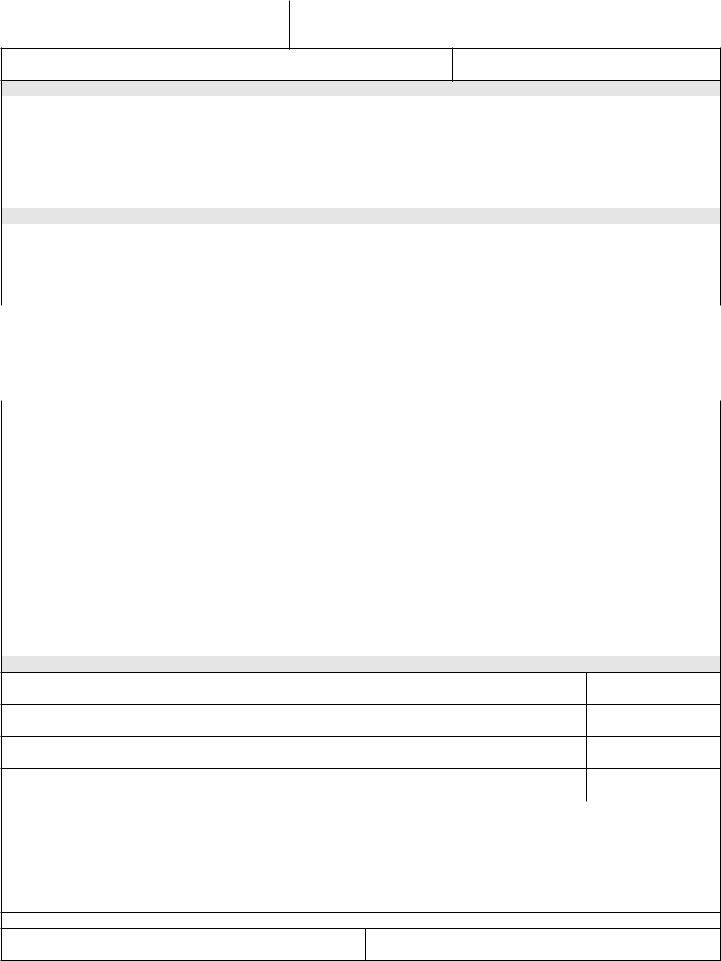

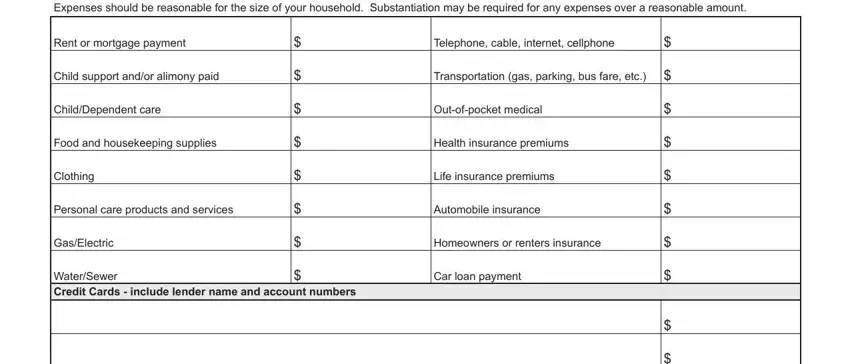

4. You're ready to start working on this next form section! In this case you've got all these Enter the monthly amount of your, Rent or mortgage payment, Child support andor alimony paid, ChildDependent care, Food and housekeeping supplies, Clothing, Personal care products and services, GasElectric, Telephone cable internet cellphone, Transportation gas parking bus, Outofpocket medical, Health insurance premiums, Life insurance premiums, Automobile insurance, and Homeowners or renters insurance empty form fields to fill in.

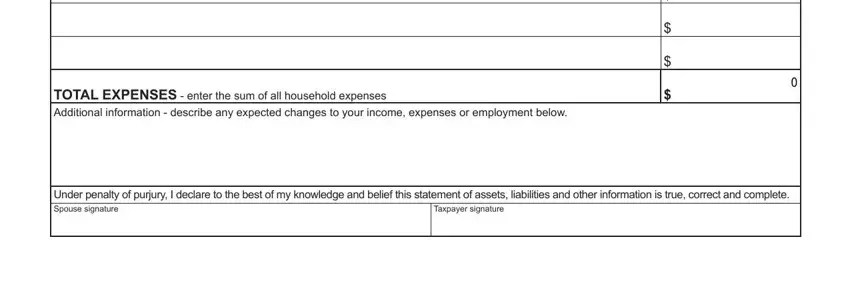

5. Now, this last section is what you'll want to complete before finalizing the PDF. The blanks here include the following: TOTAL EXPENSES enter the sum of, Under penalty of purjury I declare, and Taxpayer signature.

As to Taxpayer signature and TOTAL EXPENSES enter the sum of, be sure that you review things here. Both of these could be the key fields in this file.

Step 3: Ensure the details are accurate and simply click "Done" to finish the project. Join us now and easily get access to colorado tax form dr 6596, ready for download. Each and every change made is handily saved , allowing you to change the pdf later on if needed. At FormsPal, we strive to be sure that your information is kept secure.