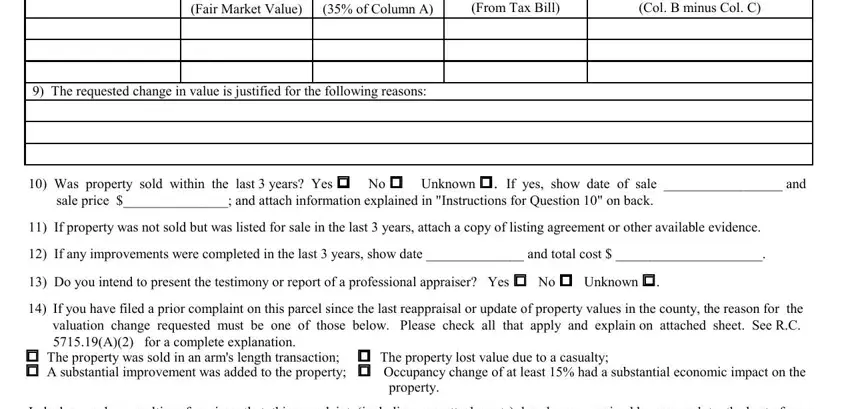

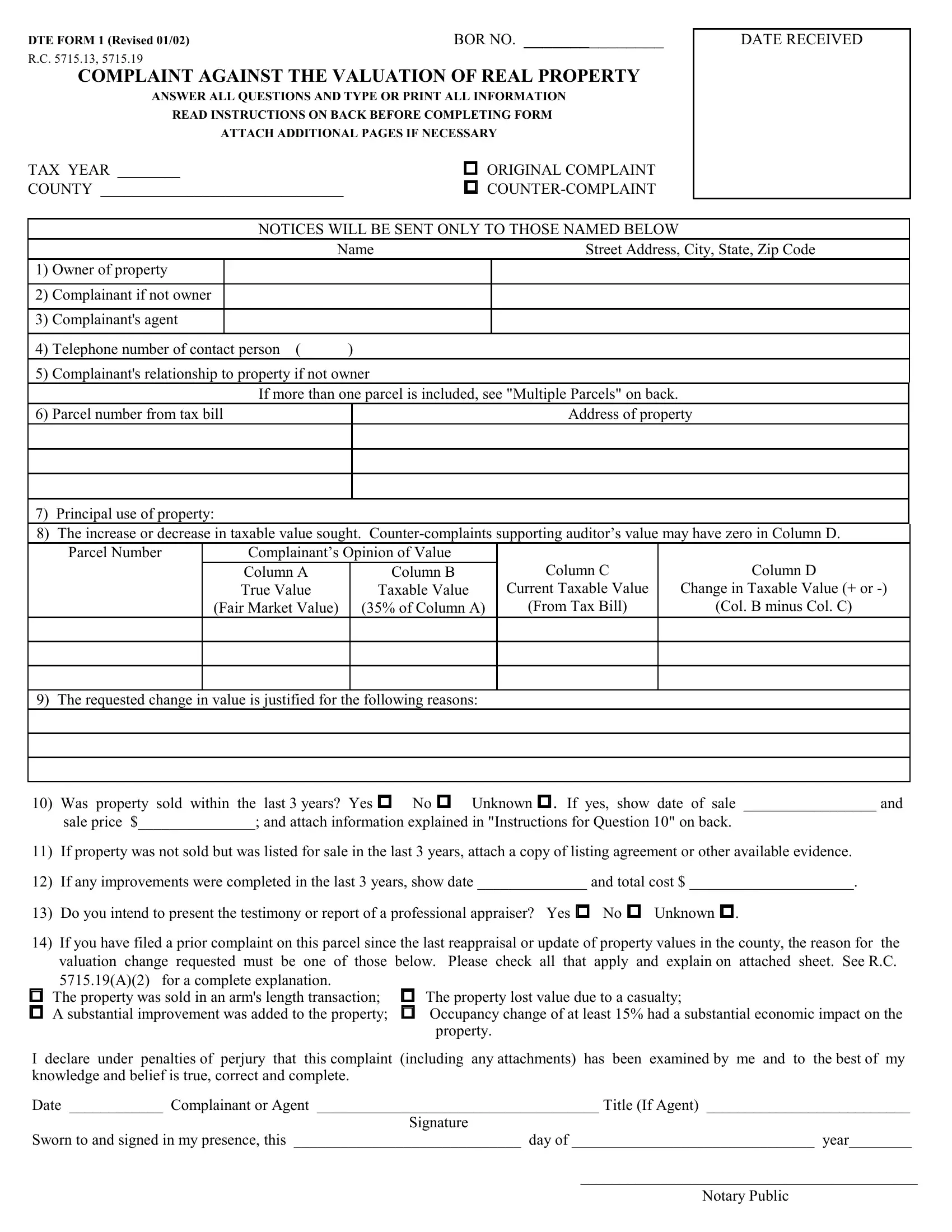

! The property lost value due to a casualty;

! Occupancy change of at least 15% had a substantial economic impact on the property.

DTE FORM 1 (Revised 01/02) |

BOR NO. _______________ |

R.C. 5715.13, 5715.19

COMPLAINT AGAINST THE VALUATION OF REAL PROPERTY

ANSWER ALL QUESTIONS AND TYPE OR PRINT ALL INFORMATION

READ INSTRUCTIONS ON BACK BEFORE COMPLETING FORM

ATTACH ADDITIONAL PAGES IF NECESSARY

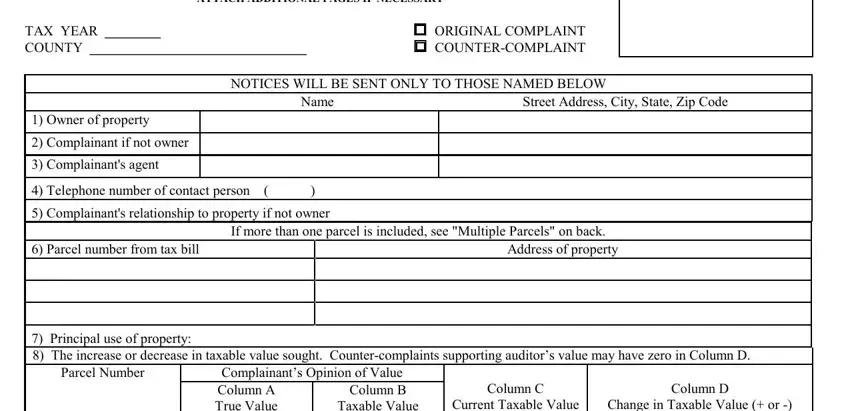

TAX YEAR ________ |

! ORIGINAL COMPLAINT |

COUNTY _______________________________ |

! COUNTER-COMPLAINT |

NOTICES WILL BE SENT ONLY TO THOSE NAMED BELOW

|

|

|

Name |

Street Address, City, State, Zip Code |

1) |

Owner of property |

|

|

|

|

|

|

|

|

|

|

2) |

Complainant if not owner |

|

|

|

|

|

|

|

|

|

|

3) |

Complainant's agent |

|

|

|

|

|

|

|

|

|

|

4) |

Telephone number of contact person ( |

) |

|

5) |

Complainant's relationship to property if not owner |

|

|

|

If more than one parcel is included, see "Multiple Parcels" on back. |

6) |

Parcel number from tax bill |

|

|

Address of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7)Principal use of property:

8)The increase or decrease in taxable value sought. Counter-complaints supporting auditor’s value may have zero in Column D.

Parcel Number |

Complainant’s Opinion of Value |

|

|

|

Column A |

Column B |

Column C |

Column D |

|

True Value |

Taxable Value |

Current Taxable Value |

Change in Taxable Value (+ or -) |

|

(Fair Market Value) |

(35% of Column A) |

(From Tax Bill) |

(Col. B minus Col. C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9) The requested change in value is justified for the following reasons:

10)Was property sold within the last 3 years? Yes ! No ! Unknown ! . If yes, show date of sale _________________ and sale price $_______________; and attach information explained in "Instructions for Question 10" on back.

11)If property was not sold but was listed for sale in the last 3 years, attach a copy of listing agreement or other available evidence.

12)If any improvements were completed in the last 3 years, show date ______________ and total cost $ _____________________.

13)Do you intend to present the testimony or report of a professional appraiser? Yes ! No ! Unknown ! .

14)If you have filed a prior complaint on this parcel since the last reappraisal or update of property values in the county, the reason for the valuation change requested must be one of those below. Please check all that apply and explain on attached sheet. See R.C.

5715.19(A)(2) for a complete explanation.

! The property was sold in an arm's length transaction; ! A substantial improvement was added to the property;

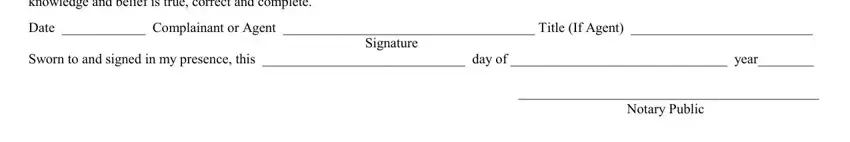

I declare under penalties of perjury that this complaint (including any attachments) has been examined by me and to the best of my knowledge and belief is true, correct and complete.

Date ____________ Complainant or Agent ____________________________________ Title (If Agent) __________________________

Signature

Sworn to and signed in my presence, this _____________________________ day of _______________________________ year________

___________________________________________

Notary Public

INSTRUCTIONS FOR COMPLETING FORM

FILING DEADLINE: A COMPLAINT FOR THE CURRENT TAX YEAR MUST BE RECEIVED BY THE COUNTY AUDITOR ON OR BEFORE MARCH 31 OF THE FOLLOWING TAX YEAR. A COUNTER-COMPLAINT MUST BE FILED WITHIN 30 DAYS AFTER RECEIPT OF NOTICE FROM THE AUDITOR THAT AN ORIGINAL COMPLAINT HAS BEEN FILED.

WHO MAY FILE: Any person owning taxable real property in the county, the board of county commissioners, the county prosecutor, the county treasurer, the board of township trustees of any township with territory in the county, the board of education of any school district with territory in the county, or the mayor or legislative authority of any municipal corporation with territory in the county may file a valuation complaint.

TENDER PAY: If the owner of a property files a complaint against the valuation of that property, then, while such complaint is pending, the owner is entitled to tender to the county treasurer an amount of taxes based on the valuation claimed for such property in the complaint. NOTE: If the amount tendered is less than the amount finally determined, interest will be charged on the difference. In addition, if the amount finally determined equals or exceeds the amount originally billed, a penalty will be charged on the difference between the amount tendered and the final amount.

MULTIPLE PARCELS: Only parcels that (1) are in the same taxing district and (2) have identical ownership may be included in one complaint. Otherwise, separate complaints must be used. However, for ease of administration, parcels that (1) are in the same taxing district,

(2)have identical ownership, and (3) form a single economic unit should be included in one complaint. The increase or decrease in valuation may be separately stated for each parcel or listed as an aggregate sum for the economic unit. If more than three parcels are included in one complaint, use additional sheets of paper.

GENERAL INSTRUCTIONS: Valuation complaints must relate to the total value of both land and buildings. The Board of Revision may increase or decrease the total value of any parcel included in a complaint. The Board will notify all parties not less than ten days prior to the hearing of the time and place the complaint will be heard. The complainant should submit any documents supporting the claimed valuation to the Board prior to the hearing. The Board may also require the complainant and/or owner to provide the Board additional information with the complaint and may request additional information at the hearing, including purchase and lease agreements, closing statements, appraisal reports, construction costs, rent rolls, and detailed income and expense statements for the property.

Section 5715.19(G) provides that "a complainant shall provide to the Board of Revision all information or evidence within his knowledge or possession that affects the real property" in question. Evidence or information that is not presented to the Board cannot later be presented on any appeal, unless good cause is shown for the failure to present such evidence or information to the Board.

INSTRUCTIONS FOR QUESTION 10. If property was sold in the last three years, attach the purchase agreement, escrow statement, closing statement, or other evidence if available. If the buyer and seller were or are related or had any common business interests, attach an explanation. If any other items of value were included with the sale of the real estate, attach a description of those items. Show the value of those items and explain how the values were determined.

NOTICE: R. C. 5715.19, as amended by H. B. 694, effective March 30, 1999, added some additional persons who may file a valuation complaint. Those additional persons are (1) the owner’s spouse, (2) an appraiser who holds a designation from a professional assessment organization retained by the owner, (3) a licensed public accountant, a licensed general or residential real estate appraiser, or a licensed real estate broker retained by the owner, (4) an officer, salaried employee, partner, or a member of an owner, if the owner is a firm, company, association, partnership, limited liability company, or corporation, and (5) a trustee, if the owner is a trust. Since that statute has been declared to be unconstitutional by an Ohio court of appeals, the Board of Tax Appeals and many county Boards of Revision have been dismissing complaints filed by those individuals, if they are not attorneys at law. Please be advised that if you choose a nonattorney to prepare and file your complaint, it will be subject to dismissal and may not be heard on its merits.