When using the online PDF editor by FormsPal, it is easy to fill in or modify bird form right here. To make our tool better and easier to utilize, we constantly implement new features, taking into consideration feedback coming from our users. Should you be looking to get going, this is what it requires:

Step 1: Hit the "Get Form" button in the top section of this page to get into our editor.

Step 2: The editor lets you customize nearly all PDF documents in many different ways. Change it by adding customized text, adjust what is originally in the file, and place in a signature - all doable in no time!

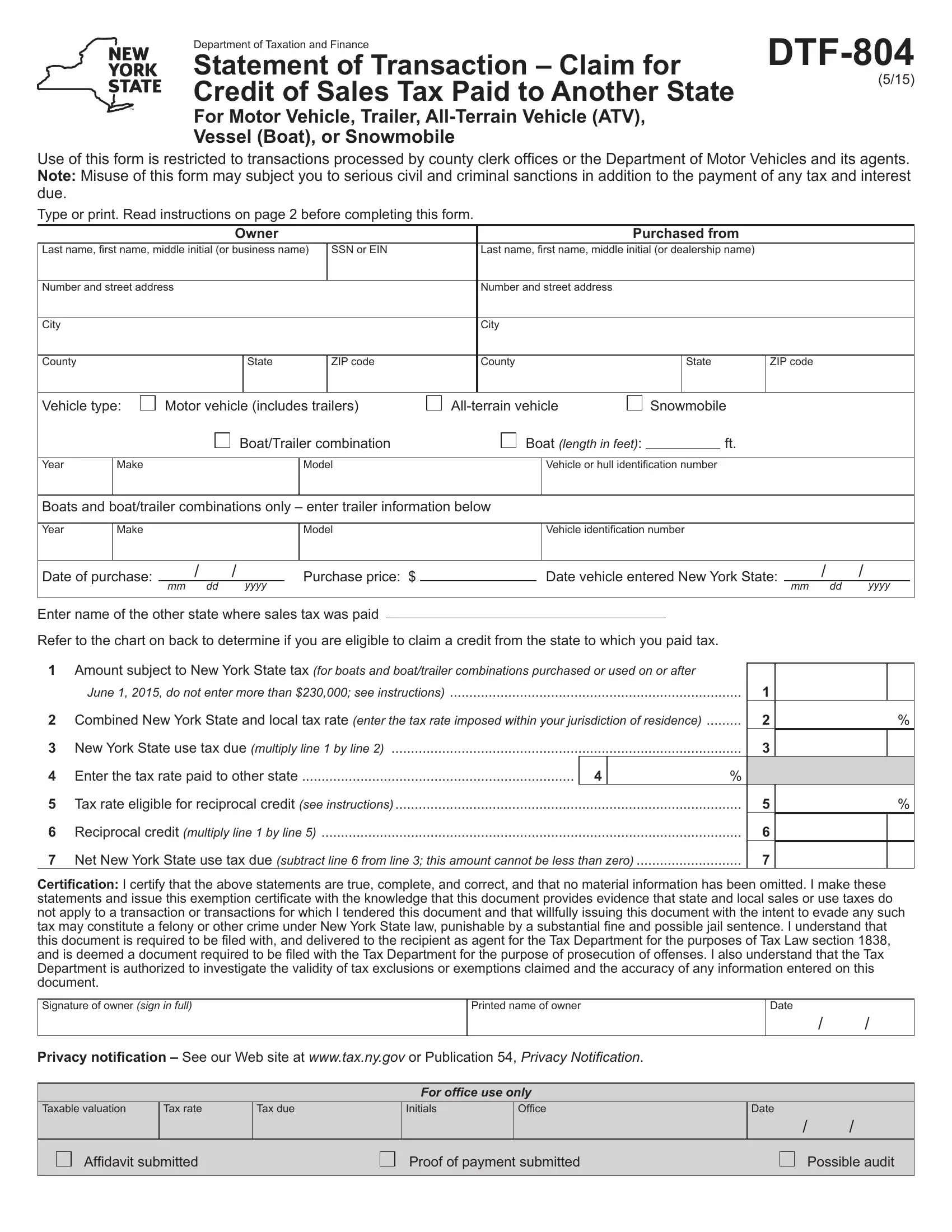

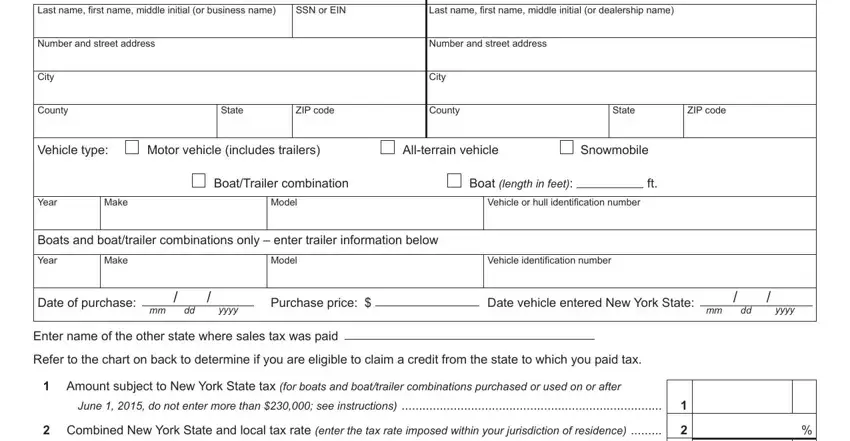

This PDF doc needs specific information; in order to ensure correctness, please make sure to take heed of the guidelines below:

1. It is critical to fill out the bird form accurately, so be mindful while filling in the segments that contain these specific blank fields:

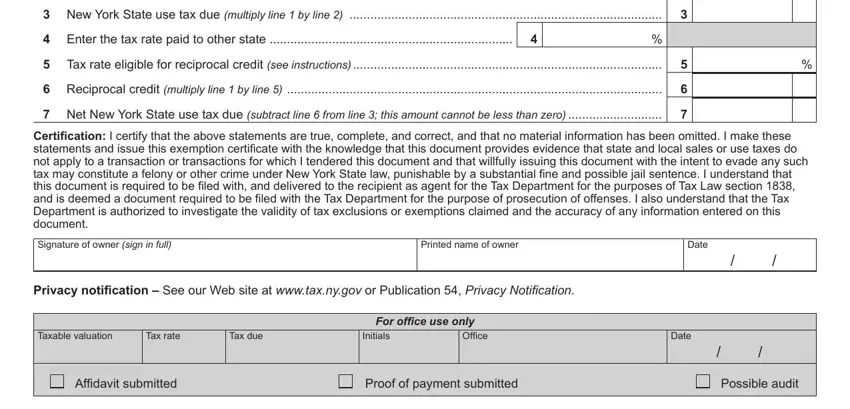

2. After this section is completed, go on to enter the relevant information in these - New York State use tax due, Enter the tax rate paid to other, Tax rate eligible for reciprocal, Reciprocal credit multiply line, Net New York State use tax due, Signature of owner sign in full, Printed name of owner, Privacy notiication See our Web, Taxable valuation, Tax rate, Tax due, For ofice use only, Initials, Ofice, and Date.

People generally make errors when filling in New York State use tax due in this part. Be sure you read again what you enter here.

Step 3: After taking another look at your form fields, hit "Done" and you are good to go! Acquire the bird form the instant you sign up at FormsPal for a 7-day free trial. Immediately gain access to the pdf file in your personal account page, with any modifications and adjustments being all saved! FormsPal provides risk-free form completion with no personal information recording or distributing. Be assured that your data is in good hands with us!