At the heart of establishing a financial relationship with Dutch-Bangla Bank Limited lies the detailed and comprehensive account opening form, designed to cater to both individual and potentially connected business entities. This form facilitates a variety of account types including, but not limited to savings, current, and fixed deposit accounts, each with options for different currencies to accommodate the diverse needs of its clientele. Beyond the mere act of opening an account, this form serves as an avenue for customers to precisely dictate the operational nuances of their account(s) — whether it’s to be operated individually or jointly. It provides a space to disclose particulars about affiliated entities, existing banking relationships with other financial institutions, and even the intricate details concerning nominees who are designated to manage the account posthumously. Additionally, the form extends into areas concerning initial deposits, special scheme deposits, and the sources of these funds, demonstrating a thorough vetting process aimed at ensuring financial security and compliance. Applicants are asked to specify their requirements for cheque books, clearly indicating a customization of service delivery. Importantly, the form doesn’t shy away from capturing essential identification data and personal information for both the account holder and, if applicable, their guardians, establishing a clear pathway for transparent and responsible banking. The closing sections seek confirmatory declarations from the applicants about the veracity of the information provided and their understanding of the bank’s terms and conditions. This meticulous attention to detail underscores the bank’s commitment to compliance, security, and customer satisfaction, crafting a banking experience that is both comprehensive and tailored to individual needs.

| Question | Answer |

|---|---|

| Form Name | Dutch Bangla Bank Account Form |

| Form Length | 12 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min |

| Other names | ডাচ বাংলা ব্যাংক ফরম, open student bank account online, student account dbbl, create bank account online bd |

|

|

Account Opening Form |

Individual Account |

O 0 M M Y Y Y Y |

|

Date ITITIC[IJ |

(For Bank use only) |

|

|

The Manager |

Ale No. |

|

|

....................................................... Branch |

|

Dear Sir,

l!We request you to open an account in your branch. My / Our full particulars are given below:

1.Title of Account

|

|

i. |

1 |

|

|

|

|

|

|

|

|

|

|

I |

|

|

ii. |

============================================~ |

|

||||||||||

|

|

1 |

|

|

|

|

|

|

|

1 |

||||

2. Type of |

DPower |

DPower Plus |

D Savings |

D Current D SND |

||||||||||

|

|

|

DFixed |

DFC |

D RFCD DNFCD D Others |

. |

|

|||||||

3. |

DTaka |

DDollar |

DEuro |

DGBP |

D Others |

. |

|

|||||||

4. Operating |

Tick (..J) DIndividual |

DJoint |

DAnyone |

D Others |

. |

|

||||||||

5. Particulars of accounts of allied or sister concern of the customer (if any): |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

SI. No. |

Account Number(s) |

Type |

|

Title the account |

Relationship |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

01. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

02. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Other Bank Accounts of the Customer (If any) |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

|

Name of the Bank(s) |

|

Branch(es) |

|

Type of Account - please Tick (...f) |

|

||||||||

|

a) |

|

|

a) |

|

D Deposit |

Ale |

D |

Loan Ale |

|

D |

Others |

|

|

|

|

|

|

|

|

|||||||||

|

b) |

|

|

b) |

|

D Deposit |

Ale |

D |

Loan Ale |

|

D |

Others |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Introducer's declaration and information: |

|

|

|

|

||

|

I hereby declare that I personally know the account holder thoroughly. The particulars given in the account opening form are correct |

||||||

|

to the best of my knowledge. |

|

|

|

|

||

|

Name |

|

ISignature |

|

|

||

|

Account Number |

|

|

|

with date |

|

|

|

|

|

|

|

|||

8. |

Initial Deposit |

|

Currency: ,'- |

_ |

Amount: , |

|

|

9. |

Particulars of FORI |

Amount: I |

|

Currency: I |

|

|

|

|

Term Deposit (if any) |

|

I Rate of Interest: I |

|

|

||

|

|

|

period:1 |

Date of maturity:1 |

/ |

/ |

|

RenewalIRedemptioninstructions D Renew Principal & Redeem Interest D RenewPrincipalwithInterest D Redeem Principal & interest D No instructions

RenewalI Redemptionpayoutmode

DBycash |

|

D By Banker'sCheque |

D Transferto Account |

|

InterestTransferAccountNo I |

|

I RedemptionTransferAccountNo·1 |

|

|

Unless instruction to the contrary is received, the Bank will renew |

|

|||

principal plus interest at the interest rate prevailing on maturity date. |

|

|||

Pay in Mode: D Cash |

D Transfer from DBBL Account , |

|

~ |

|

DCheque No |

Drawn on |

Bank |

Branch |

|

Page No. 01

10. Particulars of Deposit Under Special Scheme

|

|

|

|||

Tenure |

One time Deposit (If any) |

No. of Installments |

Installment Type |

Installment Amount |

Payable on maturity |

D Monthly

D Quarterly

D Yearly

11. Sources of Fund

12. Cheque Book Request (Charge applicable for each leaf) |

|

|

Please issue cheque book containing D 20 leaves |

D 50 leaves |

D 100 leaves |

(SB/CD) |

(CD only) |

(CD only) |

13.Details of Nominee(s):

I/we do hereby nominate the following person(s) to receive the entire amount deposited in the above account in the event of my/our death. I/we do hereby reserve the right to cancel or change the nominee(s) at any time. I/we do hereby also declare that the bank will not be held responsible for any transaction done as per instruction given by me/us.

D Cheque Book (Not required)

Photograph of

Nominee(s) with

Signature

duly attested

by the Ale Holder

Particulars |

Nominee |

Nominee - 2 |

|

|

|

Name

Date of Birth

Percent of Share

Father's Name (with prefix')

Mother's Name (with prefix')

Spouse Name (with prefix')

PermanentAddress

Profession

Relationship with the AlC Holder

National 10 Card Number, if not minor

Signature of Nominee(s), if not minor

In the event that the nominee remain(s) a minor at the time of account holder's death following person is authorized

to receive / draw the amount of deposits held by the bank on behalf of the minor.

Name

National 10 Card Number

Address

Signature of Authorized Person

*(If any

"Prefix such as Mr.lMrs.lDr.lHaji/Alhaj/Moulavi/Engineer/Barrister/Advocate

Date of Birth

Relationshipwith the Alc Holder

Exchange Regulation act shall be applicable for

etc.

Pa e No. 02

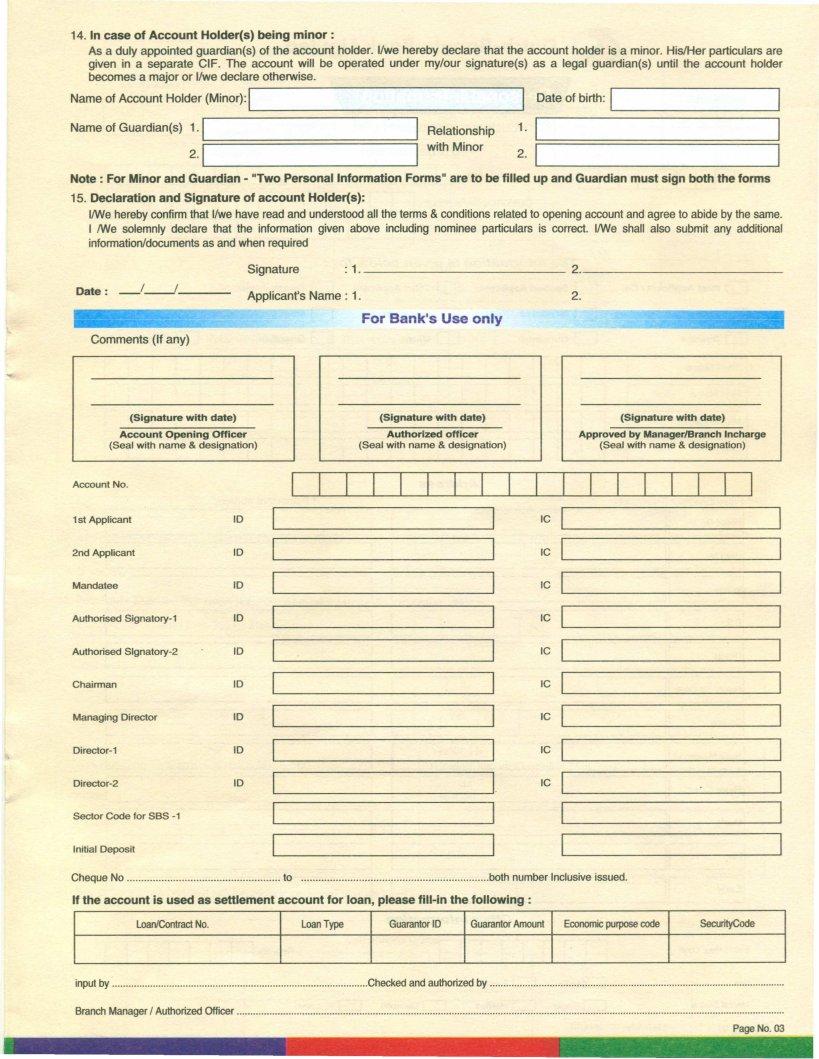

14. In case of Account Holder(s) being minor:

As a duly appointed guardian(s) of the account holder. I/we hereby declare that the account holder is a minor. His/Her particulars are given in a separate elF. The account will be operated under my/our signature(s) as a legal guardian(s) until the account holder becomes a major or I/we declare otherwise.

Name of Account Holder (Minor): |

Date of birth: 1 |

_ |

Name of Guardian(s) 1.1

================~

2·1----'

Relationship 1.

with Minor

2.

Note: For Minor and Guardian - "Two Personal Information Forms" are to be filled up and Guardian must sign both the forms

15.Declaration and Signature of account Holder(s):

l!We hereby confirm that IIwe have read and understood all the terms & conditions related to opening account and agree to abide by the same. I !WE solemnly declare that the information given above including nominee particulars is correct. l!We shall also submit any additional information/documents as and when required

|

Signature |

:1. |

2. |

_ |

|

|

|

|

|

Date: |

Applicant's Name: 1. |

2. |

|

|

|

|

|||

For Bank's Use only

Comments (If any)

(Signature with |

date) |

|

(Signature with date) |

(Signature with date) |

|

Account Opening |

Officer |

|

Authorized officer |

Approved by Manager/Branch Incharge |

|

(Seal with name & designation) |

|

(Seal with name & designation) |

(Seal with name & designation) |

||

|

|

|

|

|

|

Account No. |

|

|

|

|

|

1st Applicant |

10 |

|

|

|

IC |

|

|

|

|

|

IC |

2nd Applicant |

10 |

|

|

|

|

|

|

|

|

|

IC |

Mandatee |

10 |

|

|

|

|

Authorised |

10 |

|

|

|

IC |

|

|

|

|

|

IC |

Authorised |

10 |

|

|

|

|

Chainnan |

10 |

|

|

|

IC |

Managing Director |

10 |

|

|

|

IC |

10 |

|

|

|

IC |

|

|

|

|

|

I. |

|

10 |

|

L- |

IC |

||

|

|

|

|

|

|

Sector Code for SBS |

|

|

1 |

|

|

Initial Deposit |

|

|

- |

1 |

|

Cheque No |

|

|

10 |

bolh |

number Inclusive issued. |

If the account is used as settlement account for loan, please

loan/Contract No. |

loan Type |

GuarantorID |

GuarantorAmount |

Economicpurposecode |

SecurityCode |

|

|

|

|

|

|

input by |

|

Checked and authorized by |

|

. |

|

Branch Manager I Authorized Officer |

|

|

|

|

. |

|

|

|

|

|

Page No. 03 |

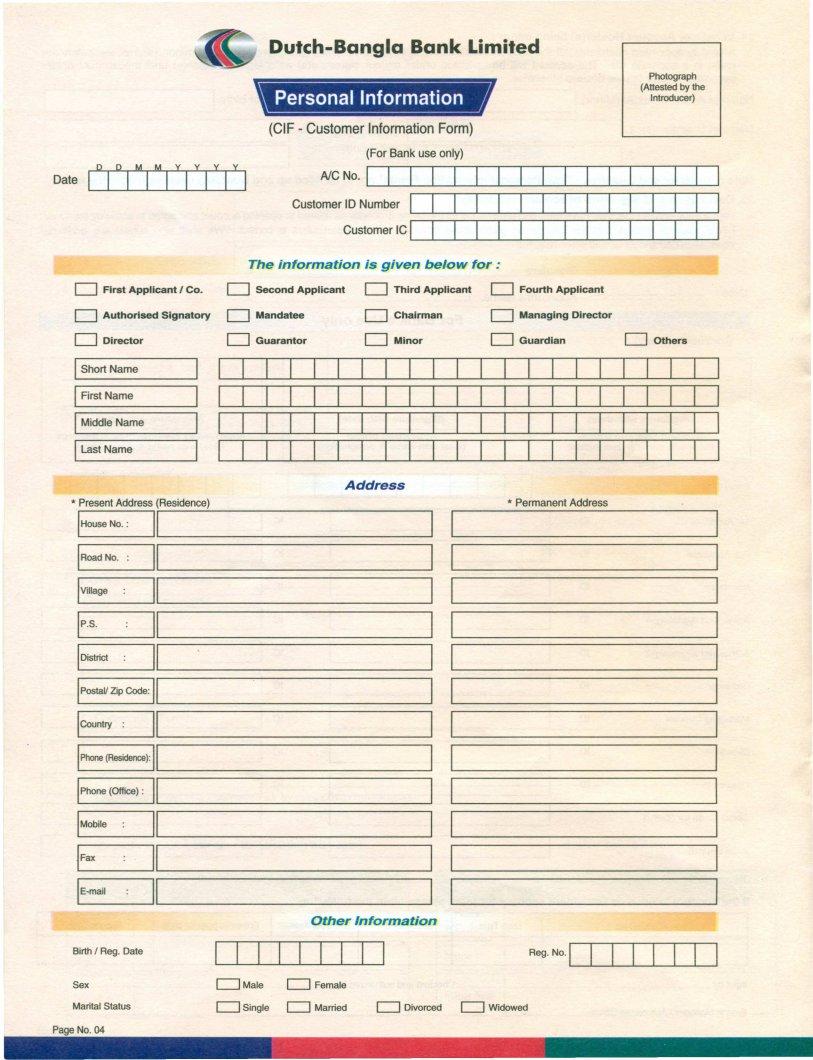

Photograph (Attested by the Introducer)

(CIF - Customer Information Form)

(For Bank use only)

Date~

The information is given below for:

D First Applicant I Co. |

D Second Applicant |

D |

|

D Authorised Signatory |

D Mandatee |

D |

|

D Director |

D Guarantor |

D |

|

IShort |

Name |

|

|

I First |

Name |

|

|

IMiddle Name

ILast Name

Third Applicant |

D Fourth Applicant |

|

Chairman |

D Managing Director |

|

Minor |

D Guardian |

D Others |

|

|

Address |

* Present Address |

(Residence) |

* Permanent Address |

IHouse No. : |

|

|

IRoad No. : |

|

|

IVillage |

|

|

IDistrict

PostaVZip Code:

ICountry :

IPhone (Residence):

Iphone (Office) :

IMobile

IE.mail

Other Information

Birth / Reg. Date |

|

|

|

|

|

Reg. No. ITIIJJTI |

|

|

|

|

|

|

|

Sex |

DMaie |

D |

Female |

|

|

|

Marital Status |

D Single |

D |

Married |

D |

Divorced D |

Widowed |

Page No. 04 |

|

|

|

|

|

|

I Race |

DMuslim |

D |

Hindu |

D |

Buddist |

D |

Christian |

D |

Tribal |

DOthers |

|

Profession |

D |

Self employed |

D |

Serviceholder |

D |

BusinessPersons |

|

|

|

||

(for individualonly) |

|

|

|

|

|

|

|

|

|

|

|

DOthsrs (Pleasespecify)

•Designation with Office Address

INationality |

|

|

|

• Resident Status D |

Resident |

D |

(Note: If a Bangladeshi live abroad for more than 6 months, he will be considered as

INationallDCardNo.

IDrivingLicenseNo.(If any)

IPassportNo(Ifany)

ICreditCardInformation |

|

|

|

Issuing Organization |

|

Credit Card Number |

|

|

|

|

|

2

ITIN(Ifany)

Father'sName(withprefix')

Mother'sName(withprefix')

ISpouseName(withprefix')

• Mailing Address :0 Present (Residence) Address 0 Permanent Address 0 Office Address

Applicant's Signature

Date

Photo and Specimen Signature

RECENT PHOTOGRAPH (2 COPIES) |

SPECIMEN SIGNATURE |

(Attested by the Introducer)

For Bank use only

Customer IC |

|

|

|

|

Account No. |

|

|

|

|

Customer 10 |

|

|

|

|

Sector Code (for CIB & |

|

|

|

|

Customer's Signature Admitted by |

, |

Introducer's signature verified by |

|

,.. |

input by |

|

Checked & Authorized by |

|

. |

Branch Manager !Authorized Officer |

|

, |

, |

. |

• Prefix such as Mr.! Mrs.! Dr. ! Haji ! Alhaj ! Moulavi ! Engineer! Barrister! Advocate etc.

Page No. 05