At the heart of establishing a financial relationship with Dutch-Bangla Bank Limited lies the detailed and comprehensive account opening form, designed to cater to both individual and potentially connected business entities. This form facilitates a variety of account types including, but not limited to savings, current, and fixed deposit accounts, each with options for different currencies to accommodate the diverse needs of its clientele. Beyond the mere act of opening an account, this form serves as an avenue for customers to precisely dictate the operational nuances of their account(s) — whether it’s to be operated individually or jointly. It provides a space to disclose particulars about affiliated entities, existing banking relationships with other financial institutions, and even the intricate details concerning nominees who are designated to manage the account posthumously. Additionally, the form extends into areas concerning initial deposits, special scheme deposits, and the sources of these funds, demonstrating a thorough vetting process aimed at ensuring financial security and compliance. Applicants are asked to specify their requirements for cheque books, clearly indicating a customization of service delivery. Importantly, the form doesn’t shy away from capturing essential identification data and personal information for both the account holder and, if applicable, their guardians, establishing a clear pathway for transparent and responsible banking. The closing sections seek confirmatory declarations from the applicants about the veracity of the information provided and their understanding of the bank’s terms and conditions. This meticulous attention to detail underscores the bank’s commitment to compliance, security, and customer satisfaction, crafting a banking experience that is both comprehensive and tailored to individual needs.

| Question | Answer |

|---|---|

| Form Name | Dutch Bangla Bank Account Form |

| Form Length | 12 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min |

| Other names | ডাচ বাংলা ব্যাংক ফরম, open student bank account online, student account dbbl, create bank account online bd |

|

|

Account Opening Form |

Individual Account |

O 0 M M Y Y Y Y |

|

Date ITITIC[IJ |

(For Bank use only) |

|

|

The Manager |

Ale No. |

|

|

....................................................... Branch |

|

Dear Sir,

l!We request you to open an account in your branch. My / Our full particulars are given below:

1.Title of Account

|

|

i. |

1 |

|

|

|

|

|

|

|

|

|

|

I |

|

|

ii. |

============================================~ |

|

||||||||||

|

|

1 |

|

|

|

|

|

|

|

1 |

||||

2. Type of |

DPower |

DPower Plus |

D Savings |

D Current D SND |

||||||||||

|

|

|

DFixed |

DFC |

D RFCD DNFCD D Others |

. |

|

|||||||

3. |

DTaka |

DDollar |

DEuro |

DGBP |

D Others |

. |

|

|||||||

4. Operating |

Tick (..J) DIndividual |

DJoint |

DAnyone |

D Others |

. |

|

||||||||

5. Particulars of accounts of allied or sister concern of the customer (if any): |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

SI. No. |

Account Number(s) |

Type |

|

Title the account |

Relationship |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

01. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

02. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Other Bank Accounts of the Customer (If any) |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

|

Name of the Bank(s) |

|

Branch(es) |

|

Type of Account - please Tick (...f) |

|

||||||||

|

a) |

|

|

a) |

|

D Deposit |

Ale |

D |

Loan Ale |

|

D |

Others |

|

|

|

|

|

|

|

|

|||||||||

|

b) |

|

|

b) |

|

D Deposit |

Ale |

D |

Loan Ale |

|

D |

Others |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Introducer's declaration and information: |

|

|

|

|

||

|

I hereby declare that I personally know the account holder thoroughly. The particulars given in the account opening form are correct |

||||||

|

to the best of my knowledge. |

|

|

|

|

||

|

Name |

|

ISignature |

|

|

||

|

Account Number |

|

|

|

with date |

|

|

|

|

|

|

|

|||

8. |

Initial Deposit |

|

Currency: ,'- |

_ |

Amount: , |

|

|

9. |

Particulars of FORI |

Amount: I |

|

Currency: I |

|

|

|

|

Term Deposit (if any) |

|

I Rate of Interest: I |

|

|

||

|

|

|

period:1 |

Date of maturity:1 |

/ |

/ |

|

RenewalIRedemptioninstructions D Renew Principal & Redeem Interest D RenewPrincipalwithInterest D Redeem Principal & interest D No instructions

RenewalI Redemptionpayoutmode

DBycash |

|

D By Banker'sCheque |

D Transferto Account |

|

InterestTransferAccountNo I |

|

I RedemptionTransferAccountNo·1 |

|

|

Unless instruction to the contrary is received, the Bank will renew |

|

|||

principal plus interest at the interest rate prevailing on maturity date. |

|

|||

Pay in Mode: D Cash |

D Transfer from DBBL Account , |

|

~ |

|

DCheque No |

Drawn on |

Bank |

Branch |

|

Page No. 01

10. Particulars of Deposit Under Special Scheme

|

|

|

|||

Tenure |

One time Deposit (If any) |

No. of Installments |

Installment Type |

Installment Amount |

Payable on maturity |

D Monthly

D Quarterly

D Yearly

11. Sources of Fund

12. Cheque Book Request (Charge applicable for each leaf) |

|

|

Please issue cheque book containing D 20 leaves |

D 50 leaves |

D 100 leaves |

(SB/CD) |

(CD only) |

(CD only) |

13.Details of Nominee(s):

I/we do hereby nominate the following person(s) to receive the entire amount deposited in the above account in the event of my/our death. I/we do hereby reserve the right to cancel or change the nominee(s) at any time. I/we do hereby also declare that the bank will not be held responsible for any transaction done as per instruction given by me/us.

D Cheque Book (Not required)

Photograph of

Nominee(s) with

Signature

duly attested

by the Ale Holder

Particulars |

Nominee |

Nominee - 2 |

|

|

|

Name

Date of Birth

Percent of Share

Father's Name (with prefix')

Mother's Name (with prefix')

Spouse Name (with prefix')

PermanentAddress

Profession

Relationship with the AlC Holder

National 10 Card Number, if not minor

Signature of Nominee(s), if not minor

In the event that the nominee remain(s) a minor at the time of account holder's death following person is authorized

to receive / draw the amount of deposits held by the bank on behalf of the minor.

Name

National 10 Card Number

Address

Signature of Authorized Person

*(If any

"Prefix such as Mr.lMrs.lDr.lHaji/Alhaj/Moulavi/Engineer/Barrister/Advocate

Date of Birth

Relationshipwith the Alc Holder

Exchange Regulation act shall be applicable for

etc.

Pa e No. 02

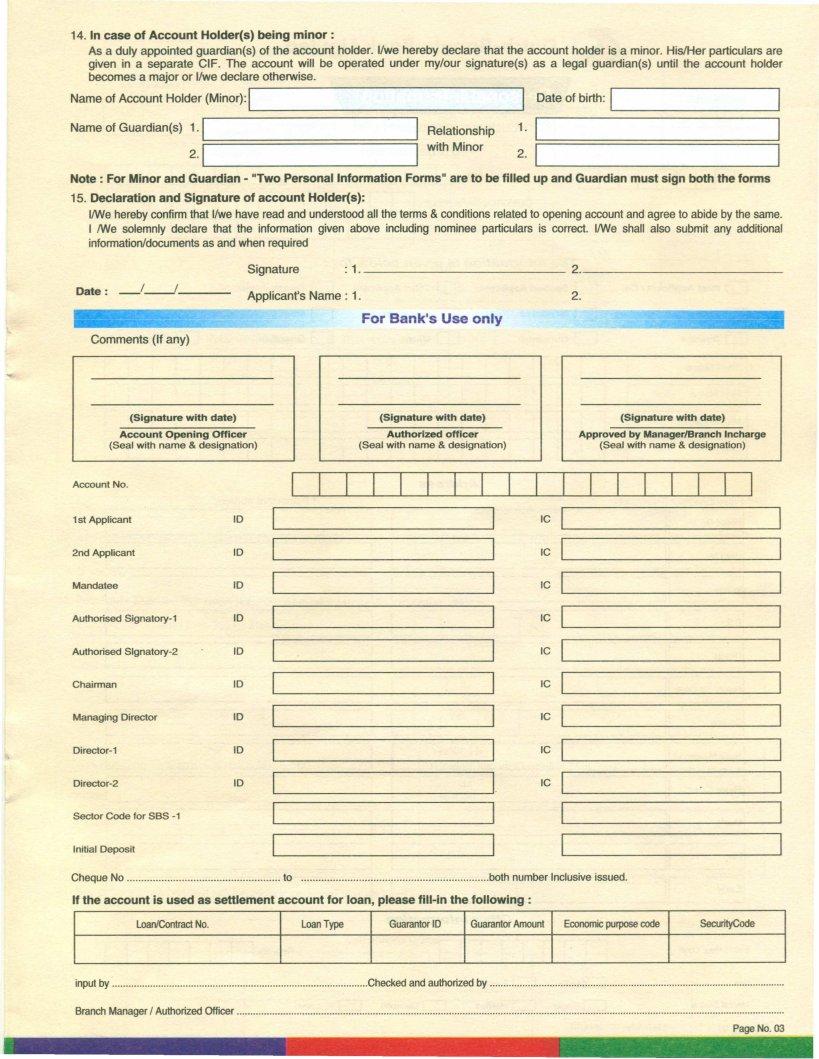

14. In case of Account Holder(s) being minor:

As a duly appointed guardian(s) of the account holder. I/we hereby declare that the account holder is a minor. His/Her particulars are given in a separate elF. The account will be operated under my/our signature(s) as a legal guardian(s) until the account holder becomes a major or I/we declare otherwise.

Name of Account Holder (Minor): |

Date of birth: 1 |

_ |

Name of Guardian(s) 1.1

================~

2·1----'

Relationship 1.

with Minor

2.

Note: For Minor and Guardian - "Two Personal Information Forms" are to be filled up and Guardian must sign both the forms

15.Declaration and Signature of account Holder(s):

l!We hereby confirm that IIwe have read and understood all the terms & conditions related to opening account and agree to abide by the same. I !WE solemnly declare that the information given above including nominee particulars is correct. l!We shall also submit any additional information/documents as and when required

|

Signature |

:1. |

2. |

_ |

|

|

|

|

|

Date: |

Applicant's Name: 1. |

2. |

|

|

|

|

|||

For Bank's Use only

Comments (If any)

(Signature with |

date) |

|

(Signature with date) |

(Signature with date) |

|

Account Opening |

Officer |

|

Authorized officer |

Approved by Manager/Branch Incharge |

|

(Seal with name & designation) |

|

(Seal with name & designation) |

(Seal with name & designation) |

||

|

|

|

|

|

|

Account No. |

|

|

|

|

|

1st Applicant |

10 |

|

|

|

IC |

|

|

|

|

|

IC |

2nd Applicant |

10 |

|

|

|

|

|

|

|

|

|

IC |

Mandatee |

10 |

|

|

|

|

Authorised |

10 |

|

|

|

IC |

|

|

|

|

|

IC |

Authorised |

10 |

|

|

|

|

Chainnan |

10 |

|

|

|

IC |

Managing Director |

10 |

|

|

|

IC |

10 |

|

|

|

IC |

|

|

|

|

|

I. |

|

10 |

|

L- |

IC |

||

|

|

|

|

|

|

Sector Code for SBS |

|

|

1 |

|

|

Initial Deposit |

|

|

- |

1 |

|

Cheque No |

|

|

10 |

bolh |

number Inclusive issued. |

If the account is used as settlement account for loan, please

loan/Contract No. |

loan Type |

GuarantorID |

GuarantorAmount |

Economicpurposecode |

SecurityCode |

|

|

|

|

|

|

input by |

|

Checked and authorized by |

|

. |

|

Branch Manager I Authorized Officer |

|

|

|

|

. |

|

|

|

|

|

Page No. 03 |

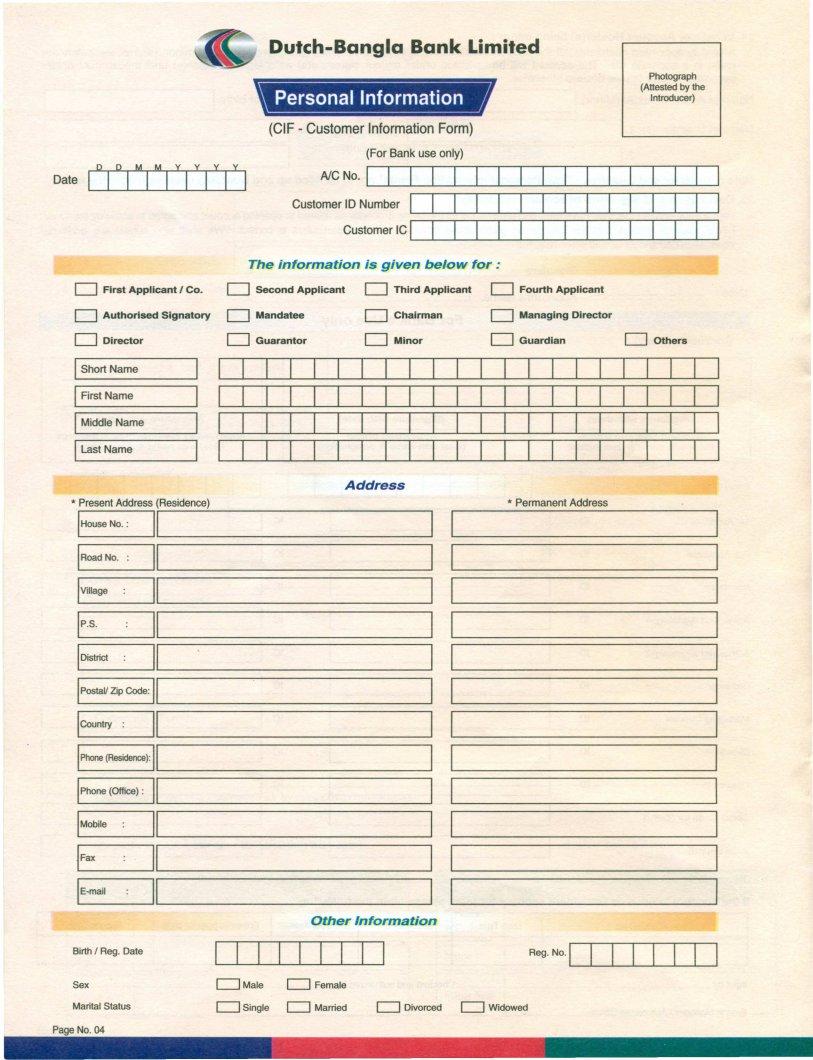

Photograph (Attested by the Introducer)

(CIF - Customer Information Form)

(For Bank use only)

Date~

The information is given below for:

D First Applicant I Co. |

D Second Applicant |

D |

|

D Authorised Signatory |

D Mandatee |

D |

|

D Director |

D Guarantor |

D |

|

IShort |

Name |

|

|

I First |

Name |

|

|

IMiddle Name

ILast Name

Third Applicant |

D Fourth Applicant |

|

Chairman |

D Managing Director |

|

Minor |

D Guardian |

D Others |

|

|

Address |

* Present Address |

(Residence) |

* Permanent Address |

IHouse No. : |

|

|

IRoad No. : |

|

|

IVillage |

|

|

IDistrict

PostaVZip Code:

ICountry :

IPhone (Residence):

Iphone (Office) :

IMobile

IE.mail

Other Information

Birth / Reg. Date |

|

|

|

|

|

Reg. No. ITIIJJTI |

|

|

|

|

|

|

|

Sex |

DMaie |

D |

Female |

|

|

|

Marital Status |

D Single |

D |

Married |

D |

Divorced D |

Widowed |

Page No. 04 |

|

|

|

|

|

|

I Race |

DMuslim |

D |

Hindu |

D |

Buddist |

D |

Christian |

D |

Tribal |

DOthers |

|

Profession |

D |

Self employed |

D |

Serviceholder |

D |

BusinessPersons |

|

|

|

||

(for individualonly) |

|

|

|

|

|

|

|

|

|

|

|

DOthsrs (Pleasespecify)

•Designation with Office Address

INationality |

|

|

|

• Resident Status D |

Resident |

D |

(Note: If a Bangladeshi live abroad for more than 6 months, he will be considered as

INationallDCardNo.

IDrivingLicenseNo.(If any)

IPassportNo(Ifany)

ICreditCardInformation |

|

|

|

Issuing Organization |

|

Credit Card Number |

|

|

|

|

|

2

ITIN(Ifany)

Father'sName(withprefix')

Mother'sName(withprefix')

ISpouseName(withprefix')

• Mailing Address :0 Present (Residence) Address 0 Permanent Address 0 Office Address

Applicant's Signature

Date

Photo and Specimen Signature

RECENT PHOTOGRAPH (2 COPIES) |

SPECIMEN SIGNATURE |

(Attested by the Introducer)

For Bank use only

Customer IC |

|

|

|

|

Account No. |

|

|

|

|

Customer 10 |

|

|

|

|

Sector Code (for CIB & |

|

|

|

|

Customer's Signature Admitted by |

, |

Introducer's signature verified by |

|

,.. |

input by |

|

Checked & Authorized by |

|

. |

Branch Manager !Authorized Officer |

|

, |

, |

. |

• Prefix such as Mr.! Mrs.! Dr. ! Haji ! Alhaj ! Moulavi ! Engineer! Barrister! Advocate etc.

Page No. 05

1.Title of Account

2.Type of Account

3.Account or Reference No.

Cash Deposit (inclusive of Online

Transactions)

Deposit by Transfer / Instruments

Deposit of Foreign Remittance

Export Revenue

Others (specify) |

. |

Cash withdrawal (inclusive of Online

Transactions and ATM)

Transfer by Instruments

Foreign Remittance withdrawal

Settlement of Import expenses

Others (specify) |

. |

|

Total withdrawal (approx.) |

4.S00~~~TffiM~~~n~I |

_ |

I/We the undersigned hereby confirm that the projected transactions volume is my/our (organization's) normal transactions, I/We do hereby assure that if necessary, I/we will Change/update the transaction profile.

SignatureSignature

NameName

DesignationDesignation

DateDate

•• |

Transaction Profile with Source of Fund Justified by |

|

|

Authorized Officer |

P • |

N 06 |

|

I . . - |

.' |

|

R- |

, |

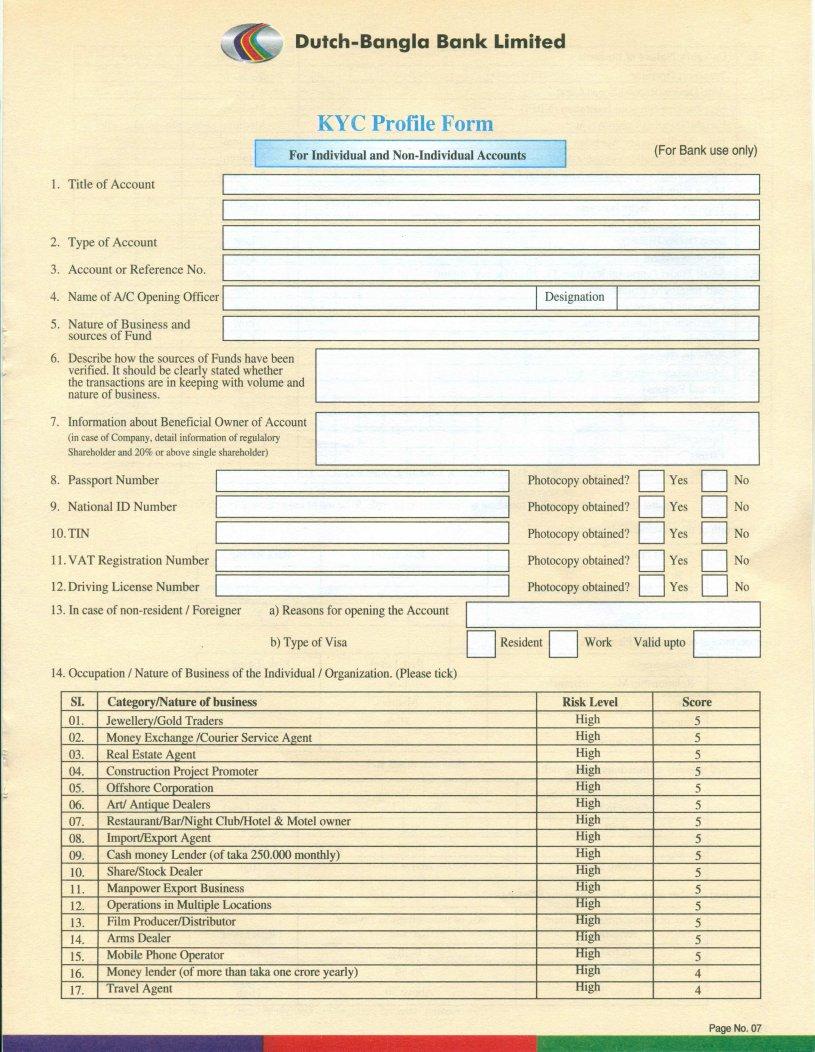

KYC Profile Form

For Individual and |

(For Bank use only) |

|

1.Title of Account

2.Type of Account

3.Account or Reference No.

4. Name of NC Opening Officer |

I Designation I |

5.Nature of Business and sources of Fund

6.Describe how the sources of Funds have been verified. It should be clearly stated whether the transactions are in keeping with volume and nature of business.

7.Information about Beneficial Owner of Account

(in case of Company, detail information of regulalory

Shareholder and 20% or above single shareholder)

8.Passport Number

9.National ID Number

10.TIN

11.VAT Registration Number I

|

|

|

|

|

|

|

|

|

|

|

========================= |

|

|

|

||

12. Driving |

License |

Number |

|

|||||||||||||

13. In case |

of |

/ Foreigner |

a) Reasons for opening |

the Account |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

b) Type of Visa |

|

|

|

|

14. Occupation / Nature |

of Business of the Individual/Organization. |

(please tick) |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

SI. |

|

CategorylNature |

of business |

|

|

Risk Level |

Score |

|

|||||||

|

01. |

|

Jewellery/Gold |

Traders |

|

|

High |

5 |

|

|||||||

|

02. |

|

Money Exchange /Courier Service Agent |

|

High |

5 |

|

|||||||||

|

03. |

|

Real |

Estate |

Agent |

|

|

|

|

High |

5 |

|

||||

|

04. |

|

Construction |

|

Proiect |

Promoter |

|

|

High |

5 |

|

|||||

|

05. |

|

Offshore |

Corporation |

|

|

|

High |

5 |

|

||||||

|

06. |

|

ART! Antique |

Dealers |

|

|

|

High |

5 |

|

||||||

|

07. |

|

Restaurant/Bar/Night |

Club/Hotel |

& Motel owner |

|

High |

5 |

|

|||||||

|

08. |

|

ImportlExport |

|

Agent |

|

|

|

High |

5 |

|

|||||

|

09. |

|

Cash |

money |

Lender |

(of taka 250.000 monthly) |

|

High |

5 |

|

||||||

|

10. |

|

Share/Stock |

|

Dealer |

|

|

|

|

High |

5 |

|

||||

|

11. |

|

Manpower |

Export |

Business |

|

|

High |

5 |

|

||||||

|

12. |

|

Operations |

in Multiple Locations |

|

|

High |

5 |

|

|||||||

|

13. |

|

Film |

ProducerlDistributor |

|

|

High |

5 |

|

|||||||

|

14. |

|

Arms |

Dealer |

|

|

|

|

|

|

HIgh |

5 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

15. |

|

Mobile |

|

Phone |

Operator |

|

|

HIgh |

5 |

|

|||||

|

16. |

|

Money |

lender |

(of more than taka |

one crore yearly) |

|

wgn |

4 |

|

||||||

|

17. |

|

Travel |

Agent |

|

|

|

|

|

|

111gn |

4 |

|

|||

Page No. 07

SI. |

CategorylNature |

of business |

|

|

Risk Level |

Score |

||||||

18. |

Transport |

Operator |

|

|

|

|

|

|

Medium |

3 |

||

19. |

Auto |

Dealer |

(Reconditioned |

Cars) |

|

Medium |

3 |

|||||

20. |

financial |

Institution |

(NBFI) |

Medium |

3 |

|||||||

21. |

Freight/Shipping/Cargo |

|

Agent |

|

|

Medium |

3 |

|||||

22. |

Insurance/Brokerage |

|

Agencies |

|

|

Medium |

3 |

|||||

23. |

Religious |

Institutions/Organizations |

|

|

Medium |

3 |

||||||

24. |

Entertainment |

Organization! |

Amusement |

Park |

Medium |

3 |

||||||

25. |

Motor |

Parts Business |

|

|

|

|

|

Medium |

3 |

|||

26. |

Tobacco |

& Cigarette |

Business |

|

|

Medium |

3 |

|||||

27. |

Auto |

Primary |

(New Car) |

|

|

|

|

Low |

2 |

|||

28. |

Shop |

Owner |

(Retail) |

|

|

|

|

|

Low |

2 |

||

29. |

Business |

|

|

|

|

|

|

Low |

2 |

|||

30. |

Small |

Trader |

(Turnover |

less |

than |

Tk. 50.00 lac per annum) |

Low |

2 |

||||

31. |

Self Employed Professional |

|

|

|

Low |

2 |

||||||

32. |

Corporate |

Customer |

|

|

|

|

|

Low |

2 |

|||

33. |

Construction |

Material |

Business |

|

|

Low |

2 |

|||||

34. |

ComputerlMobile |

Phone |

Dealer |

|

|

Low |

2 |

|||||

35. |

Software |

Business |

|

|

|

|

|

|

Low |

1 |

||

36. |

Manufactures |

(other than Arms) |

|

|

Low |

1 |

||||||

37. |

Retired Persons |

|

|

|

|

|

|

Low |

0 |

|||

38. |

Service |

|

|

|

|

|

|

|

|

Low |

0 |

|

39. |

Student |

|

|

|

|

|

|

|

|

Low |

0 |

|

40. |

Housewife |

|

|

|

|

|

|

|

|

Low |

0 |

|

41. |

Farmer |

|

|

|

|

|

|

|

|

Low |

0 |

|

|

|

|

|

|

|

|||||||

42. |

Others |

(Bank |

will rate the risk according |

to nature) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

For table 16 to 21 upper limit will be considered as same category. Example: 50 lac will be under the category of

15. Net worth of the Customer (Please tick) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Amount |

(Taka) |

|

Risk Level |

Risk |

Rating |

|

|

|

|

|

|

Low |

|

0 |

|

|

||

|

|

|

|

|

|

|

|

||

|

50 lac to 2 crore |

|

Medium |

|

1 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Above |

2 Crore |

|

High |

|

3 |

|

|

|

16.Procurement of accounts (Please tick) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Procurements |

|

|

Risk Level |

Risk |

Rating |

|

|

|

|

Relationship |

ManagerlBranch |

|

Low |

|

0 |

|

|

|

|

Direct Sales |

Agent |

|

Medium |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internet |

|

|

|

High |

|

3 |

|

|

|

motivated |

|

High |

|

3 |

|

|

||

17. Estimated monthly transactions (Please tick) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||

|

Transactions |

in Current Account |

Transactions in Savings |

Account |

|

|

|

||

|

|

(figure in Lac) |

|

(figure in Lac) |

Risk Level |

|

Risk Rating |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Low |

|

0 |

|||

|

|

|

|

Medium |

|

1 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

Above 50 |

|

Above 20 |

|

High |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

18. Estimated number of monthly transactions (Please tick)

No. of transactions |

in Current |

No. of transactions |

in Savings |

|

|

Account |

Account |

Risk Level |

Risk Rating |

||

|

|

Low |

0 |

||

100 - 250 |

|

Medium |

1 |

||

Above 250 |

Above |

50 |

High |

3 |

|

|

|

|

|

|

|

Page No. 08

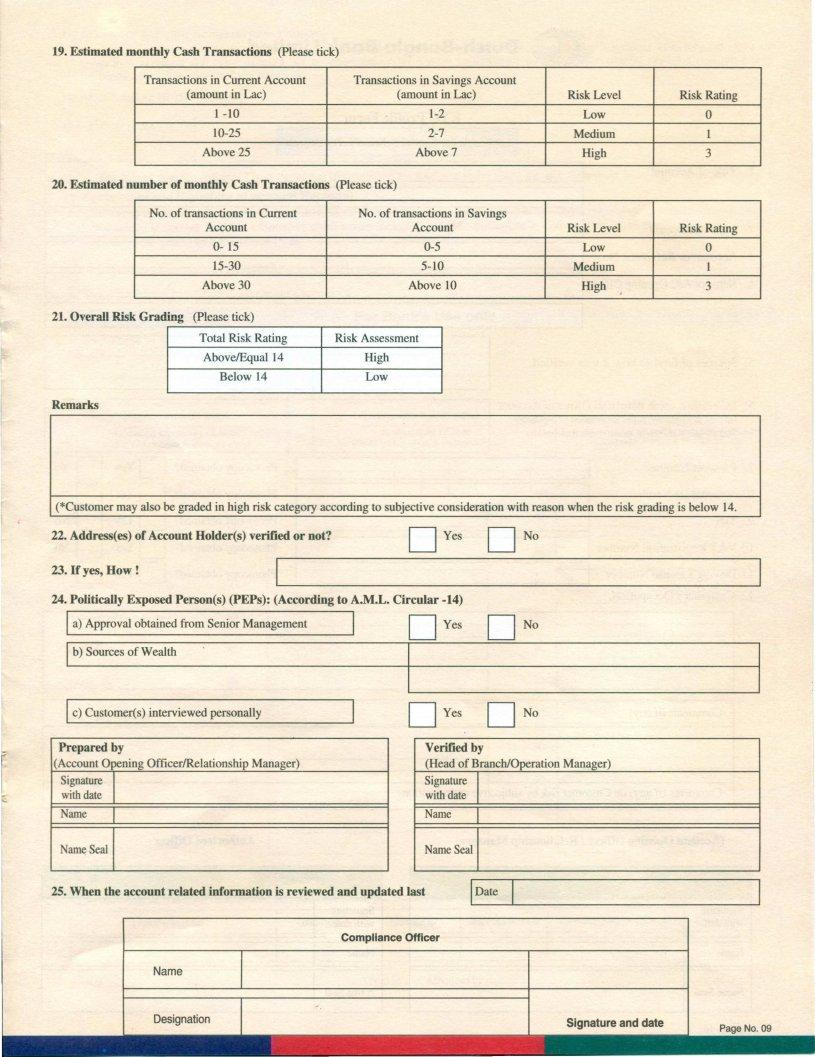

19. Estimated monthly Cash Transactions (please tick) |

|

|

||||

|

|

|

|

|

|

|

|

Transactions in Current Account |

Transactions in Savings Account |

|

|

||

|

|

(amount in Lac) |

(amount in Lac) |

Risk Level |

Risk Rating |

|

|

1 |

Low |

0 |

|||

|

Medium |

1 |

||||

|

|

Above 25 |

Above 7 |

High |

3 |

|

|

|

|

|

|

|

|

20. Estimated number of monthly Cash Transactions (please tick) |

|

|

||||

|

|

|

|

|

|

|

|

No. of transactions in Current |

No. of transactions in Savings |

|

|

||

|

|

|

|

|

|

|

|

|

Account |

Account |

Risk Level |

Risk Rating |

|

|

0- 15 |

|

Low |

0 |

||

|

Medium |

1 |

||||

|

|

Above 30 |

Above 10 |

High |

3 |

|

|

|

|

|

|

|

|

21. Overall Risk Grading (Please tick) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Total Risk Rating |

Risk Assessment |

|

|

|

|

|

|

|

|

|

|

|

|

AbovelEqual 14 |

High |

|

|

|

|

|

Below 14 |

Low |

|

|

|

|

|

|

|

|

|

|

Remarks

(*Customer may also be graded in high risk category according to subjective consideration with reason when the risk grading is below 14.

22. Address(es) of Account Holder(s) verified or not? |

DYes |

|

23.H yes, How!

24.Politically Exposed Person(s) (PEPs): (According to A.M.L. Circular

a) Approval obtained from Senior Management |

DYes |

D |

No |

|

l_b_)_S__ceoms_O_f_VV_e_al_th |

||||

Ic) Customer(s) interviewed personally |

DYes |

|

|

|

Prepared by |

|

Verified by |

|

|

(Account Opening OfficerlRelationship Manager) |

|

(Head of Branch/Operation Manager) |

||

Signature |

|

Signature |

|

|

withdate |

|

withdate |

|

|

Name |

|

Name |

|

|

NameSeal |

|

NameSeal |

|

|

25. When the account related information is reviewed and updated last |

B |

_ |

||

|

|

|

||

Compliance Officer

KYC Profile Form

IApplicable for Special Scheme/Term Deposit I

1.Title of Account

2.Type of Account

3.Account or Reference No.

4. Name of Opening Officer I

ALCI~~~~~~~~~~~~~~

5.Sources of fund & how it was verified.

6.Information about Beneficial Owner of Account

(in case of Company, detail information of regulatory

Shareholder and 20% or above single shareholder)

7. |

Passport Number |

|

|

Photocopy obtained? |

DYes |

DNo |

8. |

National ID Number |

|

|

Photocopy obtained? |

DYes |

DNO |

9. |

TIN |

|

|

Photocopy obtained? |

DYes |

DNo |

10.VAT Registration Number |

I |

|

Photocopy obtained? |

DYes |

DNo |

|

11.Driving License Number |

============================ |

|

|

|

|

|

|

Photocopy obtained? |

|

|

|||

1 |

_ |

DYes |

DNo |

|||

12.Customer's Occupation.

Comments (if any)

Comments (if any) on Customer risk by subjective consideration

(Account Opening Officer I Relationship Manager) |

Authorized Officer |

Signature |

Signature |

with date |

with date |

Name |

Name |

Name Seal |

Name Seal |

Page No. 10

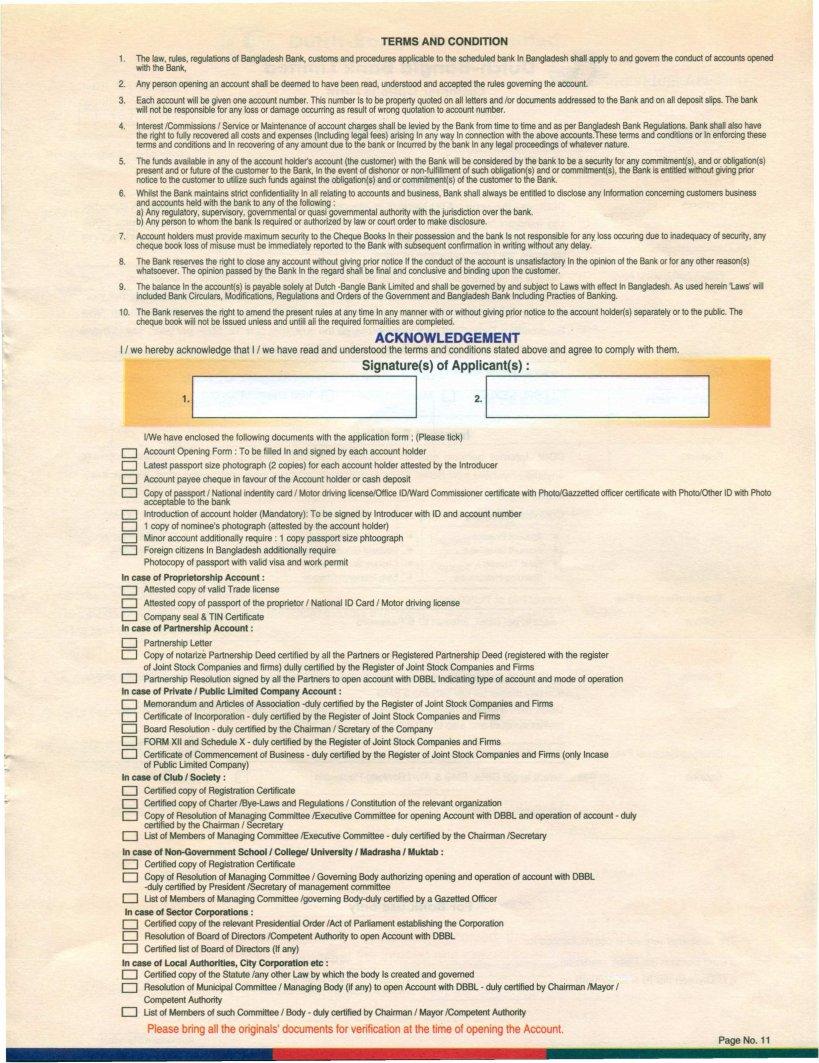

TERMS AND CONDITION

1.The law, rules, regulations of Bangladesh Bank, customs and procedures applicable to the scheduled bank In Bangladesh shall apply to and govern the conduct of accounts opened with the Bank,

2.Any person opening an account shall be deemed to have been read, understood and accepted the rules governing the account.

3.Each account will be given one account number. This number Is to be property quoted on all letters and lor documents addressed to the Bank and on all deposit slips. The bank will not be responsible for any loss or damage occurring as result of wrong quotation to account number.

4.Interest ICommissions I Service or Maintenance of account charges shall be levied by the Bank from time to time and as per Bangladesh Bank Regulations. Bank shall also have the right to fully recovered all costs and expenses (Including legal fees) arising In any way In connection with the above accounts.These terms and conditions or In enforcing these terms and conditions and In recovering of any amount due to the bank or Incurred by the bank In any legal proceedings of whatever nature.

S.The funds available in any of the account holder's account (the customer) with the Bank will be considered by the bank to be a security for any comrnitmenttsl, and or obligation(s) present and or future of the customer to the Bank, In the event of dishonor or

6.Whilst the Bank maintains strict confidentiality In all relating to accounts and business, Bank shall always be entitled to disclose any Information concerning customers business and accounts held with the bank to any of the following:

a)Any regulatory, supervisory, governmental or quasi governmental authority with the jurisdiction over the bank.

b)Any person to whom the bank Is required or authorized by law or court order to make disclosure.

7.Account holders must provide maximum security to the Cheque Books In their possession and the bank Is not responsible for any. loss occuring due to inadequacy of security, any cheque book loss of misuse must be immediately reported to the Bank with subsequent confirmation in writing without any delay.

8.The Bank reserves the right to close any account without giving prior notice If the conduct of the account is unsatisfactory In the opinion of the Bank or for any other reason(s) whatsoever. The opinion passed by the Bank In the regard shall be final and conclusive and binding upon the customer.

9.The balance In the account(s) is payable solely at Dutch

10.The Bank reserves the right to amend the present rules at any time In any manner with or without giving prior notice to the account holder(s) separately or to the public. The cheque book will not be Issued unless and untill all the required formalities are completed.

ACKNOWLEDGEMENT

IIwe hereby acknowledge that I / we have read and understood the terms and conditions stated above and agree to comply with them.

l!We have enclosed the following documents with the application form; (Please tick)

DAccount Opening Form: To be filled In and signed by each account holder

Dlatest passport size photograph (2 copies) for each account holder attested by the Introducer

DAccount payee cheque in favour of the Account holder or cash deposit

DCopy of passport I National indentity card I Motor driving license/Office IDlWard Commissioner certificate with PhotoiGazzetted officer certificate with PhotoiOther ID with Photo acceptable to the bank

DIntroduction of account holder (Mandatory): To be signed by Introducer with ID and account number

D1 copy of nominee's photograph (attested by the account holder)

DMinor account additionally require: 1 copy passport size phtoograph

DForeign citizens In Bangladesh additionally require Photocopy of passport with valid visa and work permit

In case of Proprietorship Account:

DAttested copy of valid Trade license

DAttested copy of passport of the proprietor I NationallD Card I Motor driving license

DCompany seal & TIN Certificate

In case of Partnership Account:

DPartnership Letter

DCopy of notarize Partnership Deed certified by all the Partners or Registered Partnership Deed (registered with the register of Joint Stock Companies and firms) dully certified by the Register of Joint Stock Companies and Firms

DPartnership Resolution signed by all the Partners to open account with DBBl Indicating type of account and mode of operation In case of Private I Public Limited Company Account:

DMemorandum and Articles of Association

DCertificate of Incorporation - duly certified by the Register of Joint Stock Companies and Rrms

DBoard Resolution - duly certified by the Chairman I Scretary of the Company

DFORM XII and Schedule X - duly certified by the Register of Joint Stock Companies and Firms

DCertificate of Commencement of Business - duly certified by the Register of Joint Stock Companies and Firms (only Incase of Public Limited Company)

In case of Club I Society :

DCertified copy of Registration Certi1icate

DCertified copy of

DCopy of Resolution of Managing Committee !Executive Cornmtttee for opening Account ~ DBBl and operation of account - duly certified by the Chairman I Secretary

DList of Members of Managing Committee !Executive Committee - duly certi1ied by the Chairman ISecretary

In case of

DCertified copy of Registration Certificate

DCopy of Resolution of Managing Committee I Governing Body authorizing opening and operation of account with DBBl

DUst of Members of Managing Committee 19oveming

In case of Sector Corporations :

DCertified copy of the relevant Presidential Order IAct of Parliament establishing the Corporation

DResolution of Board of Directors ICompetent Authority to open Account ~ DBBl

DCertified list of Board of Directors (If any)

In case of Local Authomies, City Corporation etc :

DCertified copy of the Statute lany other Law by which the body Is created and governed

DResolution of Municipal Committee I Managing Body (if any) to open Account with DBBl - duly certified by Chairman /Mayor I Competent Authomy

DUst |

of Members of such Committee I Body - duly certified by Chairman I Mayor ICompetent Authomy |

Please bring all the originals' documents for verification at the time of opening the Account.

Page No. 11

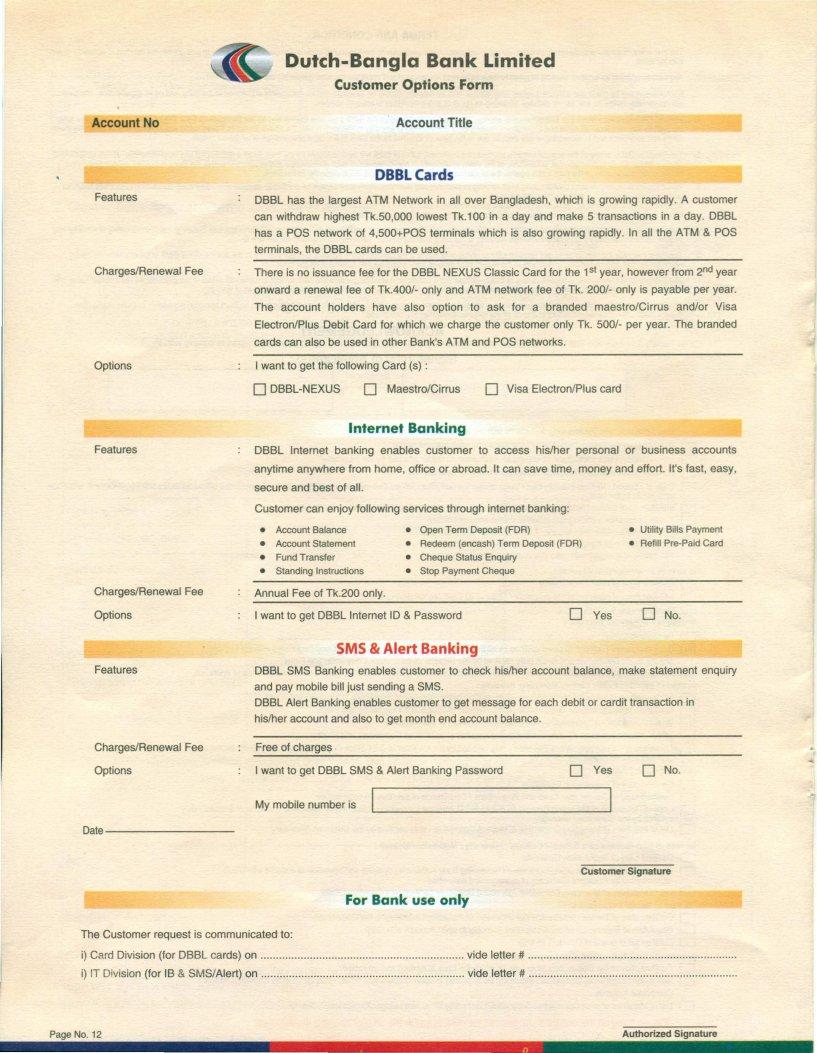

Account No

Features

Charges/Renewal Fee

Options

Customer Options Form

Account Title

DBBLCards

DBBL has the largest ATM Network in all over Bangladesh, which is growing rapidly. A customer can withdraw highest Tk.50,000 lowest Tk.100 in a day and make 5 transactions in a day. DBBL has a POS network of 4,500+POS terminals which is also growing rapidly. In all the ATM & POS terminals, the DBBL cards can be used.

There is no issuance fee for the DBBL NEXUS Classic Card for the 1st year, however from 2nd year onward a renewal fee of Tk.400/- only and ATM network fee of Tk. 200/- only is payable per year. The account holders have also option to ask for a branded maestro/Cirrus and/or Visa Electron/Plus Debit Card for which we charge the customer only Tk. 500/- per year. The branded cards can also be used in other Bank's ATM and POS networks.

I want to get the following Card (s) :

o

Internet Banking

Features

Charges/Renewal Fee

DBBL Internet banking enables customer to access his/her personal or business accounts anytime anywhere from home, office or abroad. It can save time, money and effort. It's fast, easy, secure and best of all.

Customer can enjoy following services through internet banking:

• |

Account |

Balance |

• |

Open Term Deposit (FOR) |

• |

Utility Bills Payment |

|

• |

Account |

Statement |

• |

Redeem (encash) Term Deposit (FOR) |

• |

Refill |

|

• |

Fund Transfer |

• |

Cheque Status |

Enquiry |

|

|

|

• |

Standing |

Instructions |

• |

Stop Payment |

Cheque |

|

|

Annual Fee of Tk.200 only.

Options

Features

I want to get DBBL Internet 10 & Password |

DYes |

o No. |

SMS & Alert Banking

DBBL SMS Banking enables customer to check his/her account balance, make statement enquiry and pay mobile bill just sending a SMS.

DBBL Alert Banking enables customer to get message for each debit or cardit transaction in his/her account and also to get month end account balance.

Charges/Renewal Fee |

Free of charges. |

|

|

Options |

I want to get DBBL SMS & Alert Banking Password |

DYes |

o No. |

|

My mobile number is |

|

|

|

Customer |

Signature |

|

For Bank use only |

|

The Customer request is communicated to: |

|

|

i) Card Division (for DBBL cards) on |

vide letter # |

. |

i) IT Division (for IB & SMS/Alert) on |

vide letter # |

. |

Page No. 12 |

Authorized Signature |