You'll be able to work with fill in detroit w 4 form without difficulty with the help of our PDFinity® editor. Our team is devoted to giving you the ideal experience with our tool by regularly introducing new features and upgrades. With these improvements, working with our tool becomes easier than ever! Starting is easy! All that you should do is adhere to these easy steps directly below:

Step 1: Open the PDF file inside our tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: When you start the file editor, you'll see the document ready to be filled in. Aside from filling out different blank fields, you might also do various other actions with the Document, including adding any text, changing the original text, adding graphics, affixing your signature to the PDF, and a lot more.

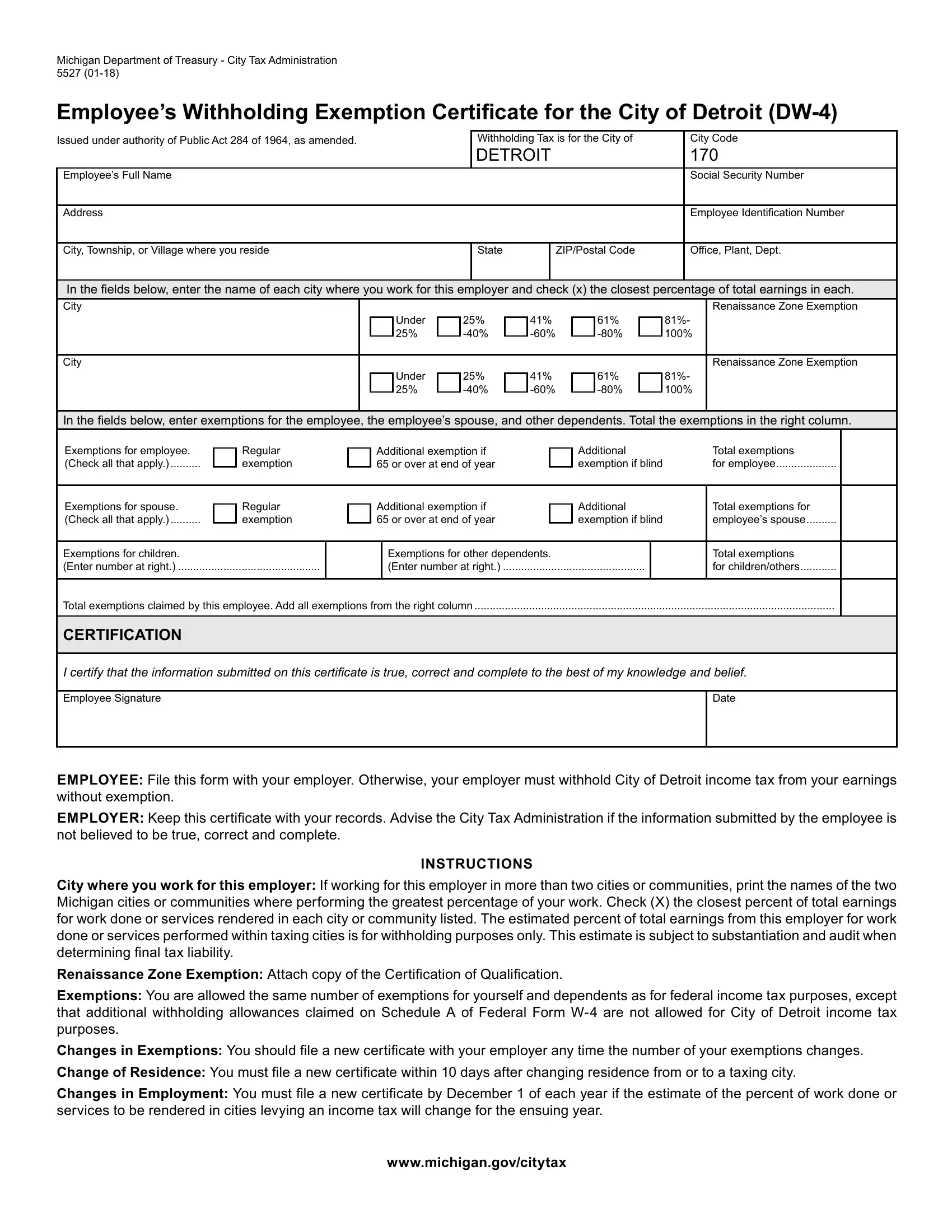

This PDF form will require specific information to be filled out, thus ensure that you take some time to provide what's expected:

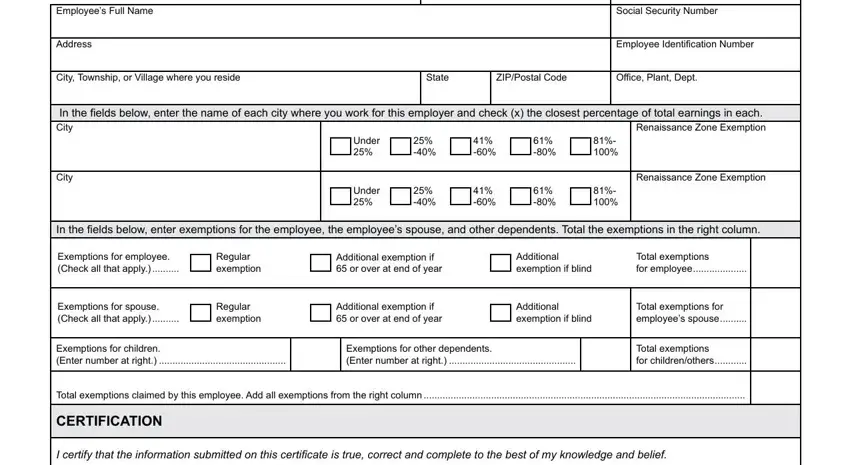

1. To start off, once completing the fill in detroit w 4 form, start in the area that features the following fields:

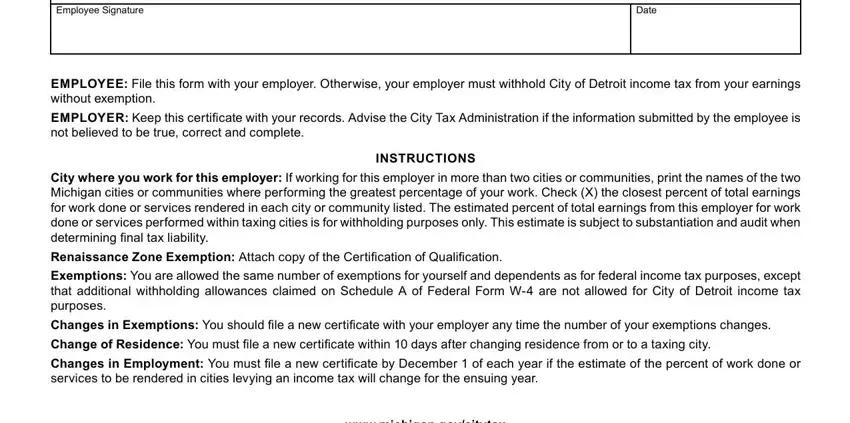

2. Given that this array of fields is completed, you'll want to include the needed details in Employee Signature, Date, EmplOyEE File this form with your, INsTRuCTIONs, City where you work for this, and wwwmichigangovcitytax so that you can go further.

Regarding City where you work for this and Employee Signature, ensure you get them right in this section. These two are the key ones in the page.

Step 3: Look through all the details you've inserted in the blank fields and hit the "Done" button. Right after creating afree trial account with us, you'll be able to download fill in detroit w 4 form or send it via email without delay. The PDF document will also be available via your personal cabinet with your each edit. We do not sell or share any details that you enter whenever completing documents at our site.