Form E-589CI, Afidavit of Capital Improvement, may be issued to substantiate that a contract, or a portion of work performed to fulill a contract, is a capital improvement to real property and subject to sales and use tax as a real property contract. Generally, services to real property are retail sales of or the gross receipts derived from repair, maintenance, and installation services, unless a person substantiates that a transaction is subject to tax as a real property contract, subject to tax as a mixed transaction contract, or the transaction is not subject to sales and use tax. A “real property contract” is a contract between a real property contractor and another person to perform a capital improvement to real property.

A mixed transaction contract is a contract that includes both a real property contract for a capital improvement and repair, maintenance, and installation services for real property that are not related to the capital improvement. For a mixed transaction contract, if the allocated sales price of the taxable repair, maintenance, and installation services included in the contract is less than or equal to twenty-ive percent (25%) of the contract price, then the repair, maintenance, and installation services portion of the contract, and the tangible personal property, digital property, or service used to perform those services, are taxable as a real property contract for sales and use tax purposes.

•A person that issues Form E-589CI is liable for any additional tax due on the transaction in excess of tax paid on purchases pursuant to N.C. Gen. Stat. § 105- 164.4H(a), if it is determined that the transaction is not a capital improvement, but rather the transaction is subject to tax as a retail sale.

•A person who receives Form E-589CI from another person, absent fraud or other egregious activities, is not liable for any additional tax on the gross receipts from the transaction if it is determined that the transaction is not a capital improvement.

•Form E-589CI is not an afidavit of tax paid on tangible personal property, or digital property purchased or used to fulill a real property contract.

•Form E-589CI may not to be used to purchase tangible personal property, or digital property exempt from sales and use tax.

Exceptions from the Issuance of Form E-589CI to Establish a Transaction is to be Taxed as a Real Property Contract

In lieu of issuing an afidavit of capital improvement, a person may substantiate by other records that a transaction is a real property contract or a mixed transaction contract subject to tax as a real property contract, as discussed above, for a capital improvement to real property. However, where subcontractors are involved, it may be in the best interest of all parties to use Form E-589CI to ensure proper application of the sales and use tax laws.

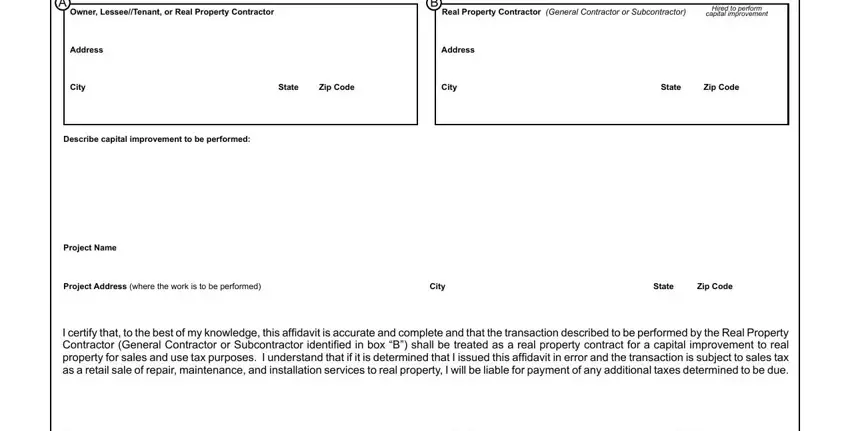

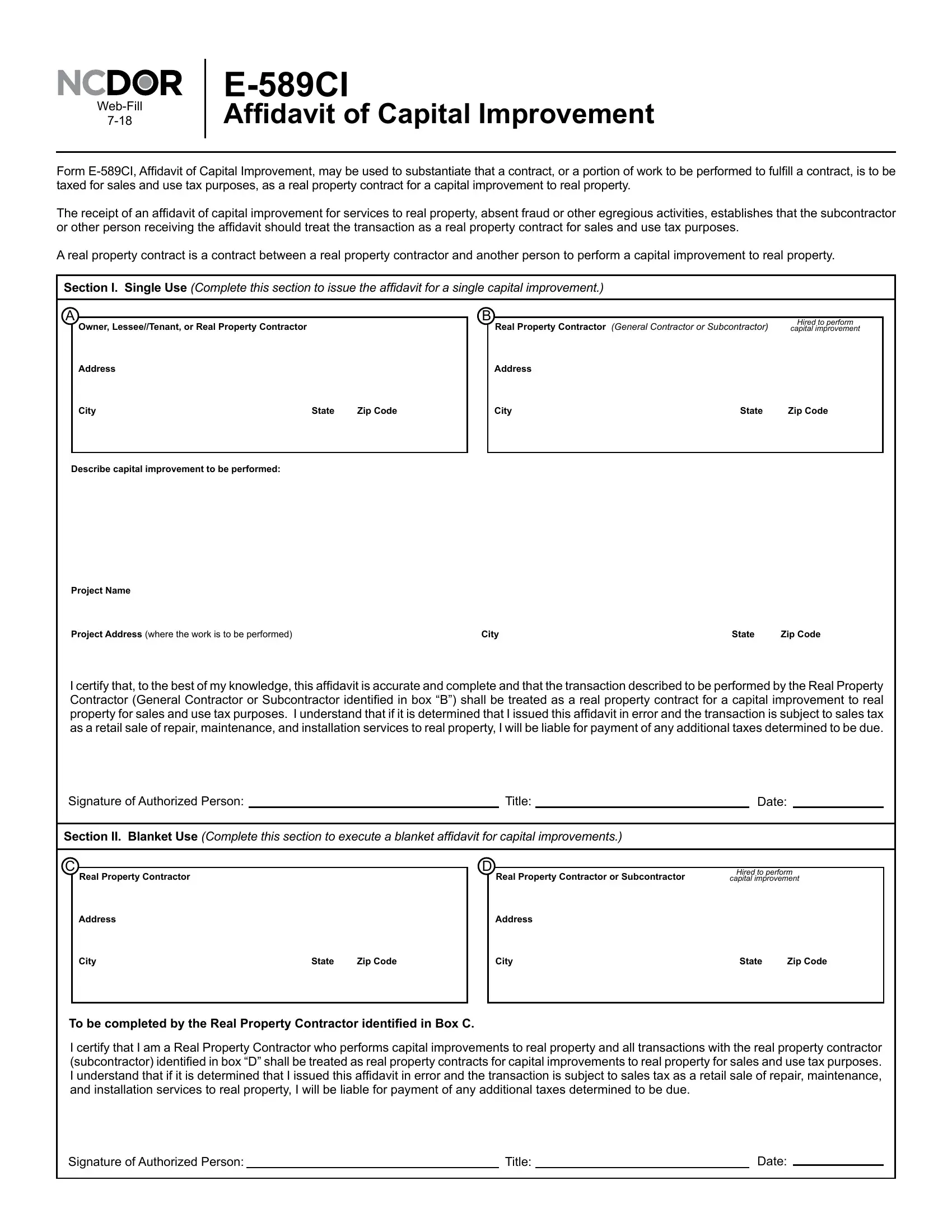

Section I. Single Use Instructions

A person may complete “Section I - Single Use” for a one time use to substantiate that a transaction is a real property contract for a single capital improvement to real property and subject to sales and use tax as a real property contract. When a real property contractor hires a subcontractor to perform a portion of the overall real property contract and there is not a recurring business relationship between the two parties (when a period of no more than twelve months elapse between transactions between two parties), “Section I – Single Use” may be completed and the form issued to the subcontractor as notice that the transaction is subject to sales and use tax as a real property contract.

The following scenarios are for reference to assist a person to complete and issue Form E-589CI. The scenarios presented are not intended to cover all possible uses of the form.

Aproperty owner oversees the entire activity to real property that is a real property contract for a capital improvement to real property. The property owner hires various subcontractors to complete the real property contract or portions thereof:

•Box A - Owner, Lessee/Tenant or Real Property Contractor: Enter property owner’s name and address.

•Box B - Real Property Contractor (General Contractor or Subcontractor): Enter a single subcontractor’s name and address.

•Owner listed in Box A must describe the real property contract activity to be performed.

•Owner listed in Box A must enter the project address (if different than the address entered in Box A).

•Authorized Person (owner) signs, enters title (owner), enters the date, and issues to the person listed in Box B.

A property owner hires a general contractor to oversee the entire activity to real property that is a real property contract for a capital improvement to real property. The general contractor hires a subcontractor to perform the real property contract, or portion thereof:

•Box A - Owner, Lessee/Tenant or Real Property Contractor: Enter general contractor’s name and address.

•Box B - Real Property Contractor (General Contractor or Subcontractor): Enter subcontractor’s name and address.

•General contractor listed in Box A must describe the real property contract activity to be performed.

•General contractor listed in Box A must enter the project address.

•Authorized Person (general contractor) signs, enters title (general contractor), enters the date, and issues to the person listed in Box B.

Alessee/tenant hires a general contractor for the installation of equipment that is to be attached to real property and will be depreciated under the Internal Revenue Code:

•Box A - Owner, Lessee/Tenant or Real Property Contractor: Enter lessee/tenant’s name and address.

•Box B - Real Property Contractor (General Contractor or Subcontractor): Enter general contractor’s name and address.

•Lessee or tenant listed in Box A must describe the capital improvement to be performed and indicate the equipment will be depreciated under the Internal Revenue Code.

•Authorized Person (typically lessee or tenant) signs, enters title (lessee or tenant), enters the date, and issues to the person listed in Box B.

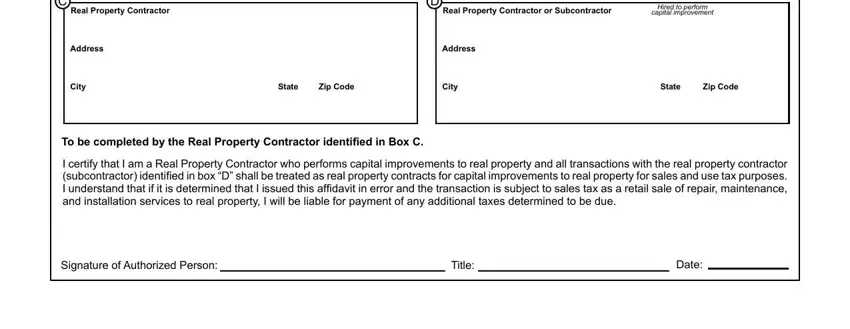

Section II. Blanket Use Instructions

A real property contractor may complete “Section II – Blanket Use” and issue the form to another real property contractor (subcontractor) who is used exclusively to perform part, or all, of real property contracts with respect to capital improvements to real properties, where the parties have a recurring business relationship (when a period of no more than twelve months elapse between transactions between two parties). A blanket use afidavit continues in force so long as the real property contractor named in “Box C” and the real property contractor (subcontractor) named in ”Box D” maintain a recurring business relationship or until the afidavit is withdrawn or otherwise notiied by the issuer of the form.

The blanket use will generally apply for the following: (1) a builder who hires the same contractor(s) only for new construction; (2) a real property contractor who hires the same subcontractor(s) only for reconstruction; (3) a real property contractor who hires the same subcontractor(s) for remodeling or renovation and the activities performed by the subcontractor(s) for the other party are never repair, maintenance, and installation services for real property based on the contract or agreement between the parties; and (4) a real property contractor who exclusively hires the same subcontractor(s) to perform part, or all, of its real property contracts for capital improvements to real properties.

Ageneral contractor or subcontractor hires a subcontractor that will replace the complete electrical wiring in all renovated homes:

•Box C - Real Property Contractor: Enter the hiring real property contractor’s name and address.

•Box D - Real Property Contractor (General Contractor or Subcontractor): Enter the hired subcontractor’s name and address.

•Authorized person listed in Box C signs, enters title, enters the date, and issues to the person listed in Box D.