Individuals looking to either transfer or retain a vehicle registration number find the Editable V317 form instrumental for their needs. This form serves a dual purpose: it enables the current registered keeper of a vehicle to transfer its unique registration number to another vehicle, or to retain the number for future use on a different vehicle, securing it on a Retention Document. The fees associated with these transactions vary, with £80 required for a direct transfer and a sliding scale fee starting from £105 for retaining the number for one year, reflecting varying durations up to three years. Applicants are urged to meticulously fill the form using black ink and capital letters, ensuring clarity in their submissions. It is critical to peruse the attached guidance notes prior to completing the form to grasp fully the process's subtleties, including the required documentation such as the vehicle's registration certificate (V5C), MoT certificates where applicable, and the appropriate application fee. This form underscores the importance of accurate, up-to-date documentation in managing vehicle registration numbers, offering a methodical approach for those looking to either retain their vehicle's identity for posterity or bestow it upon another vehicle.

| Question | Answer |

|---|---|

| Form Name | Editable V317 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | v317, v317 form, v317 form gov, V5C |

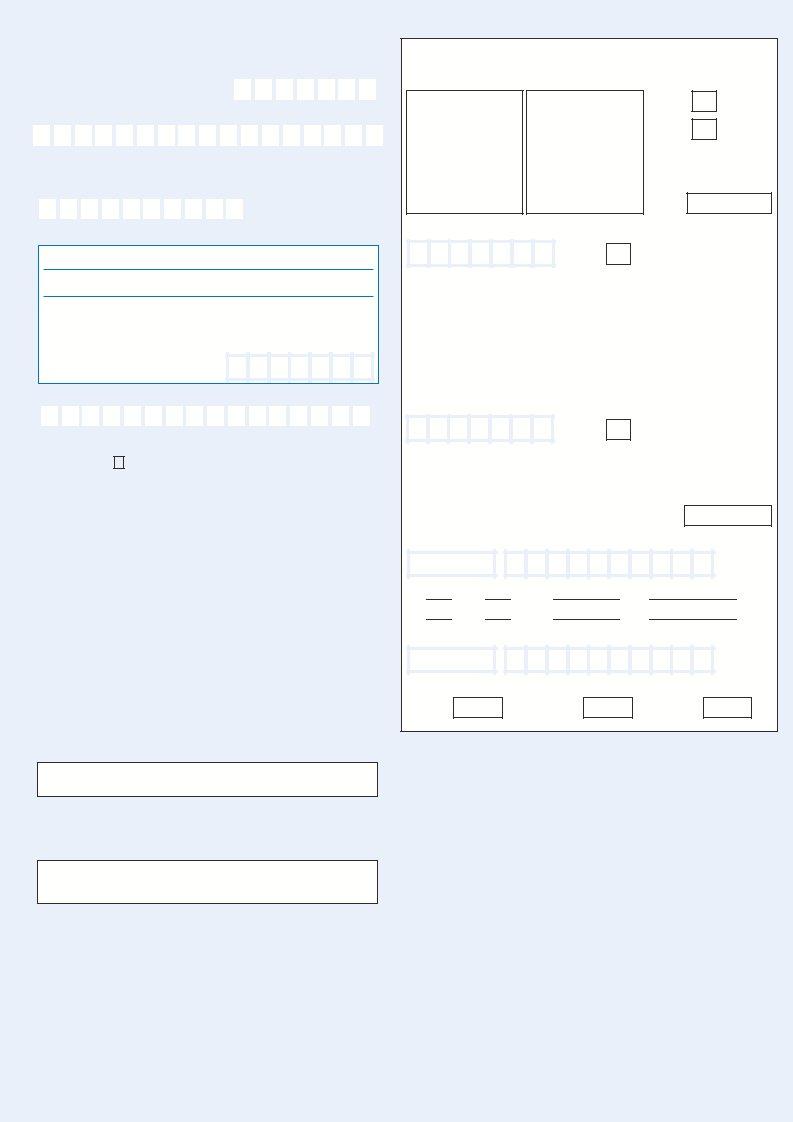

Application to transfer or retain |

|

a vehicle registration number |

V317 |

For more information go to w w w .direct.gov.uk/ numbertransfer

You must read the attached Guidance notes before you fill in this form. Please use black ink and CAPITAL LETTERS.

1

What are you applying for? Put a

✖

in the box that applies.

To transfer the vehicle registration number directly to another vehicle Ð fill in sections 2 and 4. The fee is £80. To retain (keep the use of) the vehicle registration number on a Retention Document Ð fill in section 2 and 3 below.

How long do you want to retain the vehicle registration number? One year: £105 ✖ Two years: £130 ✖

✖

✖

2 |

Details of the vehicle that currently carries the vehicle |

|

registration number being transferred or retained |

||

|

|

|

Vehicle registration number:

VIN/Chassis No:

Date the tax disc runs out:■■M M ■■Y Y

Tax disc serial number (taken from the top of your tax disc):

Registered keeper’s details

Title or company name:

Name:

House No: |

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode:

Your phone number: (We need this so we can get in touch with you.)

Declaration

Please put a |

✖ |

in the relevant box to show what you |

|

||||||

are enclosing with this application. |

|

||||||||

¥ |

The Registration Certificate (V5C) or |

✖ |

|||||||

¥ |

New |

|

keeperÕs |

|

details |

|

(V5C/2) for the vehicle with an |

|

|

|

|

|

✖ |

||||||

|

Application for |

a vehicle registration certificate (V62) |

|||||||

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

¥Application for a tax disc (V10) or an Application to tax

|

a Heavy Goods Vehicle (HGV) (V85) and a certificate |

|

✖ |

|

of insurance or cover note (if you need to tax the vehicle) |

|

|

¥ |

An MoT or Goods Vehicle Test (GVT) certificate |

|

|

|

✖ |

||

|

|

|

|

|

(if appropriate) |

|

|

¥ |

The appropriate fee |

|

✖ |

If any details on the V5C have changed, please fill in the changes section and send this with your application.

I declare that I am the registered keeper of this vehicle, the details on the enclosed forms are correct, and I have read and understood the attached Guidance notes.

Signature:

Date: ■■D D ■■M M ■■■■Y Y Y Y

If you are signing for a partnership, limited company or other organisation, please give your position in the firm.

3Details for the Retention Document

IMPORTANT Ð Please read this section and notes A and B overleaf carefully before filling in.

If you are retaining the vehicle registration number, as the registered keeper do you want to become the Grantee (the Grantee is the one who has the right to the vehicle registration number)?

Yes ✖ No ✖

If no, in the box below give details of who should be the Grantee. This means that as the registered keeper, you will give up the right to the vehicle registration number.

Grantee’s details (see notes A and B)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

Title: Mr |

✖ |

Mrs |

✖ |

Miss |

✖ |

Ms |

✖ |

|

|||||||||

(for example, Dr) |

|

||||||||||||||||

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First name: |

|

|

|

|

|

|

|

|

|

|||||||

|

Surname: |

|

|

|

|

|

|

|

|

|

|||||||

|

Company name: |

|

|

|

|

|

|

|

|

|

|||||||

|

House No: |

|

|

|

|

|

|

|

|

Address: |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode:

GranteeÕs phone number: (We need this so we can get in touch with you.)

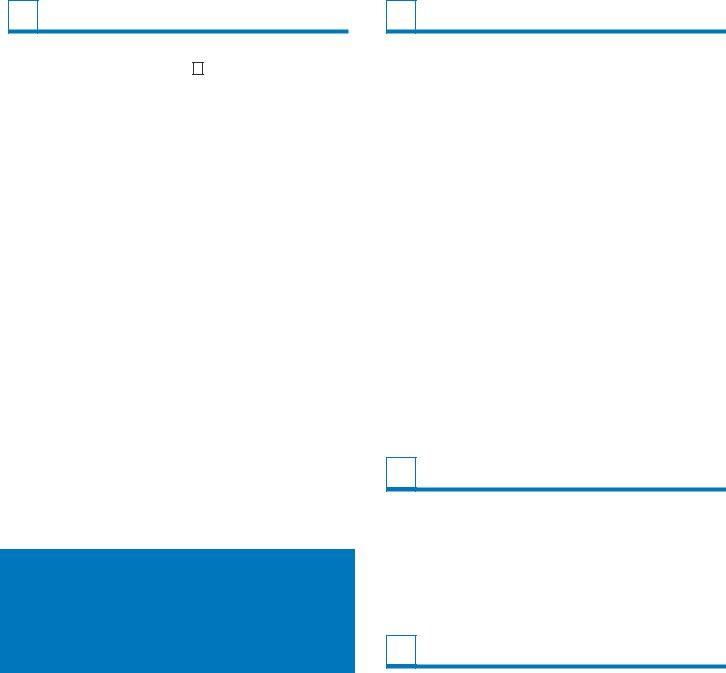

Nominee’s details (see notes A and B)

If you are retaining the vehicle registration number and are becoming the Grantee you may want to assign it (put on) to a vehicle registered in someone elseÕs name. This person is known as the Nominee, give the NomineeÕs details below.

Title: Mr |

✖ |

Mrs |

✖ |

Miss |

✖ |

Ms |

✖ |

Other |

|

(for example, Dr) |

|||||||||

|

|

|

|

First name:

Surname:

Company name:

GranteeÕs signature:

Date: ■■D D ■■M M ■■■■Y Y Y Y

4 |

Details of the vehicle the vehicle registration |

number is being transferred to |

|

|

|

Vehicle registration number:

VIN/Chassis No:

Date the tax disc runs out:■■M M ■■Y Y

Tax disc serial number (taken from the top of your tax disc):

Registered keeper’s details

Title or company name:

Name:

House No: |

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode:

Your phone number: (We need this so we can get in touch with you.)

Declaration

Please put a ✖ in the relevant box to show what you are enclosing with this application.

¥ |

The Registration Certificate (V5C) or |

✖ |

|

¥ |

New keeperÕs details (V5C/2) for the vehicle with an |

|

|

✖ |

|||

|

Application for a vehicle registration certificate (V62) or |

||

¥ |

|

||

Application for registering the vehicle with the |

|

||

✖ |

|||

|

vehicle registration number for the first time (V55) |

||

|

|

||

|

(if it is an unregistered vehicle) |

|

|

|

|

|

|

¥ |

Application for a tax disc (V10) or an Application to tax |

✖ |

|

|

a Heavy Goods Vehicle (HGV) (V85) and a certificate |

|

|

|

of insurance or cover note (if you need to tax the vehicle) |

|

|

|

|

|

|

¥ |

An MoT or GVT certificate (if appropriate) |

✖ |

If any details on the V5C have changed, please fill in the changes section and send this with your application.

I declare that I am the registered keeper of this vehicle, the details on the enclosed forms are correct, and I have read and understood the attached Guidance notes.

Signature:

Date: ■■D D ■■M M ■■■■Y Y Y Y

If you are signing for a partnership, limited company or other organisation, please give your position in the firm.

Office use only

Date received at LO |

Date processed at LO |

ITT 126

ITT 127

Output marker

Vehicle from Section 2: Vehicle registration number

CD

Associated docs: V10 ■ V85 ■

Vehicle from Section 2 replacement vehicle registration number and C/D

(V53 sticker) |

Is this replacement vehicle |

|

registration number |

|

transferable? Yes ■ No ■ |

|

|

Vehicle from Section 4: Vehicle registration number (for transfer applications only)

CD

Associated docs: V10 ■ V85 ■ V55 ■

Please select indicator(s): Void ■ Retained ■ Inhibit ■ SOM ■

EPOS taxing information

Donor: T/C |

|

Period |

|

CC/CO2 |

|

Value |

|

|

|

Replacement tax disc expiry month or serial number

M M Y Y

Recipient (transfer applications only)

T/C Period CC/CO2 Value

Replacement tax disc expiry month or serial number

M M Y Y

Period of retention |

|

|

One year |

Two years |

Three years |

Guidance notes. Read these notes before filling in the form and keep them safe so you can read them in the future. You should also read Registration numbers and you (INF46) which gives more information,

you can get this from www.direct.gov.uk/motoringleaflets

AHow to fill in this form

Section 1 – What are you applying for?

Choose one option by putting a ✖ in the relevant box.

¥If you choose to retain (keep the use of) a vehicle registration number, you can retain it for one, two or three years. Please make sure you Þll in section 1 and send in the correct fee.

Please note the fee to retain the vehicle registration number includes the assignment fee of £80.

Section 2 – Details of the vehicle that currently carries the vehicle registration number being transferred or retained

Only the registered keeper of this vehicle can apply.

Give all the details section 2 asks for.

¥If you are enclosing a New keeperÕs details (V5C/2) you must ensure that it has not been previously stamped by a DVLA local ofÞce.

¥If your V5C/2 has been previously stamped or you do not have one, you will need to Þll in an Application for a vehicle registration certiÞcate (V62) before you apply for a transfer or retention.

¥Do not enclose the vehicle’s tax disc with this application.

¥Do not apply for a refund of the vehicle tax while we are considering your application. If you do, we will cancel your application.

¥The registered keeper of this vehicle must sign and date the declaration.

Section 3 – Details for the Retention Document

Give all the details section 3 asks for.

IMPORTANT

If you are retaining the vehicle registration number you, as the registered keeper, can choose to become the Grantee (see note B) or give the details of someone else. Once the retention application is Þnalised only the Grantee will have the right to the vehicle registration number.

¥If a Nominee (see note B) has been given on this application the Grantee must sign section 3. The Grantee can choose to add a Nominee at a later date but will have to pay a further fee of £25.

Section 4 – Details of the vehicle the vehicle registration number is being transferred to

Give all the details section 4 asks for.

¥If you are enclosing a V5C/2 you must ensure that it has not been previously stamped by a DVLA local ofÞce.

¥If your V5C/2 has been previously stamped or you do not have one, you will need to Þll in a V62 before you apply for a transfer or retention.

¥Do not enclose the vehicle’s tax disc with this application.

¥Do not apply for a refund of the vehicle tax while we are considering your application. If you do, we will cancel your application.

¥The registered keeper of this vehicle must sign and date the declaration.

BFurther information

¥The Grantee is the one who has the right to the vehicle registration number.

¥The Grantee has the right to assign (put on) the vehicle registration number to a vehicle registered in someone elseÕs name. This person is known as a Nominee.

¥Only the Grantee can assign the vehicle registration number to their vehicle or to the NomineeÕs vehicle.

¥The Nominee will have no right to the vehicle registration number until it is assigned to their vehicle.

¥If there is a Nominee they must be the registered keeper of the vehicle the vehicle registration number is going to be assigned to.

¥You cannot transfer or retain a vehicle registration number starting with a ÔQÕ or Northern Ireland (NI) ÔQÕ preÞx.

¥It is an offence to misrepresent a vehicle registration number on a number plate (for example, by making a Ô5Õ look like an ÔSÕ). See leaßet Display of Registration Numbers for Motor Vehicles (V796) which you can get from www.direct.gov.uk/ motoringleaflets

¥You can transfer a vehicle registration number to or from a vehicle registered in Northern Ireland (NI) as long as both vehicles are registered either at DVLA or on the NI register. See leaßet, Registration numbers and you (INF46).

CHow to pay

You can pay by:

¥debit or credit card, there is a £2.50 fee if you use your credit card;

¥cheque, bankerÕs draft or postal order made payable to ÔDVLA SwanseaÕ. For transfers to vehicles in Northern Ireland, cheques should be made payable to ÔDepartment of Environment (NI)Õ; or

¥cash (do not send cash through the post).

DWhere to get your application forms

You can get application forms V62 and Application for a tax disc (V10) from the website at www.direct.gov.uk/motoringforms or from DVLA local ofÞces, or any Post OfÞce¨ branch that issues tax discs.

You can get an Application for registering the vehicle with the vehicle registration number for the Þrst time (V55) and an Application to tax a Heavy Goods Vehicle (HGV) (V85) from DVLA local ofÞces or by phoning 0870 240 0010. If you are deaf or hard of hearing and have a textphone, phone 01792 766426. (This number will not respond to ordinary phones).

EHow and where to apply

You must either take or send this application and the appropriate documents to a DVLA local ofÞce.

All documents must be originals; not photocopies, faxed copies or downloaded copies.

You can Þnd the address of your nearest local ofÞce:

¥on the website at www.direct.gov.uk/dvlalocal; or

¥by phoning 0870 243 0444. (You will be asked to give your postcode.)

Do not send your application to us at DVLA Swansea.

FConditions for transferring or retaining a vehicle registration number

To transfer or retain a vehicle registration number the following must apply.

¥The vehicle must exist and be registered at either DVLA or on the Northern Ireland register.

¥The vehicle must be available for inspection.

¥You must be the registered keeper of the vehicle.

¥You cannot display a vehicle registration number that will make your vehicle appear younger.

¥You must not sell or get rid of the vehicle until you receive a replacement V5C. If you do sell or get rid of the vehicle before you get a replacement V5C, the new keeper is entitled to keep the vehicle registration number if they want to.

¥The vehicle must be a type that has to have an MoT or GVT certiÞcate.

Under the Retention of Registration Marks Regulations (as amended) at any time we may withdraw your right to the vehicle registration number.

Also, we can cancel a transfer or retention application if:

¥you have not met the conditions for transferring or retaining a vehicle registration number;

¥any information you give in this form, or in any document used to support this form, is false or incorrect;

¥there is any mistake relating to the vehicle registration number; or

¥your bank does not send us your payment.

GInsurance

This applies to the vehicle in section 2.

If your vehicle has been written off it may still be possible to transfer or retain its vehicle registration number if:

¥your insurers have not scrapped the vehicle and have agreed, in writing, to you transferring or retaining the vehicle registration number (include the written agreement with your application);

¥the vehicle is available for us to inspect (we may also ask for an insurerÕs engineers report); and

¥you have met the conditions for transferring or retaining the vehicle registration number.

HConditions on taxing a vehicle

The vehicle that currently has the vehicle registration number (as in section 2)

¥If the vehicle is not taxed, you can still apply to transfer itÕs vehicle registration number without renewing the tax, if you have made a Statutory Off Road NotiÞcation (SORN).

¥There must be no break between the date a tax disc runs out and the start of the SORN.

¥The vehicle tax should have run out no more than 12 months before the date of this application.

The vehicle the registration number is being transferred to (as in section 4)

¥If the vehicle is not taxed, you must tax it.

¥You will need either a V55, V10 or V85, a certiÞcate of insurance or cover note, and a valid MoT or GVT certiÞcate (if appropriate) for the vehicle.

The certiÞcates must be valid on the date the tax disc starts.

¥You must pay the appropriate fees.

IWhat happens next?

¥The DVLA local ofÞce may want to inspect your vehicle. If so, the local ofÞce will tell you the date and place of the inspection.

Once your application is approved, the following will apply.

¥The vehicle in section 2 will be given a replacement vehicle registration number appropriate to its age, unless you want to assign another appropriate vehicle registration number at the same time.

¥The vehicle in section 4 will have its current vehicle registration number withdrawn, unless you also apply to transfer or retain it when you make this application.

¥The DVLA local ofÞce will send you a conÞrmation letter, usually within 10 working days. In most cases this will include your new tax disc, authorisation to display the new vehicle registration number and your amended MoT or GVT certiÞcate (if appropriate).

¥We will send your new V5C and a Retention Document, (if you are retaining the vehicle registration number), within 20 working days of receiving your application. However, this could take up to 40 working days if you sent us a V62 or if we need to inspect the vehicle. If you do not receive your documents after 40 working days, phone DVLA Customer Enquiries on 0870 240 0010.

¥If you have given someone elseÕs details as the Grantee the Retention Document will be sent to them.

5/08