In nurturing the academic aspirations of its citizens, the Republic of the Philippines extends a financial lifeline through the Social Security System's Education Loan Form, a crucial document designed to bridge the gap between potential and opportunity for learners across the nation. This form serves as an application for subsequent releases of educational assistance loans, encapsulating a process that is meticulous yet vital for members seeking to support their educational endeavors or those of their dependents. The structure of the form demands detailed member information, including personal and school details, meticulously laid out to ensure accuracy and integrity in the application process. It emphasizes a member's commitment to truthfulness, with stern warnings against the provision of falsified information. Beyond personal data, the form outlines the loan's scope, from eligibility criteria—wherein members must have a consistent contribution history—and loan amounts, tailored to the level of education being pursued. It depicts a path for release and repayment, meticulously balancing support with accountability. Furthermore, the form delineates the requirements for both the application and the schools involved, ensuring the loan's alignment with accredited educational institutions. This form, therefore, is not merely a document but a testament to the value placed on education, a structured effort to ensure that financial constraints do not hinder the educational growth of its citizens.

| Question | Answer |

|---|---|

| Form Name | Education Loan Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | sss application letter format, sss member loan application form sample fill up, sss fill up form sample, sss loan form fill up |

MLD-

Republic of the Philippines

SOCIAL SECURITY SYSTEM

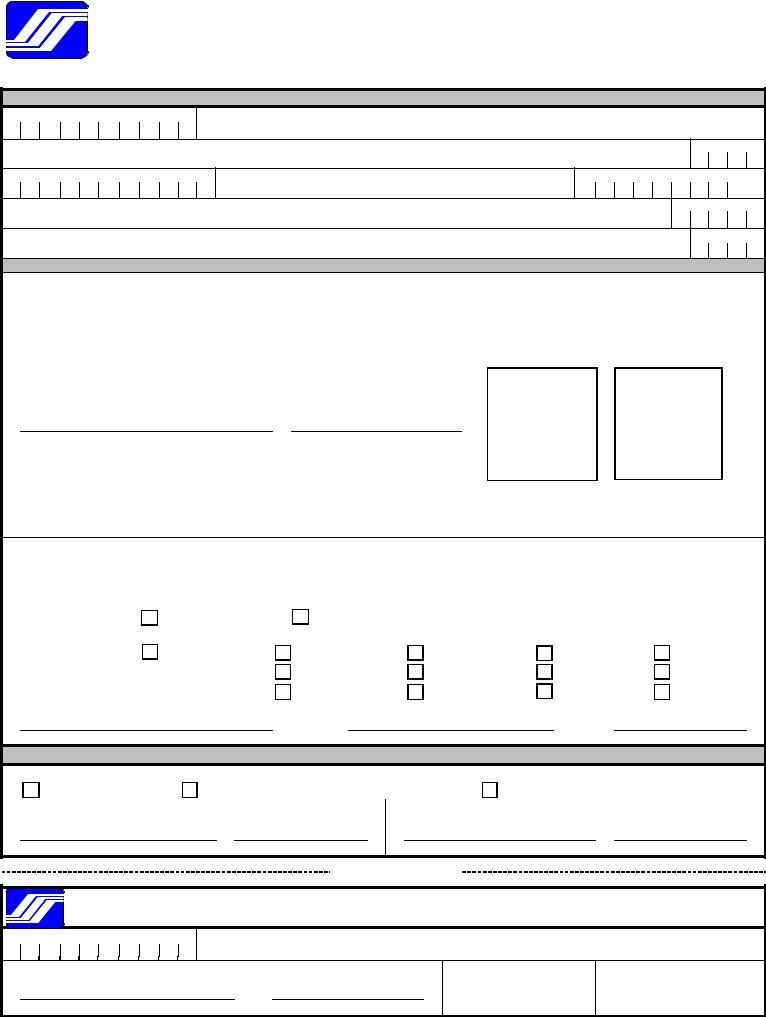

APPLICATION FOR SUBSEQUENT RELEASE OF EDUCATIONAL ASSISTANCE LOAN

Please read the terms & conditions and instructions at the back before accomplishing this form. Print all information in capital letters and use black ink only.

PART I - TO BE FILLED OUT BY THE MEMBER

SS NUMBER

NAME OF MEMBER |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

|

|

|

ADDRESS |

(NO. & STREET) |

(BARANGAY) |

(TOWN/DISTRICT) |

(CITY/PROVINCE) |

POSTAL CODE

TELEPHONE/MOBILE NUMBER

TIN

NAME OF SCHOOL

SCHOOL CODE

ADDRESS OF SCHOOL

POSTAL CODE

MEMBER'S CERTIFICATION

I certify that all information provided in this form are true and correct. I understand that any false statement in this application or the submission of any falsified document in connection with this loan application shall subject me to criminal prosecution for violation of Section 28 of R.A. 8282 or under the pertinent provisions of the revised Penal Code of the Philippines.

Further, I agree to the terms and conditions of this loan as enumerated at the back of this form.

SIGNATURE OVER PRINTED NAMEDATE

If member cannot sign, below are the witnesses to fingerprinting:RIGHT THUMB RIGHT INDEX

|

1) |

|

|

|

2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

|

DATE |

|

SIGNATURE OVER PRINTED NAME |

|

DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHOOL'S CERTIFICATION |

|

|

|

||

This is to certify that _________________________________________ is enrolled/has applied for enrollment with

(Name of Student)

the following details:

•Name of course : ________________________________________

|

Degree |

Vocational/Technical |

|

|

|

• School year : ____________________ |

|

|

|

||

• Level : |

1st year |

2nd year |

3rd year |

4th year |

5th year |

• Semester/Trimester/Quarter : |

1st |

2nd |

3rd |

4th |

|

• No. of years to finish course : |

2 years |

3 years |

4 years |

5 years |

|

SIGNATURE OVER PRINTED NAMEOFFICIAL DESIGNATIONDATE

PART II - TO BE FILLED OUT BY SSS

IDENTIFICATION/DOCUMENT(S) PRESENTED/SUBMITTED: |

|

|

SS ID card |

Two valid IDs, one with photo and signature |

Assessment/Billing statement from school |

|

|

|

RECEIVED BY : |

ENCODED BY : |

|

SIGNATURE OVER PRINTED NAME |

DATE |

SIGNATURE OVER PRINTED NAME |

DATE |

Perforate Here

APPLICATION FOR SUBSEQUENT RELEASE OF EDUCATIONAL ASSISTANCE LOAN

ACKNOWLEDGEMENT STUB

SS NUMBER

NAME OF MEMBER |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

RECEIVED BY :

DATE RECEIVED

RECEIVING BRANCH

SIGNATURE OVER PRINTED NAME |

DESIGNATION |

TERMS AND CONDITIONS

I.ELIGIBLE BORROWERS

1.SSS Members who have paid at least 36 monthly contributions, three (3) of which should be within the last 12 months prior to the date of application for loan;

2.Members whose last posted Monthly Salary Credit (MSC) is Php15,000 or below, provided that their actual basic salary or income is not more than Php15,000 per month; and

3.Members who are

II.COVERED BENEFICIARIES

Member, legal spouse, child of SSS member (including illegitimate) and sibling of unmarried SSS member (including half- brother/sister).

III.AMOUNT OF LOAN

Degree course - Maximum of Php15,000 per semester/trimester/quarter term or actual tuition/miscellaneous fees, whichever is lower, rounded off to the next higher Php100.

Vocational/Technical course (minimum of 2 years) – Maximum of Php7,500 per semester/trimester or actual tuition/miscellaneous fees, whichever is lower, rounded off to the next higher Php100.

A member shall be allowed to avail only once to defray educational expenses. No substitution of beneficiary shall be allowed.

All semestral/trimestral/quarter term releases shall be consolidated at the end of the

The loan shall be funded by National Government (NG) and SSS on a 50:50 basis.

IV. INTEREST RATE AND PENALTY

1.NG portion - 0 interest

SSS portion - 6% per annum based on diminishing principal balance until fully paid.

2.A 1% penalty per month shall be charged for any unpaid amortization.

V. REQUIREMENTS

1.SSS ID or two (2) valid IDs.

2. Accomplished application form.

3.Assessment/Billing statement issued by the school of member/beneficiary.

Any excess on the tuition fee and miscellaneous expenses shall be borne by the member/beneficiary.

VI. MANNER OF RELEASES

1.The check shall be payable to the school where the member/beneficiary is enrolled/has applied for enrollment and shall be released to the member/beneficiary.

2.Subsequent loan releases shall be made upon submission of another accomplished application form and corresponding assessment/billing statement from the school. Validation by the SSS may be done to ensure the continuous schooling of the member/beneficiary.

VII. REPAYMENT TERMS

Degree Course - The term is up to five (5) years and loan payment shall start after 18 months for semestral courses, 15 months for trimestral courses or 14 months & 15 days for quarter term courses from the scheduled last release date or from the date of last release for those who will not avail of the subsequent releases.

Vocational/Technical Course - The term is up to three (3) years and loan payment shall start after 18 months for semestral courses or 15 months for trimestral courses from the scheduled last release date or from the date of last release for those who will not avail of the subsequent release.

Any unpaid educational assistance loan shall be deducted from the future benefit of the member.

VIII. ELIGIBLE SCHOOLS

The school must be accredited by the Commission on Higher Education for degree courses and Technical Education and Skills Development Authority for vocational/technical courses.

IX. MISCELLANEOUS CONDITIONS

1.SSS number shall be issued to a

2.The SSS reserves the right to require additional documents as deemed necessary.

INSTRUCTIONS

1)Member to fill out “Member Details”.

2)Member must file application for educational assistance loan program personally and must present his Social Security card.

In the absence of the Social Security card, member is advised to apply immediately for said card and present two valid IDs, one with photo and signature.

3)If filed by member’s representative, the member's representative must present the following: (1) his Social Security card or any two of

the following IDs: unexpired driver’s license; PRC card; passport; postal ID; school or company ID; Tax Identification Number card (TIN); (2) borrower’s Social Security card and authorization letter (signed by both member and the representative).