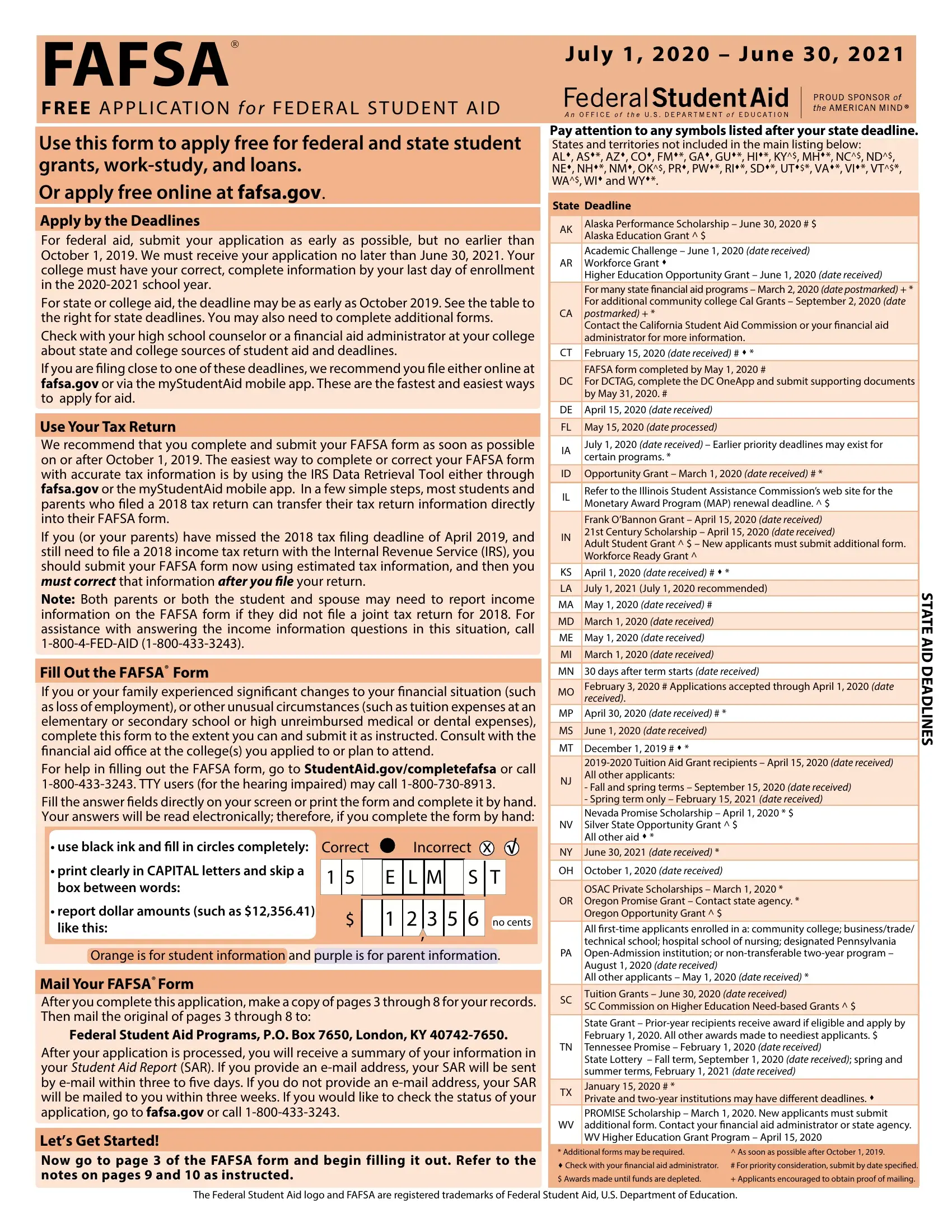

Using the online PDF editor by FormsPal, you'll be able to fill out or modify application federal aid form here and now. The tool is continually upgraded by our staff, acquiring new awesome functions and growing to be greater. Should you be seeking to get going, here is what it will require:

Step 1: Open the form in our tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: With our handy PDF editing tool, you could do more than just fill in blanks. Express yourself and make your docs look sublime with custom text put in, or optimize the file's original content to perfection - all that comes along with an ability to incorporate almost any images and sign it off.

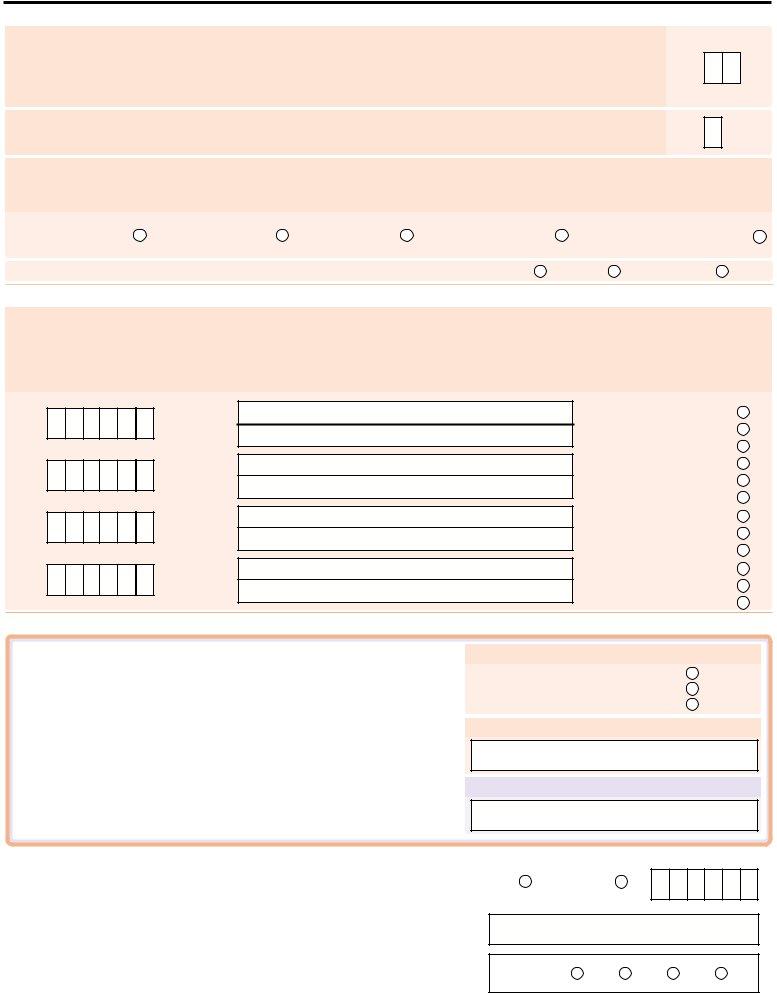

In order to finalize this document, be sure you enter the right details in each blank:

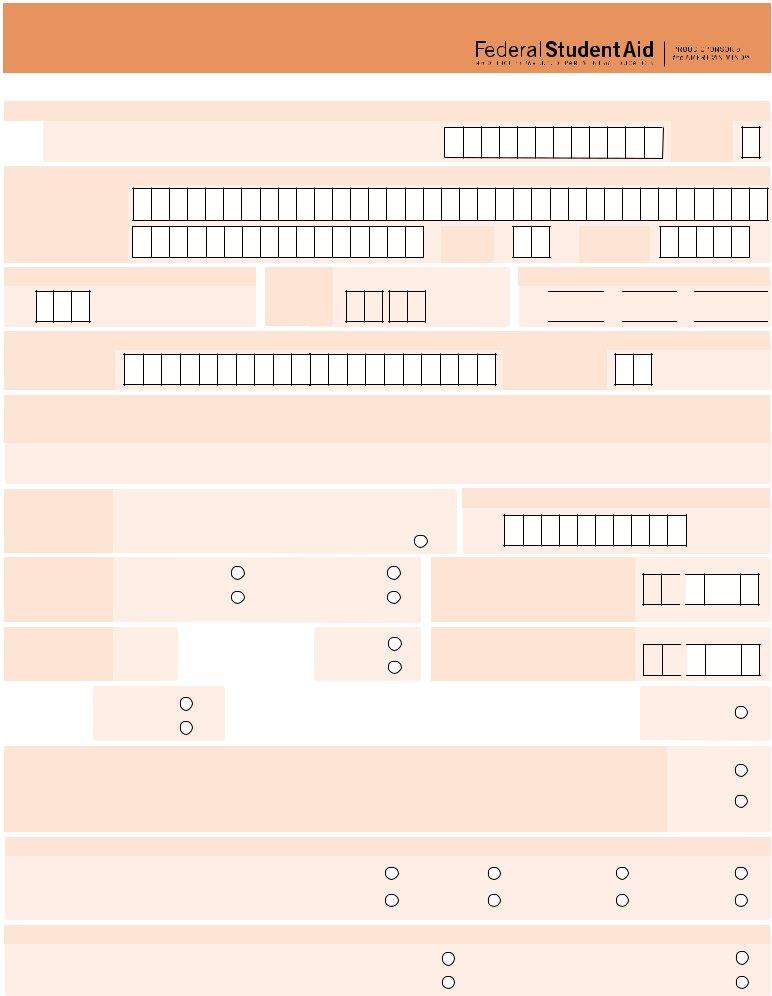

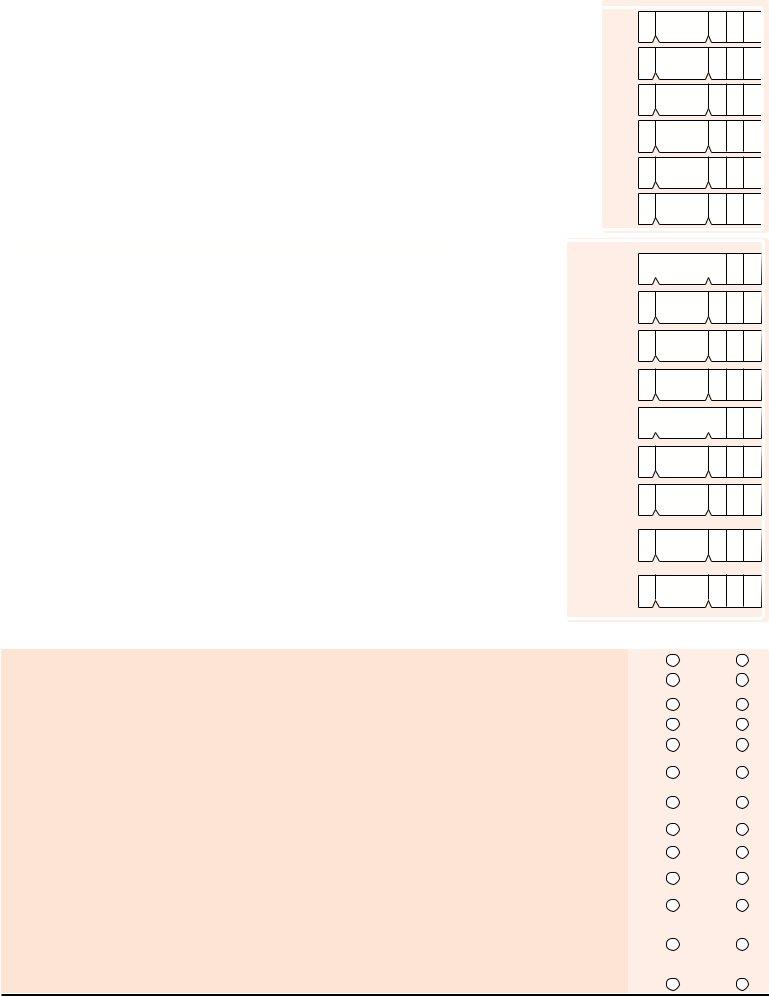

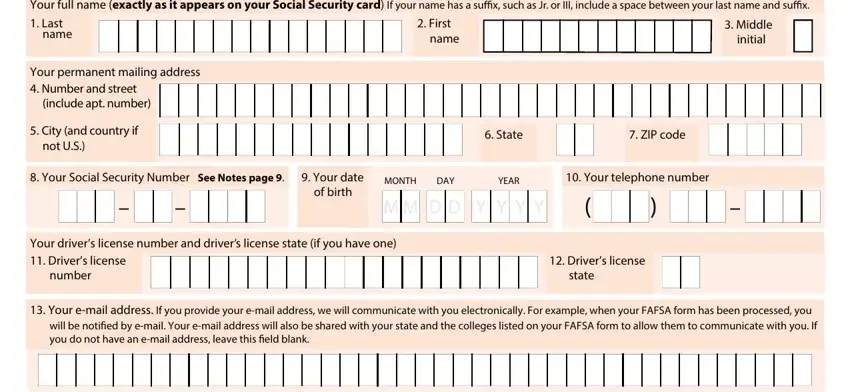

1. The application federal aid form needs specific information to be entered. Make sure the following blanks are complete:

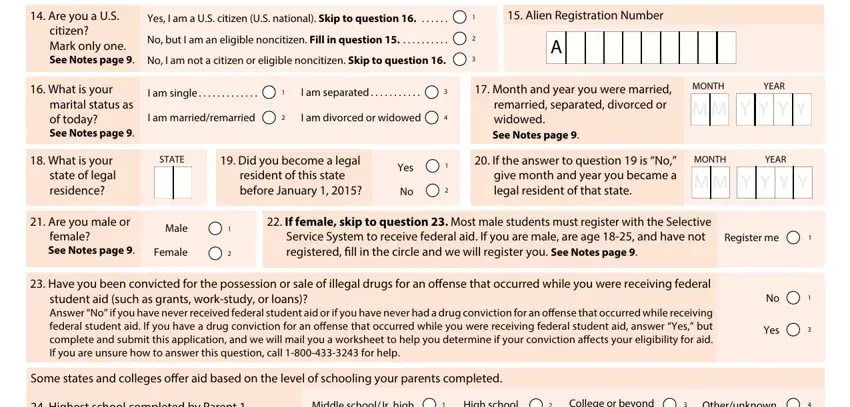

2. The subsequent step is usually to fill in these particular fields: Are you a US, Yes I am a US citizen US national, citizen Mark only one See Notes, No but I am an eligible noncitizen, No I am not a citizen or eligible, Alien Registration Number, What is your, I am single, marital status as of today See, I am marriedremarried, I am separated, I am divorced or widowed, What is your state of legal, STATE, and Did you become a legal.

Always be extremely attentive while filling in Are you a US and I am marriedremarried, as this is where a lot of people make a few mistakes.

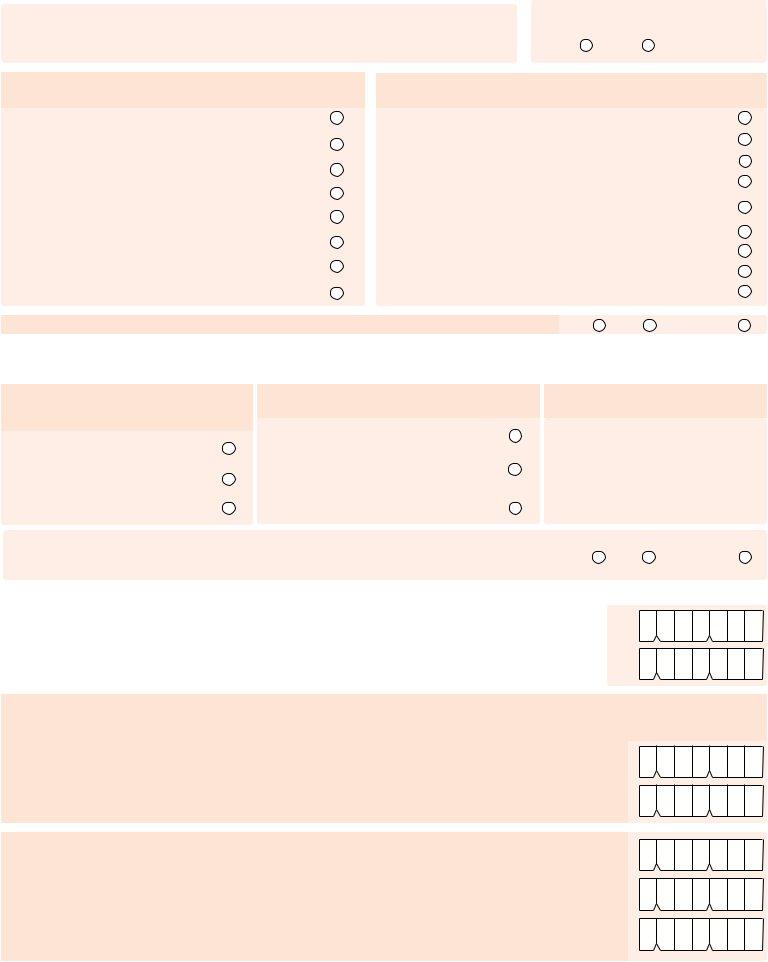

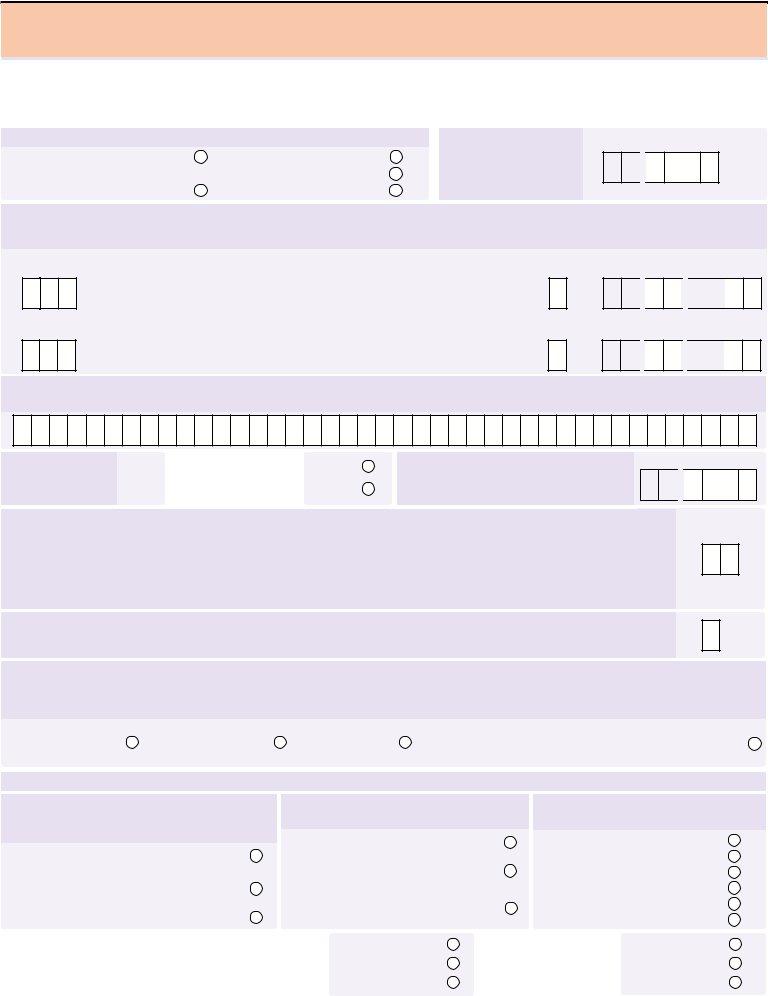

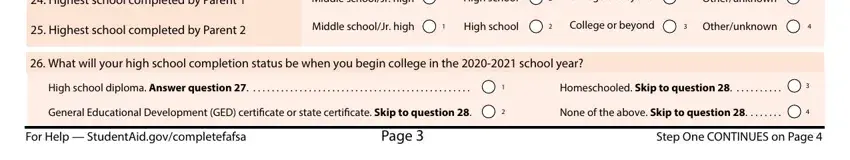

3. The next stage is generally simple - fill in all of the blanks in Highest school completed by, Middle schoolJr high, Highest school completed by, Middle schoolJr high, High school, High school, College or beyond, College or beyond, Otherunknown, Otherunknown, What will your high school, High school diploma Answer, General Educational Development, Homeschooled Skip to question, and None of the above Skip to question in order to finish this process.

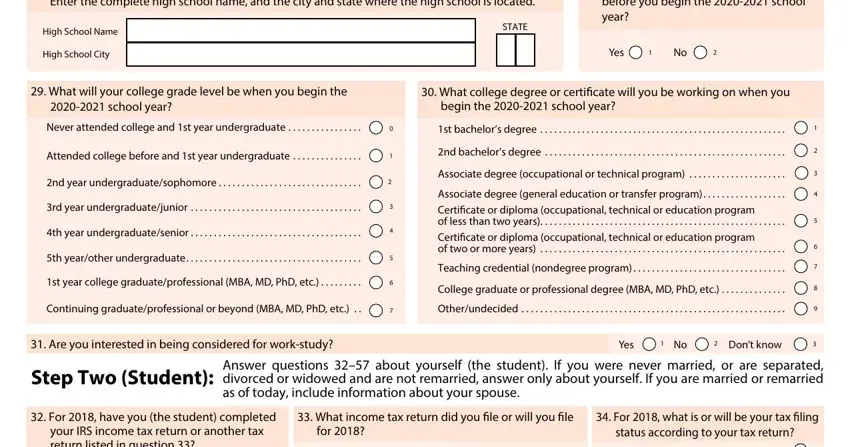

4. The following paragraph needs your input in the subsequent parts: Enter the complete high school, High School Name, High School City, STATE, before you begin the school year, Yes, What will your college grade, What college degree or, school year, begin the school year, Never attended college and st year, Attended college before and st, nd year undergraduatesophomore, rd year undergraduatejunior, and th year undergraduatesenior. Ensure that you fill out all requested details to go onward.

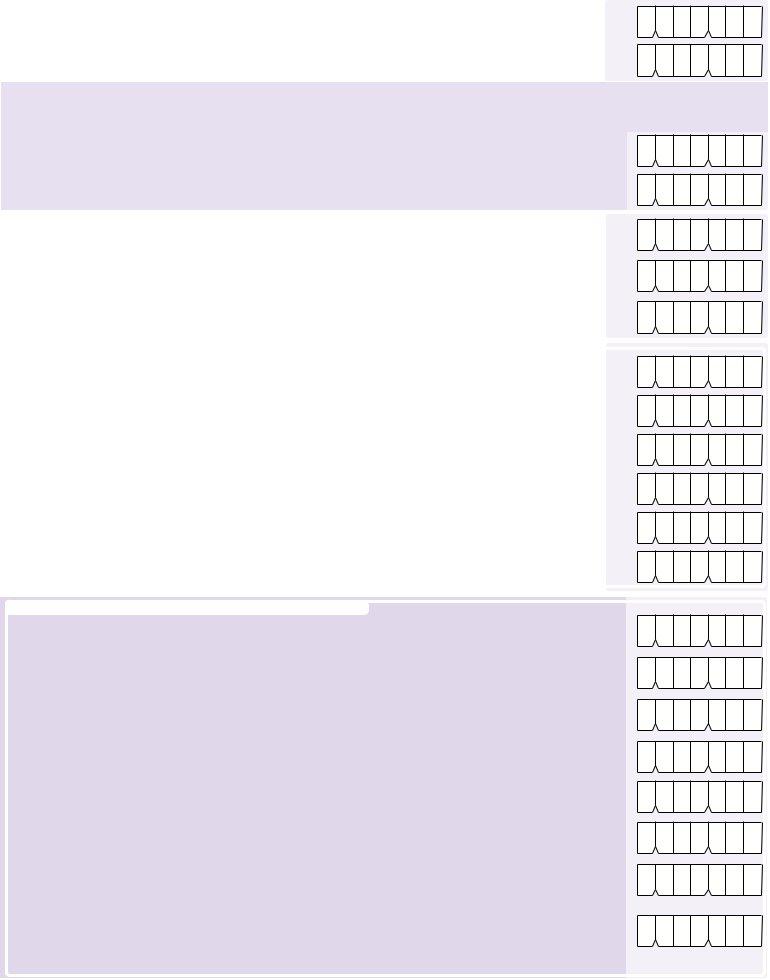

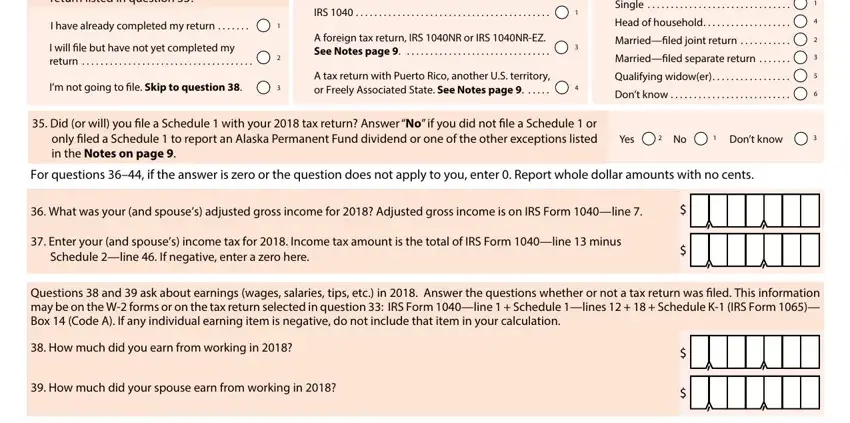

5. This form must be concluded by filling out this segment. Here you can find a detailed list of blank fields that require specific details for your document usage to be accomplished: your IRS income tax return or, I have already completed my return, I will file but have not yet, Im not going to file Skip to, IRS, A foreign tax return IRS NR or IRS, A tax return with Puerto Rico, Single, Head of household, Marriedfiled joint return, Marriedfiled separate return, Qualifying widower, Dont know, Did or will you file a Schedule, and Yes.

Step 3: Soon after proofreading the fields, click "Done" and you're all set! Make a free trial account at FormsPal and acquire instant access to application federal aid form - downloadable, emailable, and editable from your FormsPal account page. With FormsPal, it is simple to fill out documents without the need to be concerned about personal information incidents or data entries being distributed. Our protected software makes sure that your private information is maintained safe.