wa fhog application form can be filled out without any problem. Just make use of FormsPal PDF editor to get it done in a timely fashion. Our tool is continually evolving to provide the very best user experience possible, and that is thanks to our commitment to continuous improvement and listening closely to feedback from users. To get the ball rolling, go through these simple steps:

Step 1: First of all, access the tool by clicking the "Get Form Button" at the top of this site.

Step 2: The tool will let you modify PDF files in a variety of ways. Enhance it by writing customized text, adjust existing content, and put in a signature - all manageable in no time!

When it comes to blanks of this precise document, here's what you want to do:

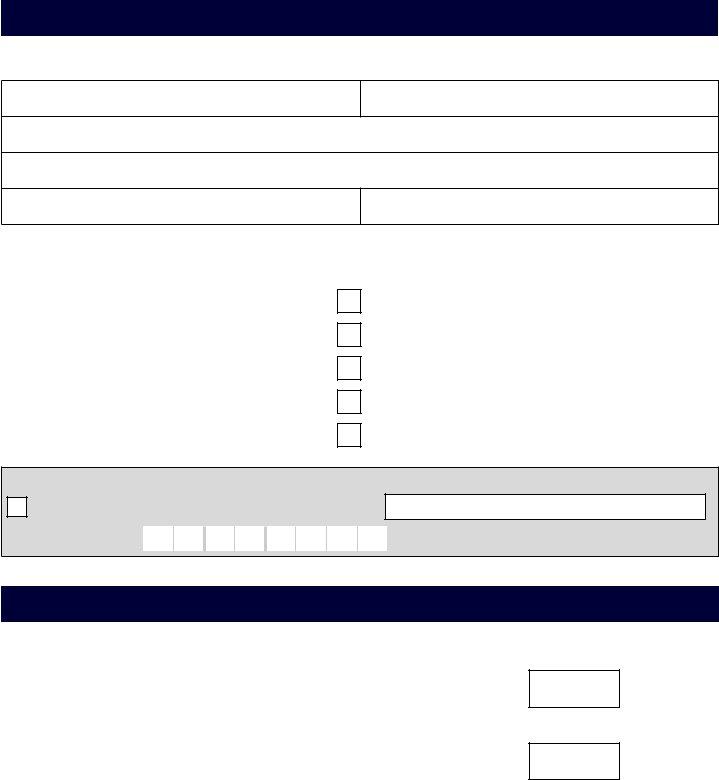

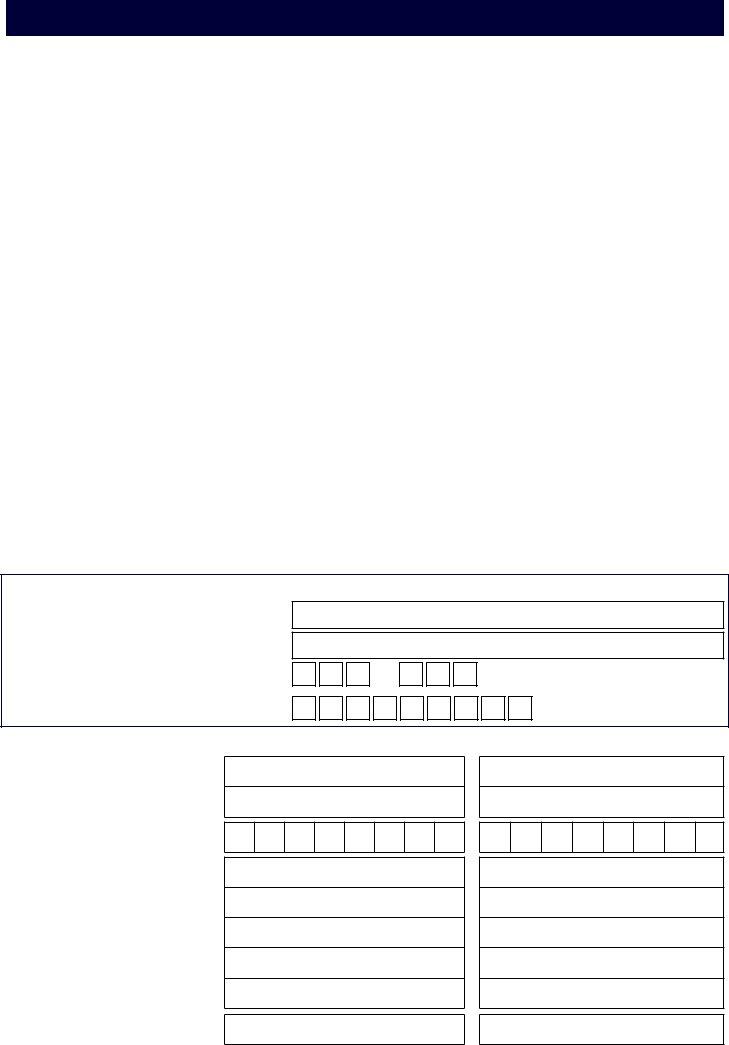

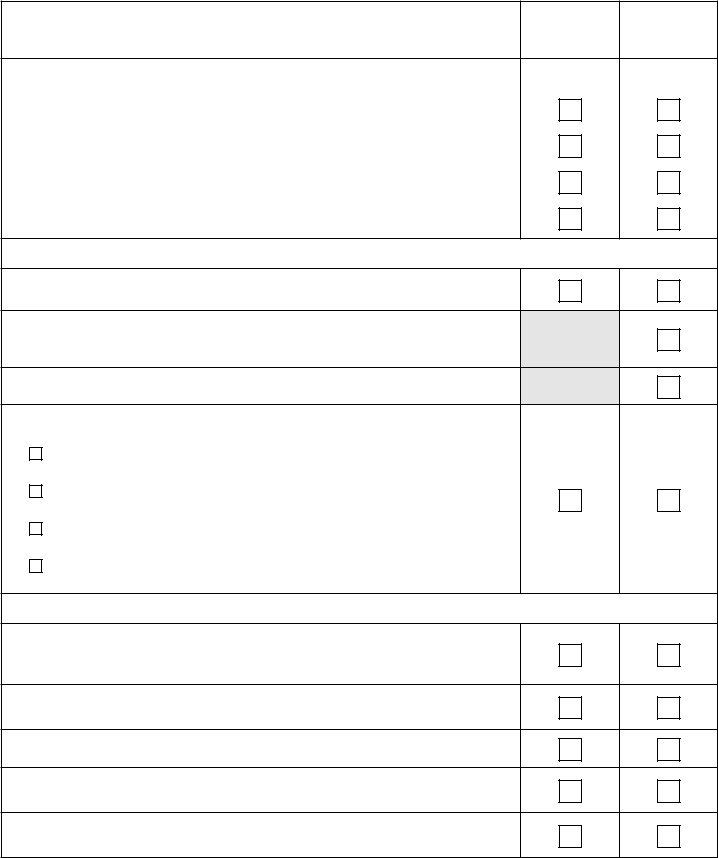

1. Complete your wa fhog application form with a group of major blanks. Note all of the information you need and ensure there is nothing missed!

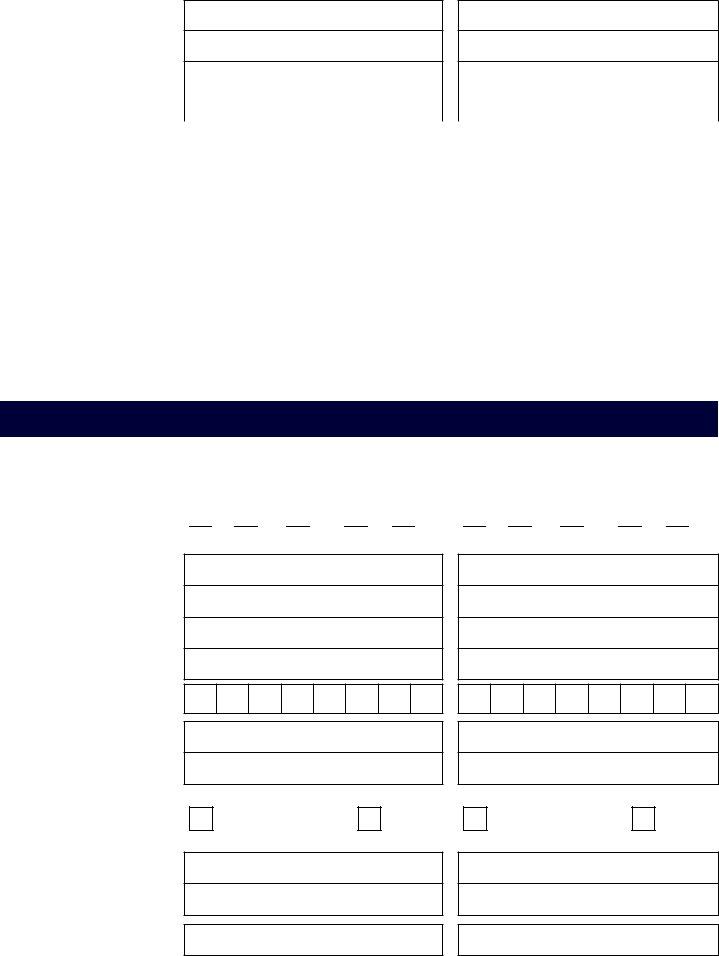

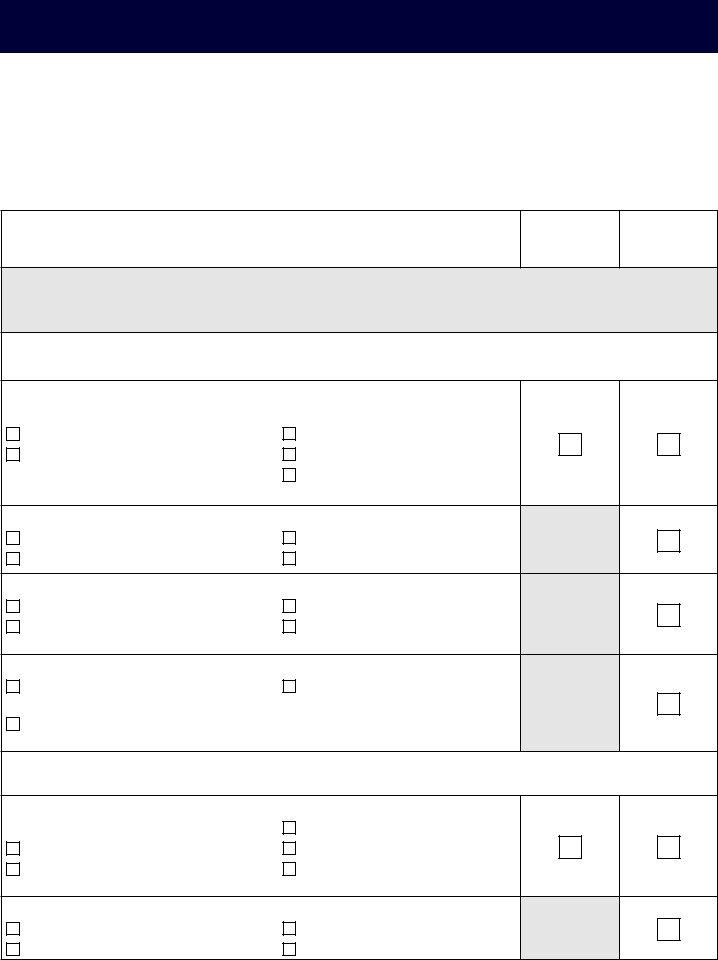

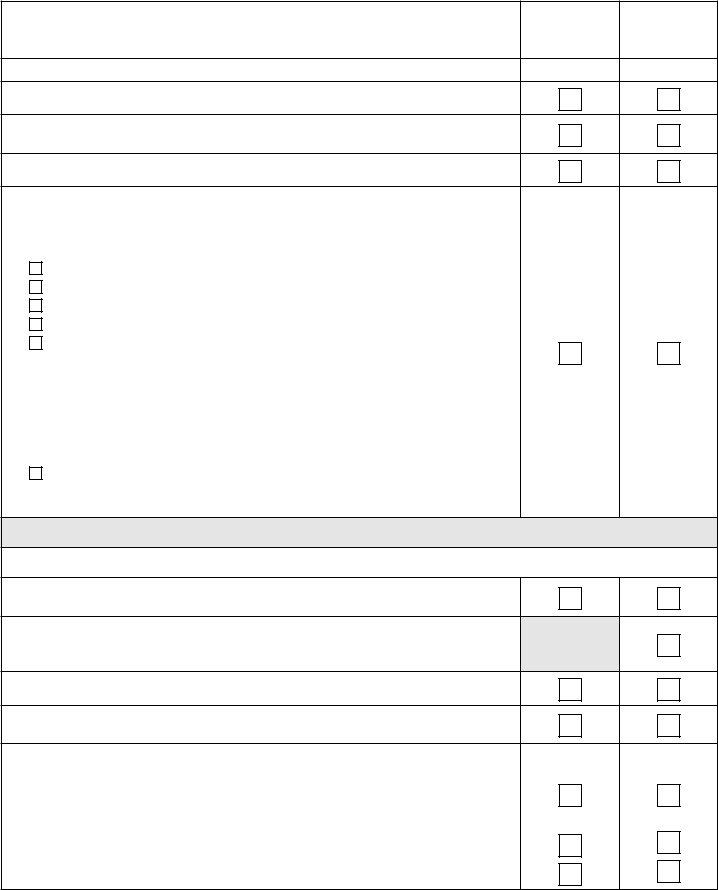

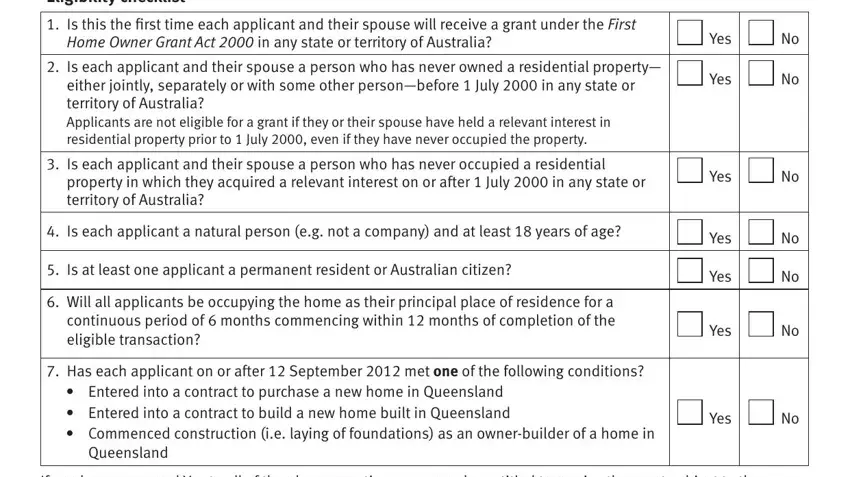

2. Just after completing the last part, head on to the next step and enter the necessary particulars in these fields - Disqualifying arrangements, Is the new home being purchased, Is the consideration for the new, Have any of the applicants, or indirectly to assist with the, If No also select No for questions, If Yes you must lodge a statutory, Is the person or persons providing, applicants, If No also select No for question, Will the related persons, frequently or otherwise to a, Yes, Yes, and Yes.

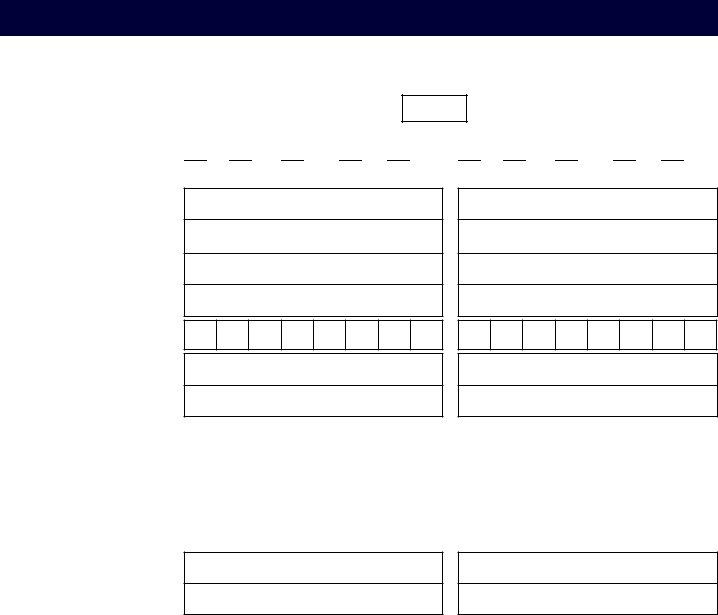

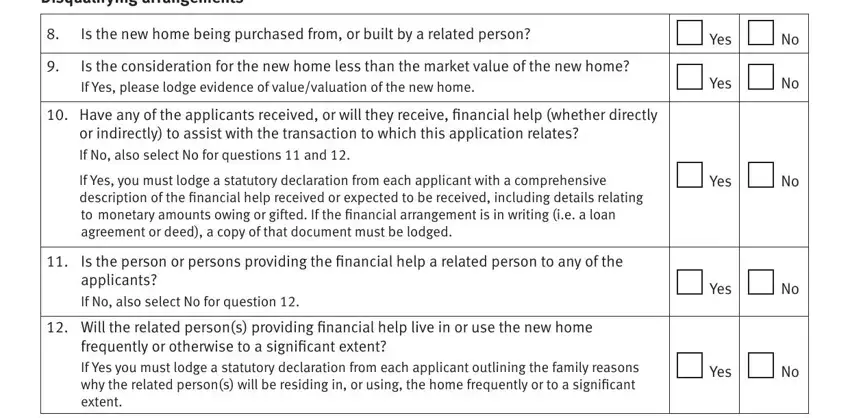

3. This part is going to be simple - fill in all of the form fields in All applicants must complete this, If there are more than two, How many people will have a, Applicant Contact applicant, Applicant, Mrs, Miss, Mrs, Miss, D M M Y, D M M Y, StateTerritory, Country, StateTerritory, and Country in order to complete this process.

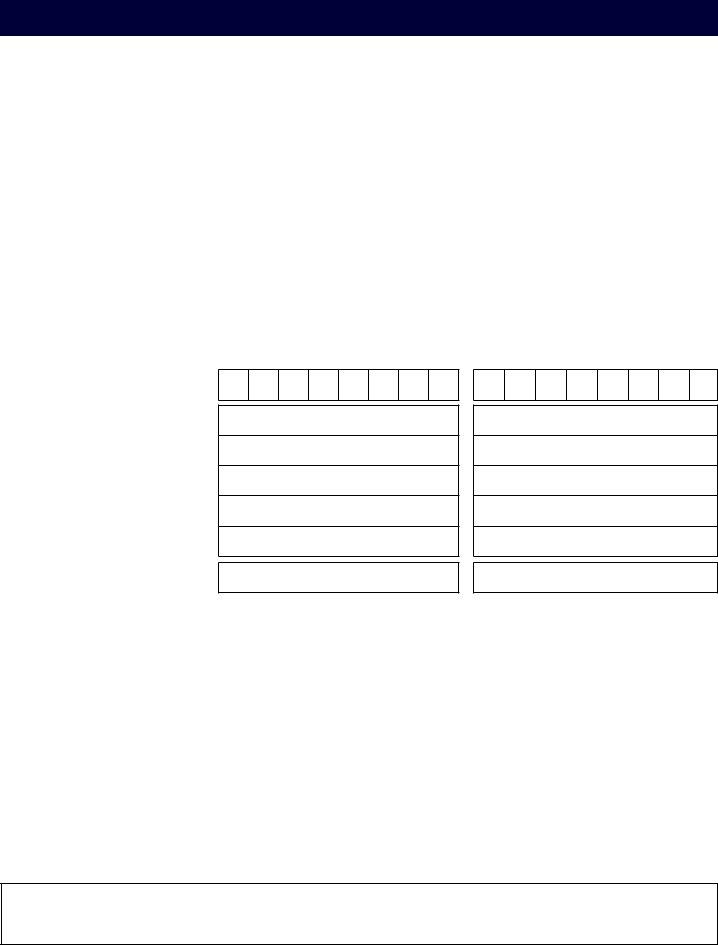

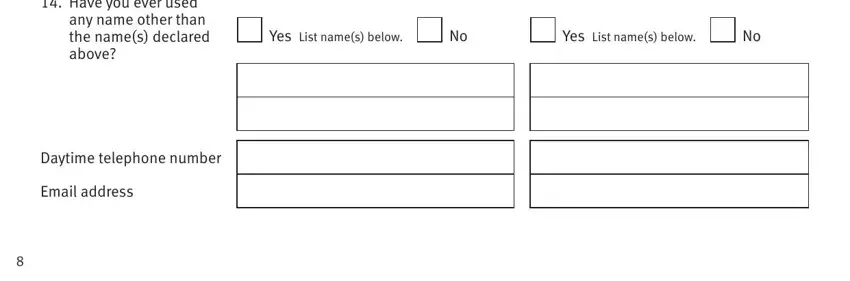

4. Completing Yes List names below, Yes List names below, Have you ever used any name other, Daytime telephone number, and Email address is vital in this next part - make certain that you don't hurry and fill in every field!

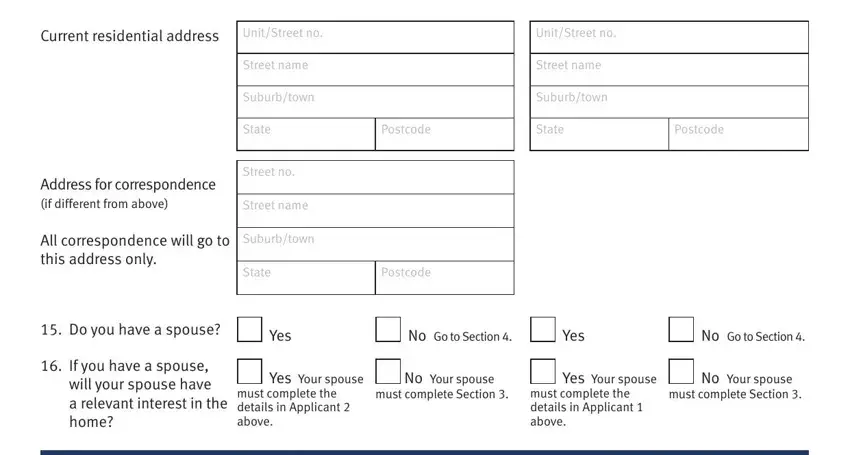

5. And finally, the following final subsection is what you should complete before using the document. The blanks here include the next: Current residential address, UnitStreet no, Street name, Suburbtown, UnitStreet no, Street name, Suburbtown, State, Postcode, State, Postcode, Address for correspondence if, All correspondence will go to this, Do you have a spouse, and If you have a spouse will your.

As for Suburbtown and Current residential address, be sure that you don't make any errors here. Both of these could be the most significant fields in this page.

Step 3: Right after rereading the form fields, press "Done" and you're all set! Get hold of your wa fhog application form as soon as you sign up for a 7-day free trial. Instantly gain access to the form from your FormsPal cabinet, along with any modifications and adjustments all kept! FormsPal is dedicated to the confidentiality of our users; we ensure that all information used in our editor continues to be confidential.