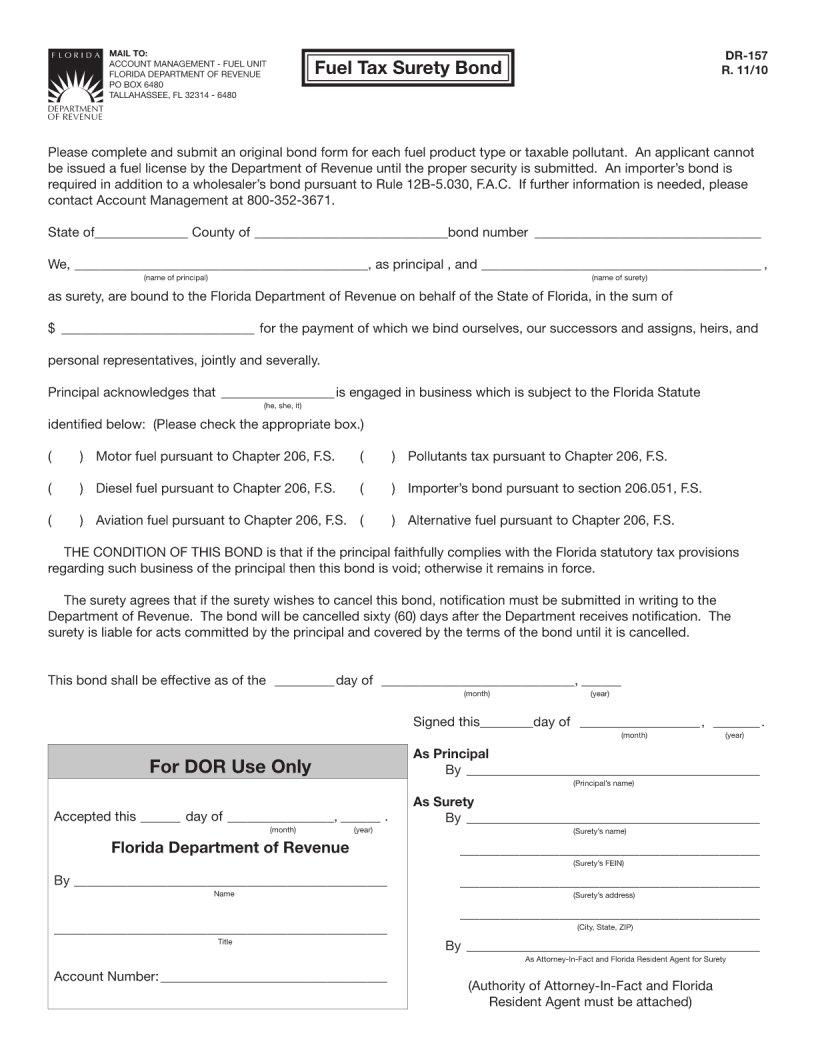

Navigating the processes of settling a loved one's estate can be a daunting task, especially when it involves understanding and completing necessary forms. One such form in Florida, known as the Dr 157 form, plays a pivotal role in this process. This document is essential for anyone dealing with the financial aspects of an estate, as it pertains to the waiver or release of estate taxes imposed by the state. Its primary function is to ensure that the Florida Department of Revenue is aware that all due taxes have been settled, allowing the estate to be properly distributed without any legal hold-ups. The form requires detailed information regarding the decedent, the estate, and the tax details, making it a critical step for executors or administrators. Understanding how to accurately complete and submit this form is crucial for those looking to expedite the estate settlement process and comply with Florida's tax laws.

| Question | Answer |

|---|---|

| Form Name | Florida Form Dr 157 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | pollutant, Pollutants, taxable, wholesaler |