You could work with rt 6 form 2021 easily in our online PDF tool. In order to make our tool better and easier to utilize, we consistently implement new features, taking into consideration feedback coming from our users. All it requires is several easy steps:

Step 1: Press the "Get Form" button at the top of this webpage to access our tool.

Step 2: Using our advanced PDF editor, you're able to do more than simply complete blank fields. Express yourself and make your forms look sublime with customized textual content added in, or optimize the file's original input to perfection - all that comes with the capability to add stunning photos and sign it off.

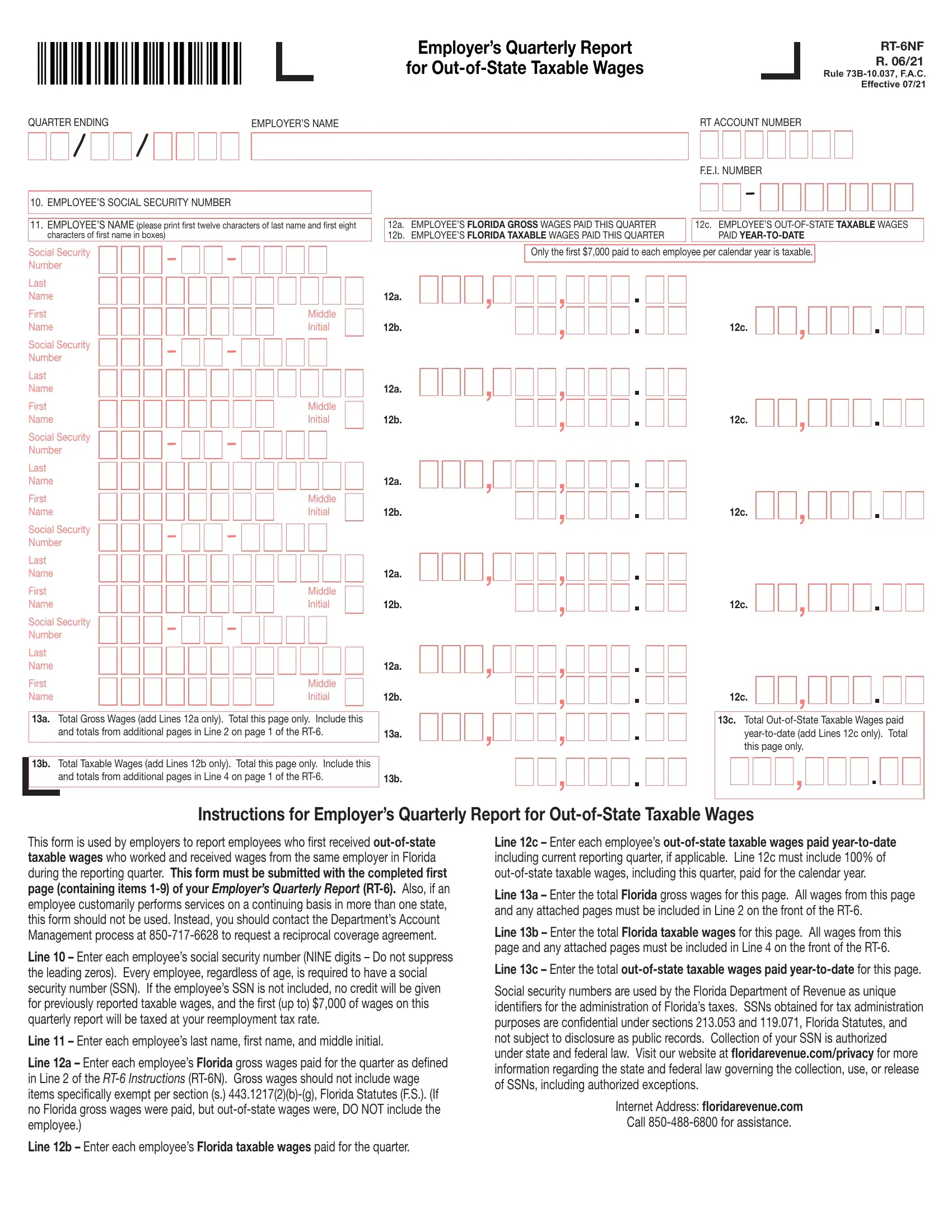

With regards to the blank fields of this specific PDF, here's what you should consider:

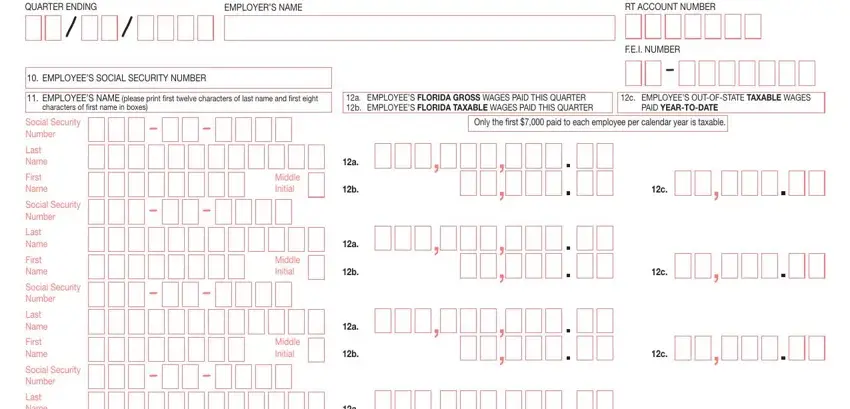

1. Before anything else, when filling in the rt 6 form 2021, beging with the part that includes the next fields:

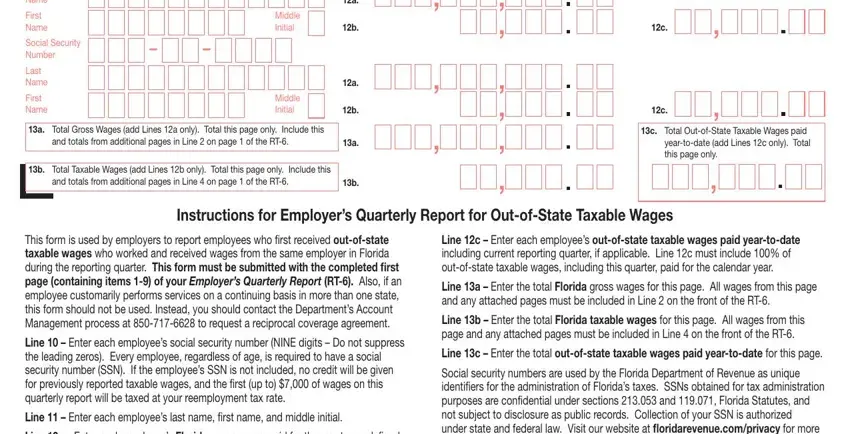

2. Once your current task is complete, take the next step – fill out all of these fields - Last Name, First Name, Social Security Number, Last Name, First Name, Middle Initial, Middle Initial, a Total Gross Wages add Lines a, and totals from additional pages, b Total Taxable Wages add Lines b, and totals from additional pages, c Total OutofState Taxable Wages, Instructions for Employers, This form is used by employers to, and Line Enter each employees social with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Concerning c Total OutofState Taxable Wages and Middle Initial, be sure that you don't make any mistakes here. These are considered the most important fields in the form.

Step 3: Always make sure that your details are correct and then click "Done" to finish the task. Right after registering afree trial account at FormsPal, it will be possible to download rt 6 form 2021 or email it directly. The document will also be available from your personal account page with all your adjustments. FormsPal offers secure document editing without personal data record-keeping or distributing. Be assured that your information is in good hands with us!