You are able to fill in form ex501fl without difficulty with our PDFinity® editor. Our team is devoted to making sure you have the ideal experience with our tool by continuously presenting new capabilities and improvements. Our editor has become a lot more helpful as the result of the newest updates! So now, editing PDF documents is easier and faster than before. If you're looking to begin, here is what it's going to take:

Step 1: Access the PDF doc in our editor by pressing the "Get Form Button" in the top area of this webpage.

Step 2: As soon as you launch the PDF editor, you will get the document ready to be filled out. Besides filling out various blanks, it's also possible to perform other actions with the form, including adding your own words, changing the original text, adding images, placing your signature to the PDF, and much more.

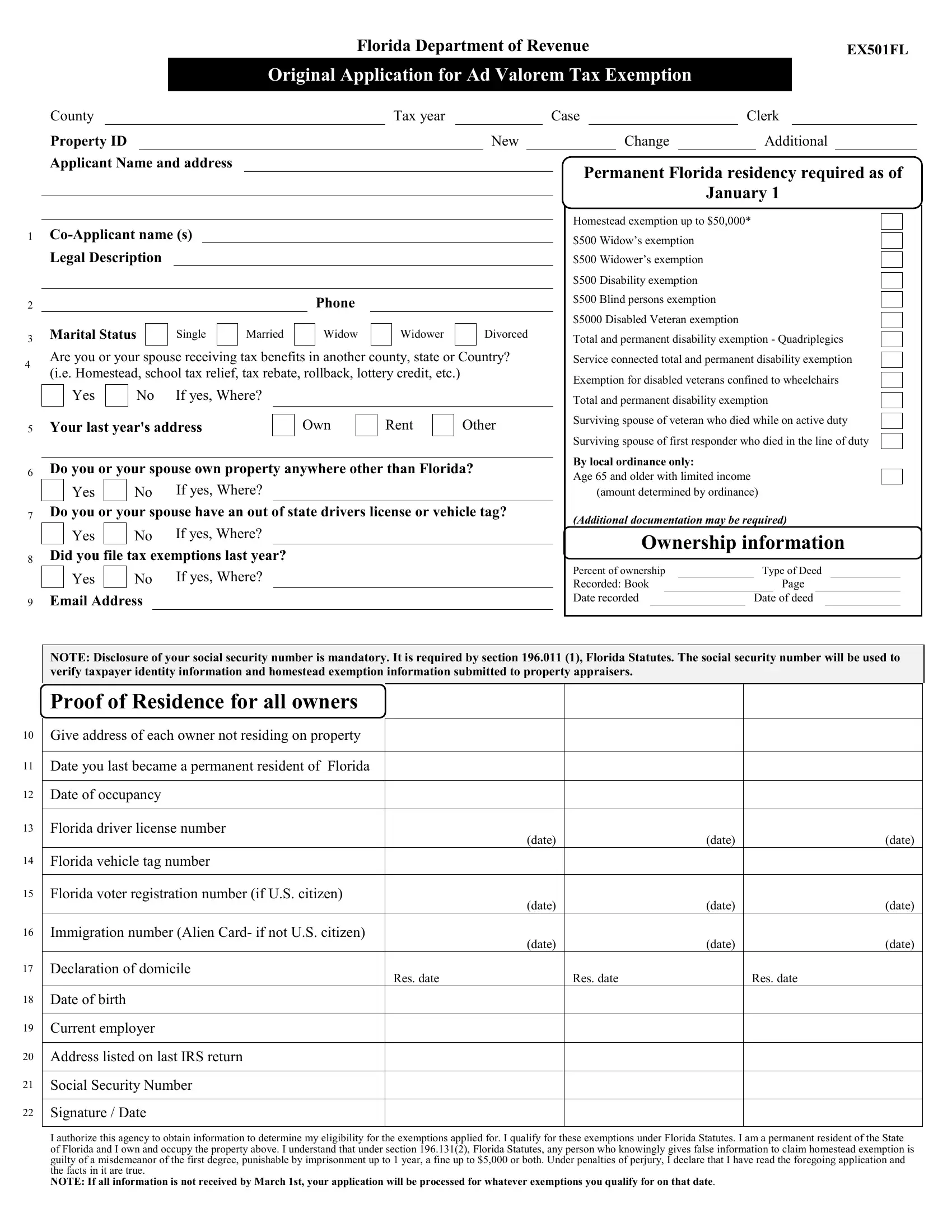

To be able to fill out this document, be sure to enter the required details in each field:

1. When filling out the form ex501fl, make sure to include all important blanks in the corresponding form section. It will help to expedite the process, making it possible for your information to be processed efficiently and properly.

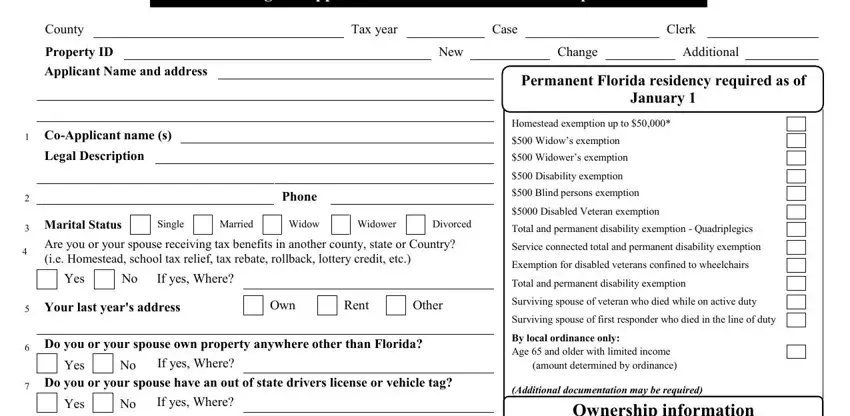

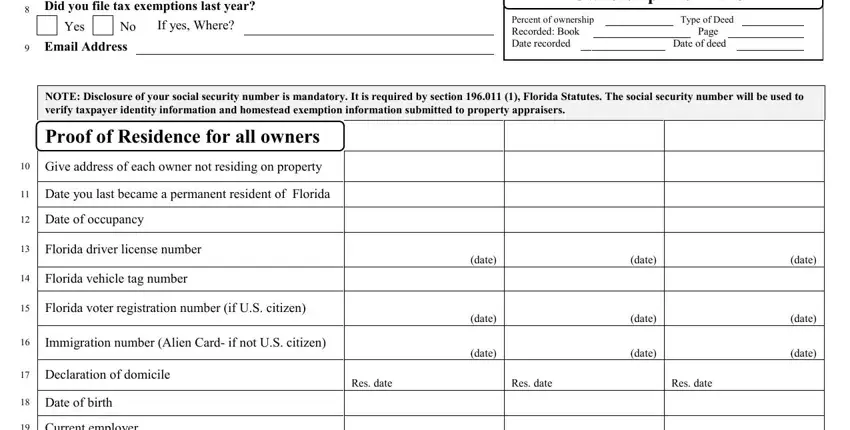

2. Soon after performing the last part, go on to the next step and complete the necessary details in all these blank fields - Ownership information, Percent of ownership Recorded Book, Type of Deed, Page, Date of deed, Did you file tax exemptions last, Yes, If yes Where, Email Address, NOTE Disclosure of your social, Proof of Residence for all owners, Give address of each owner not, Date you last became a permanent, Date of occupancy, and Florida driver license number.

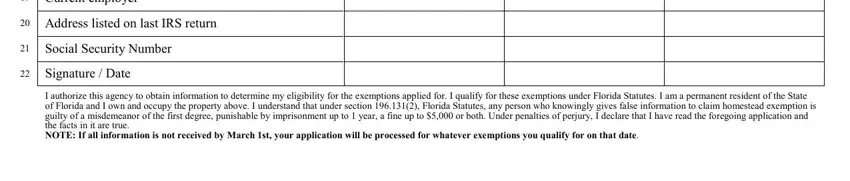

3. This 3rd part is relatively easy, Current employer, Address listed on last IRS return, Social Security Number, Signature Date, and I authorize this agency to obtain - each one of these form fields has to be completed here.

Be extremely attentive when completing Current employer and Address listed on last IRS return, as this is where many people make mistakes.

Step 3: Confirm that the details are accurate and click on "Done" to progress further. Sign up with us today and instantly get access to form ex501fl, prepared for downloading. Each modification you make is conveniently preserved , meaning you can customize the file later if required. FormsPal guarantees your information confidentiality with a secure system that never records or distributes any sort of personal information used. Be confident knowing your files are kept safe whenever you work with our editor!