debtor financial statement can be filled out with ease. Just try FormsPal PDF tool to get the job done quickly. To make our editor better and easier to utilize, we constantly develop new features, taking into account suggestions coming from our users. To start your journey, consider these simple steps:

Step 1: First, open the pdf editor by pressing the "Get Form Button" at the top of this site.

Step 2: As you start the file editor, you will find the document prepared to be filled out. Apart from filling out different blanks, you could also perform some other things with the Document, including putting on your own words, editing the initial text, adding graphics, putting your signature on the PDF, and a lot more.

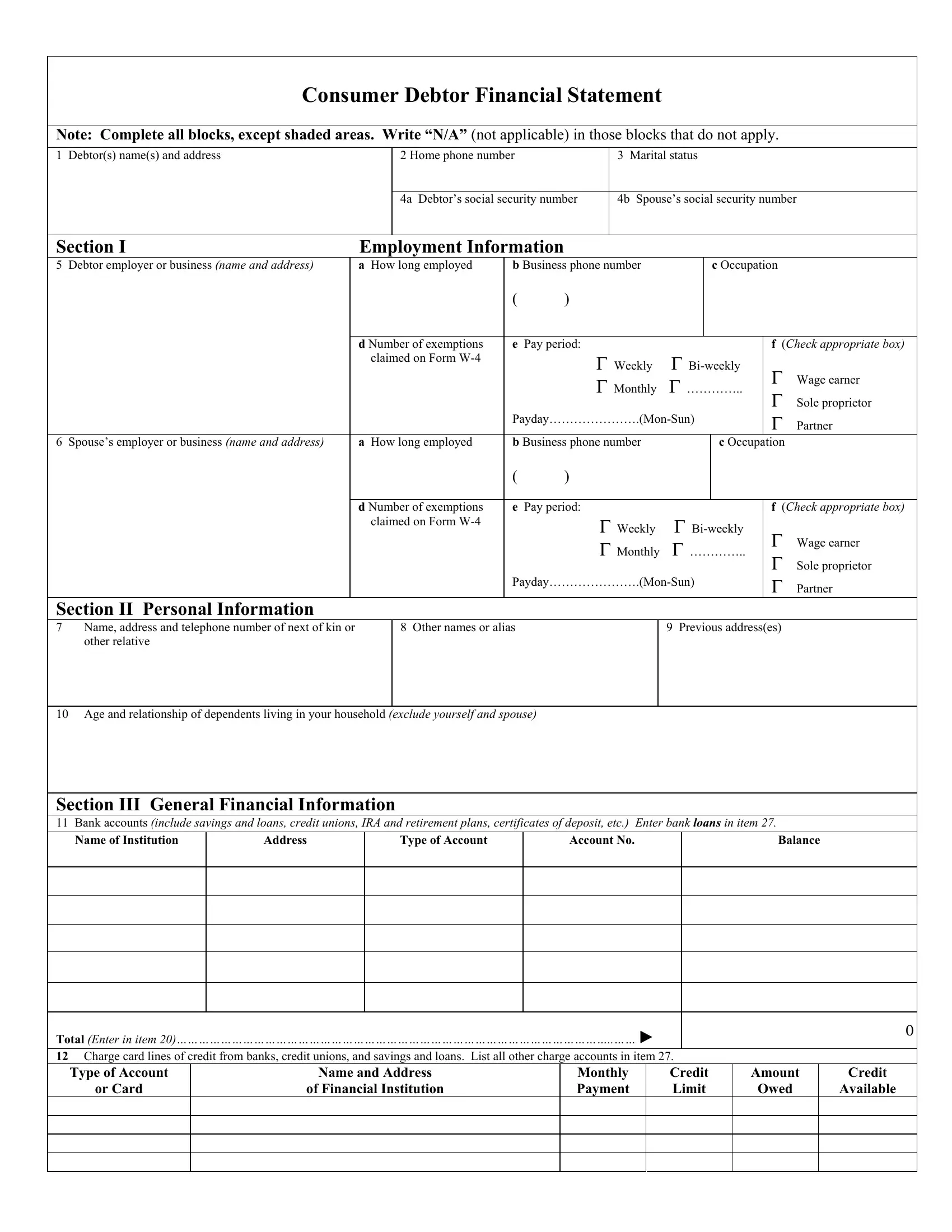

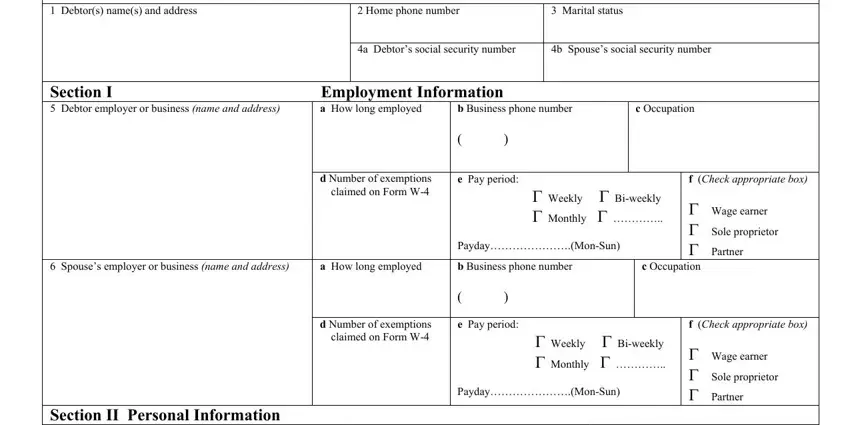

Completing this form calls for focus on details. Make sure that all mandatory blanks are done properly.

1. Begin completing the debtor financial statement with a group of necessary fields. Note all of the necessary information and make certain not a single thing left out!

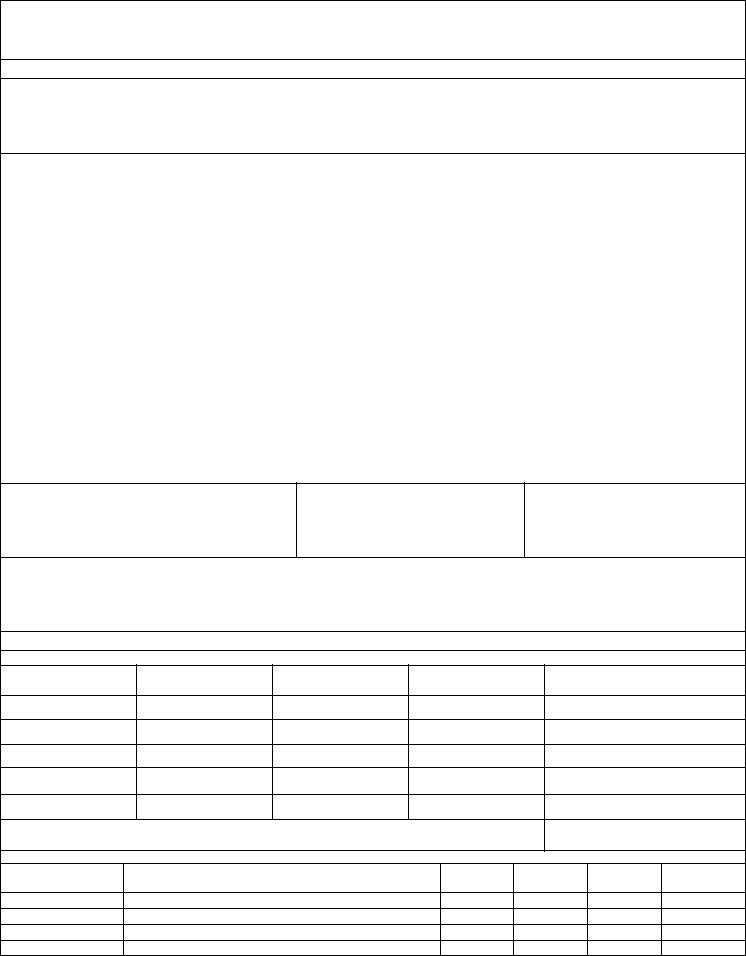

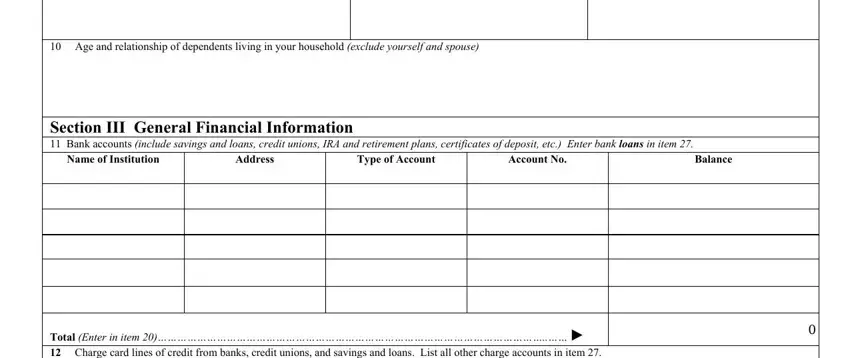

2. The third stage would be to submit these blank fields: Age and relationship of, Name of Institution, Address, Type of Account, Account No, Balance, and Total Enter in item Charge card.

People frequently make mistakes while completing Name of Institution in this section. Ensure you read twice everything you type in here.

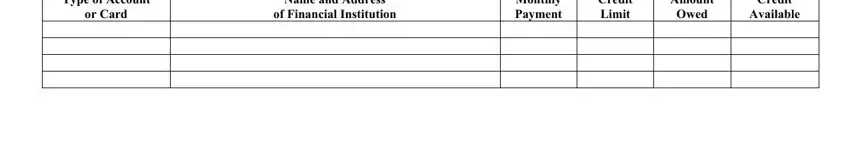

3. Completing Type of Account, or Card, Name and Address, of Financial Institution, Monthly Payment, Credit Limit, Amount, Owed, Credit, and Available is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

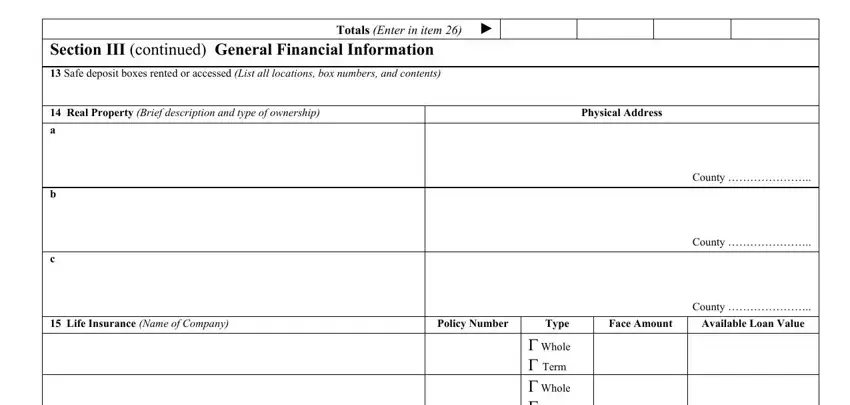

4. The form's fourth section comes next with the following fields to enter your details in: Totals Enter in item, Section III continued General, Safe deposit boxes rented or, Physical Address, a b c Life Insurance Name of, County, County, Policy Number, Type, Face Amount, Available Loan Value, County, and Whole Term Whole Term Whole.

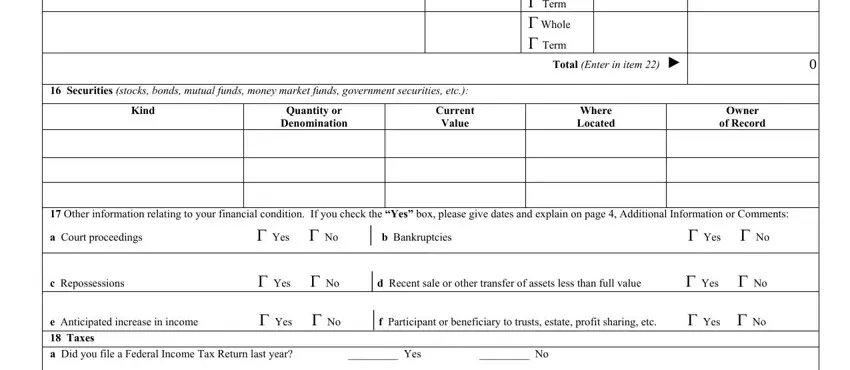

5. As a final point, the following final segment is what you should wrap up before using the PDF. The fields you're looking at are the following: Whole Term Whole Term Whole, Total Enter in item, Securities stocks bonds mutual, Kind, Quantity or, Denomination, Current, Value, Where Located, Owner, of Record, Other information relating to, a Court proceedings Yes No b, c Repossessions Yes No d Recent, and e Anticipated increase in income.

Step 3: Prior to getting to the next stage, it's a good idea to ensure that blanks were filled out the correct way. As soon as you determine that it is correct, click “Done." After starting afree trial account at FormsPal, you will be able to download debtor financial statement or email it right away. The PDF file will also be easily accessible through your personal account with your changes. When you use FormsPal, you're able to complete documents without worrying about personal information incidents or records being distributed. Our protected system makes sure that your private details are kept safely.