INSTRUCTIONS

Short Sale Affidavit

The borrower, purchaser, and all parties involved in the transaction must sign and date a Short Sale Affidavit (Form 191) at the time of the closing confirming that the transaction is an arm's-length transaction with all proceeds (net of allowable transaction costs as described in the Servicing Guide) applied to the mortgage loan payoff in full satisfaction of the entire first-lien mortgage debt. An arm's-length transaction is a transaction between parties who are unrelated and unaffiliated by family, marriage, or commercial enterprise. The servicer may allow the borrower, purchaser, and all parties involved to sign individually on separate copies of the short sale affidavit. In addition, the servicer must retain the original signed short sale affidavit(s) or electronically stored image of the original affidavit(s) in the mortgage loan servicing file.

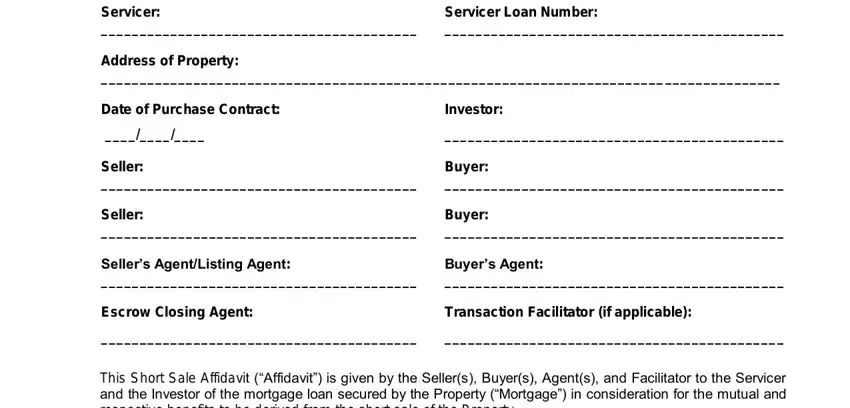

SHORT SALE AFFIDAVIT

Servicer: |

Servicer Loan Number: |

_________________________________________ |

____________________________________________ |

Address of Property:

________________________________________________________________________________________

Date of Purchase Contract: |

Investor: |

____/____/____ |

____________________________________________ |

Seller: |

Buyer: |

_________________________________________ |

____________________________________________ |

Seller: |

Buyer: |

_________________________________________ |

____________________________________________ |

Seller’s Agent/Listing Agent: |

Buyer’s Agent: |

_________________________________________ |

____________________________________________ |

Escrow Closing Agent: |

Transaction Facilitator (if applicable): |

_________________________________________ |

____________________________________________ |

This Short Sale Affidavit (“Affidavit”) is given by the Seller(s), Buyer(s), Agent(s), and Facilitator to the Servicer and the Investor of the mortgage loan secured by the Property (“Mortgage”) in consideration for the mutual and respective benefits to be derived from the short sale of the Property.

NOW, THEREFORE, the Seller(s), Buyer(s), Agent(s), and Facilitator do hereby represent, warrant and agree under the pains and penalties of perjury, to the best of each signatory's knowledge and belief, as follows:

(a)The sale of the Property is an "arm's length" transaction, between Seller(s) and Buyer(s) who are unrelated and unaffiliated by family, marriage, or commercial enterprise;

(b)There are no agreements, understandings or contracts between the Seller(s) and Buyer(s) that the Seller(s) will remain in the Property as tenants or later obtain title or ownership of the Property, except that the Sellers(s) are permitted to remain as tenants in the Property for a short term, as is common and customary in the market but no longer than ninety (90) days, in order to facilitate relocation;

(c)Neither the Sellers(s) nor the Buyer(s) will receive any funds or commissions from the sale of the Property except that the Seller(s) may receive a payment if it is offered by the Servicer, approved by the Investor and, if the payment is made at closing of the short sale of the Property, reflected on the HUD-1 Settlement Statement;

(d)The Seller’s Listing Agent has presented all offers for the purchase of the Property to the Borrower and no offers have been held, concealed or delayed due to action or inaction by any Agent.1

(e)There are no agreements, understandings or contracts relating to the current sale or subsequent sale of the Property that have not been disclosed to the Servicer;

1As of August 1, 2014, this attestation is a mandatory requirement as stated in SVC-2014-09: Updates to Short Sale and Mortgage ReleaseTM

Fannie Mae Form 191 |

Page 1 of 3 |

6.10.2015 |

(f)All amounts to be paid to any person or entity, including holders of other liens on the Property, in connection with the short sale have been disclosed to and approved by the Servicer and will be reflected on the HUD-1 Settlement Statement;

(g)Each signatory understands, agrees and intends that the Servicer and the Investor are relying upon the statements made in this Affidavit as consideration for the reduction of the payoff amount of the Mortgage and agreement to the sale of the Property;

(h)A signatory who makes a negligent or intentional misrepresentation agrees to indemnify the Servicer and the Investor for any and all loss resulting from the misrepresentation including, but not limited to, repayment of the amount of the reduced payoff of the Mortgage;

(i)This Affidavit and all representations, warranties and statements made herein will survive the closing of the short sale transaction; and

(j)Each signatory understands that a misrepresentation may subject the person making the misrepresentation to civil and/or criminal liability.

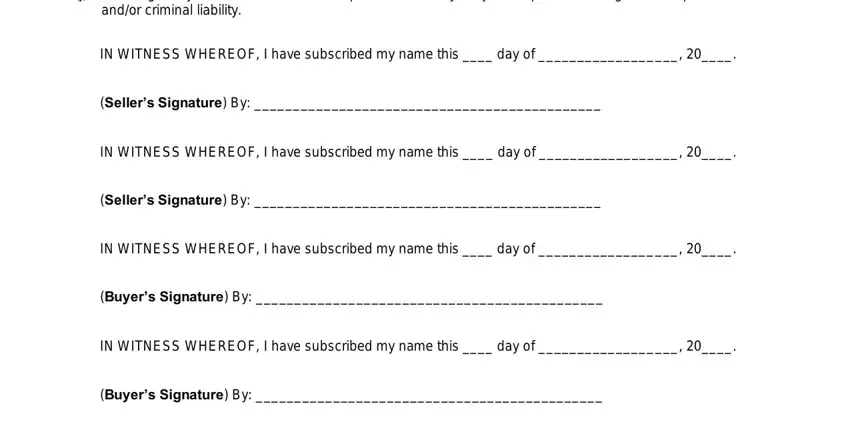

IN WITNESS WHEREOF, I have subscribed my name this ____ day of __________________, 20____.

(Seller’s Signature) By: _____________________________________________

IN WITNESS WHEREOF, I have subscribed my name this ____ day of __________________, 20____.

(Seller’s Signature) By: _____________________________________________

IN WITNESS WHEREOF, I have subscribed my name this ____ day of __________________, 20____.

(Buyer’s Signature) By: _____________________________________________

IN WITNESS WHEREOF, I have subscribed my name this ____ day of __________________, 20____.

(Buyer’s Signature) By: _____________________________________________

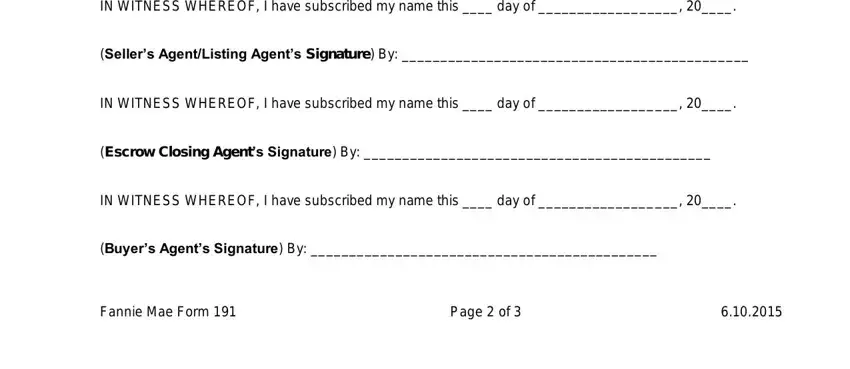

IN WITNESS WHEREOF, I have subscribed my name this ____ day of __________________, 20____.

(Seller’s Agent/Listing Agent’s Signature) By: _____________________________________________

IN WITNESS WHEREOF, I have subscribed my name this ____ day of __________________, 20____.

(Escrow Closing Agent’s Signature) By: _____________________________________________

IN WITNESS WHEREOF, I have subscribed my name this ____ day of __________________, 20____.

(Buyer’s Agent’s Signature) By: _____________________________________________

Fannie Mae Form 191 |

Page 2 of 3 |

6.10.2015 |

IN WITNESS WHEREOF, I have subscribed my name this ____ day of __________________, 20____.

(Transaction Facilitator’s Signature (if applicable)) By: ____________________________________

Fannie Mae Form 191 |

Page 3 of 3 |

6.10.2015 |