Dealing with PDF documents online is actually super easy with this PDF tool. Anyone can fill in franchise here painlessly. FormsPal professional team is continuously endeavoring to enhance the editor and insure that it is even better for users with its multiple features. Unlock an endlessly revolutionary experience now - check out and discover new opportunities as you go! With some simple steps, you can begin your PDF editing:

Step 1: Simply press the "Get Form Button" in the top section of this webpage to get into our pdf form editor. Here you will find all that is required to work with your document.

Step 2: Using this handy PDF editing tool, you could accomplish more than simply complete blank fields. Express yourself and make your documents look faultless with custom text put in, or modify the original input to excellence - all that comes with the capability to incorporate almost any photos and sign the PDF off.

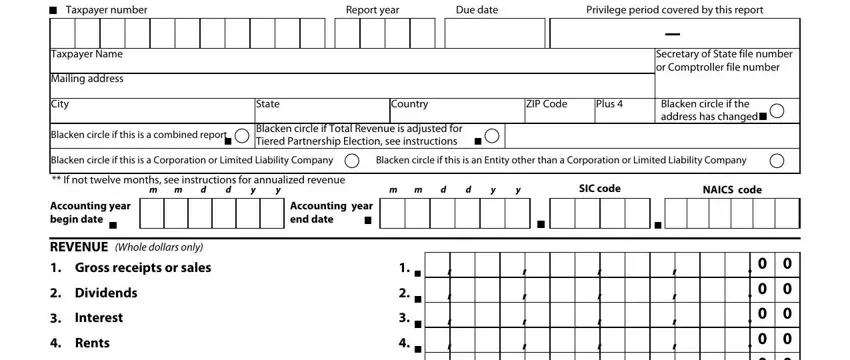

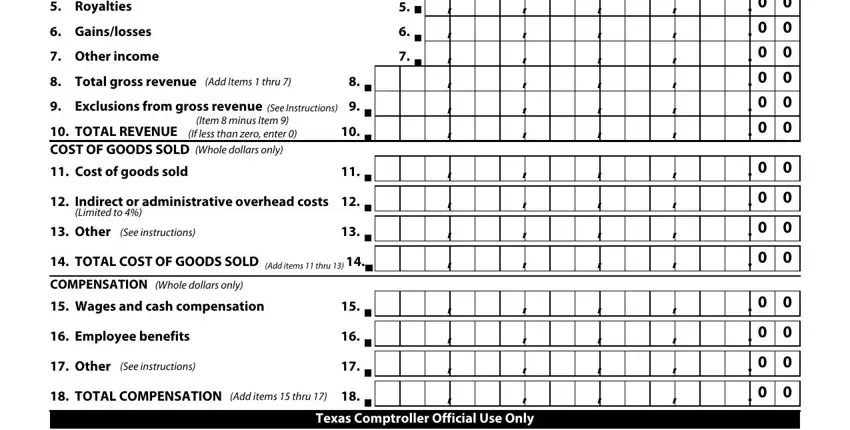

As a way to finalize this document, be certain to provide the information you need in each and every area:

1. Whenever filling in the franchise, make certain to include all of the important blanks in their relevant part. It will help hasten the work, allowing your details to be processed promptly and correctly.

2. When the previous part is done, it is time to add the necessary details in Royalties, Gainslosses, Other income, Total gross revenue Add Items, Exclusions from gross revenue See, TOTAL REVENUE COST OF GOODS SOLD, If less than zero enter, Item minus Item, Cost of goods sold, Indirect or administrative, Limited to, Other, See instructions, TOTAL COST OF GOODS SOLD Add, and COMPENSATION Whole dollars only allowing you to move forward to the 3rd part.

Lots of people generally make mistakes while filling out Indirect or administrative in this section. Be sure to review what you enter right here.

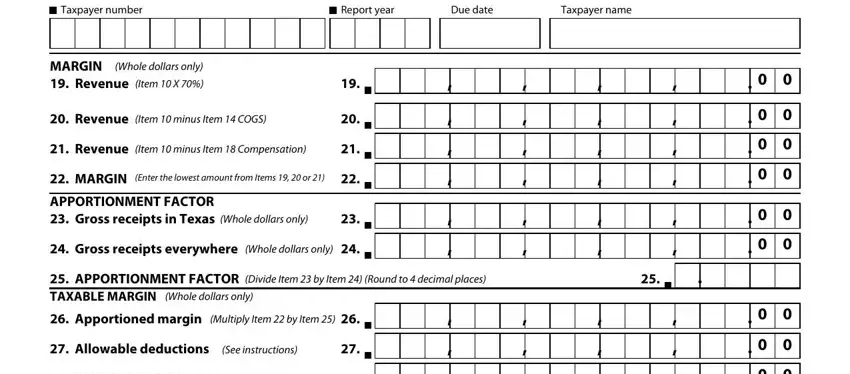

3. This next segment is typically pretty simple, Taxpayer number, Report year, Due date, Taxpayer name, MARGIN Whole dollars only Revenue, Revenue Item minus Item COGS, Revenue Item minus Item, MARGIN Enter the lowest amount, APPORTIONMENT FACTOR, Gross receipts in Texas Whole, Gross receipts everywhere Whole, APPORTIONMENT FACTOR Divide Item, Whole dollars only, Apportioned margin, and Multiply Item by Item - these form fields must be completed here.

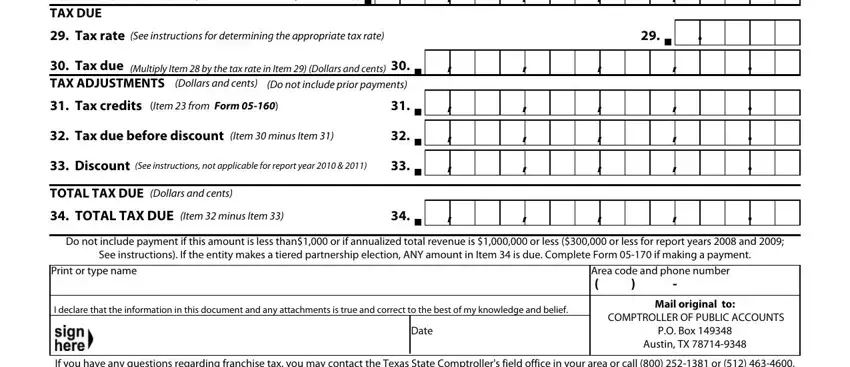

4. The next subsection needs your details in the subsequent places: TAXABLE MARGIN Item minus Item, Tax rate See instructions for, Tax due Multiply Item by the tax, Tax credits Item from Form, Tax due before discount Item, Discount, See instructions not applicable, TOTAL TAX DUE Dollars and cents, TOTAL TAX DUE Item minus Item, X X, X X, X X, Do not include payment if this, See instructions If the entity, and Print or type name. Make certain to type in all needed info to go onward.

Step 3: Spell-check the details you've typed into the form fields and press the "Done" button. Right after setting up afree trial account with us, you'll be able to download franchise or send it through email at once. The PDF document will also be accessible through your personal account with your changes. FormsPal is focused on the privacy of our users; we make sure that all information going through our editor is confidential.