ne income tax forms can be completed effortlessly. Just open FormsPal PDF tool to do the job fast. To make our editor better and less complicated to use, we consistently develop new features, with our users' suggestions in mind. Starting is simple! All you should do is adhere to these easy steps directly below:

Step 1: Open the PDF doc inside our editor by pressing the "Get Form Button" above on this page.

Step 2: As you access the file editor, you will find the document prepared to be completed. Besides filling in different blanks, you might also perform many other actions with the file, such as adding your own text, modifying the original textual content, adding images, affixing your signature to the PDF, and a lot more.

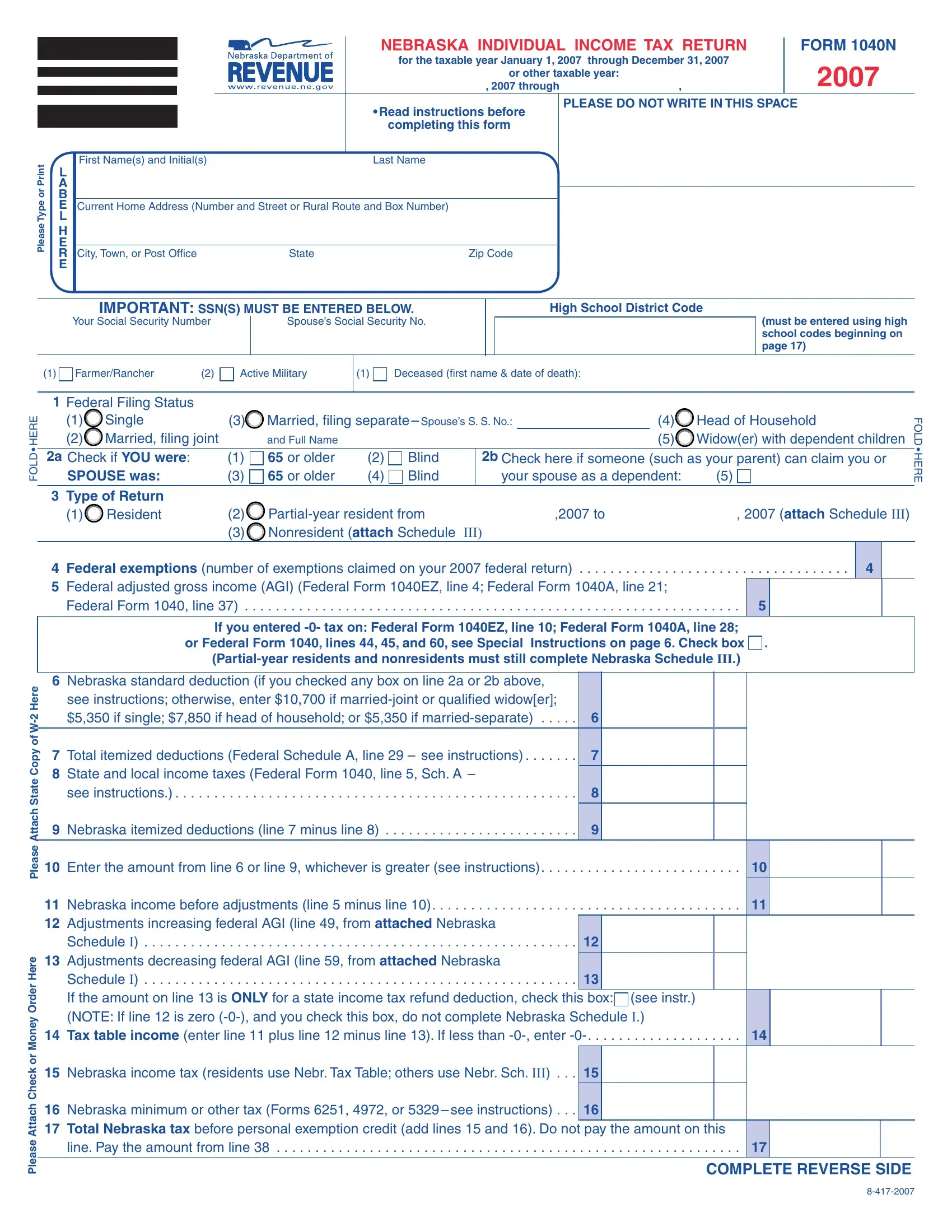

To be able to complete this document, ensure that you type in the information you need in every single blank field:

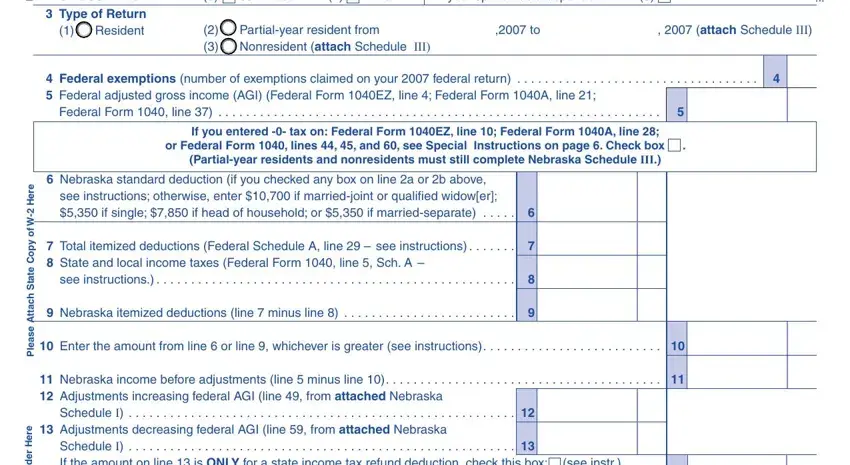

1. Start completing the ne income tax forms with a number of major blank fields. Gather all the information you need and be sure there is nothing missed!

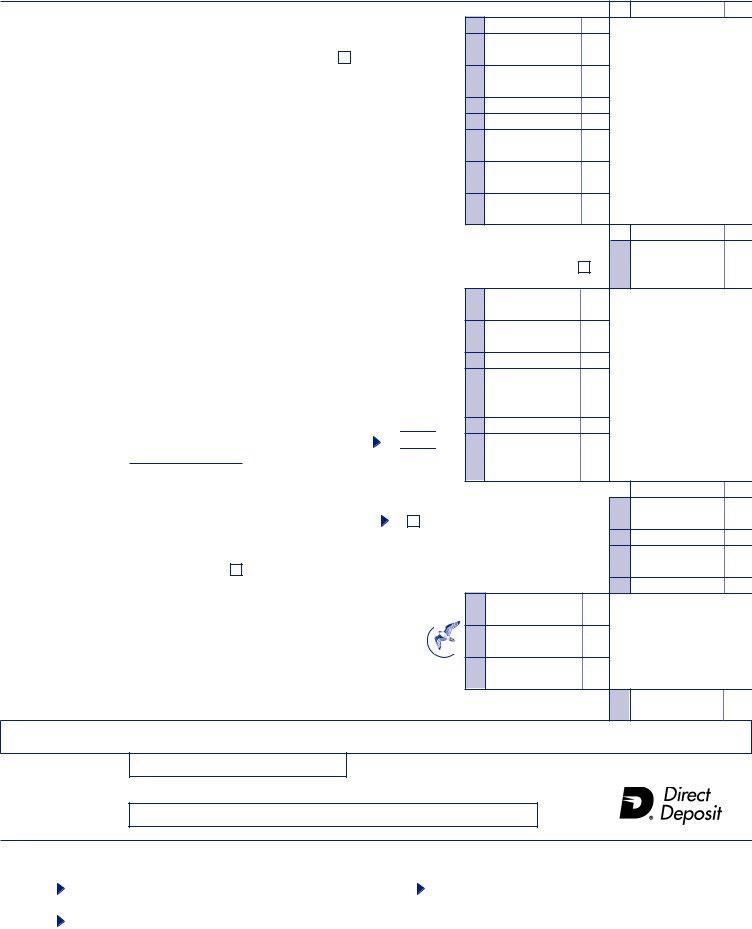

2. The subsequent step would be to complete the following blank fields: SPOUSEwas TypeofReturn, MarriedfilingseparateSpousesSSNo, andFullName orolder orolder, Blind Blind, F O L D H E R E, Partialyearresidentfrom, NonresidentattachScheduleIII, attachScheduleIII, ScheduleI, ScheduleI, seeinstr, e r e H r e d r O y e n o M, E R E H D L O F, f o y p o C e t a t S h c a t t, and A e s a e P.

Be extremely attentive while completing andFullName orolder orolder and Partialyearresidentfrom, since this is the part where most users make a few mistakes.

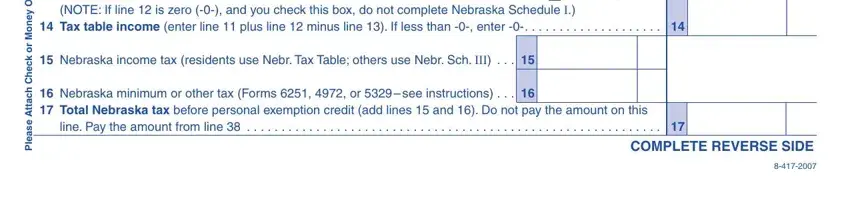

3. Throughout this step, look at ScheduleI, seeinstr, e r e H r e d r O y e n o M, r o k c e h C h c a t t, A e s a e P, linePaytheamountfromline, and COMPLETEREVERSESIDE. These are required to be taken care of with highest awareness of detail.

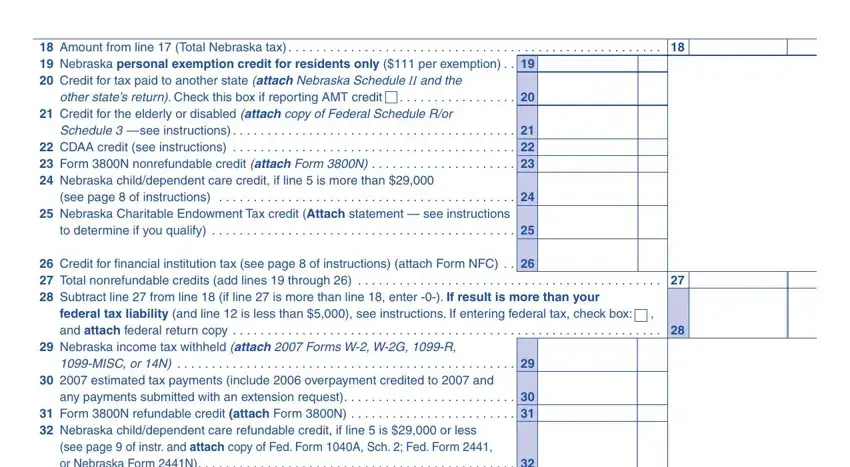

4. The form's fourth subsection comes with these particular blank fields to complete: AmountfromlineTotalNebraskatax, seepageofinstructions, todetermineifyouqualify, and MISCorN.

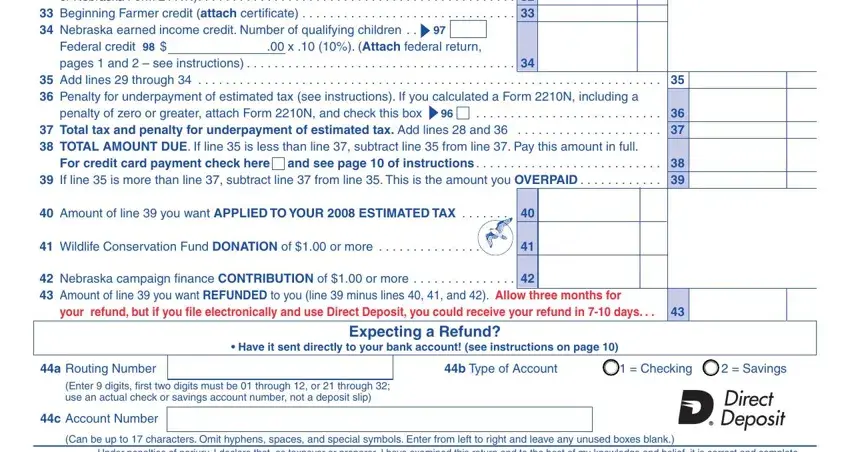

5. Finally, the following final segment is precisely what you'll have to finish before using the PDF. The blanks at this stage are the following: Federalcredit, Forcreditcardpaymentcheckhere, xAttachfederalreturn, ExpectingaRefund, aRoutingNumber, bTypeofAccount, Checking, Savings, and cAccountNumber.

Step 3: After going through your form fields, click "Done" and you're done and dusted! Right after starting a7-day free trial account with us, it will be possible to download ne income tax forms or email it right away. The file will also be readily accessible via your personal account menu with your each and every modification. FormsPal ensures your data confidentiality via a secure method that in no way records or shares any type of sensitive information used in the form. Rest assured knowing your docs are kept confidential each time you use our tools!