Should you need to fill out Form 1040Nr Ez, you don't have to download and install any programs - simply use our PDF tool. In order to make our tool better and less complicated to utilize, we consistently design new features, taking into consideration feedback coming from our users. To start your journey, take these simple steps:

Step 1: Access the PDF form inside our editor by pressing the "Get Form Button" at the top of this page.

Step 2: As soon as you launch the editor, you will notice the document all set to be completed. In addition to filling out various blank fields, you can also do other sorts of things with the form, specifically writing custom text, modifying the initial text, adding graphics, putting your signature on the PDF, and a lot more.

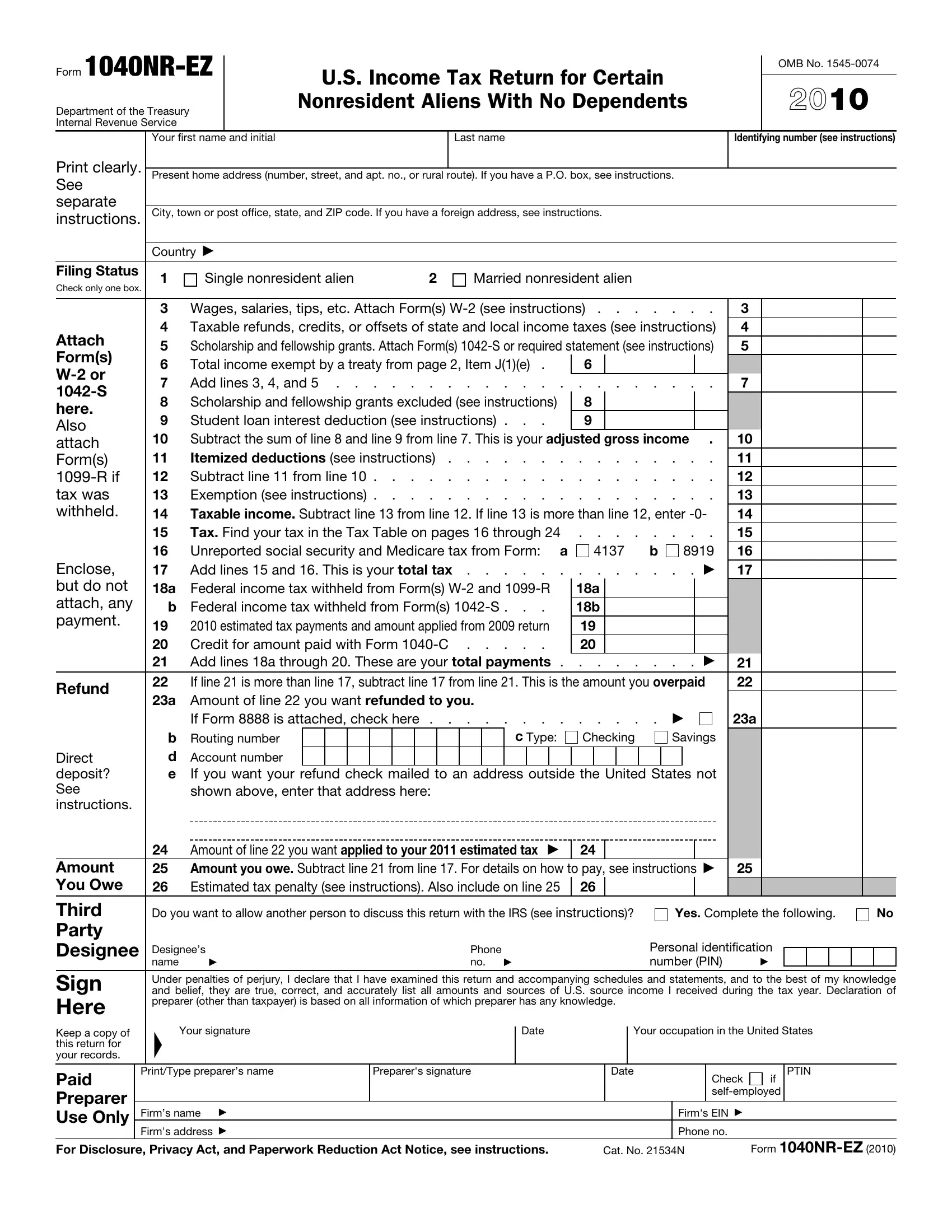

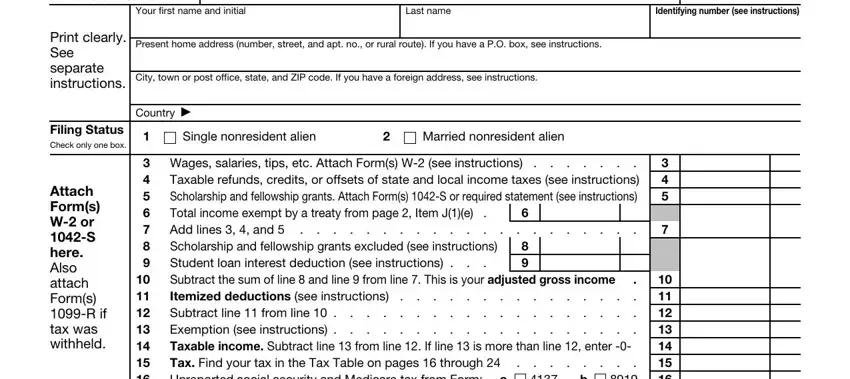

With regards to the fields of this specific document, this is what you want to do:

1. It's very important to complete the Form 1040Nr Ez accurately, hence pay close attention when working with the areas comprising these specific blank fields:

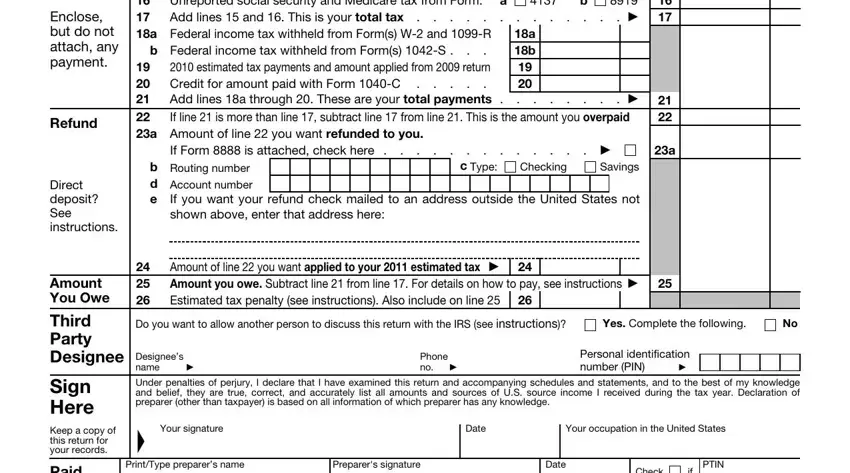

2. The subsequent step would be to submit the following blanks: Enclose but do not attach any, Taxable refunds credits or, Wages salaries tips etc Attach, a b, b Federal income tax withheld from, Refund, If line is more than line, a Amount of line you want, If Form is attached check here, b Routing number d Account number, c Type, Checking, Savings, shown above enter that address here, and Amount of line you want applied.

Many people often make errors when filling in Enclose but do not attach any in this area. Remember to revise everything you enter right here.

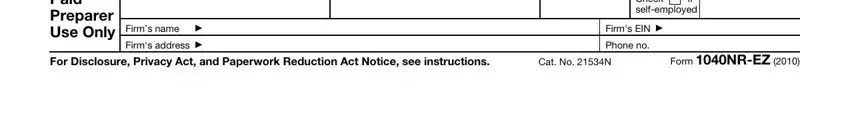

3. This next portion is focused on Paid Preparer Use Only, Firms name, Firms address, Check if selfemployed, Firms EIN, Phone no, For Disclosure Privacy Act and, Cat No N, and Form NREZ - type in every one of these empty form fields.

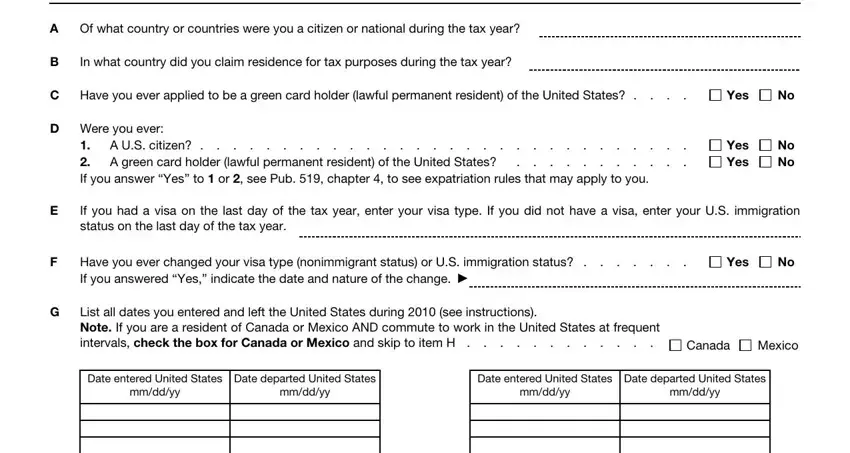

4. To go forward, the following part will require filling in a few fields. Included in these are Of what country or countries were, In what country did you claim, Have you ever applied to be a, D Were you ever, A US citizen A green card holder, If you answer Yes to or see, Yes, Yes Yes, No No, If you had a visa on the last day, Have you ever changed your visa, Yes, List all dates you entered and, Canada, and Mexico, which you'll find crucial to carrying on with this particular form.

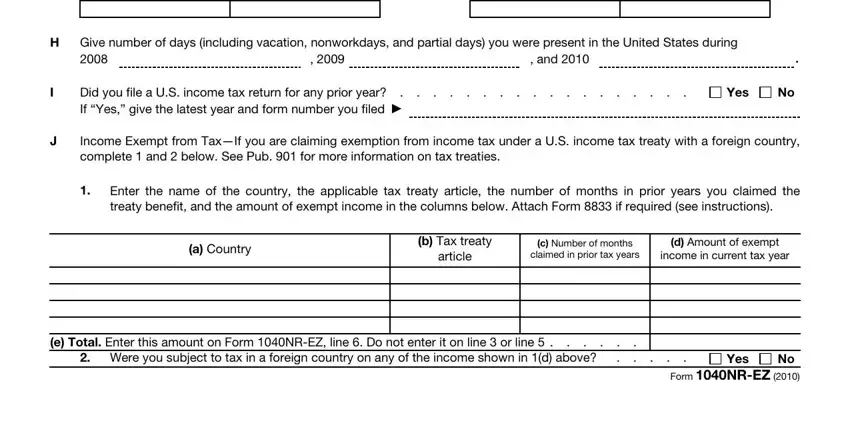

5. Last of all, this last segment is precisely what you'll want to wrap up before submitting the form. The blanks here are the next: Give number of days including, and, Did you file a US income tax, Yes, Income Exempt from TaxIf you are, Enter the name of the country the, a Country, b Tax treaty, article, c Number of months claimed in, d Amount of exempt, income in current tax year, e Total Enter this amount on Form, Were you subject to tax in a, and No Form NREZ.

Step 3: Proofread the information you have inserted in the blank fields and then click on the "Done" button. Go for a free trial plan with us and gain immediate access to Form 1040Nr Ez - which you may then work with as you would like in your personal account. We do not sell or share the details you provide when working with documents at FormsPal.