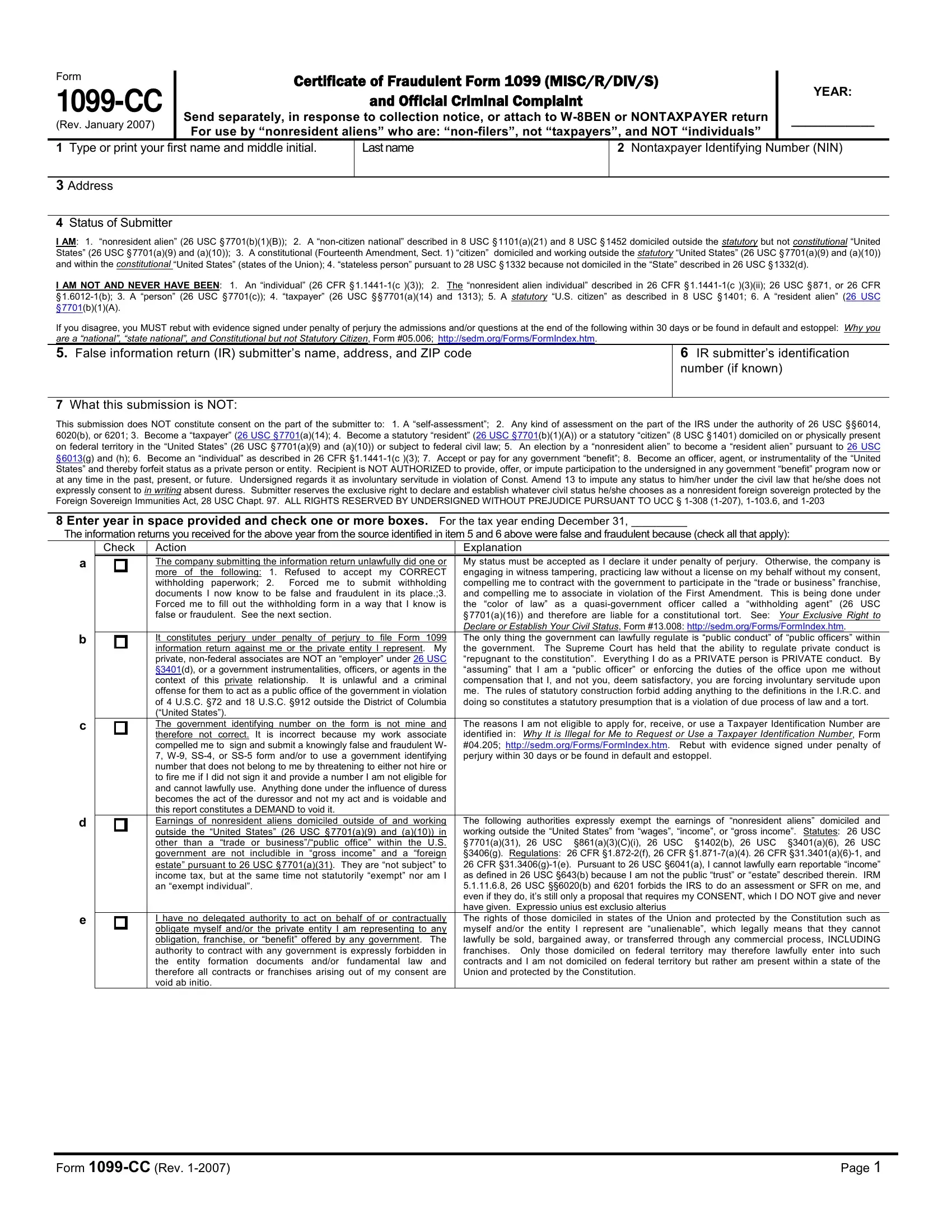

This submission does NOT constitute consent on the part of the submitter to: 1. A “self-assessment”; 2. Any kind of assessment on the part of the IRS under the authority of 26 USC § § 6014, 6020(b), or 6201; 3. Become a “taxpayer” (26 USC § 7701(a)(14); 4. Become a statutory “resident” (26 USC § 7701(b)(1)(A)) or a statutory “citizen” (8 USC § 1401) domiciled on or physically present on federal territory in the “United States” (26 USC § 7701(a)(9) and (a)(10)) or subject to federal civil law; 5. An election by a “nonresident alien” to become a “resident alien” pursuant to 26 USC

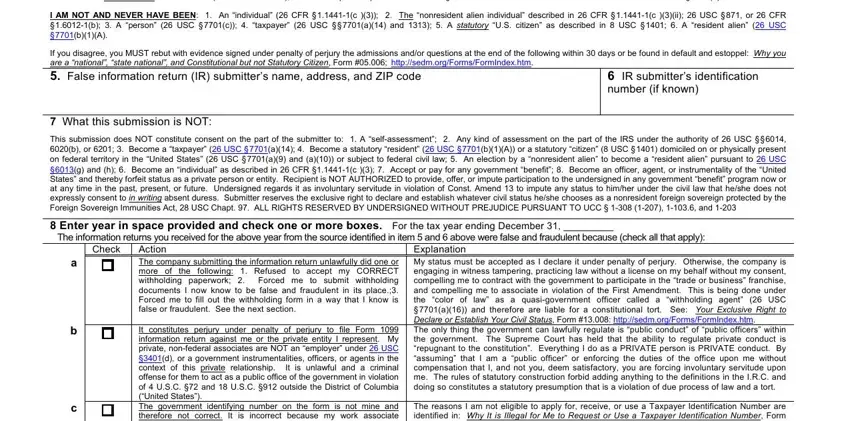

8 Enter year in space provided and check one or more boxes. For the tax year ending December 31, _________

The information returns you received for the above year from the source identified in item 5 and 6 above were false and fraudulent because (check all that apply):

|

Check |

Action |

|

Explanation |

|

|

|

|

|

|

|

a |

|

The company submitting the information return unlawfully did one or |

My status must be accepted as I declare it under penalty of perjury. Otherwise, the company is |

more of the following: 1. Refused to accept my CORRECT |

engaging in witness tampering, practicing law without a license on my behalf without my consent, |

|

|

withholding paperwork; 2. Forced me to submit withholding |

compelling me to contract with the government to participate in the “trade or business” franchise, |

|

|

documents I now know to be false and fraudulent in its place.;3. |

and compelling me to associate in violation of the First Amendment. |

This is being done under |

|

|

Forced me to fill out the withholding form in a way that I know is |

the “color |

of law” as |

a quasi-government |

officer called a “withholding agent” (26 USC |

|

|

false or fraudulent. See the next section. |

|

§ 7701(a)(16)) and therefore are liable for a |

constitutional tort. |

See: |

Your Exclusive Right to |

|

|

|

|

Declare or Establish Your Civil Status, Form #13.008: http://sedm.org/Forms/FormIndex.htm. |

b |

|

It constitutes perjury under penalty of perjury to file Form 1099 |

The only thing the government can lawfully regulate is “public conduct” of “public officers” within |

information return against me or the private entity I represent. |

My |

the government. |

The Supreme Court has held that the ability to regulate private conduct is |

|

|

private, non-federal associates are NOT an “employer” under 26 USC |

“repugnant to the constitution”. Everything I do as a PRIVATE person is PRIVATE conduct. By |

|

|

§3401(d), or a government instrumentalities, officers, or agents in the |

“assuming” that I am a “public officer” or enforcing the duties of the office upon me without |

|

|

context of this private relationship. It is unlawful and a criminal |

compensation that I, and not you, deem satisfactory, you are forcing involuntary servitude upon |

|

|

offense for them to act as a public office of the government in violation |

me. The rules of statutory construction forbid adding anything to the definitions in the I.R.C. and |

|

|

of 4 U.S.C. §72 and 18 U.S.C. §912 outside the District of Columbia |

doing so constitutes a statutory presumption that is a violation of due process of law and a tort. |

|

|

(“United States”). |

|

|

|

|

|

|

|

|

|

|

c |

|

The government identifying number on the form is not mine and |

The reasons I am not eligible to apply for, receive, or use a Taxpayer Identification Number are |

therefore not correct. It is incorrect because my work associate |

identified in: Why It is Illegal for Me to Request or Use a Taxpayer Identification Number, Form |

|

|

compelled me to sign and submit a knowingly false and fraudulent W- |

#04.205; http://sedm.org/Forms/FormIndex.htm. |

Rebut with evidence signed under penalty of |

|

|

7, W-9, SS-4, or SS-5 form and/or to use a government identifying |

perjury within 30 days or be found in default and estoppel. |

|

|

|

|

|

number that does not belong to me by threatening to either not hire or |

|

|

|

|

|

|

|

|

|

|

|

to fire me if I did not sign it and provide a number I am not eligible for |

|

|

|

|

|

|

|

|

|

|

|

and cannot lawfully use. Anything done under the influence of duress |

|

|

|

|

|

|

|

|

|

|

|

becomes the act of the duressor and not my act and is voidable and |

|

|

|

|

|

|

|

|

|

|

|

this report constitutes a DEMAND to void it. |

|

|

|

|

|

|

|

|

|

|

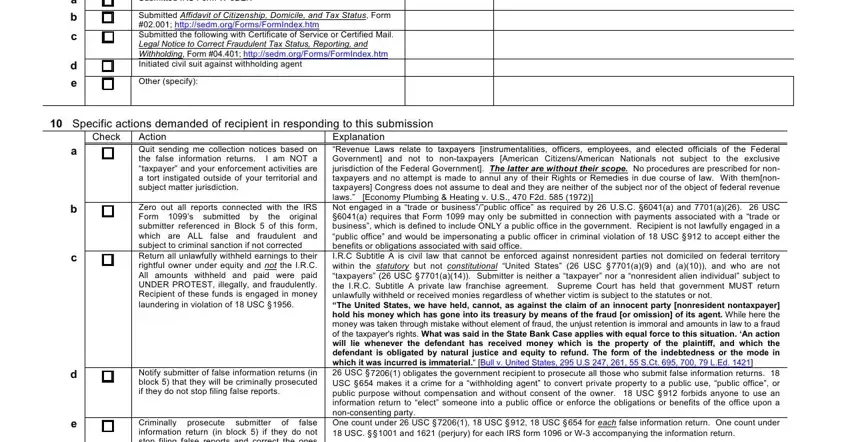

d |

|

Earnings of nonresident aliens domiciled outside of and working |

The following authorities expressly exempt the earnings of “nonresident aliens” domiciled and |

outside the “United States” (26 USC § 7701(a)(9) and (a)(10)) in |

working outside the “United States” from “wages”, “income”, or “gross income”. Statutes: |

26 USC |

|

|

other than a “trade or business”/“public office” within the U.S. |

§ 7701(a)(31), 26 USC |

§861(a)(3)(C)(i), 26 |

USC §1402(b), 26 |

USC §3401(a)(6), |

26 USC |

|

|

government are not includible in “gross income” and a “foreign |

§3406(g). Regulations: 26 CFR §1.872-2(f), 26 CFR §1.871-7(a)(4). 26 CFR §31.3401(a)(6)-1, and |

|

|

estate” pursuant to 26 USC § 7701(a)(31). They are “not subject” to |

26 CFR §31.3406(g)-1(e). Pursuant to 26 USC §6041(a), I cannot lawfully earn reportable “income” |

|

|

income tax, but at the same time not statutorily “exempt” nor am I |

as defined in 26 USC §643(b) because I am not the public “trust” or “estate” described therein. IRM |

|

|

an “exempt individual”. |

|

5.1.11.6.8, 26 USC §§6020(b) and 6201 forbids the IRS to do an assessment or SFR on me, and |

|

|

|

|

even if they do, it’s still only a proposal that requires my CONSENT, which I DO NOT give and never |

|

|

|

|

have given. Expressio unius est exclusio alterius |

|

|

|

|

e |

|

I have no delegated authority to act on behalf of or contractually |

The rights of those domiciled in states of the Union and protected by the Constitution such as |

obligate myself and/or the private entity I am representing to any |

myself and/or the entity I represent are “unalienable”, which legally means that they cannot |

|

|

obligation, franchise, or “benefit” offered by any government. |

The |

lawfully be sold, bargained away, or transferred through any commercial process, INCLUDING |

|

|

authority to contract with any government is expressly forbidden in |

franchises. |

Only |

those |

domiciled on federal |

territory may therefore |

lawfully enter into such |

|

|

the entity formation documents and/or fundamental law and |

contracts and I am not domiciled on federal territory but rather am present within a state of the |

|

|

therefore all contracts or franchises arising out of my consent are |

Union and protected by the Constitution. |

|

|

|

|

|

|

|

void ab initio. |

|

|

|

|

|

|

|

|

|

|