You'll be able to fill out 1099 sf louisville ky effortlessly with our online editor for PDFs. Our tool is constantly developing to deliver the very best user experience possible, and that is because of our dedication to constant improvement and listening closely to comments from users. Starting is simple! All you have to do is take the following basic steps directly below:

Step 1: Simply hit the "Get Form Button" above on this page to access our pdf editor. This way, you'll find all that is necessary to work with your file.

Step 2: The tool will let you change PDF files in many different ways. Improve it by adding your own text, adjust original content, and include a signature - all within a few mouse clicks!

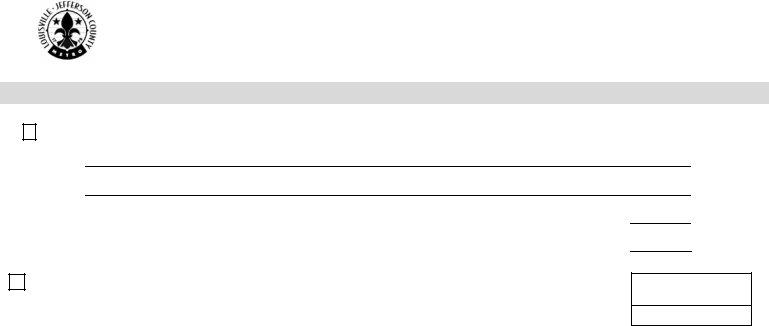

Filling out this document usually requires attention to detail. Make sure that each and every blank field is filled in properly.

1. Complete the 1099 sf louisville ky with a number of major fields. Gather all the important information and make certain nothing is neglected!

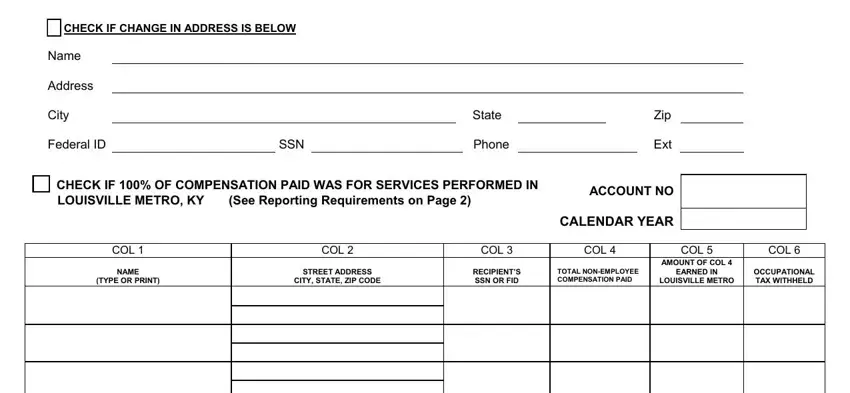

2. Just after the last selection of blank fields is done, go to enter the suitable details in all these: INSTRUCTIONS FOR PREPARING FORM SF, and PRINT NAME TITLE.

When it comes to PRINT NAME TITLE and PRINT NAME TITLE, make sure that you review things in this current part. These two could be the most significant fields in the document.

Step 3: Just after rereading the fields you have filled out, click "Done" and you are done and dusted! Download your 1099 sf louisville ky the instant you register here for a 7-day free trial. Immediately use the pdf form in your FormsPal account, together with any edits and changes automatically saved! FormsPal guarantees your data confidentiality by using a secure system that never saves or shares any kind of personal information used. Feel safe knowing your files are kept safe each time you use our service!