You are able to work with form 10 rita instantly by using our PDFinity® online tool. The tool is consistently upgraded by us, receiving powerful functions and turning out to be more versatile. Starting is effortless! All that you should do is follow these easy steps down below:

Step 1: Just press the "Get Form Button" above on this page to start up our pdf file editing tool. Here you will find all that is needed to work with your file.

Step 2: Once you start the file editor, you'll see the document ready to be filled in. In addition to filling in various blank fields, you can also perform other sorts of things with the Document, specifically adding your own text, editing the initial text, inserting images, signing the form, and a lot more.

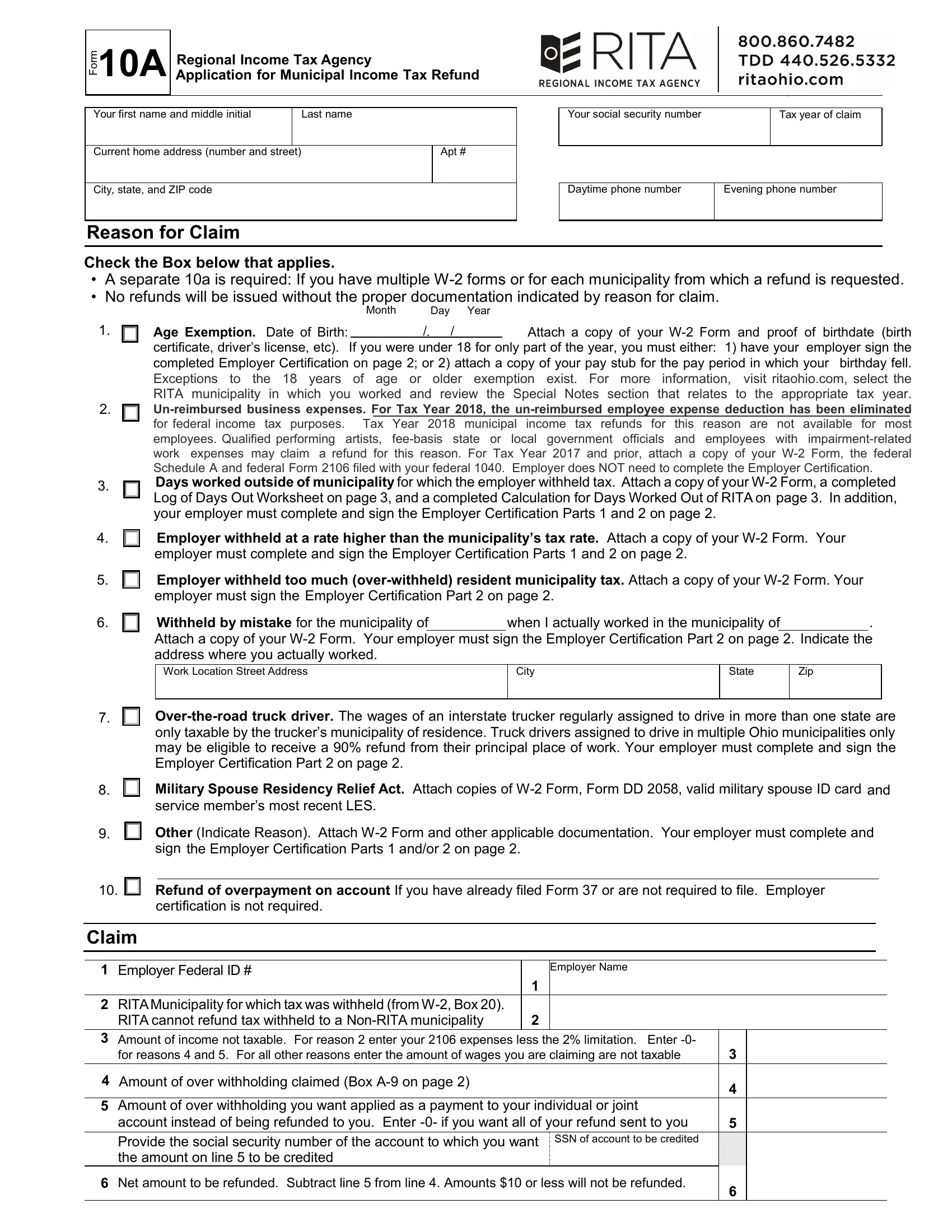

When it comes to fields of this specific PDF, here's what you should do:

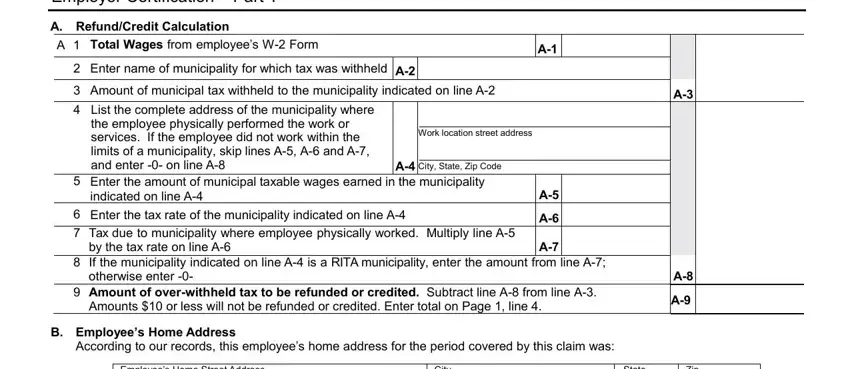

1. When filling out the form 10 rita, be sure to complete all of the important fields in their associated form section. This will help to expedite the work, allowing for your details to be processed without delay and correctly.

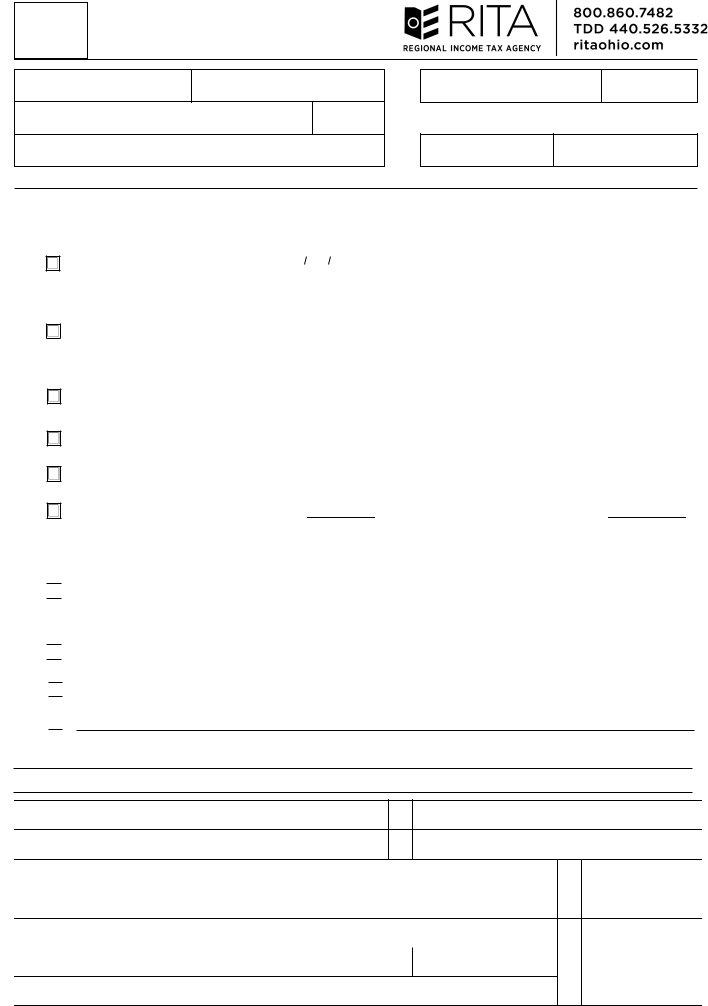

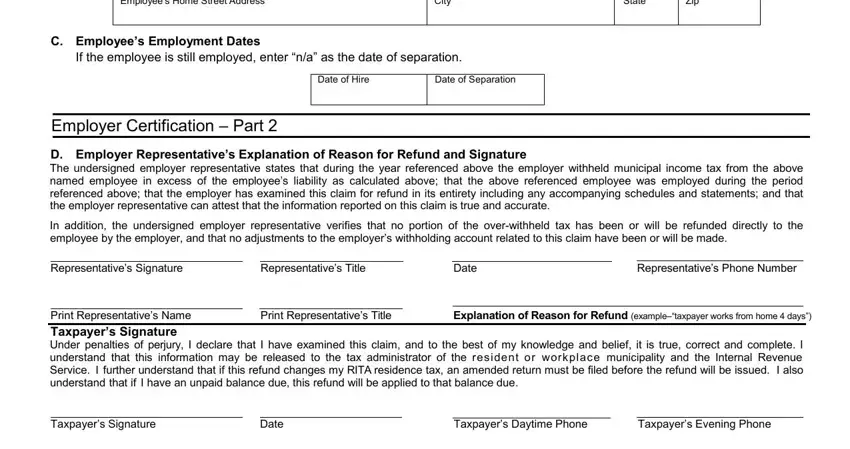

2. Once your current task is complete, take the next step – fill out all of these fields - Employees Home Street Address, City, State, Zip, C Employees Employment Dates, If the employee is still employed, Date of Hire, Date of Separation, Employer Certification Part D, In addition the undersigned, Representatives Signature, Representatives Title, Date, Representatives Phone Number, and Print Representatives Name with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

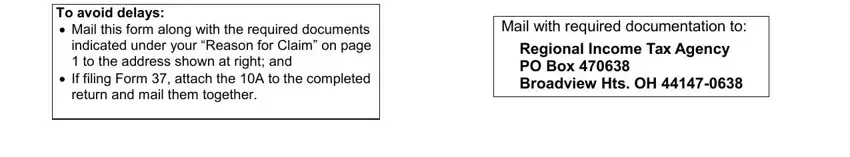

3. This next segment is fairly straightforward, To avoid delays Mail this form, If filing Form attach the A to, return and mail them together, Mail with required documentation to, and Regional Income Tax Agency PO Box - every one of these fields is required to be filled out here.

It is possible to make errors when filling in the Regional Income Tax Agency PO Box, therefore be sure you look again before you decide to send it in.

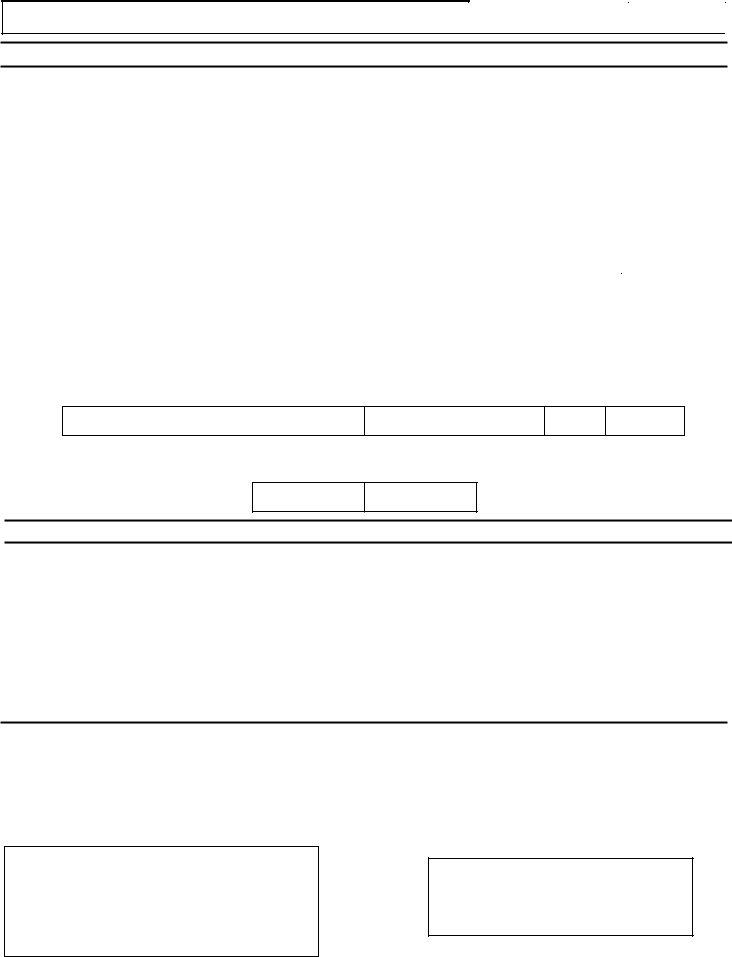

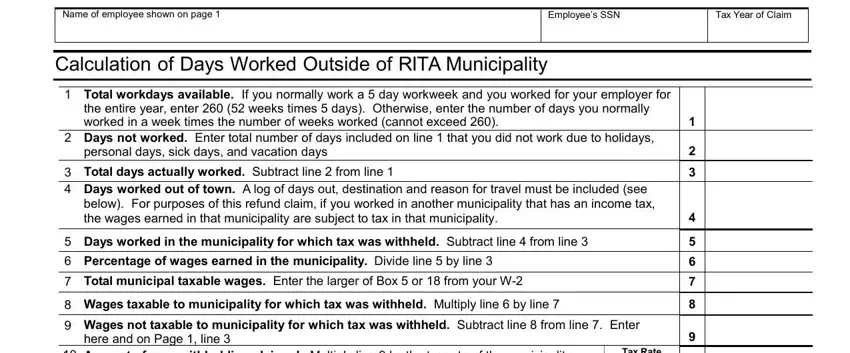

4. Filling out Name of employee shown on page, Employees SSN, Tax Year of Claim, Calculation of Days Worked Outside, Total workdays available If you, the entire year enter weeks, Days not worked Enter total, personal days sick days and, Total days actually worked, below For purposes of this refund, Days worked in the municipality, Percentage of wages earned in the, Total municipal taxable wages, Wages taxable to municipality for, and Wages not taxable to municipality is vital in this fourth section - don't forget to don't rush and take a close look at each and every blank!

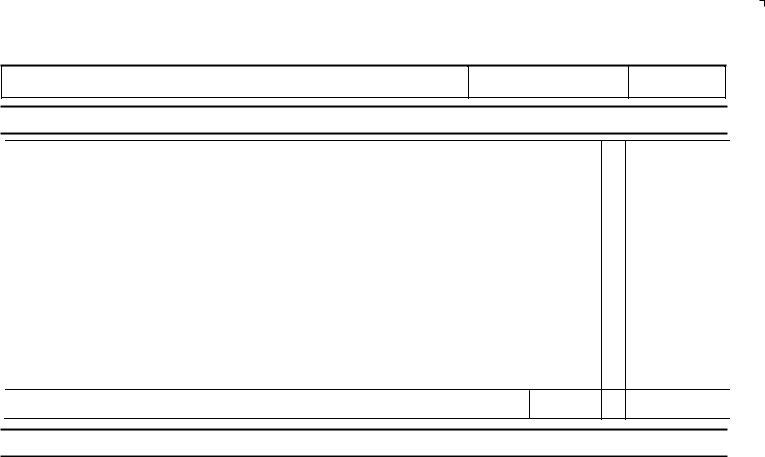

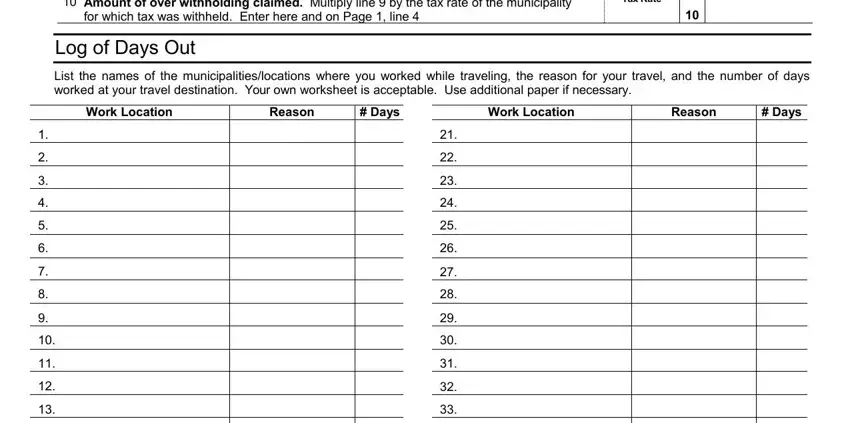

5. Last of all, the following final segment is what you need to wrap up before submitting the PDF. The fields here include the following: Amount of over withholding, for which tax was withheld Enter, Tax Rate, Log of Days Out, List the names of the, Work Location, Reason, Days, Work Location, Reason, and Days.

Step 3: Reread all the details you have inserted in the blank fields and hit the "Done" button. Right after creating a7-day free trial account with us, you will be able to download form 10 rita or send it through email at once. The form will also be accessible via your personal account with all your adjustments. FormsPal guarantees your data confidentiality by using a protected system that in no way saves or distributes any sort of personal information provided. Be confident knowing your paperwork are kept protected any time you work with our services!