Through the online editor for PDFs by FormsPal, it is easy to fill in or alter Form 1120 Ic Disc right here and now. Our editor is continually developing to give the very best user experience possible, and that's because of our dedication to constant improvement and listening closely to testimonials. It merely requires several basic steps:

Step 1: Click on the "Get Form" button at the top of this webpage to access our PDF editor.

Step 2: When you open the PDF editor, you will notice the document prepared to be completed. Apart from filling out different fields, you may also do various other actions with the PDF, particularly writing custom text, editing the original text, adding images, affixing your signature to the PDF, and much more.

This document will need you to provide specific details; in order to ensure accuracy and reliability, be sure to heed the recommendations listed below:

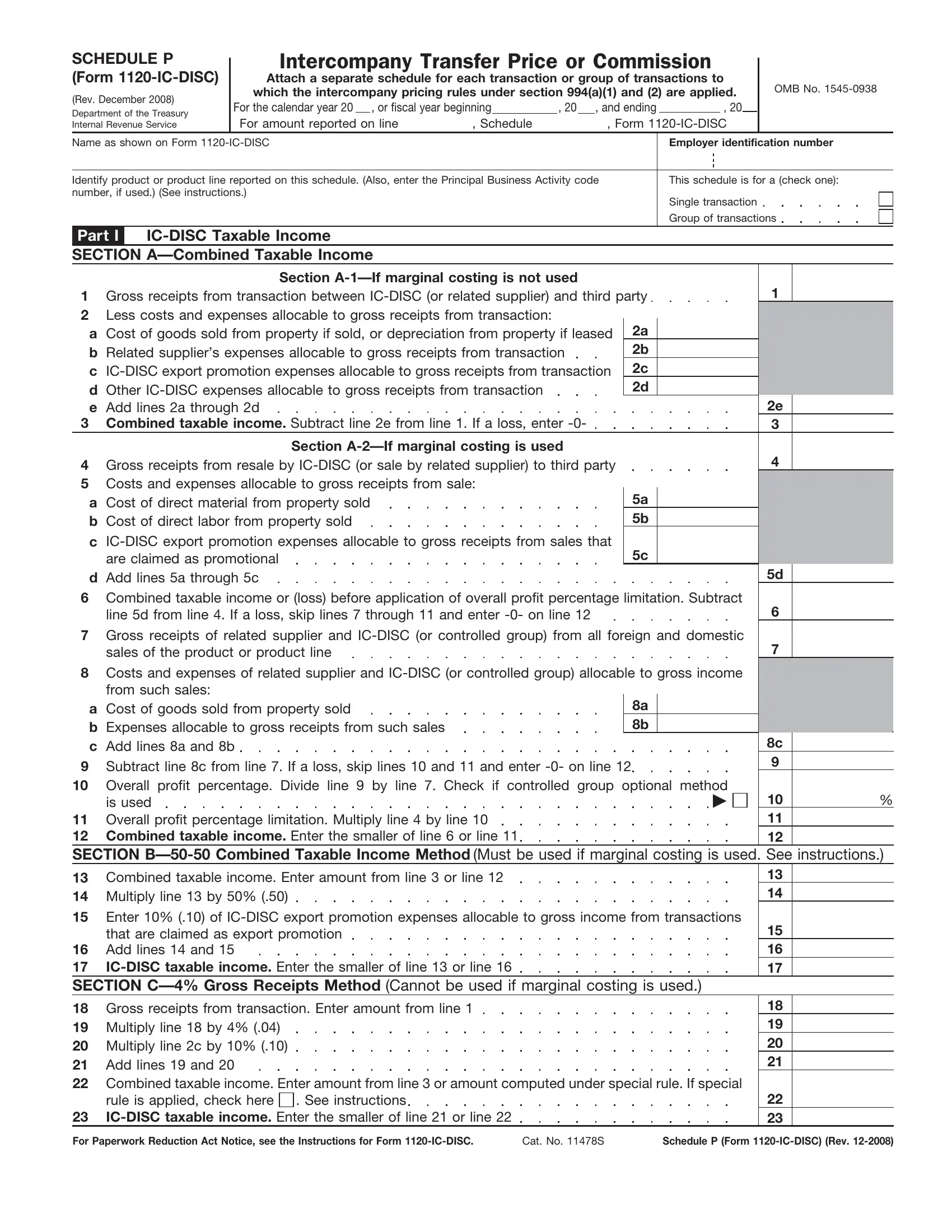

1. Begin completing your Form 1120 Ic Disc with a selection of essential blanks. Get all of the necessary information and ensure there is nothing forgotten!

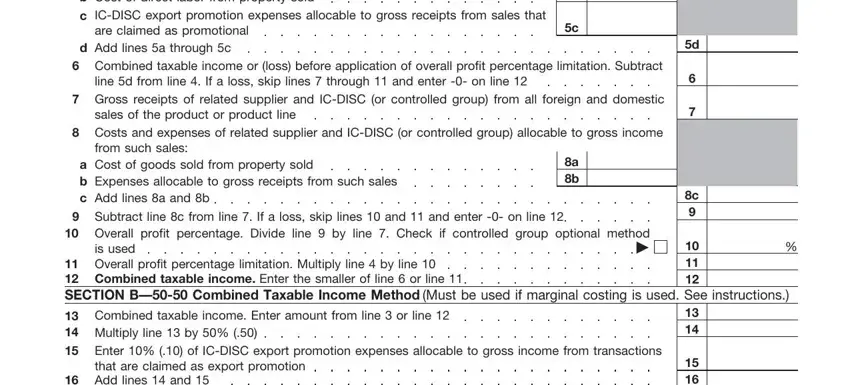

2. Given that this array of fields is complete, you're ready to put in the essential specifics in a Cost of direct material from, c ICDISC export promotion expenses, are claimed as promotional, d Add lines a through c, a b, Combined taxable income or loss, line d from line If a loss skip, Gross receipts of related, sales of the product or product, Costs and expenses of related, from such sales, a Cost of goods sold from property, a b, Subtract line c from line If a, and Overall profit percentage Divide so you can progress to the third step.

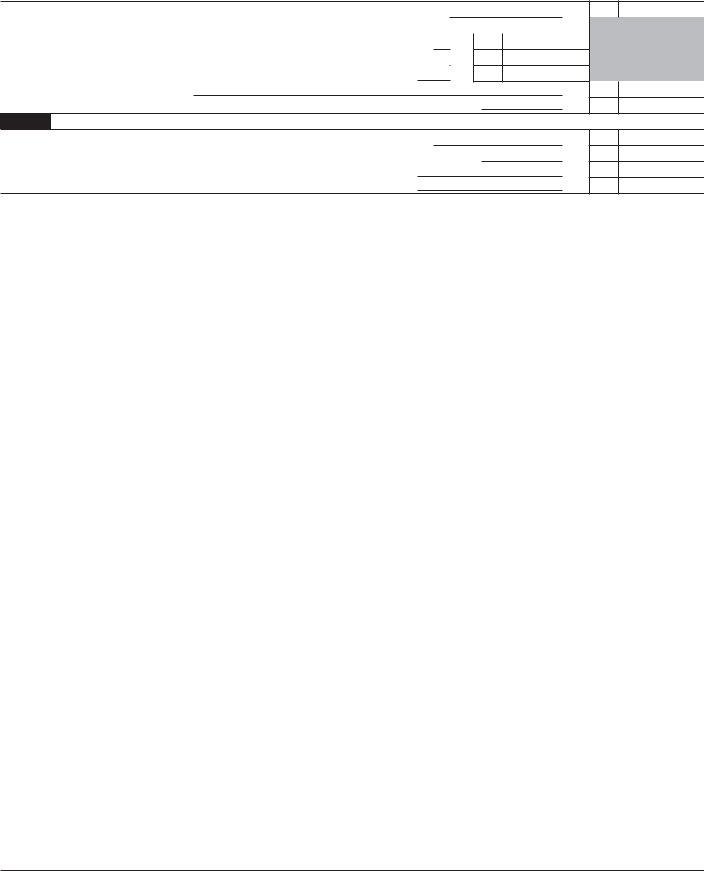

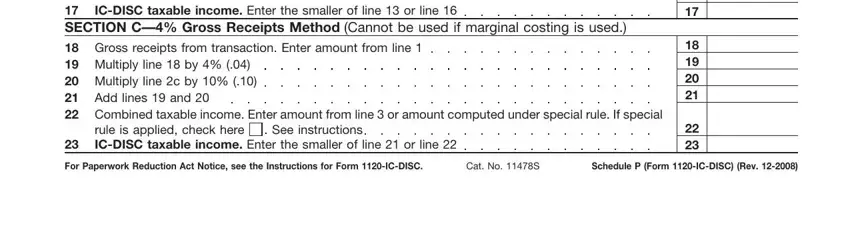

3. Completing Add lines and SECTION C Gross, ICDISC taxable income Enter the, Gross receipts from transaction, rule is applied check here ICDISC, See instructions, For Paperwork Reduction Act Notice, Cat No S, and Schedule P Form ICDISC Rev is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Always be really careful while completing Schedule P Form ICDISC Rev and rule is applied check here ICDISC, as this is where most users make mistakes.

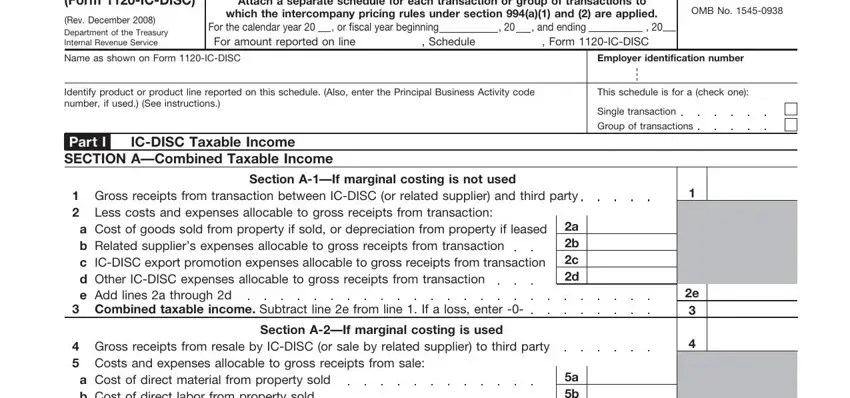

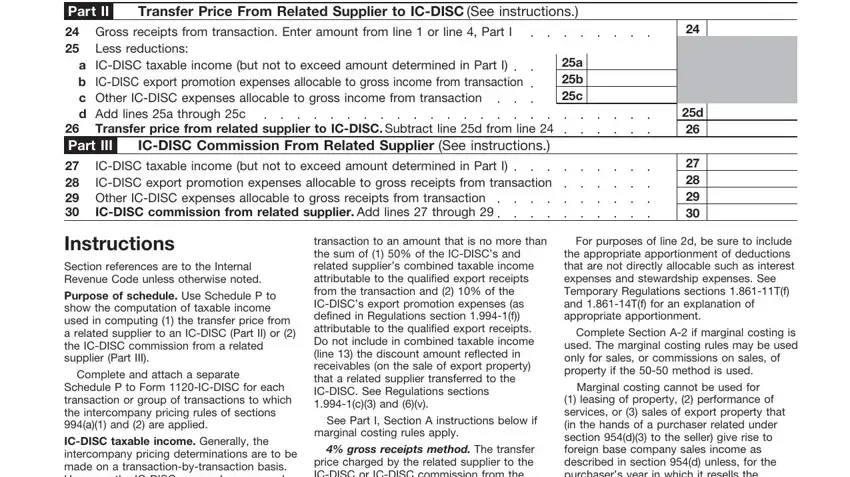

4. Filling in Part II, Transfer Price From Related, Gross receipts from transaction, a ICDISC taxable income but not to, Transfer price from related, a b c, ICDISC taxable income but not to, Other ICDISC expenses allocable, ICDISC commission from related, Instructions Section references, Purpose of schedule Use Schedule P, Complete and attach a separate, Schedule P to Form ICDISC for each, ICDISC taxable income Generally, and transaction to an amount that is is essential in the fourth stage - make certain that you devote some time and take a close look at every single blank!

Step 3: Ensure the information is accurate and click on "Done" to finish the task. Join us right now and instantly get access to Form 1120 Ic Disc, prepared for download. All alterations you make are kept , helping you to edit the pdf further as needed. FormsPal guarantees safe form editor without personal data recording or sharing. Feel at ease knowing that your information is safe here!