You may fill in M-3 effectively by using our online PDF editor. Our tool is continually evolving to give the best user experience attainable, and that is thanks to our commitment to continual improvement and listening closely to user feedback. Starting is simple! All you have to do is stick to these simple steps directly below:

Step 1: Simply click on the "Get Form Button" above on this webpage to access our pdf editor. Here you will find all that is needed to fill out your file.

Step 2: With this online PDF file editor, it is possible to do more than merely complete forms. Express yourself and make your docs look sublime with custom textual content added, or modify the file's original content to perfection - all backed up by an ability to incorporate almost any images and sign the file off.

Completing this document requires care for details. Make certain every single blank field is filled in properly.

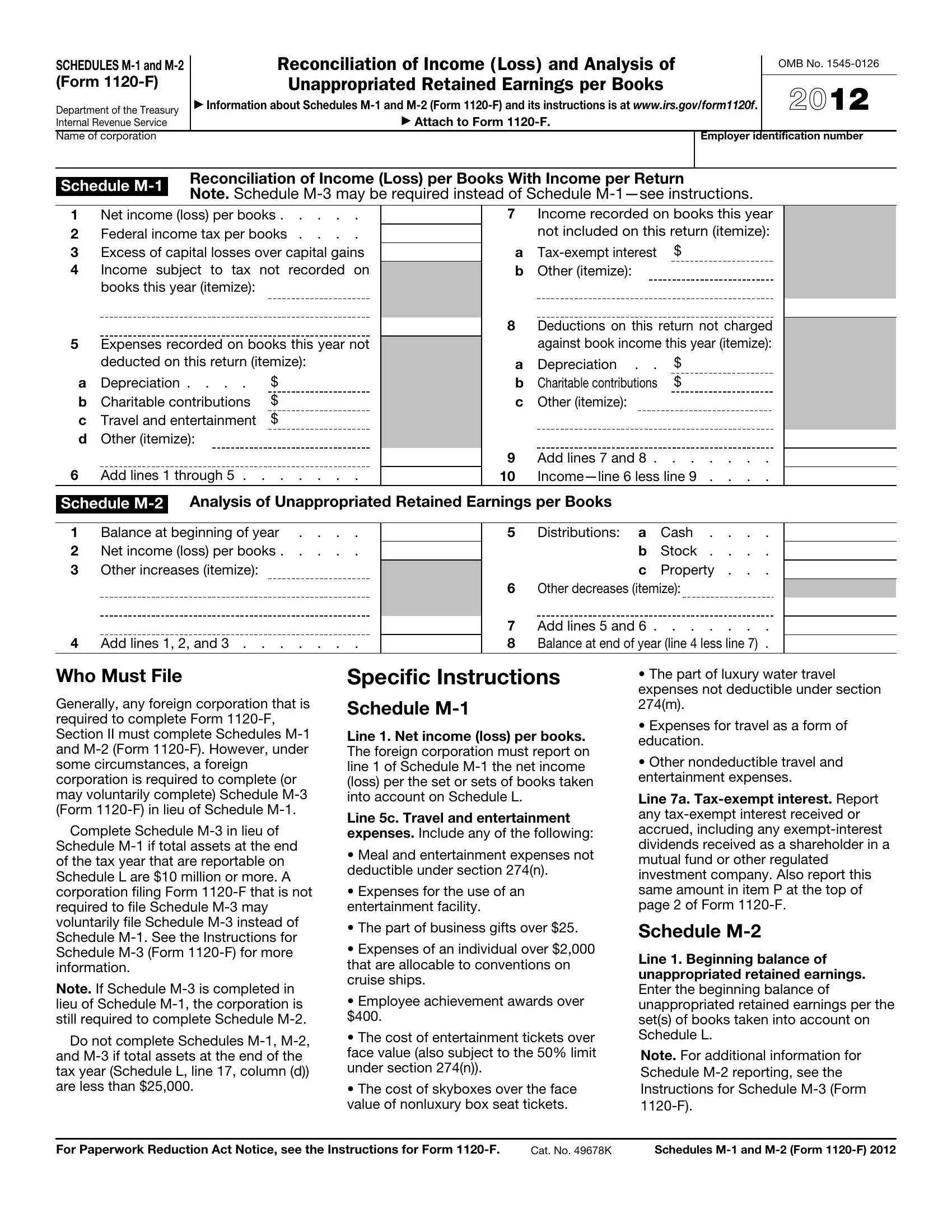

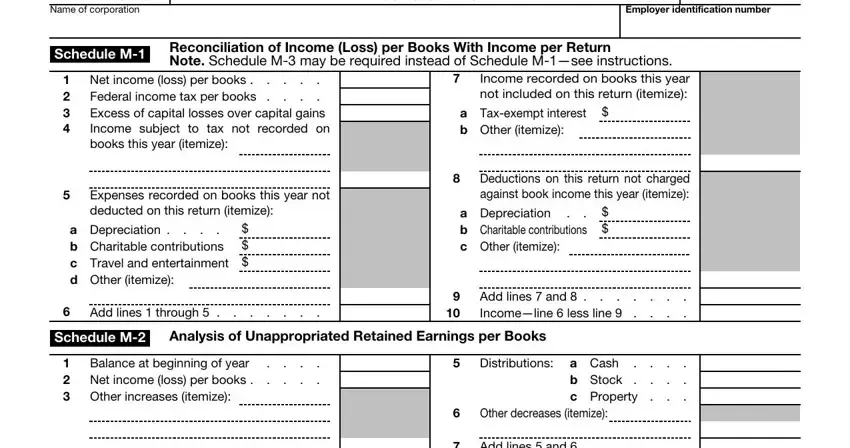

1. While submitting the M-3, make certain to complete all important blanks within its associated part. It will help speed up the process, allowing for your details to be handled swiftly and correctly.

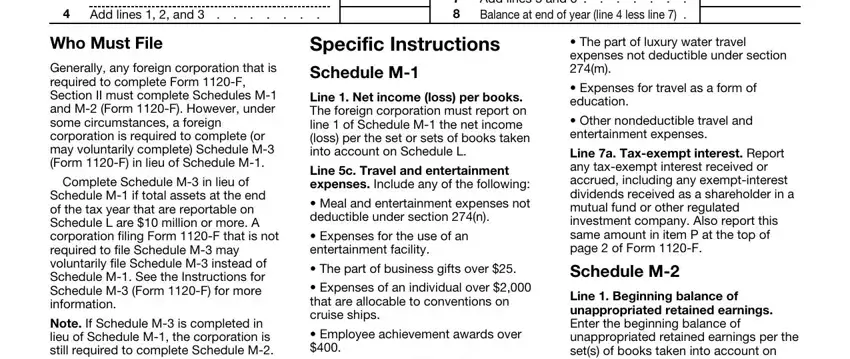

2. When the previous array of fields is complete, it is time to put in the needed details in Add lines and, Add lines and Balance at end, Who Must File, Specific Instructions, Generally any foreign corporation, Complete Schedule M in lieu of, Schedule M if total assets at the, Note If Schedule M is completed in, Schedule M, Line Net income loss per books, Line c Travel and entertainment, Meal and entertainment expenses, Expenses for the use of an, The part of business gifts over, and Expenses of an individual over in order to progress to the next step.

Be really mindful when completing Schedule M and Line Net income loss per books, since this is the section where most users make a few mistakes.

Step 3: Before finalizing your file, ensure that blanks are filled in the proper way. When you believe it's all good, click “Done." Go for a 7-day free trial plan with us and acquire direct access to M-3 - accessible from your FormsPal account page. If you use FormsPal, you're able to fill out forms without stressing about personal data incidents or entries being distributed. Our protected software makes sure that your personal data is stored safe.