Form 1120S Schedule M 3 can be filled out online easily. Simply open FormsPal PDF editor to complete the task in a timely fashion. We at FormsPal are devoted to providing you the ideal experience with our tool by constantly presenting new features and improvements. With all of these updates, using our tool gets easier than ever before! This is what you'll have to do to start:

Step 1: Access the PDF doc inside our tool by clicking the "Get Form Button" in the top part of this webpage.

Step 2: With this state-of-the-art PDF tool, you could accomplish more than just fill in forms. Express yourself and make your documents appear sublime with custom text put in, or adjust the file's original input to perfection - all that supported by the capability to insert almost any photos and sign the document off.

It's straightforward to finish the pdf using this detailed tutorial! Here's what you must do:

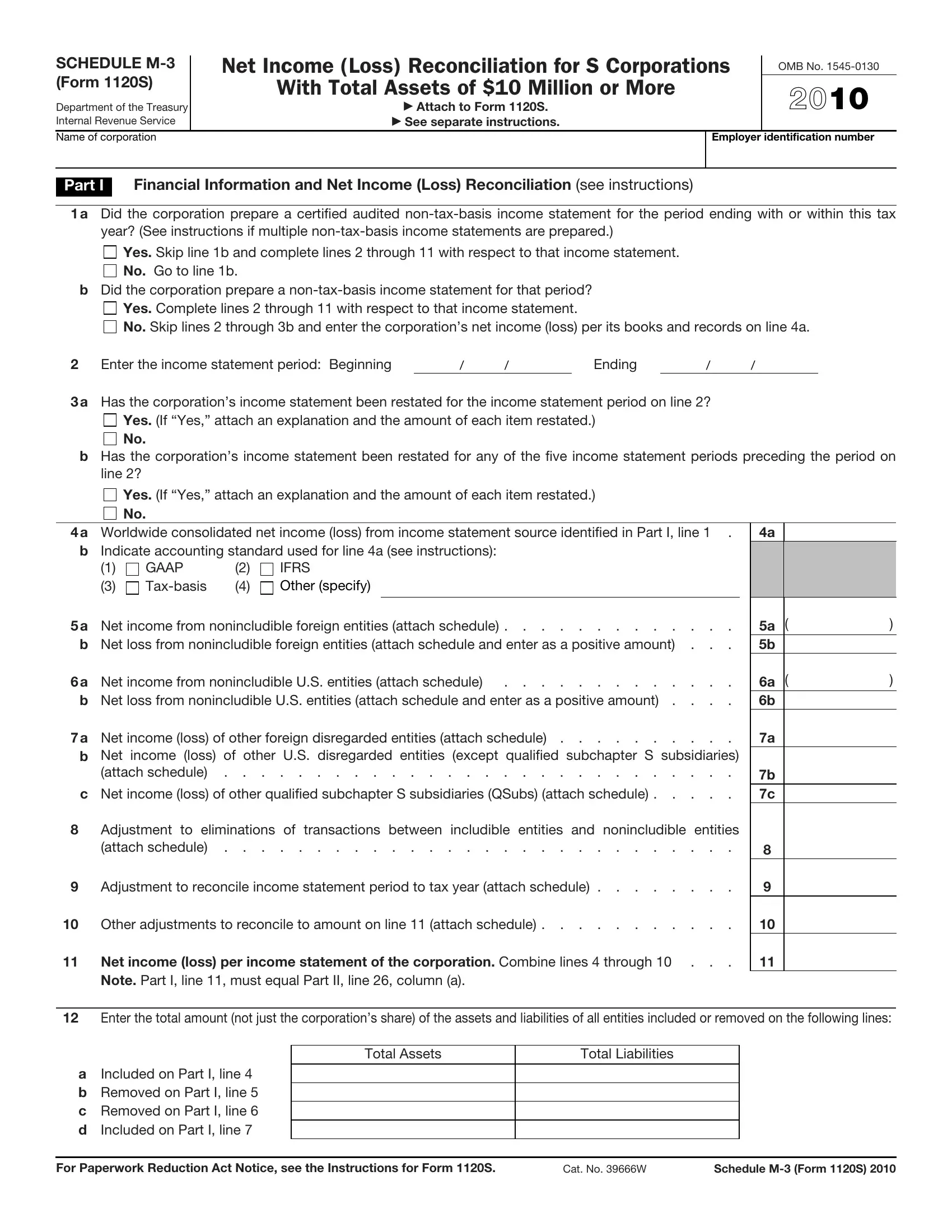

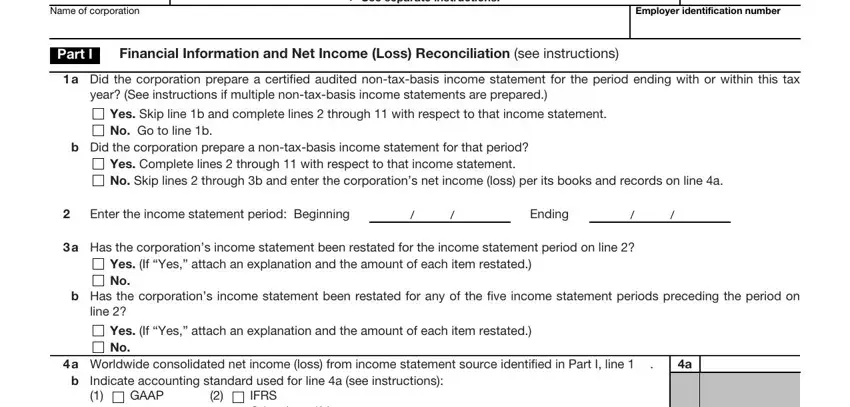

1. Start filling out the Form 1120S Schedule M 3 with a group of essential blanks. Note all of the necessary information and make sure there is nothing omitted!

2. Once the last array of fields is finished, it is time to add the required particulars in Indicate accounting standard used, IFRS Other specify, GAAP Taxbasis, a Net income from nonincludible, b Net loss from nonincludible, a Net income from nonincludible, b Net loss from nonincludible US, a Net income loss of other, b Net income loss of other US, attach schedule, c Net income loss of other, Adjustment to eliminations of, Adjustment to reconcile income, Other adjustments to reconcile to, and Net income loss per income so that you can move forward further.

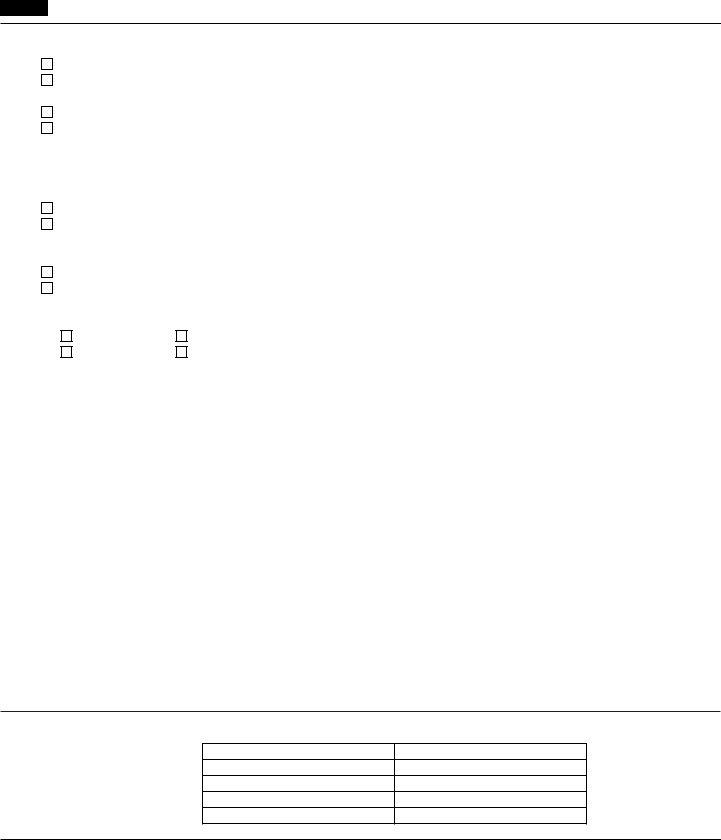

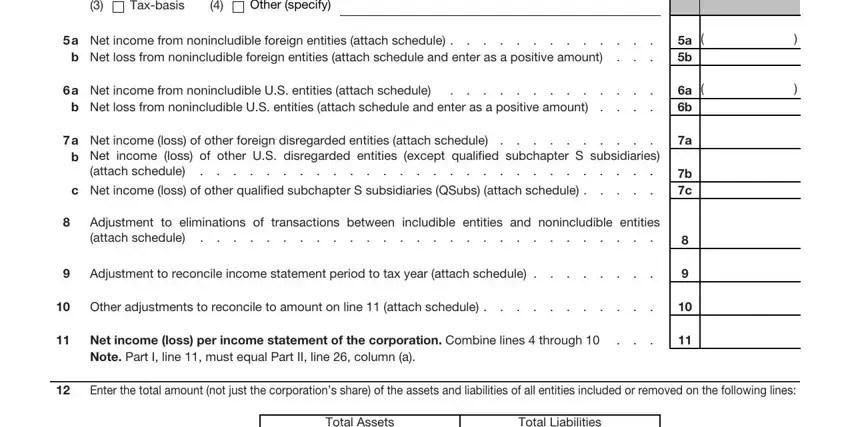

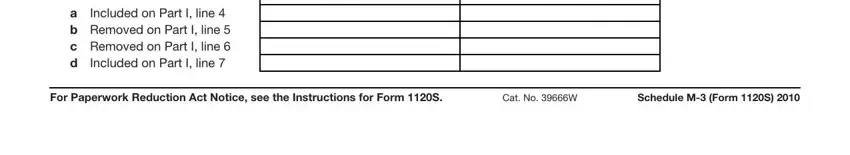

3. Completing Total Assets, Total Liabilities, Included on Part I line a b, For Paperwork Reduction Act Notice, Cat No W, and Schedule M Form S is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

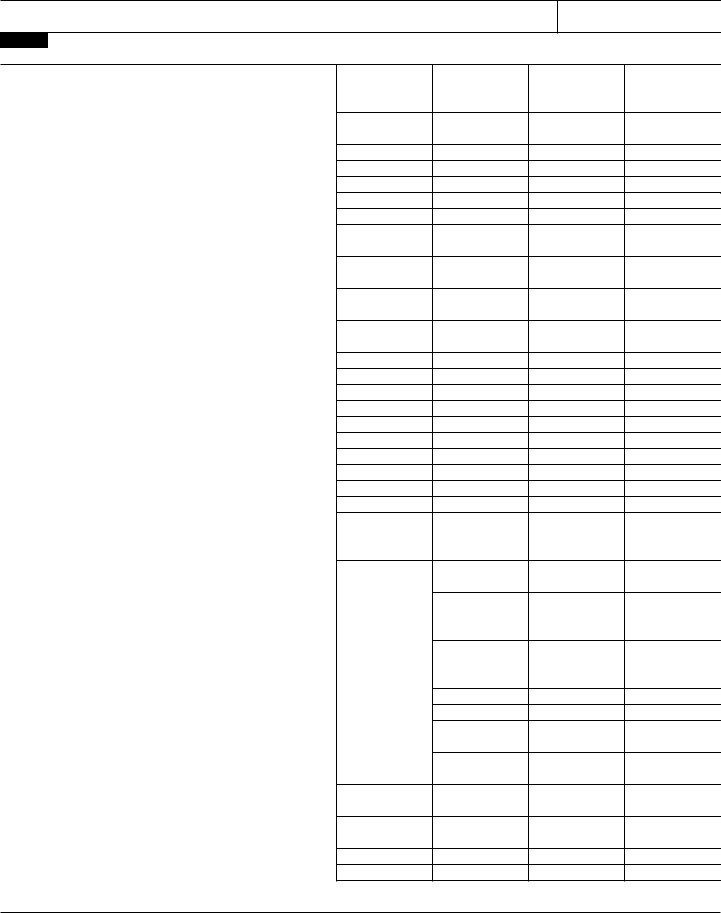

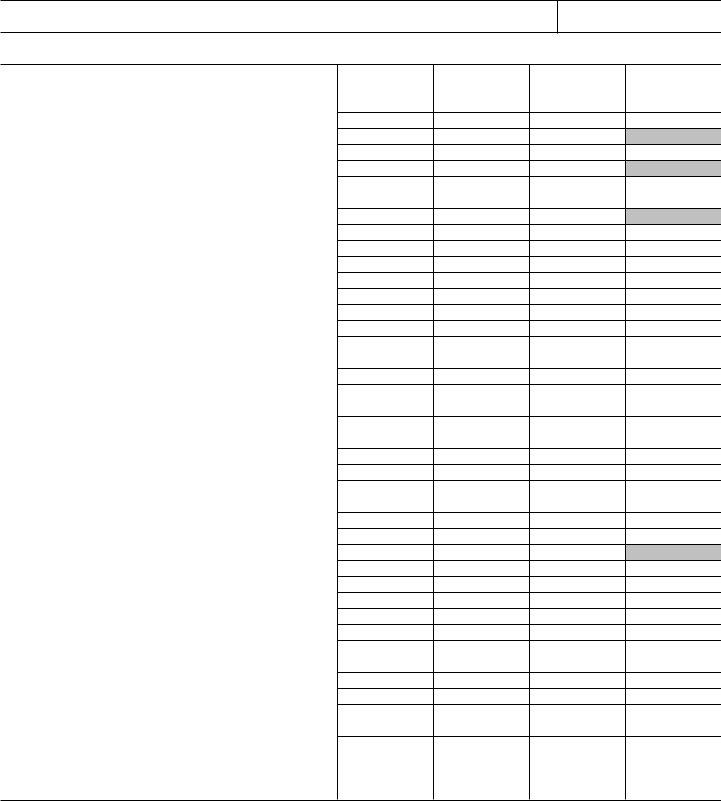

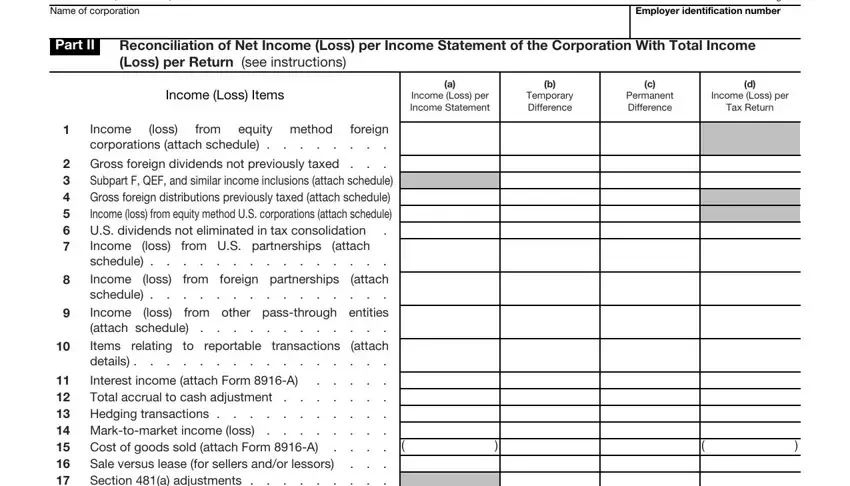

4. This specific part arrives with these particular blanks to consider: Schedule M Form S, Name of corporation, Employer identification number, Page, Part II, Reconciliation of Net Income Loss, Income Loss Items, Income Loss per Income Statement, Temporary Difference, Permanent Difference, Income Loss per, Tax Return, Income corporations attach schedule, equity method, and loss.

As to Income Loss per and Page, be certain that you take another look here. Both of these are considered the most significant fields in this PDF.

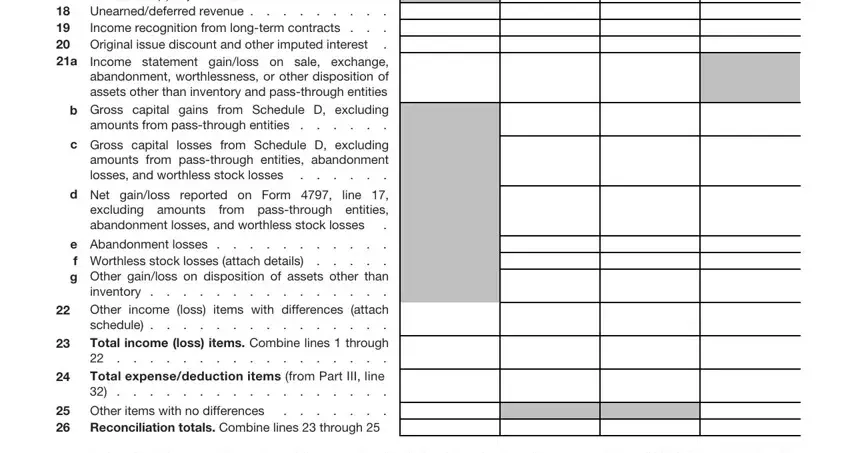

5. This document needs to be completed by filling out this part. Below you'll find a full listing of blanks that need specific details to allow your document submission to be faultless: Income recognition from, Hedging transactions, b Gross capital gains from, amounts from passthrough entities, c Gross capital losses from, d Net gainloss reported on Form, excluding amounts abandonment, e Abandonment losses f Worthless, inventory, Other income loss items with, schedule, Total income loss items Combine, Total expensededuction items from, and Other items with no differences.

Step 3: Check that your details are right and click "Done" to conclude the task. Obtain the Form 1120S Schedule M 3 once you join for a 7-day free trial. Instantly access the pdf inside your personal cabinet, along with any modifications and changes automatically synced! FormsPal guarantees your information confidentiality with a secure system that in no way saves or shares any kind of personal information involved. Be assured knowing your files are kept protected whenever you use our services!