When you wish to fill out form 1125 a, you won't need to download and install any sort of applications - just make use of our online tool. To have our editor on the forefront of convenience, we work to integrate user-driven capabilities and enhancements regularly. We are routinely grateful for any feedback - play a pivotal part in remolding how we work with PDF docs. In case you are looking to start, this is what it will take:

Step 1: Click the orange "Get Form" button above. It's going to open up our editor so that you could start completing your form.

Step 2: As you launch the PDF editor, you will see the form made ready to be filled in. Besides filling in various blank fields, you may as well do other sorts of actions with the form, namely writing custom text, changing the initial textual content, adding graphics, signing the document, and more.

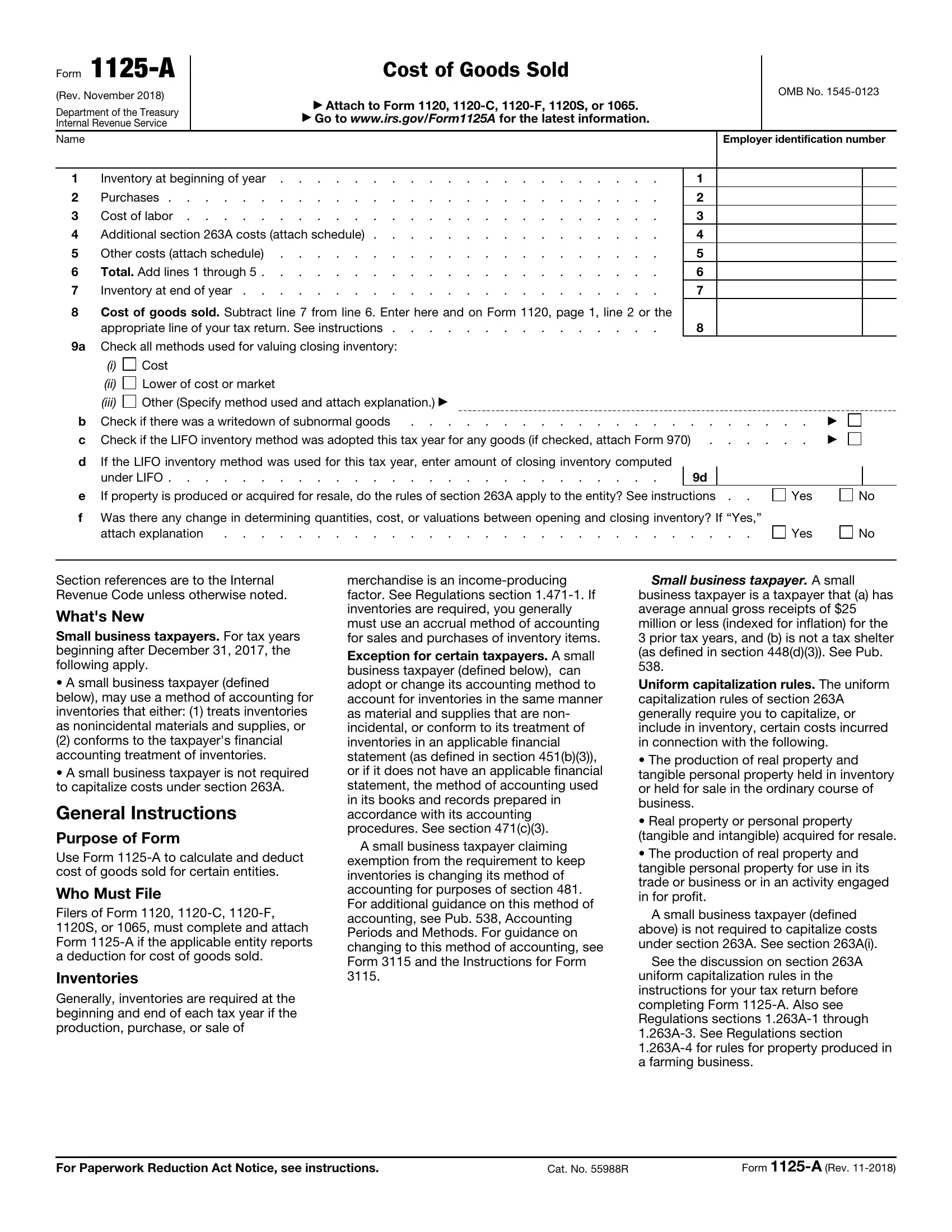

If you want to complete this form, be certain to provide the required details in each field:

1. The form 1125 a needs specific information to be entered. Make sure the subsequent blank fields are finalized:

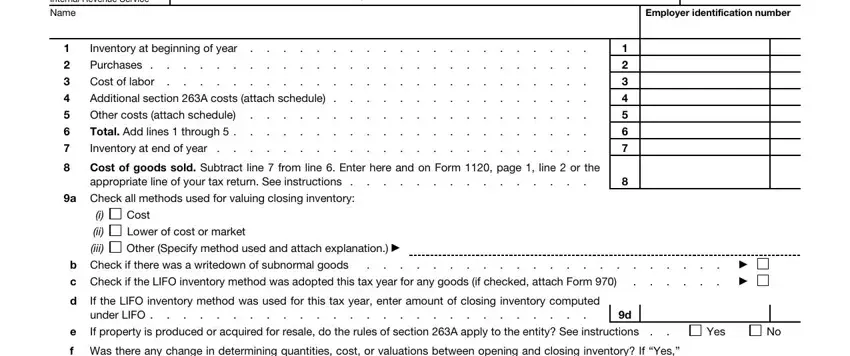

2. Immediately after the first selection of blanks is done, go on to enter the applicable details in all these: f Was there any change in, attach explanation, Yes, Section references are to the, Whats New Small business taxpayers, General Instructions Purpose of, Who Must File Filers of Form C F, Inventories Generally inventories, merchandise is an incomeproducing, A small business taxpayer claiming, exemption from the requirement to, Small business taxpayer A small, business taxpayer is a taxpayer, A small business taxpayer defined, and above is not required to.

Always be really attentive while filling out Who Must File Filers of Form C F and A small business taxpayer defined, as this is the part where many people make mistakes.

Step 3: Make certain the details are accurate and click on "Done" to complete the task. Make a free trial option at FormsPal and get direct access to form 1125 a - with all transformations saved and accessible in your personal cabinet. At FormsPal.com, we endeavor to be sure that all of your details are stored private.