You could fill out utah 116m form effectively using our online PDF tool. We are dedicated to making sure you have the best possible experience with our editor by consistently adding new features and enhancements. With these updates, working with our tool gets better than ever before! Starting is simple! All that you should do is adhere to these easy steps directly below:

Step 1: Hit the "Get Form" button at the top of this page to access our tool.

Step 2: This tool provides you with the ability to customize nearly all PDF files in a variety of ways. Change it by including customized text, adjust original content, and include a signature - all doable within minutes!

When it comes to blank fields of this specific document, here's what you want to do:

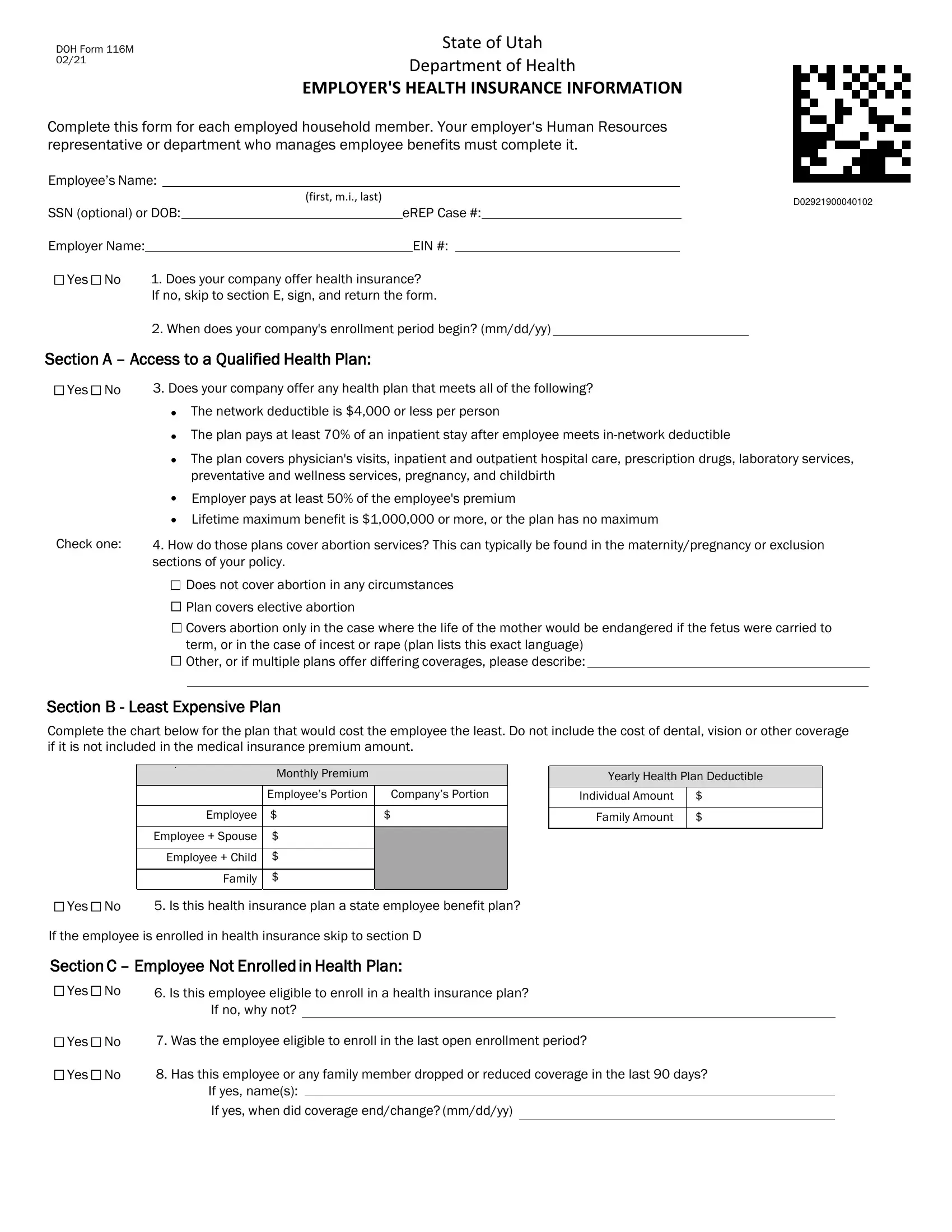

1. The utah 116m form will require certain information to be inserted. Be sure that the next blank fields are completed:

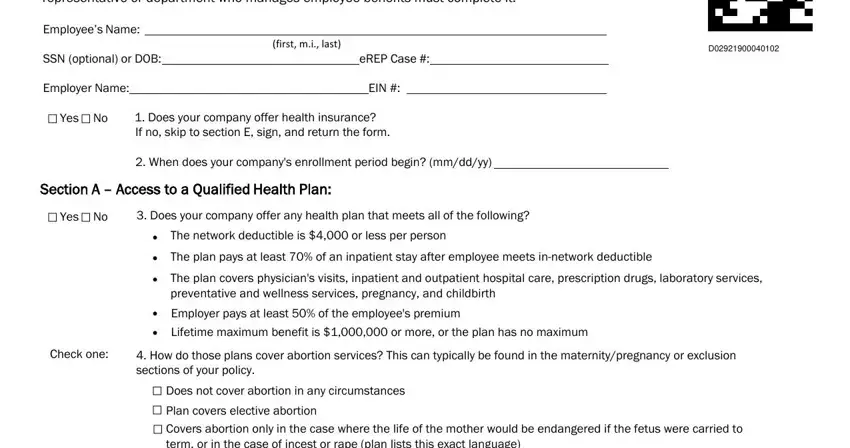

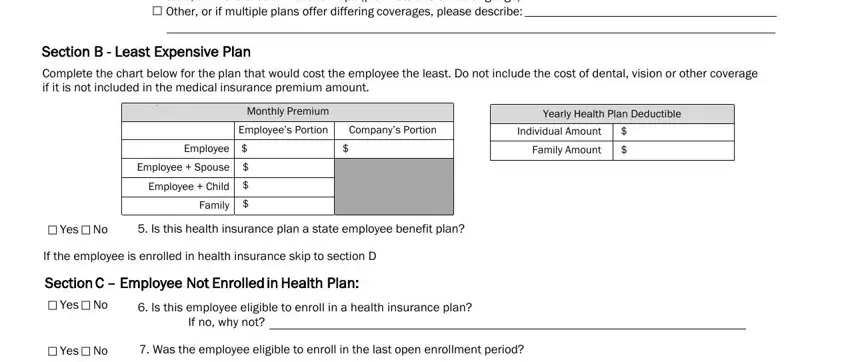

2. Soon after performing this section, head on to the subsequent part and fill in the necessary details in all these blank fields - Does not cover abortion in any, Section B Least Expensive Plan, Monthly Premium Employees Portion, Employee Employee Spouse, Companys Portion, Yearly Health Plan Deductible, Individual Amount Family Amount, Yes No, Is this health insurance plan a, If the employee is enrolled in, Yes No, Yes No, Is this employee eligible to, If no why not, and Was the employee eligible to.

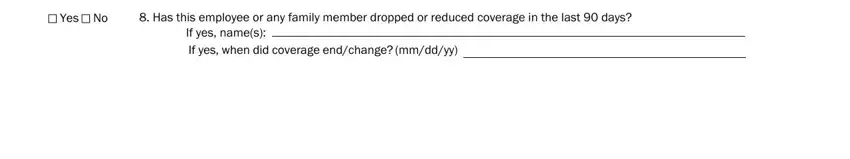

3. The third stage is straightforward - complete all of the form fields in Yes No, Has this employee or any family, and If yes names If yes when did to conclude this part.

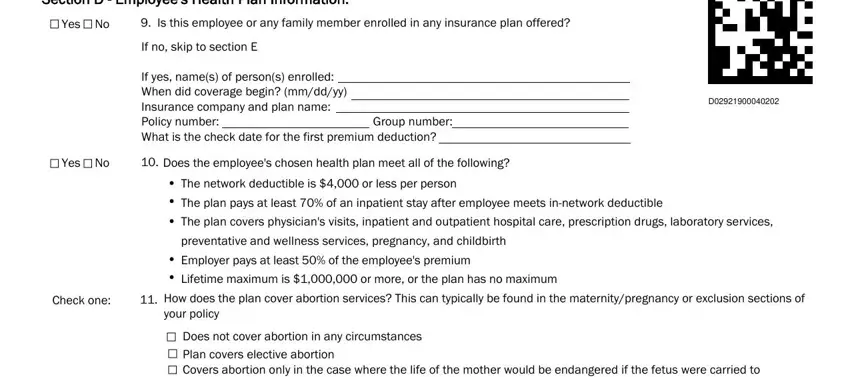

4. You're ready to begin working on this next segment! In this case you will have these Section D Employees Health Plan, Yes No, Is this employee or any family, If no skip to section E, If yes names of persons enrolled, Group number, Yes No, Check one, Does the employees chosen health, The network deductible is or less, How does the plan cover abortion, and Does not cover abortion in any blank fields to do.

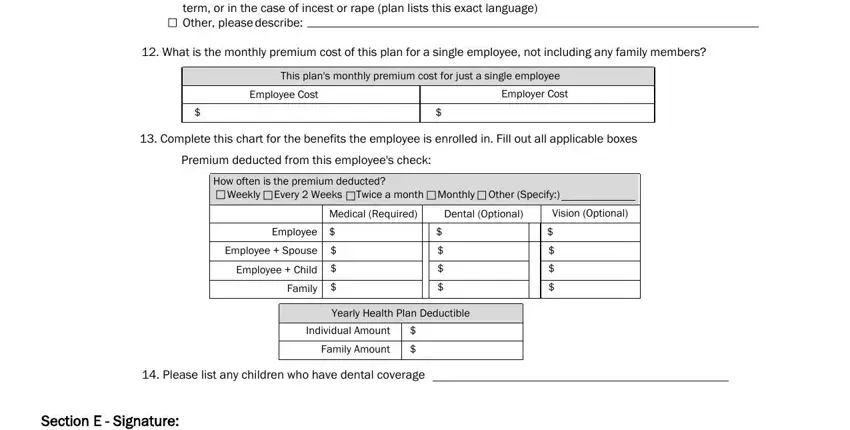

5. This document should be wrapped up by filling out this part. Further you can see an extensive list of blanks that need correct details in order for your form submission to be accomplished: Does not cover abortion in any, What is the monthly premium cost, This plans monthly premium cost, Employee Cost, Employer Cost, Complete this chart for the, Premium deducted from this, How often is the premium deducted, Weekly Every Weeks Twice a month, Medical Required, Dental Optional, Employee Employee Spouse, Vision Optional, Yearly Health Plan Deductible, and Individual Amount Family Amount.

In terms of Employer Cost and Dental Optional, be certain that you double-check them here. Both of these are the most significant ones in this page.

Step 3: Glance through what you have entered into the blank fields and then hit the "Done" button. Join FormsPal now and instantly get access to utah 116m form, prepared for downloading. All changes you make are saved , meaning you can change the form at a later point if necessary. Whenever you work with FormsPal, you can easily fill out forms without being concerned about data incidents or data entries being distributed. Our protected software ensures that your personal data is kept safely.