You'll be able to work with documentation effectively by using our PDFinity® online tool. Our tool is continually developing to give the best user experience achievable, and that is due to our resolve for continual development and listening closely to feedback from users. To get the ball rolling, consider these easy steps:

Step 1: Just click on the "Get Form Button" above on this page to launch our pdf form editing tool. Here you will find everything that is necessary to work with your file.

Step 2: The editor will give you the ability to customize your PDF form in various ways. Enhance it by writing any text, adjust what's originally in the file, and add a signature - all when you need it!

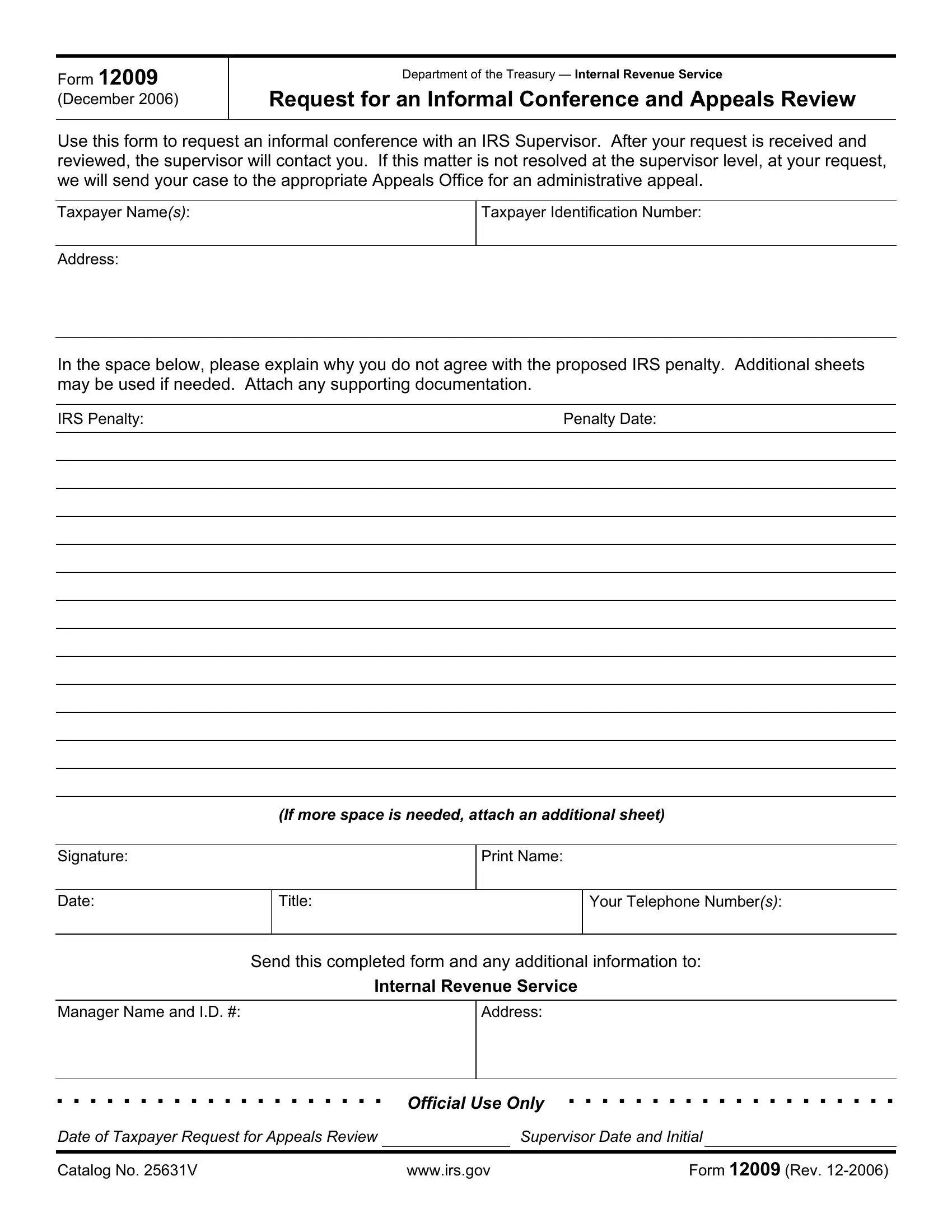

It's straightforward to finish the document using out helpful guide! Here's what you have to do:

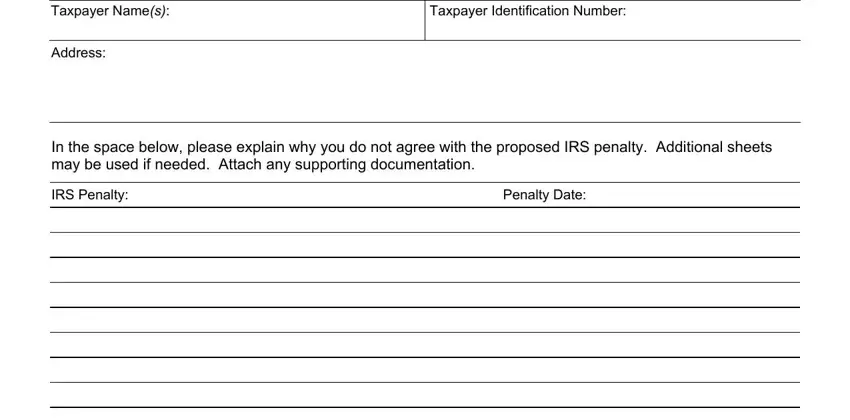

1. When filling out the documentation, ensure to include all needed blanks in its associated part. It will help hasten the work, making it possible for your details to be handled fast and correctly.

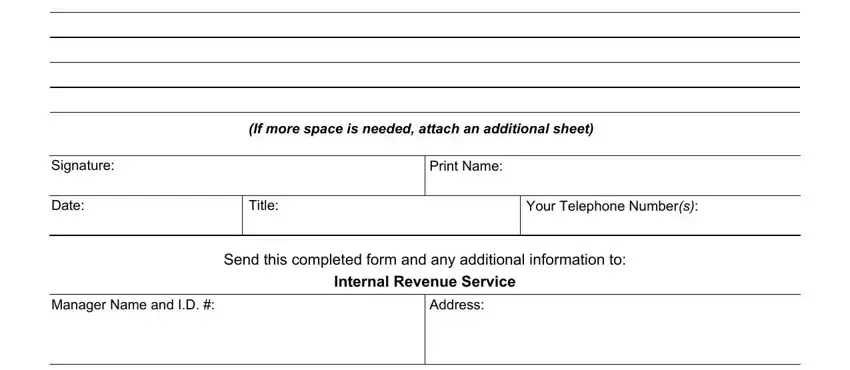

2. After completing the last section, go on to the subsequent part and complete the essential particulars in all these fields - If more space is needed attach an, Signature, Print Name, Date, Title, Your Telephone Numbers, Send this completed form and any, Internal Revenue Service, Manager Name and ID, and Address.

You can easily get it wrong when completing your Address, hence ensure that you take another look before you'll finalize the form.

3. This 3rd section should also be fairly uncomplicated, Official Use Only, Date of Taxpayer Request for, Supervisor Date and Initial, Catalog No V, wwwirsgov, and Form Rev - all of these blanks will need to be filled out here.

Step 3: Before submitting your form, check that form fields were filled out the proper way. As soon as you are satisfied with it, click “Done." Join us now and easily obtain documentation, all set for downloading. All modifications you make are preserved , which means you can customize the document later if needed. Here at FormsPal.com, we aim to be certain that all of your details are maintained protected.