By using the online editor for PDFs by FormsPal, you may fill in or alter form 12c right here and now. FormsPal professional team is continuously endeavoring to enhance the tool and enable it to be even easier for people with its many features. Take your experience to a higher level with continuously growing and amazing opportunities available today! By taking a few simple steps, you are able to begin your PDF editing:

Step 1: Hit the "Get Form" button above. It will open up our tool so you can begin filling in your form.

Step 2: As soon as you open the PDF editor, you will find the form ready to be completed. Other than filling in various fields, you may as well do several other actions with the PDF, including putting on any textual content, editing the initial textual content, adding illustrations or photos, affixing your signature to the document, and more.

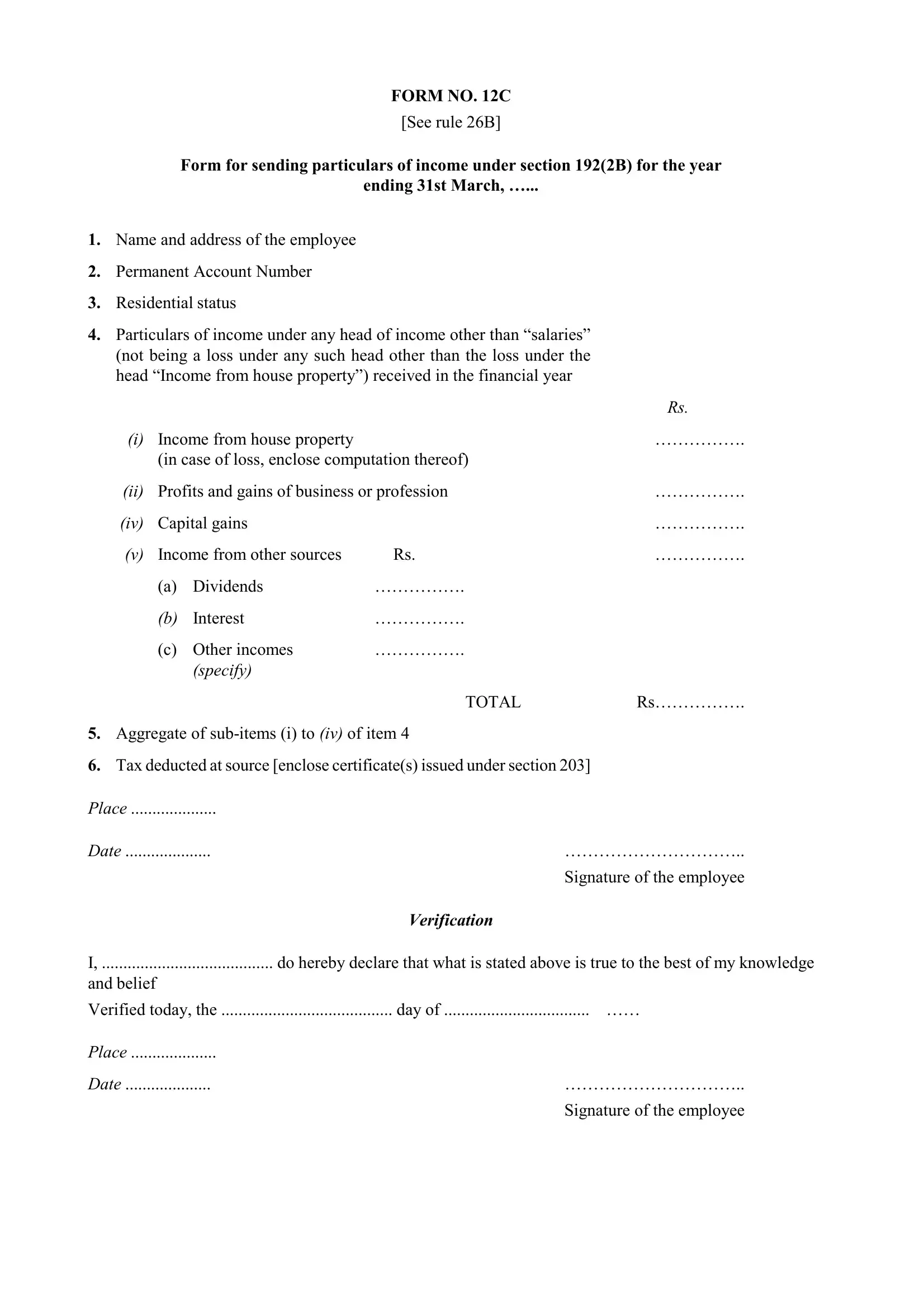

As a way to complete this document, be sure you enter the information you need in every single area:

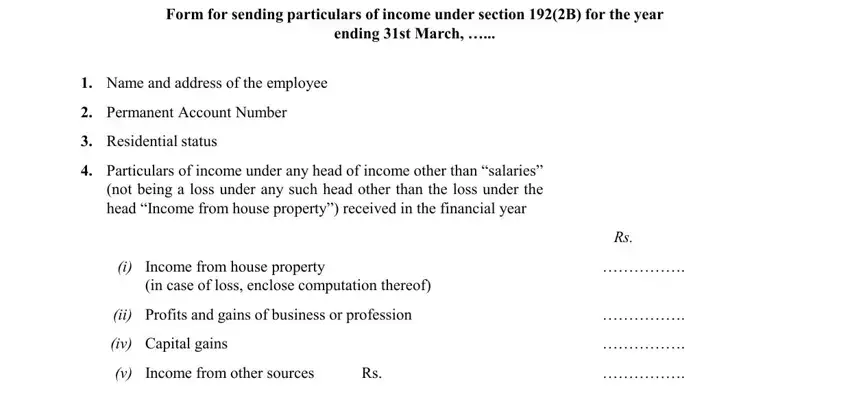

1. To start off, once filling out the form 12c, start out with the page that has the following blanks:

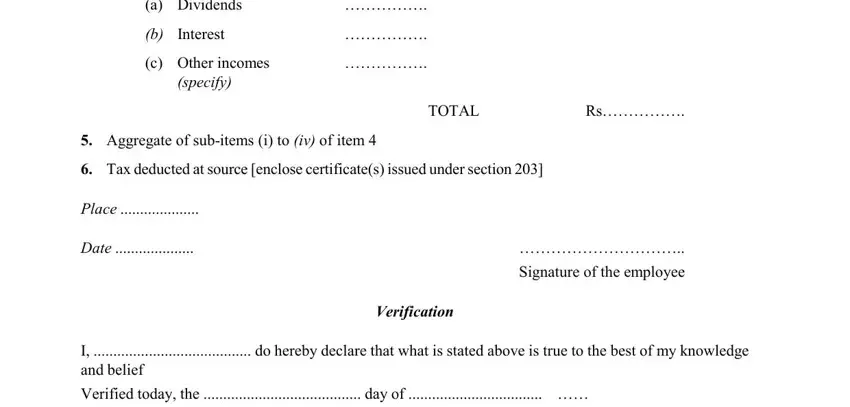

2. Right after completing this section, head on to the next step and fill in the essential particulars in all these blanks - a Dividends, Interest, c Other incomes, specify, Aggregate of subitems i to iv of, Tax deducted at source enclose, TOTAL, Place, Date, Signature of the employee, Verification, I do hereby declare that what is, and Verified today the day of.

3. The next stage will be straightforward - complete all of the fields in Place, Date, and Signature of the employee to conclude this segment.

Always be very attentive while filling in Place and Signature of the employee, since this is where most people make mistakes.

Step 3: As soon as you have glanced through the information in the document, click "Done" to finalize your FormsPal process. After starting afree trial account with us, it will be possible to download form 12c or send it through email without delay. The PDF document will also be readily accessible in your personal account with your every change. When you work with FormsPal, you can easily complete forms without needing to be concerned about personal information breaches or entries being shared. Our protected platform makes sure that your private information is kept safe.