Filling out 2013 is a snap. We made our PDF editor to make it user friendly and allow you to fill in any PDF online. Here are some steps you need to adhere to:

Step 1: Pick the button "Get Form Here".

Step 2: The moment you enter our 2013 editing page, there'll be lots of the actions you can take with regards to your file within the top menu.

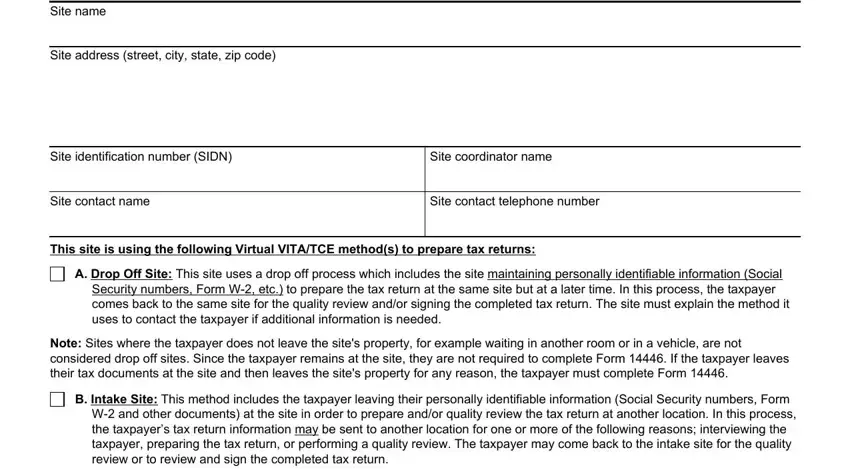

Type in the required material in every section to prepare the PDF 2013

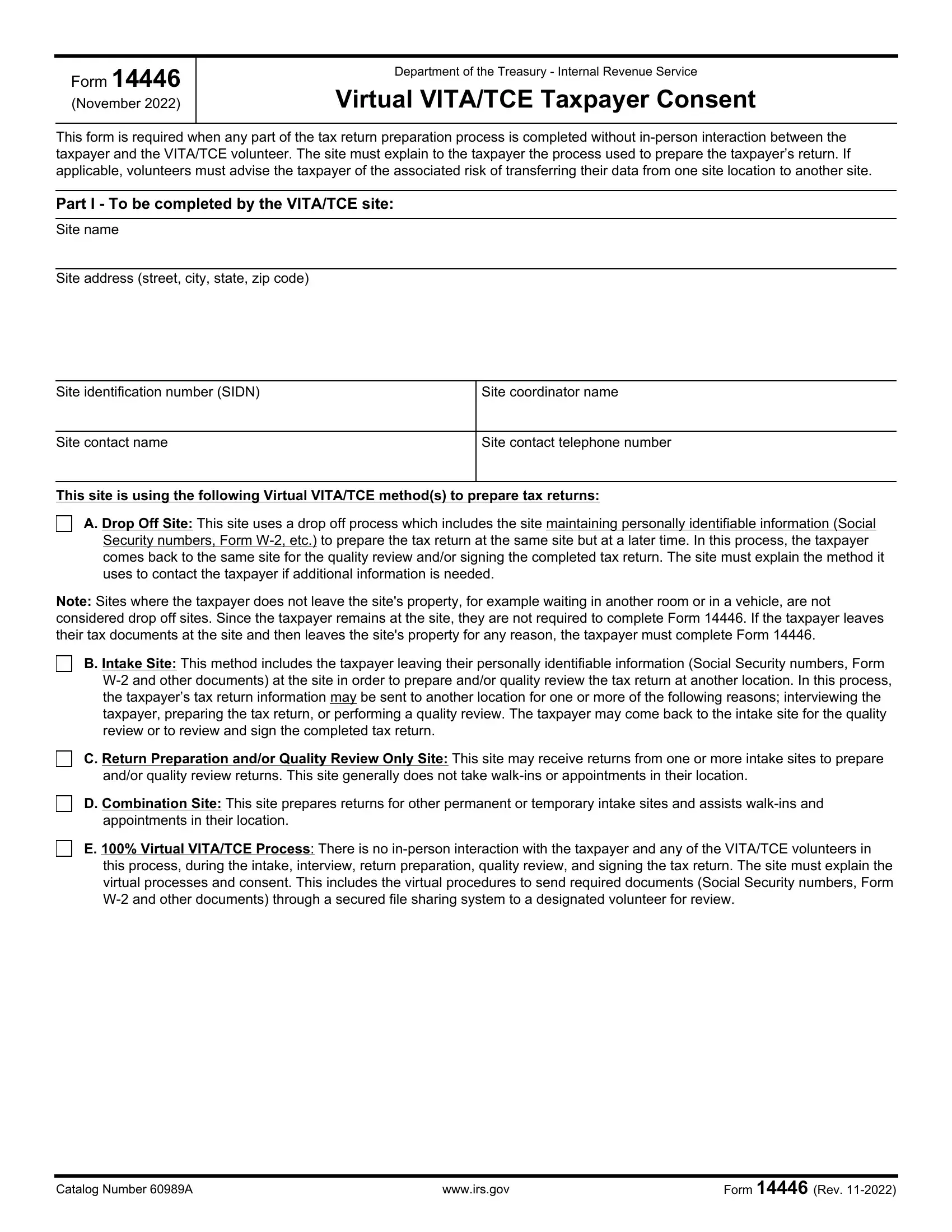

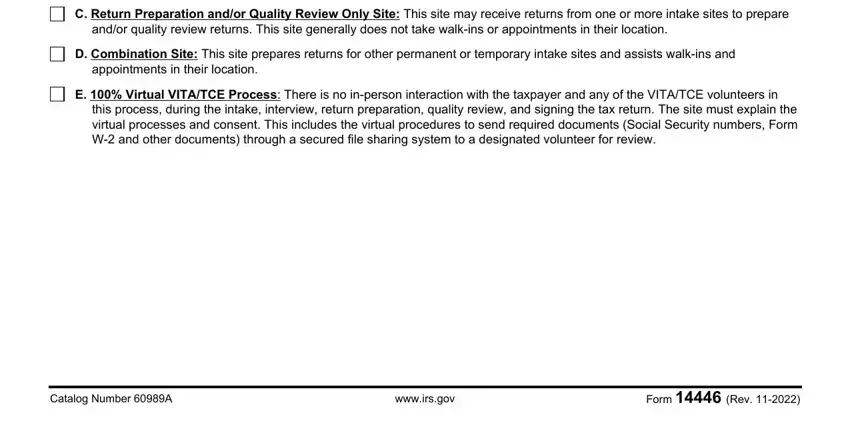

Include the required information in the C Return Preparation andor Quality, andor quality review returns This, D Combination Site This site, appointments in their location, E Virtual VITATCE Process There, this process during the intake, Catalog Number A, wwwirsgov, and Form Rev box.

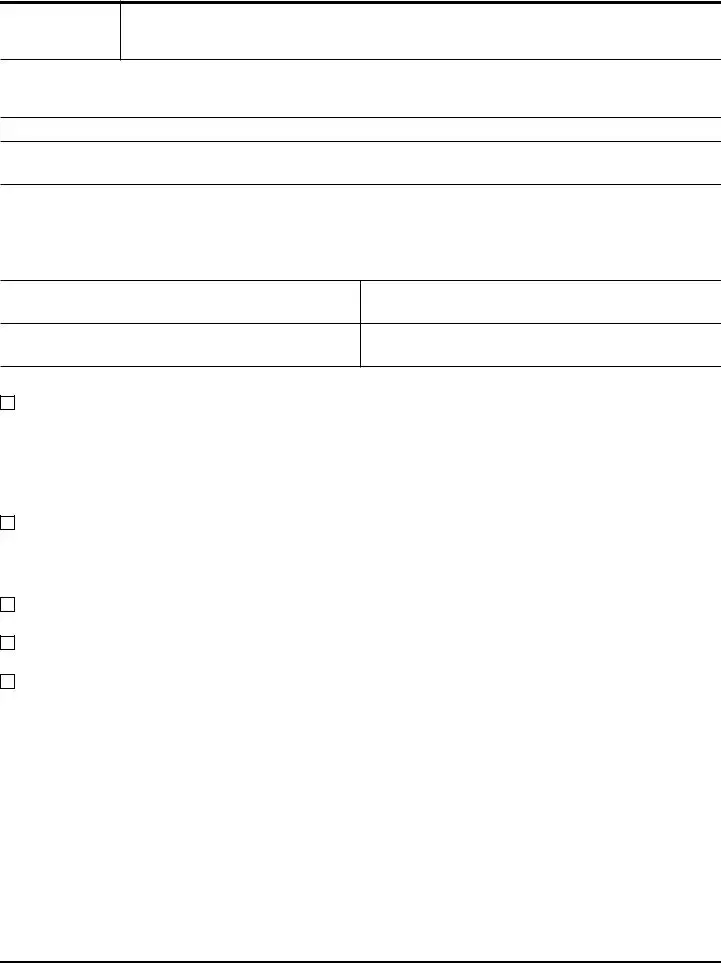

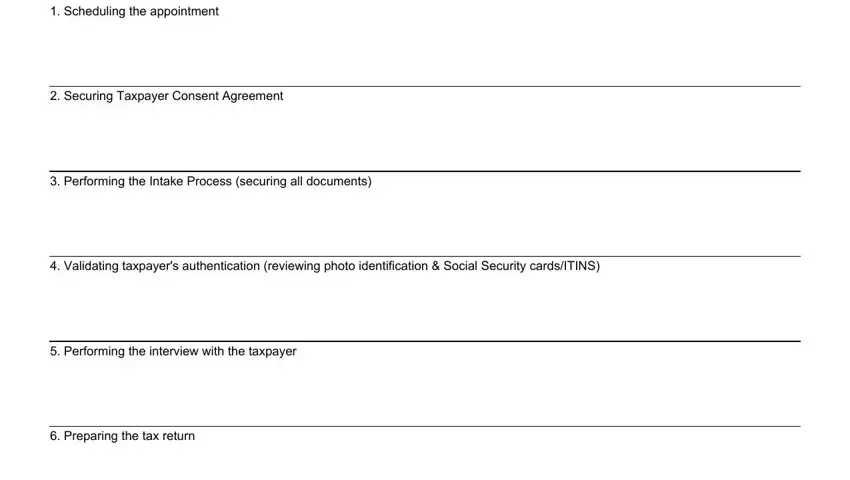

You can be asked to note the information to let the application fill out the section Scheduling the appointment, Securing Taxpayer Consent, Performing the Intake Process, Validating taxpayers, Performing the interview with the, and Preparing the tax return.

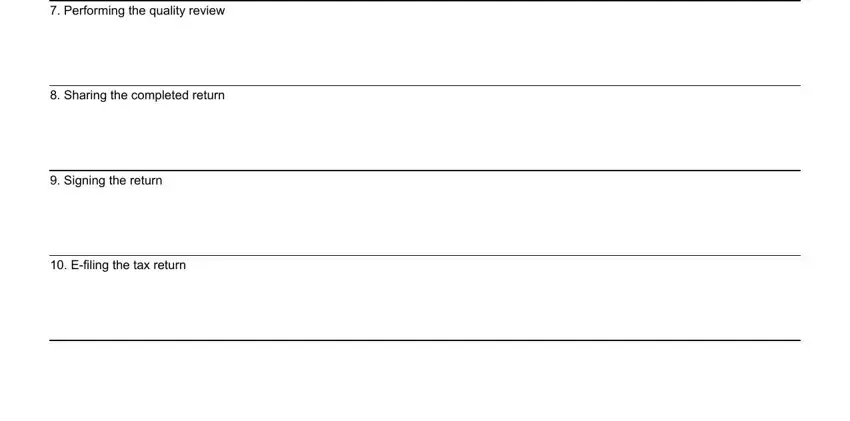

In the part Performing the quality review, Sharing the completed return, Signing the return, and Efiling the tax return, state the rights and responsibilities.

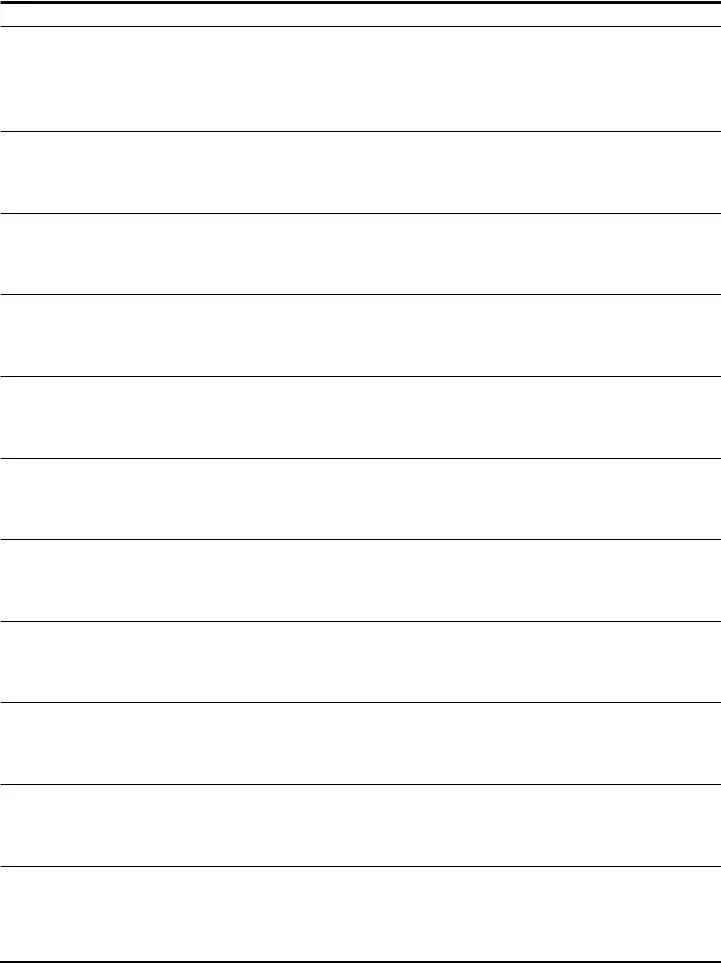

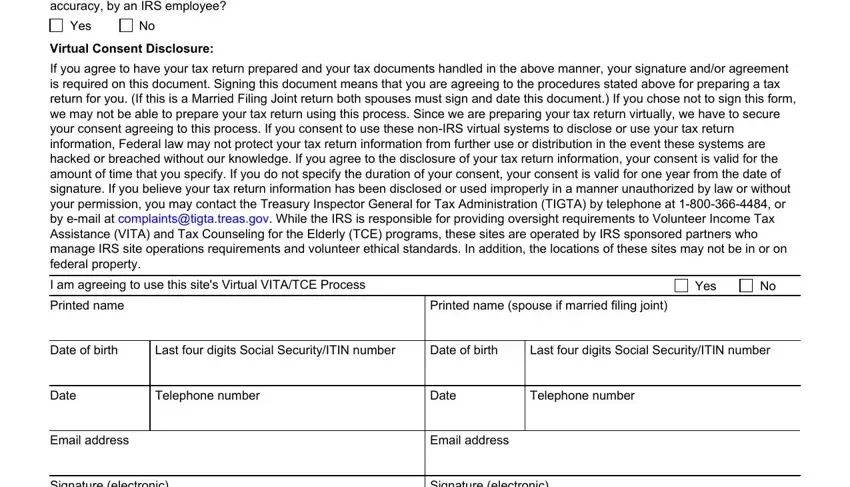

End by reading the following sections and filling in the required particulars: To ensure you are receiving, Yes, Virtual Consent Disclosure, If you agree to have your tax, I am agreeing to use this sites, Yes, Printed name, Printed name spouse if married, Date of birth, Last four digits Social, Date of birth, Last four digits Social, Date, Telephone number, and Date.

Step 3: Click the Done button to be sure that your finalized file is available to be transferred to every device you use or forwarded to an email you indicate.

Step 4: To prevent yourself from possible upcoming difficulties, you should always have a minimum of two or more copies of every document.