The 150 101 159 form serves as a comprehensive blueprint for declaring one's financial condition, crucial for individuals navigating the challenges of debt collection activities. This form mandates a thorough documentation of both personal and business financial standings, making it indispensable for preventing harsh collection measures like garnishment, liens, or the assignment of debt to third-party agencies. It requires the submission of recent bank statements and pay stubs across a three-month span, alongside a detailed account of all household income, to ensure a holistic assessment. Moreover, personal, employment, and general financial information sections seek to gather exhaustive data inclusive of assets, liabilities, and monthly income and expenses. This form not only plays a pivotal role in forestalling collection actions but also facilitates a structured process for individuals to present their financial scenario comprehensively. Through its detailed requisites—from documenting employment details to listing assets and liabilities, the form aids in charting a clear financial snapshot, thereby assisting revenue agents in evaluating the filer's economic viability with precision.

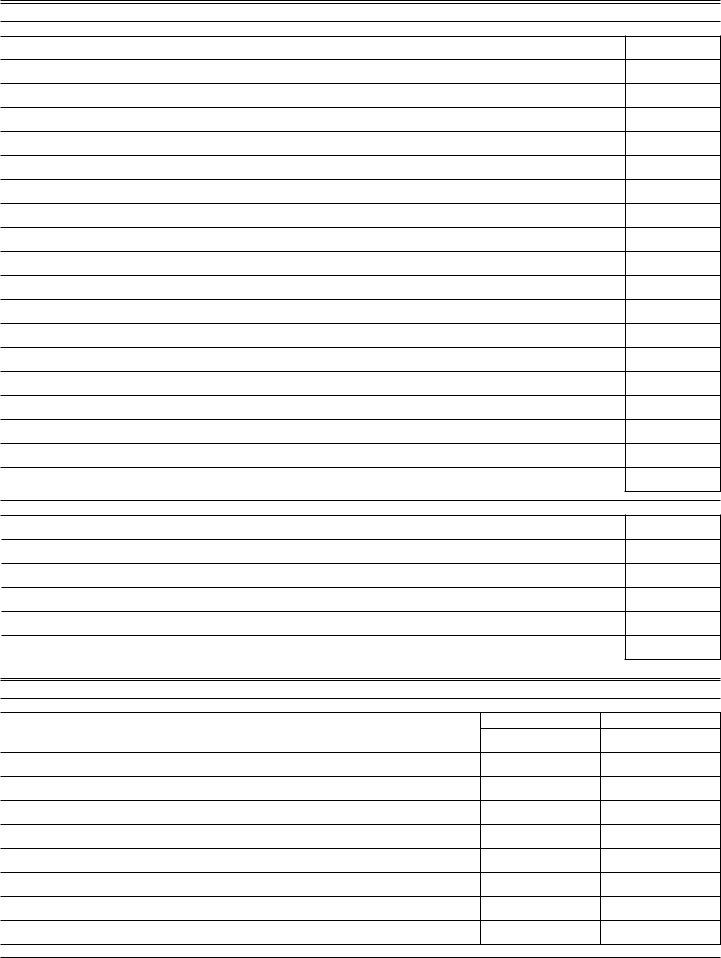

| Question | Answer |

|---|---|

| Form Name | Form 150 101 159 |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | W-4, Subtotal, AssetsSum, Receiverships |

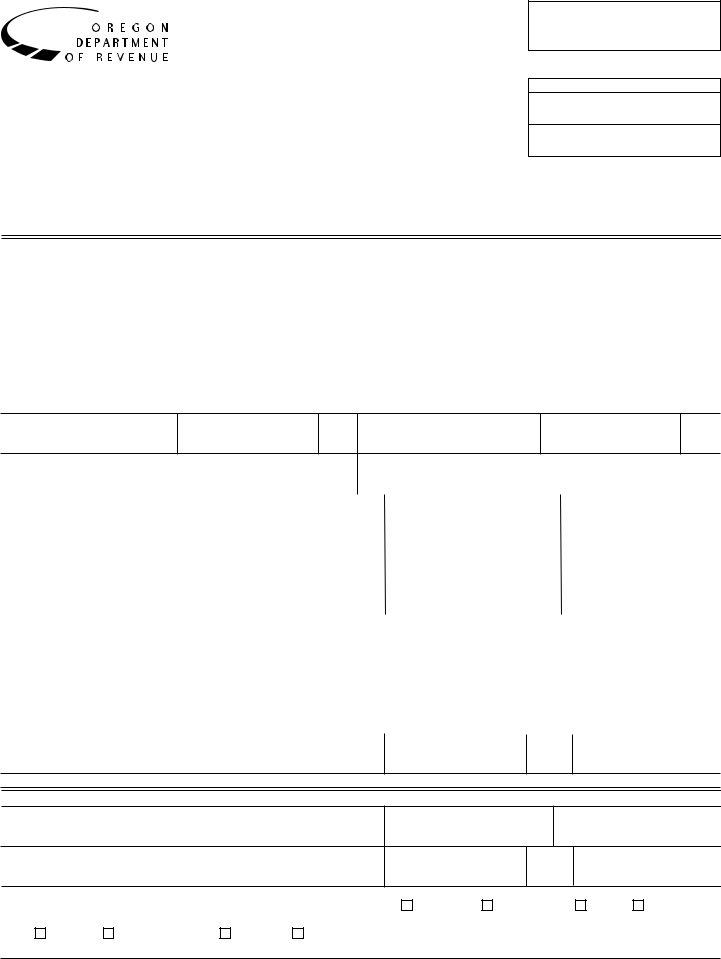

Statement of Financial Condition

Return by:

Complete all sections of this form. If you don’t complete all sections of this form, we can- not process it, which will continue collection activity. This may result in garnishment, lien, or assignment of debt to a private collection agency.

Include:

Three months of current bank

•All household income.

Additional sheets, as needed, for additional information.

Revenue use only

Date received

Revenue agent

Section 1. Personal information

Your irst name |

MI |

Last name |

Your Social Security number |

Your date of birth |

|

|

|

|

|

|

|

|

|

Other names or aliases used |

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s irst name |

MI |

Last name |

Spouse’s Social Security number |

Spouse’s date of birth |

||

|

|

|

|

|

|

|

Spouse’s other names or aliases used |

|

|

|

|

|

|

Your cell phone

Your driver license number

State

Spouse’s cell phone

Spouse’s driver license number

State

Your email

Spouse’s email

Dependent’s name (living with you) |

|

|

Date of birth |

Social Security number |

|

Relationship |

||||

|

|

|

|

|

|

|

|

|

|

|

Dependent’s name (living with you) |

|

|

Date of birth |

Social Security number |

|

Relationship |

||||

|

|

|

|

|

|

|

|

|

|

|

Dependent’s name (living with you) |

|

|

Date of birth |

Social Security number |

|

Relationship |

||||

|

|

|

|

|

|

|

|

|

|

|

Your current physical address |

City |

|

State |

ZIP code |

County |

|

|

Your home phone |

||

|

|

|

|

|

|

|

|

|

|

|

Your mailing address (if different from above) |

|

|

|

|

|

City |

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

Name of your tax representative (CPA, attorney, enrolled agent) |

|

|

Fax number |

|

Phone |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Address of your tax representative

City

State

ZIP code

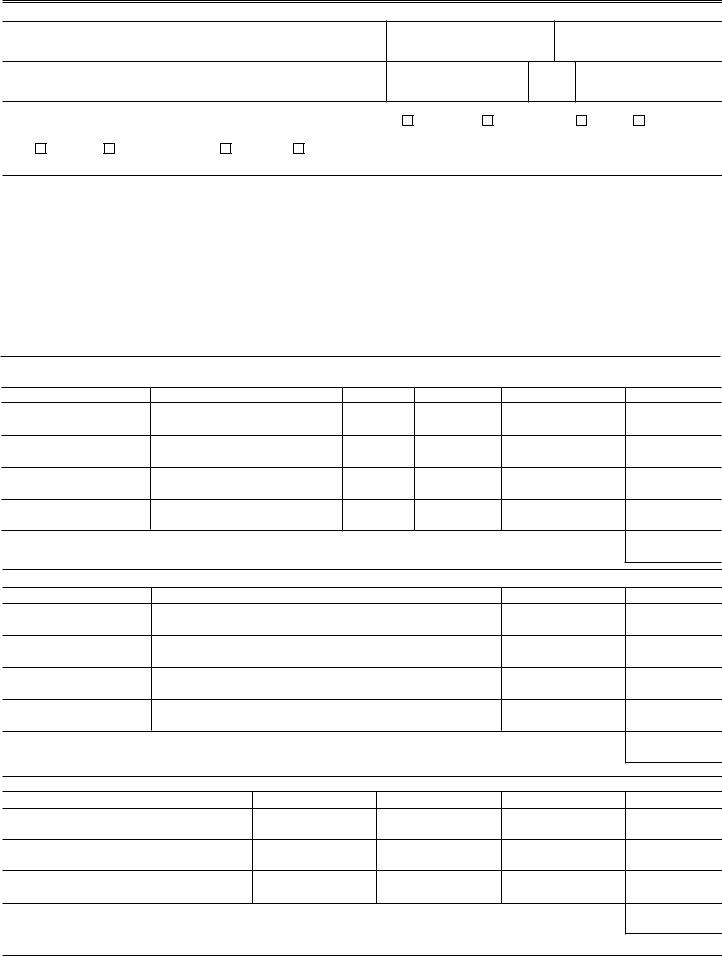

Section 2. Employment information (personal and business)

Your employer or business name

Business phone

Business fax

Address

City

State

ZIP code

Date hired:____________________ Occupation: _______________________________ |

Wage earner |

Sole proprietor |

Partner |

Owner oficer |

Paid:

Weekly |

Every other week |

Monthly |

Twice a month |

Number of allowances claimed on Form |

Financial |

Section 2. (continued) Employment information (personal and business)

Spouse’s employer or business name

Business phone

Business fax

Address

City

State

ZIP code

Date hired:____________________ Occupation: _______________________________ |

Wage earner |

Sole proprietor |

Partner |

Owner oficer |

Paid:

Weekly |

Every other week |

Monthly |

Twice a month |

Number of allowances claimed on Form |

If

Identify the major responsibilities of each by circling the codes that apply: 1 = Files returns; 2 = Pays taxes; 3 = Prefers creditors; 4 = Hires and ires

|

Name and title |

Effective date |

Home address |

Home phone |

SSN |

Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

2 |

3 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

2 |

3 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

2 |

3 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

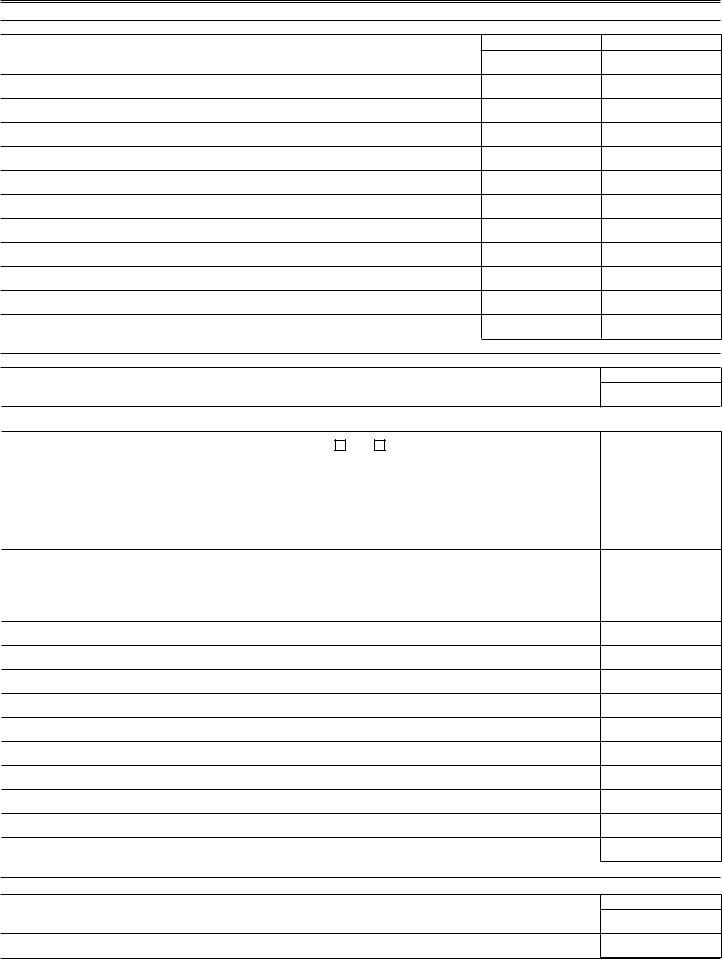

Section 3. General inancial information (personal and business)

Bank accounts. Include IRA and retirement plans certiicates of deposit, etc. For all accounts, attach copies of your last three bank statements. Attach additional pages as needed.

Name of institution

Address

Type

Date opened

Account number

Balance

Total. Enter this amount on line 2, Section 4 (asset and liability analysis)........................

$

Safe deposit boxes (rented or accessed). Include location, box number, and contents. Attach additional pages as needed.

Name of institution

Address

Box identiication

Current value of assets

Total. Enter this amount on line 3, Section 4 (asset and liability analysis)........................

$

Vehicles. Attach supporting documentation of current payoff. Attach additional pages as needed, and vehicles paid in full.

Year, make, model, license number

Lender/lien holder

Current market value

Current payoff

Available equity

(cannot be less than

Total. Enter this amount on line 4, section 4 (asset and liability analysis) ........................

$

Financial |

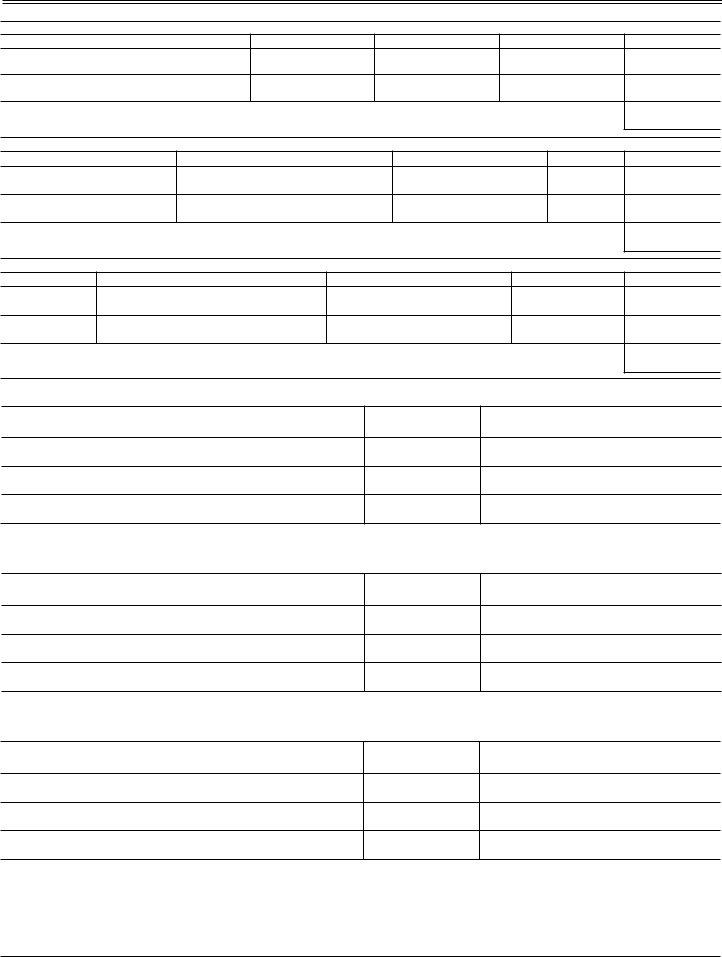

Section 3. (continued) General inancial information (personal and business)

Personal property. Include water craft, RVs, air craft, business equipment, and/or machinery. Attach additional pages as needed.

Year, make, model, license number

Lender/lien holder

Current market value

Current payoff

Available equity

(cannot be less than

Total. Enter this amount on line 5, section 4 (asset and liability analysis) ........................

$

Life insurance. Attach additional pages as needed.

Name of insurance company

Agent’s name and phone

Policy number |

Type |

|

|

Face amount

Loan/cash

surrender value

Total. Enter this amount on line 6, section 4 (asset and liability analysis) ........................

$

Securities. Include stocks, bonds, mutual funds, money market funds, securities, 401(k), etc. Attach additional pages as needed.

Type

Where located

Owner of record

Quantity or denomination

Current value

Total. Enter this amount on line 7, section 4 (asset and liability analysis) ........................

$

Real property. Include a copy of the deed and a copy of homeowners/rental insurance policy with riders and supporting documentation of loan balance. Attach additional pages as needed.

A. Physical address

Type

(single- or

lot, rental, etc.)

Mortgage lender’s name and address

Parcel number:_______________

How is title held:______________________________________ Purchase price: _________________ Purchase date: __________________

Current market value: _______________________Mortgage balance: ___________________________ Equity: ___________________________

B. Physical address

Type

(single- or

lot, rental, etc.)

Mortgage lender’s name and address

Parcel number:_______________

How is title held:______________________________________ Purchase price: _________________ Purchase date: __________________

Current market value: _______________________Mortgage balance: ___________________________ Equity: ___________________________

C. Physical address

Type

(single- or

lot, rental, etc.)

Mortgage lender’s name and address

Parcel number:_______________

How is title held:______________________________________ Purchase price: _________________ Purchase date: __________________

Current market value: _______________________Mortgage balance: ___________________________ Equity: ___________________________

Financial |

Section 3. (continued) General inancial information (personal and business)

D. Physical address

Type

(single- or

lot, rental, etc.)

Mortgage lender’s name and address

Parcel number:_______________

How is title held:______________________________________ Purchase price: _________________ Purchase date: __________________

Current market value: _______________________Mortgage balance: ___________________________ Equity: ___________________________

Total Equity. Enter this amount on line 8, Section 4 (asset and liability analysis) . . . . . . . . .

$

Credit cards and lines of credit. Credit cards and unsecured lines of credit may only be allowed with three months of statements showing they are used for living expenses.

Type of account

Name and address of creditor

Monthly payment |

Credit limit |

Credit available

Amount owed

Total $ |

|

||

|

|

|

|

Total. Enter this amount on line 20, Section 4 (asset and liability analysis) |

|

$ |

|

|

|

||

Other inancial information. Please provide the following information relating to your inancial conditions. If you check “Yes” in any box, provide dates, an explanation, and documentation. Attach additional pages as needed.

Court proceedings |

No |

Yes _______________________________________________________________________________ |

Repossessions |

No |

Yes _______________________________________________________________________________ |

Anticipated increase in income |

No |

Yes _______________________________________________________________________________ |

Bankruptcies/receiverships |

No |

Yes _______________________________________________________________________________ |

Recent transfer of assets |

No |

Yes _______________________________________________________________________________ |

Beneiciary to trust, estate, proit sharing, etc. . |

No |

Yes _______________________________________________________________________________ |

Last Oregon income tax return iled |

Year:_______ _______________________________________________________________________________ |

|

Total number of exemptions claimed |

___________ ________________________________________________________________________________ |

|

Adjusted gross income from return |

$__________ ________________________________________________________________________________ |

|

List any vehicles, equipment, or property sold, given away, or repossessed during the past three years. Attach additional pages as needed.

Year, make, model of vehicle, or property address

Who took possession

Value

Financial |

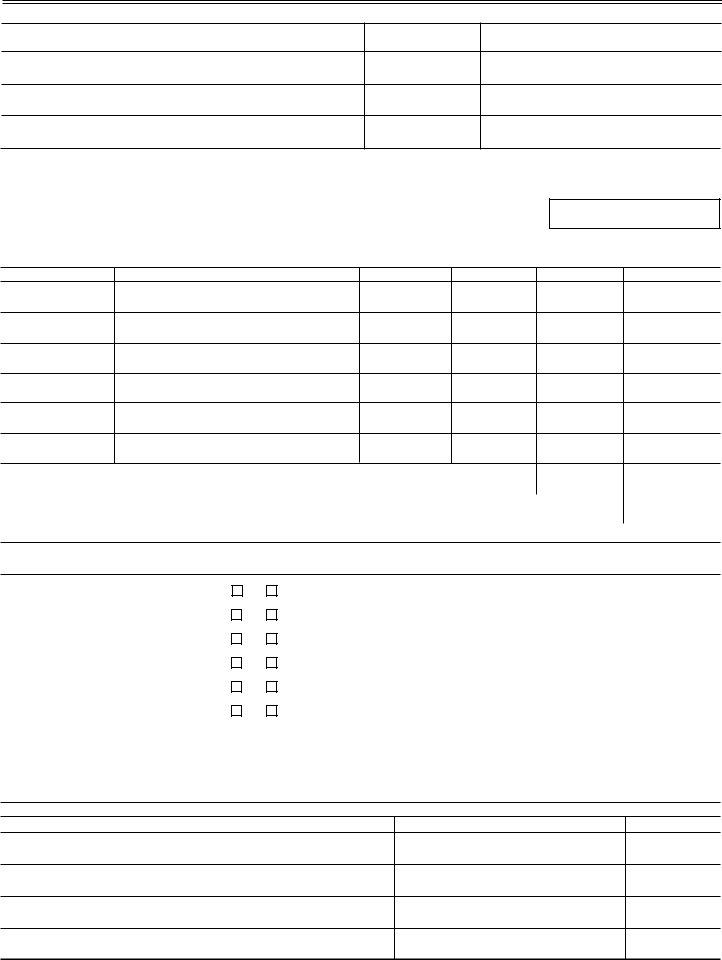

Section 4. Assets and liability analysis

Immediate assets.

1.Cash

2.Bank accounts / balance (from section 3)

3.Safe deposit box value of contents (from section 3)

4.Vehicles / available equity (from section 3)

5.Personal property (from section 3)

6.Loan / cash surrender value for life insurance (from section 3)

7.Securities (from section 3)

8.Current real estate equity (from section 3)

9.Notes

10.Accounts receivable

11.Judgements / settlements received or pending

12. Interest in trusts

13. Interest in estates

14. Partnership interests

15. Major machinery / equipment, etc.

16. Business inventory

17. Other assets: Collectibles / guns / jewelry / coins / gold / silver, etc.

18. Other assets (specify):

19. Total assests |

$ |

Current liabilities. Include judgements, notes, and other charge accounts. Do not include vehicle or home loans.

20. Amount owed to credit cards and lines of credit

21. Taxes owed to IRS (provide a copy of recent notices)

22. Other liabilities (specify):

23. Other liabilities (specify):

24. Other liabilities (specify):

25. Total liabilities |

$ |

Section 5. Monthly income and expense analysis

Income. Attach copies of all income sources that contribute to household expenses (minimum three months).

Gross |

Net |

26.Wages / salaries / tips (yours)

27.Social Security income (yours)

28.Pension / annuities (yours)

29.Disability (yours)

30. Wages / salaries / tips (spouse’s)

31.Social Security income (spouse’s)

32.Pension / annuities (spouse’s)

33.Disability (spouse’s)

34.Business income (yours)

Financial |

Section 5. Monthly income and expense analysis (continued)

Income. Attach copies of all income sources that contribute to household expenses (minimum three months).

Gross |

Net |

35.Business income (spouse’s)

36.Rental income

37. Interest / dividends / royalties (average monthly)

38. Payments from trusts / partnerships / entities

39.Child support

40.Alimony

41.Unemployment

42. Seller carried contracts / sales

43. Other income (specify):

44. Other income (specify):

45. Other income (specify):

46. Total income |

$ |

$ |

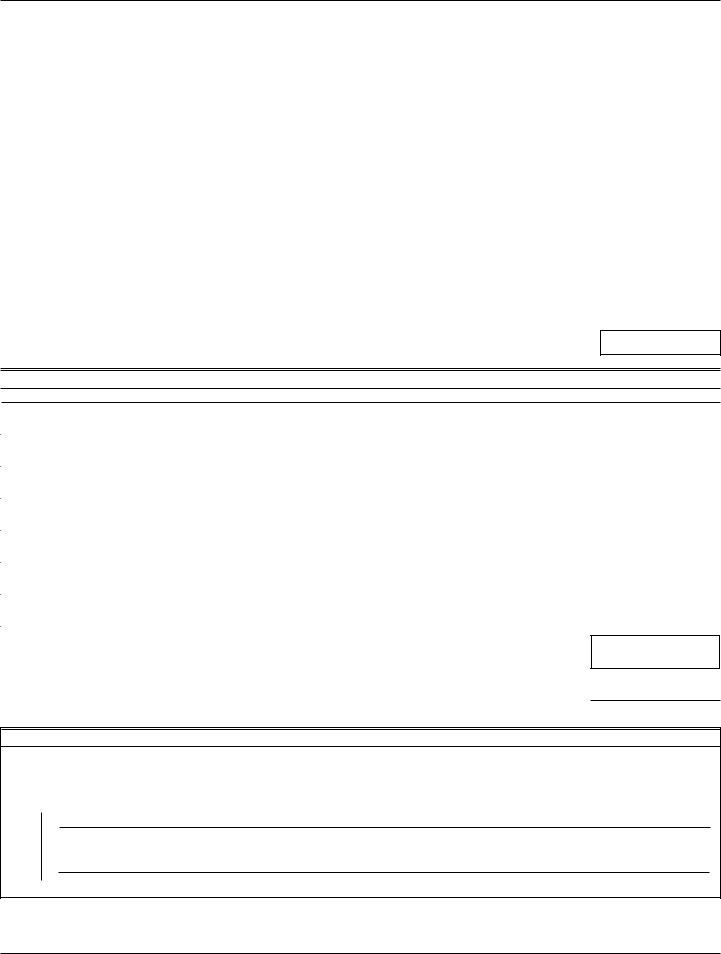

Personal expenses (actually paid). (May be limited by federal standards.)

47. Rent / mortgage / real estate secured line(s) of credit

If

Amount

48. Real estate taxes |

(Is this included in your mortgage payment? |

No |

Yes) |

|

||

49. Personal home owners / renters insurance: ( |

|

) Assoc. fees: ( |

|

) |

||

50. Personal utilities: |

Electric: ( |

) |

|

|

|

|

|

Gas / oil: ( |

) |

Phone, internet, & cable: ( |

) |

||

|

Garbage: ( |

) |

|

Water / sewer: ( |

) |

|

51. |

Food / clothing / other Items: No. of people: ( |

) Their ages: ( |

) |

52. Auto payments / lease |

|

|

|

53. |

Auto insurance |

|

|

54. Auto maintenance / fuel / other transportation

55. Life / health insurance

56. Medical payments (not covered by insurance) (provide proof)

57. Estimated tax payments (provide proof)

58.Court ordered payments (alimony, child support, restitution, not deducted from your paycheck)

59.Garnishments (specify)

60. Delinquent tax payments (other than Oregon state taxes, IRS, etc.)

61. Work related child care expenses

62. Other expenses (do not include unsecured debt) (specify)

63. Total personal expenses |

$ |

Business expenses (actually paid). Provide current general ledger and proit / loss.

Amount

64. Materials purchased (specify)

65. Supplies (specify)

Financial |

Business expenses (actually paid) (continued). Provide current general ledger and proit / loss.

|

|

|

|

|

Amount |

66. Installment payments (specify) |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

67. Monthly payments (specify) |

|

|

|

|

|

|

|

|

|

|

|

68. Rent / mortgage |

|

|

|

|

|

|

|

|

|

|

|

If |

|

|

|

|

|

|

|

|

|

|

|

69. |

Insurance |

|

|

|

|

|

|

|

|

|

|

70. Business utilities: Electric: ( |

) |

|

|

|

|

|

|

|

|

|

|

|

Gas / oil: ( |

) |

Phone, internet, & cable: ( |

) |

|

|

|

|

|

|

|

|

Garbage: ( |

) |

Water / sewer: ( |

) |

|

|

|

|

|

|

|

71. |

Net wages and salaries paid to employees |

|

|

|

|

|

|

|

|

|

|

72. Current taxes (payroll / business) |

|

|

|

|

|

|

|

|

|

|

|

73. Other: Specify: (do not include unsecured debt) |

|

|

|

|

|

|

|

|

|

|

|

74. |

Total business expenses |

|

|

$ |

|

|

|

|

|

|

|

75. Net disposable income (line 46 minus lines 63 and 74)........................................................................................................

$

Section 6. Additional information

Please provide any additional information not already included. Attach additional pages as needed. All household income must be included.

Your proposed monthly payment.....................................................................................................................

$

Your proposed payment date...........................................................................................................................................

Section 7. Authorization to disclose

Under penalties of perjury, I declare that I have examined this statement of assets, liabilities, and other information, and to the best of my knowledge and belief, it is true, correct, and complete. I (we) authorize the Oregon Department of Revenue to verify any information on this inancial statement which may include credit reports.

Sign here

X

Your signatureDate

X

Spouse’s signature (if applying jointly, both must sign even if only one had income) |

Date |

Return your completed form to: Oregon Department of Revenue

PO Box 14725

Salem OR

Financial |