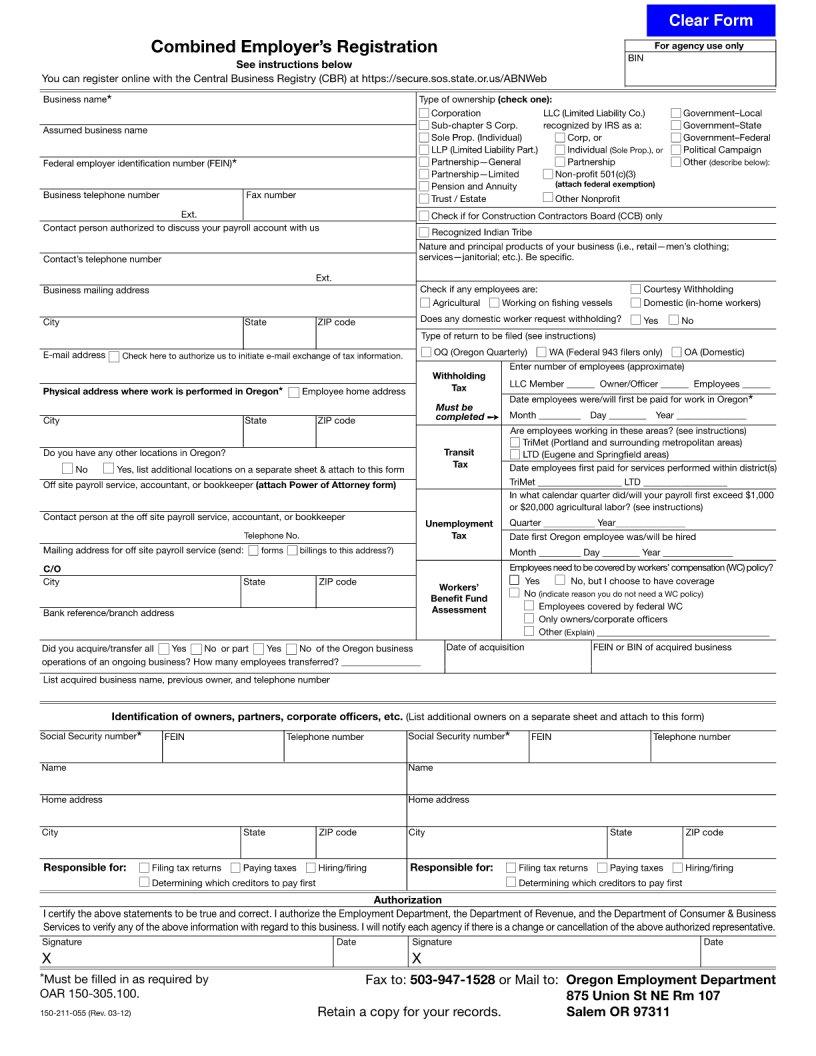

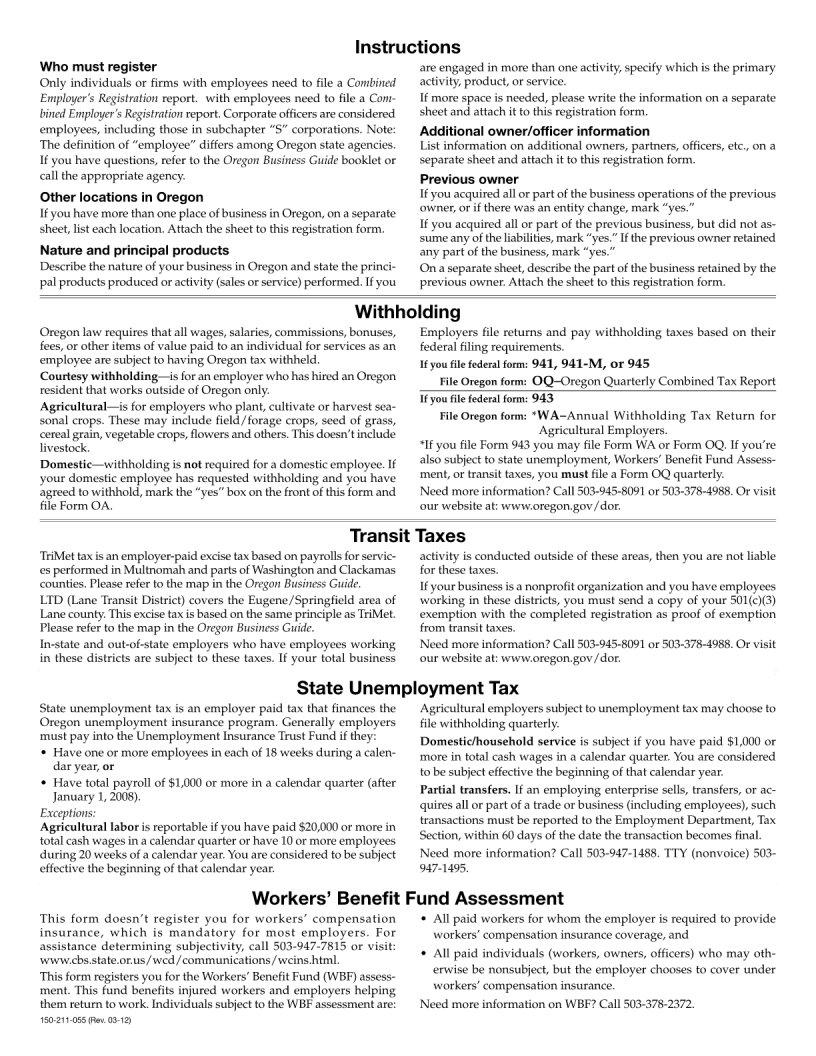

In navigating the complexities of tax documentation, certain forms emerge as pivotal for ensuring compliance and accuracy in reporting financial information. Among these, the 150 211 055 form stands out as a critical document for taxpayers. This form serves multiple purposes, including the declaration of income, deductions, and credits, which are essential for calculating the correct amount of taxes owed. It is designed to streamline the tax filing process, making it more straightforward for individuals to comply with their tax obligations. Furthermore, the comprehensive nature of the form means that it not only aids in the accurate reporting of financial activities but also plays a significant role in the prevention of tax fraud. By requiring detailed information, it allows tax authorities to better assess and verify the accuracy of reported data. The importance of this form extends beyond mere compliance; it is a tool that facilitates the fair and efficient operation of the tax system, ensuring that individuals and entities contribute their fair share to public coffers. As such, understanding and correctly completing the 150 211 055 form is vital for all taxpayers, signaling its relevance in the broader context of fiscal responsibility and citizenship.

| Question | Answer |

|---|---|

| Form Name | Form 150 211 055 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | combined_employ er_registration _150 211 055 150 211 055 form |