Through the online PDF editor by FormsPal, you are able to fill in or change franchise tax board 199 right here. FormsPal team is dedicated to providing you with the absolute best experience with our editor by continuously presenting new functions and enhancements. Our tool is now much more helpful thanks to the latest updates! At this point, filling out PDF files is a lot easier and faster than ever before. Should you be seeking to get started, here's what it's going to take:

Step 1: Hit the "Get Form" button above on this webpage to open our tool.

Step 2: This tool will allow you to customize PDF documents in a range of ways. Transform it by including any text, adjust existing content, and place in a signature - all when it's needed!

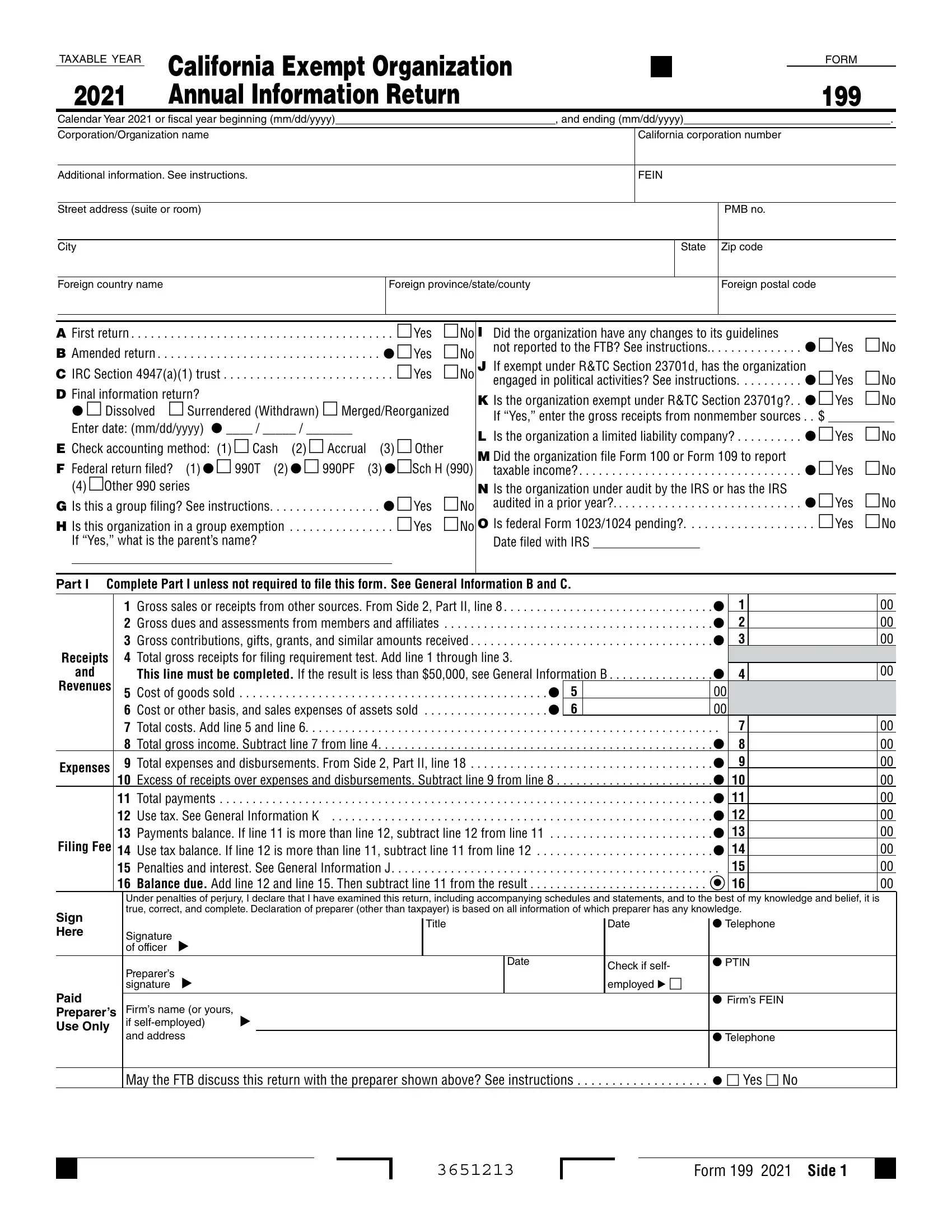

So as to fill out this PDF form, make sure you type in the information you need in every single area:

1. The franchise tax board 199 necessitates specific details to be inserted. Be sure that the subsequent fields are completed:

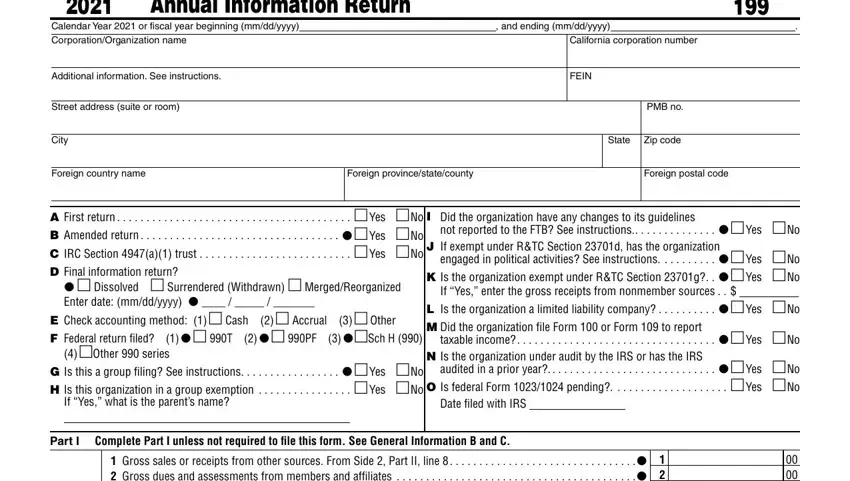

2. Once your current task is complete, take the next step – fill out all of these fields - Gross sales or receipts from, This line must be completed If the, Cost of goods sold, Under penalties of perjury I, Receipts, and, Revenues, Expenses, Filing Fee, Sign Here, Signature of officer, Preparers signature, Title, Date, and Date with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

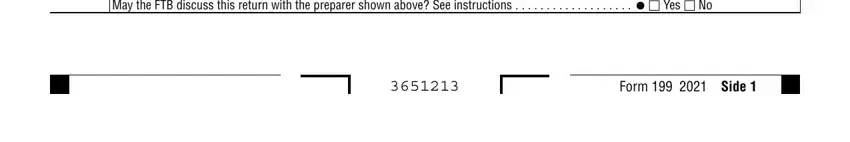

3. In this part, look at May the FTB discuss this return, and Form Side. Every one of these have to be filled out with utmost accuracy.

Be very careful when filling in Form Side and Form Side, because this is the part where a lot of people make errors.

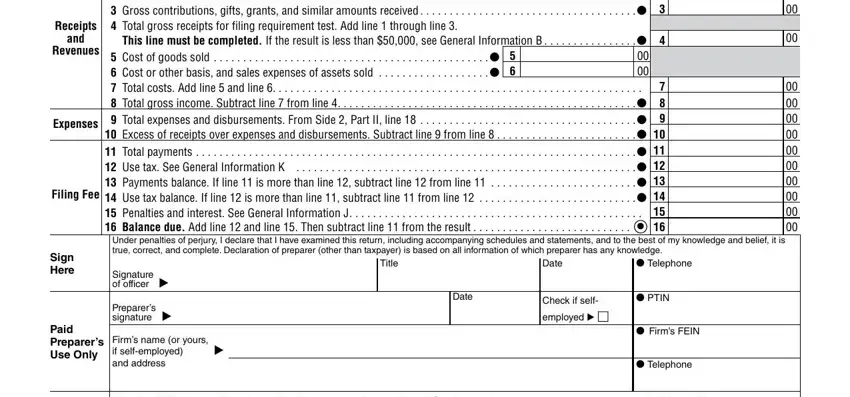

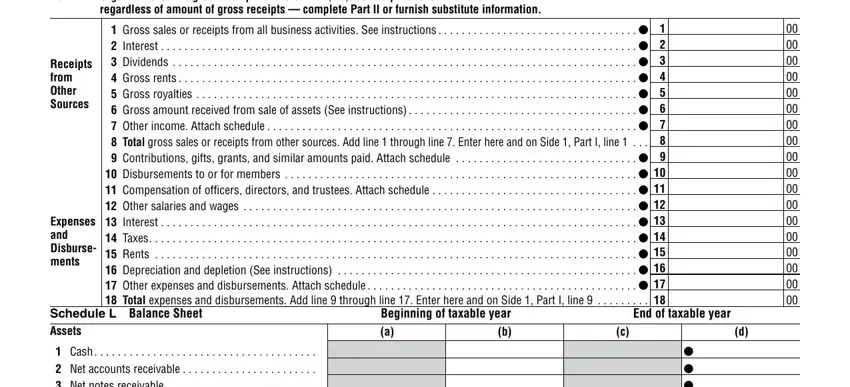

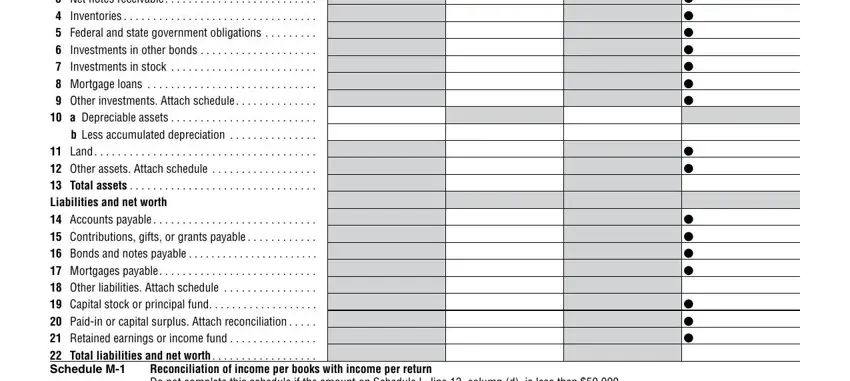

4. The subsequent subsection requires your involvement in the subsequent areas: Part II Organizations with gross, regardless of amount of gross, Receipts from Other Sources, Expenses and Disburse ments, Gross sales or receipts from all, Schedule L Balance Sheet Assets, Beginning of taxable year b a, End of taxable year, and Cash. Make sure you enter all of the requested details to go onward.

5. This final stage to conclude this PDF form is critical. Ensure you fill out the appropriate blanks, such as Cash, and Reconciliation of income per books, before finalizing. If not, it might end up in a flawed and possibly unacceptable document!

Step 3: Soon after double-checking your fields and details, hit "Done" and you're good to go! After setting up a7-day free trial account here, you'll be able to download franchise tax board 199 or email it promptly. The form will also be easily accessible through your personal account page with all your changes. We don't share any information that you provide whenever filling out forms at our site.