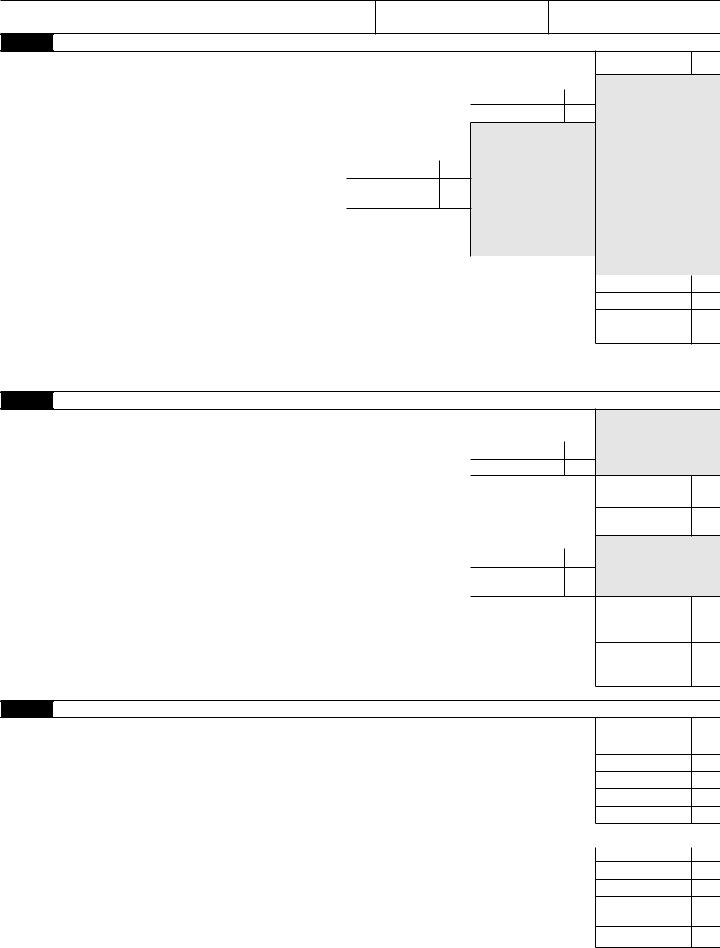

The Schedule WD, capital gains and losses form, serves as a crucial document for estates or trusts that need to report short-term and long-term capital gains and losses during the tax year 2012. It is an essential attachment to the Wisconsin Form 2 and requires careful attention to detail when filling it out. The document is divided into distinct parts, beginning with the calculation of short-term capital gains and losses for assets held for one year or less, where the description of the property, acquisition and sale dates, sales price, and cost or basis are meticulously recorded to determine gains or losses. It further extends to long-term capital gains and losses for assets held for more than one year, capturing similar details and calculations to ascertain the net financial impact on the estate or trust. The form also includes sections for adjustments based on differences between Wisconsin and federal basis, capital loss carryovers from the previous year, and computations specific to Wisconsin income adjustments. Furthermore, it details the process for calculating capital loss carryovers to future tax years, and it includes provisions for accounting for gain allocated to charitable purposes. It's a comprehensive document designed to address the unique requirements set forth by the Wisconsin Department of Revenue, ensuring estates and trusts accurately report their capital transactions for state tax purposes.

| Question | Answer |

|---|---|

| Form Name | Form 2 Schedule Wd |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ScheduleWD Form2 wisconsin schedule wd form 2 fill in |

SCHEDULE |

WD |

|

CAPITAL GAINS AND LOSSES |

2012 |

|

||||||||||||

(Form 2) |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

Enclose with your Wisconsin Form 2 |

|

|

|

|||||||||

|

|

Wisconsin Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name of estate or trust |

|

|

|

|

|

Decedent's social security number |

Estate or trust federal EIN |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Part I |

|

|

|

|

|

|

||||||||||

|

(a) Description of property |

(b) Date acquired |

(c) Date sold |

(d) Sales price |

(e) Cost or other |

(f) |

LOSS |

(g) GAIN |

|||||||||

|

If (e) is more than (d), |

If (d) is more than (e), |

|||||||||||||||

|

(Example, 100 shares XYZ Co.) |

(mo., day, yr.) |

(mo., day, yr.) |

|

|

basis |

|

||||||||||

|

|

|

|

subtract (d) from (e) |

subtract (e) from (d) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

. |

2 |

|

|

|

|

|

|||||||||

|

3 Net |

3 |

|

|

|

|

|

||||||||||

|

4 Adjustment to capital gain or (loss) for differences between Wisconsin and federal basis |

|

|

|

|

|

|

||||||||||

|

|

from Schedule C of Form 2 |

. . . . . . . . . . . |

. . . . . . . . . . . |

. . . . |

. . . . . . . . . . . |

. |

4 |

|

|

|

|

|

||||

5 |

5 |

|

|

|

|

|

|||||||||||

|

6 Add lines 1 through 5, in columns (f) and (g) |

. |

6 |

( |

|

) |

|

|

|||||||||

|

.7a Net |

. . . . . . . . . . . |

. |

. . . . |

. . . . . . . |

. . . . . . |

7a |

|

|

||||||||

|

7b Nondistributable portion included on line 7a (see instructions) |

|

|

|

|

. |

7b |

|

|

||||||||

|

. |

. . . . |

. . . . . . . |

. . . . . |

|

|

|||||||||||

|

7c Distributable portion included on line 7a (ill in here and on line 3, column (d), of Schedule 2K‑1 if a gain, and |

|

|

||||||||||||||

|

|

|

|||||||||||||||

|

|

on line 11, column (d) of Schedule |

. |

. . . . |

. . . . . . . |

. . . . . . |

7c |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Part II |

|

|

|

|

|

|||||||||||

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 Gain from Form 4797, Part I; |

|

|

|

|

|

|

||||||||||

|

|

. . . . . . . . . . . |

. |

9 |

|

|

|

|

|

||||||||

10 |

Net |

|

|

|

|

|

|||||||||||

11 |

Capital gain distributions |

. . . . . . |

. . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . |

. . . . |

. . . . . . . . . . . |

. |

11 |

|

|

|

|

|

|||

12 Adjustment to capital gain or (loss) for differences between Wisconsin and federal |

|

|

|

|

|

|

|||||||||||

|

|

basis from Schedule C of Form 2 |

. . . . . . . . . . . |

. . . . . . . . . . . |

. . . . |

. . . . . . . . . . . |

. |

12 |

|

|

|

|

|

||||

13 |

13 |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|||||||||||||

14 Add lines 8 through 13, in columns (f) and (g) |

. . . . . . . . . . . |

. |

14 |

( |

|

) |

|

|

|||||||||

15a Net |

. . . . . . . . . . . |

. |

. . . |

. . . . . . . . |

. . . . . |

15a |

|

|

|||||||||

. . . . . . . . .15b Nondistributable portion included on line 15a (see instructions) |

. . . . . . . . . . . |

. |

. . . |

. . . . . . . . |

. . . . . |

15b |

|

|

|||||||||

15c Distributable portion included on line 15a (fill in here and on line 4a, column (d), of Schedule |

|

|

|||||||||||||||

|

|

and on line 11, column (d) of Schedule |

. . . . . . . . . . . |

. |

. . . |

. . . . . . . . |

. . . . . |

15c |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 Schedule WD (Form 2) |

Page 2 |

Name of estate or trust

Decedent's social security number

Estate or trust federal EIN

Part III Summary of Parts I and II (see instructions)

16Combine lines 7b and 15b, and fill in the net gain or (loss) here (if line 16 is a loss, go to line 26) . . . . . 16

17If line 16 shows a gain, fill in the smaller of line 15b or 16. Fill in

there is a loss or no entry on line 15b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Fill in 30% of line 17 * . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19Portion of the amount on line 14, column (g) that is attributable to the nondistributable portion of gain on the sale of farm assets. If zero, skip lines

and fill in the amount from line 18 on line 24 . . . . . . . . . . 19

20Nondistributable portion of the amount from

line 14, column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21Divide line 19 by line 20.

|

Carry the decimal to 4 places |

21 |

. |

|

|

|

|

|

22 |

. . . . . .Multiply line 17 by the decimal amount on line 21 |

22 |

|

|

|

|

|

|

23 |

. . . . . .Fill in 30% of line 22 * |

. . . |

. . . . . . . . . . . . . . 23. . |

|

|

|

|

|

24 |

. . . . . .Add lines 18 and 23 |

. . . |

. . . . . . . . . . . . . .24 |

|||||

25 |

Subtract line 24 from line 16 |

. . . |

. . . . . . . . . . . . . .25 |

|||||

26If line 16 shows a loss, fill in the smaller of:

(a) The loss on line 16, (b) $500, or (c) Wisconsin ordinary income (see instructions) . . . . . . . . . . . . . . . 26

Note: When figuring whether 26a, 26b, or 26c is smaller, treat all numbers as if they are positive.

*If capital gain income is used or set aside for charitable purposes, see instructions.

Part IV Computation of Wisconsin Adjustment to Income (Do not complete this part if you are filing Schedule NR.)

27Adjustment (see instructions for Part IV)

aPortion of the capital gain from federal Form 1041 allocable to the estate

or trust (if a loss, fill in

cIf line 27b is more than line 27a, subtract line 27a from line 27b.

Fill in result here and on line 4 of Schedule A, Form 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27c

dIf line 27b is less than line 27a, subtract line 27b from line 27a.

Fill in result here and on line 9 of Schedule A, Form 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .27d

ePortion of the capital loss from federal Form 1041 allocable to the

estate or trust. Fill in as a positive amount (if a gain, fill in

fFill in loss from line 26 above as a positive amount

(if blank, fill in

gIf line 27f is more than line 27e, subtract line 27e from line 27f. Fill in result here and on line 9 of Schedule A, Form 2 as a positive amount (if you also have an amount on line 27d,

add the amounts on lines 27d and 27g, and fill in only the total) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .27g

hIf line 27f is less than line 27e, subtract line 27f from line 27e. Fill in result here and on line 4 of Schedule A, Form 2 as a positive amount (if you also have an amount on line 27c,

add the amounts on lines 27c and 27h, and fill in only the total) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .27h

Part V

Computation of Capital Loss Carryovers From 2012 to 2013 (Complete this part if the loss on line 16 is more than the loss on line 26.)

28 Fill in loss shown on line 7b as a positive amount. If none, fill in

33 Fill in loss from line 15b as a positive amount. If none, fill in

36Subtract line 31 from line 26, treating both as positive amounts. (Note: If you skipped lines 29

through 32, fill in amount from line 26 as a positive amount.) |

36 |

37 Subtract line 36 from line 35. This is your |

37 |