You'll be able to prepare Form 2220 instantly by using our PDFinity® online tool. FormsPal development team is constantly working to improve the editor and ensure it is even easier for people with its extensive features. Uncover an ceaselessly progressive experience now - explore and uncover new opportunities along the way! To begin your journey, go through these basic steps:

Step 1: Firstly, access the pdf tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: With this handy PDF editing tool, you could accomplish more than merely complete forms. Try all the features and make your docs look great with custom text incorporated, or fine-tune the original content to perfection - all that comes with an ability to incorporate your personal photos and sign the document off.

It really is straightforward to finish the form adhering to this practical guide! This is what you should do:

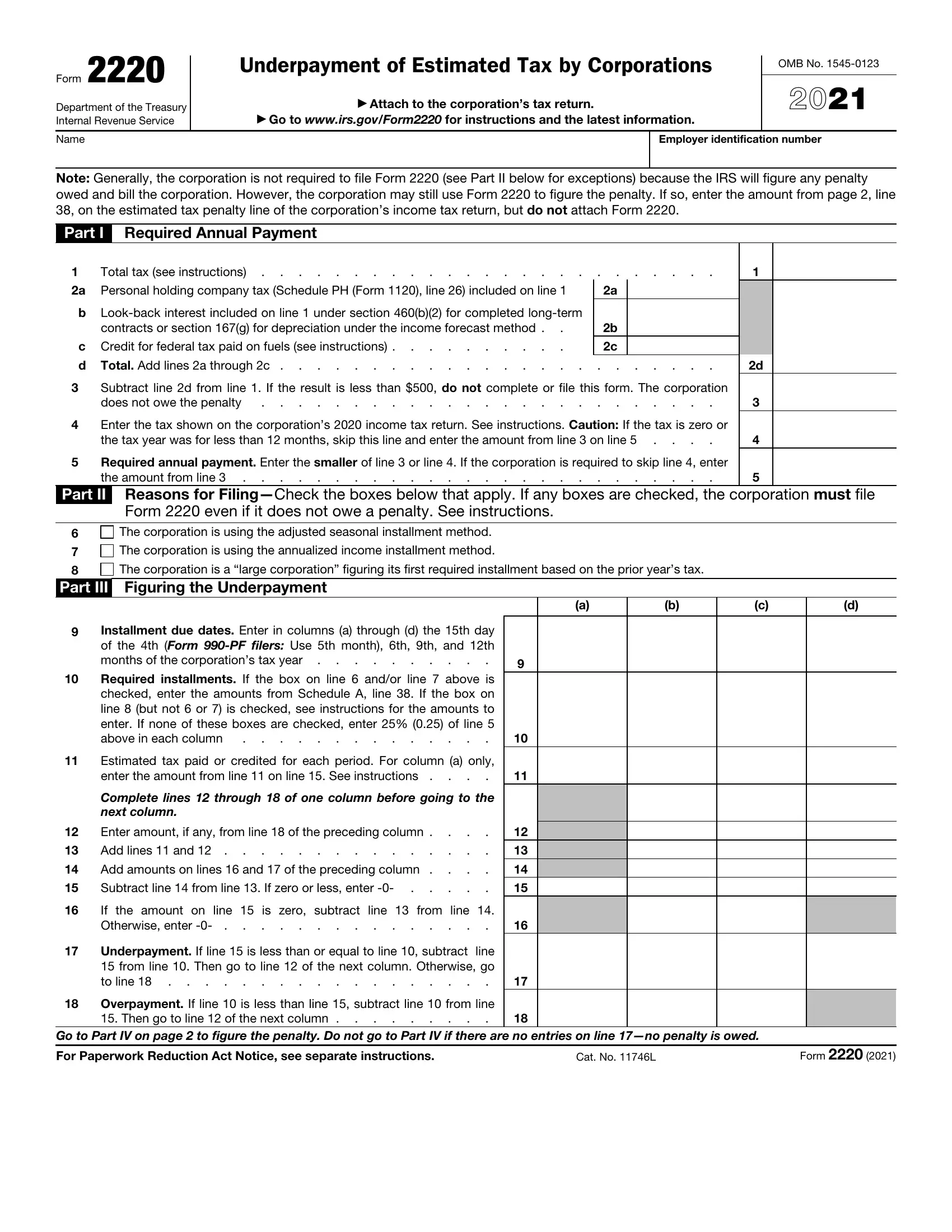

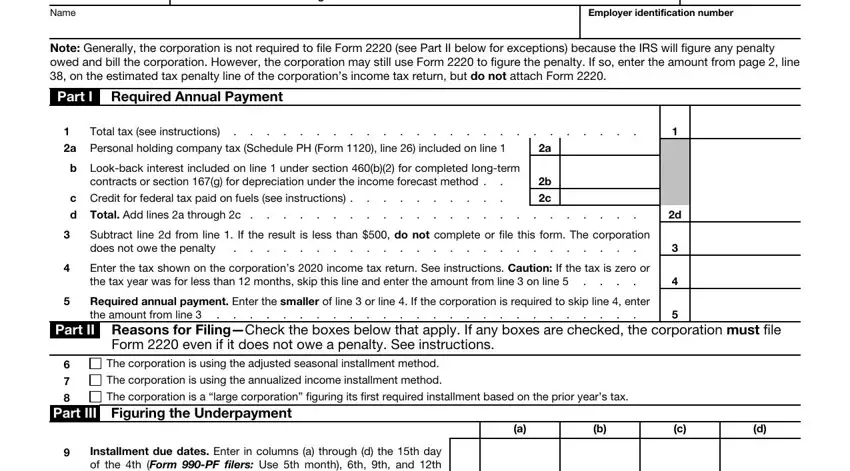

1. Start filling out your Form 2220 with a selection of necessary blanks. Get all of the information you need and make sure there is nothing neglected!

2. Once the last array of fields is completed, you need to add the needed details in Installment due dates Enter in, Required installments If the box, Estimated tax paid or credited for, Complete lines through of one, Enter amount if any from line of, If the amount on line is zero, Underpayment If line is less than, Overpayment If line is less than, Then go to line of the next, Go to Part IV on page to figure, For Paperwork Reduction Act Notice, Cat No L, and Form so you're able to go to the 3rd part.

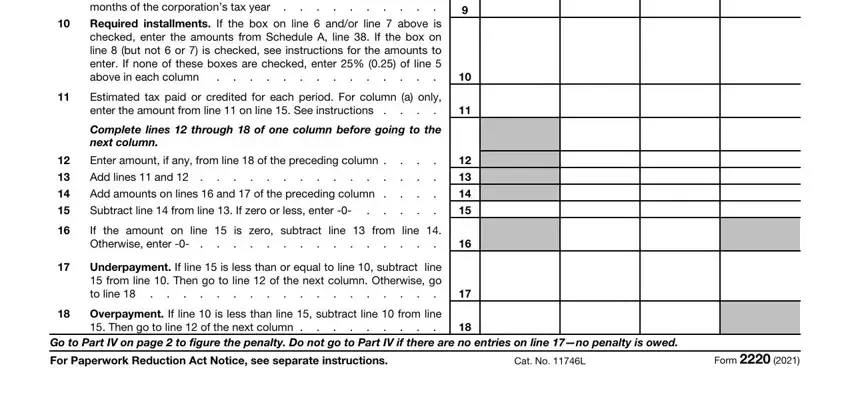

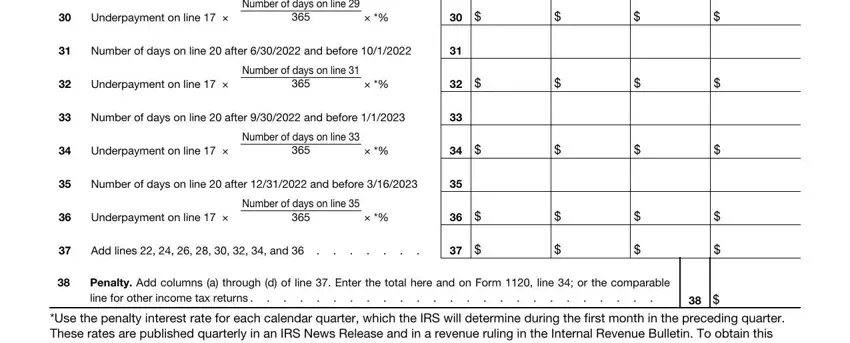

3. This next part will be focused on Part IV Figuring the Penalty, Enter the date of payment or the, Number of days from due date of, Number of days on line after and, Underpayment on line, Number of days on line, Number of days on line after and, Underpayment on line, Number of days on line, Number of days on line after and, Underpayment on line, Number of days on line, Number of days on line after and, Underpayment on line, and Number of days on line - complete these empty form fields.

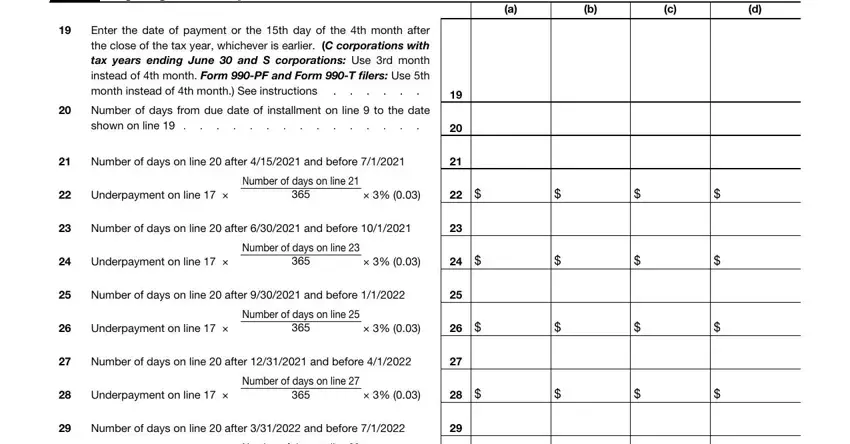

4. Completing Underpayment on line, Number of days on line, Number of days on line after and, Underpayment on line, Number of days on line, Number of days on line after and, Underpayment on line, Number of days on line, Number of days on line after and, Underpayment on line, Number of days on line, Add lines and, Penalty Add columns a through d of, and Use the penalty interest rate for is crucial in this next section - don't forget to don't hurry and fill in every single blank!

Those who use this document frequently make errors while completing Number of days on line in this section. You should definitely read again everything you enter right here.

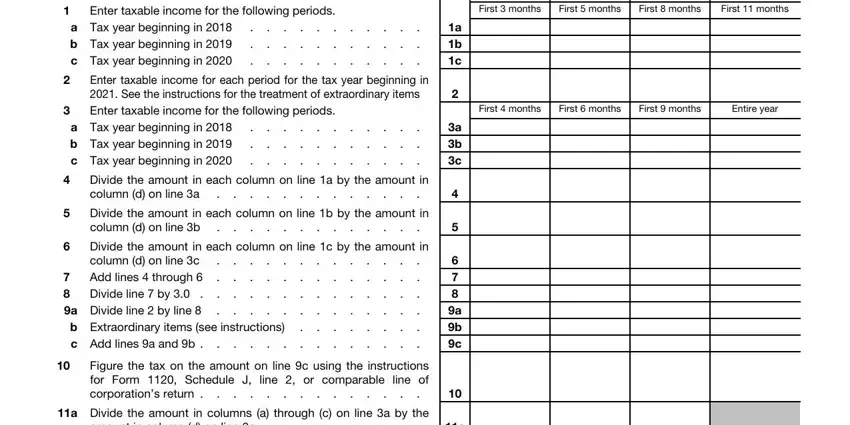

5. While you come near to the completion of your file, you'll notice just a few more things to do. Mainly, Enter taxable income for the, a Tax year beginning in b Tax, Enter taxable income for each, a Tax year beginning in b Tax, Divide the amount in each column, Divide the amount in each column, Divide the amount in each column, b Extraordinary items see, Figure the tax on the amount on, First months, First months, First months, First months, First months, and First months should be filled in.

Step 3: Just after rereading your entries, click "Done" and you're done and dusted! Right after setting up a7-day free trial account here, you'll be able to download Form 2220 or send it via email at once. The form will also be easily accessible from your personal cabinet with your every modification. Here at FormsPal.com, we endeavor to guarantee that all your information is stored secure.