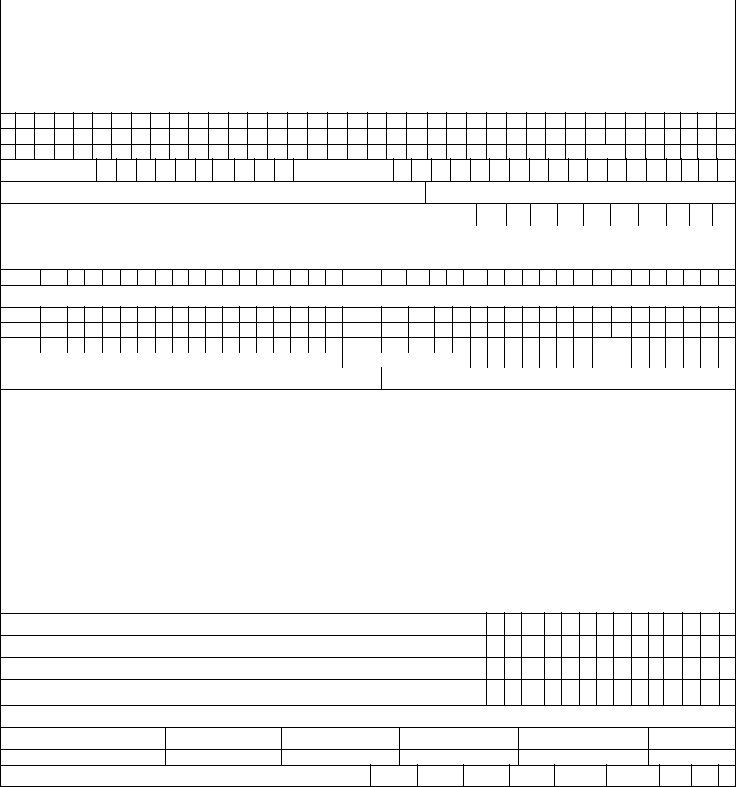

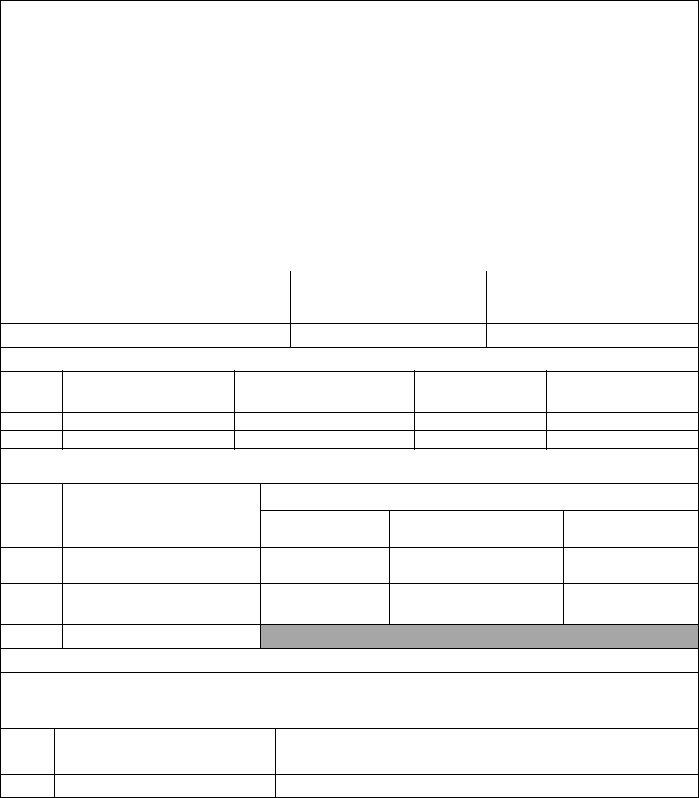

In the realm of financial transactions, particularly in real estate, certain statutory obligations are imposed to ensure transparency and compliance with tax laws. Among these, Form No. 26QB plays a pivotal role, serving as a challan-cum-statement for the deduction of tax under section 194-IA of the Income Tax Act. This form is integral for transactions involving the purchase of property, mandating the buyer to deduct tax at source when the transaction value exceeds a specified limit. The form captures essential details including the financial year, major and minor head codes, as well as the complete identification and address details of both the buyer (transferee/payer) and seller (transferor/payee), alongside the permanent account number (PAN) for both parties. It also requires specifics about the property transaction, such as the complete address of the property, date of agreement, total value of consideration, and details regarding the tax deducted, such as the rate, amount, date of deduction, and payment. Notably, the form facilitates simultaneous e-tax payment or subsequent e-tax payments, underlining the flexibility offered to comply with tax obligations. Additionally, Form No. 16B, which serves as a certificate for tax deducted at source under section 203 of the Income-tax Act, 1961, complements Form No. 26QB by providing a summary transaction and tax deposit details, further emphasizing the comprehensive approach towards ensuring tax compliance in property transactions.

| Question | Answer |

|---|---|

| Form Name | Form 26Qb |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | form 26qb download in word format, 26qb form download in excel, form no 26qb, form 26qb pdf |

http://www.simpletaxindia.net

“Form No.26QB

[ SEE section

Challan

|

Financial Year |

|

|

|

|

|

- |

|

|

|

|

|

Major Head Code* |

|

|

|

|

|

|

|

|

|

|

|

Minor Head Code* |

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permanent Account Number (PAN) of Transferee/ Payer/ Buyer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Category of PAN* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Status of PAN* |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Full Name of Transferee/ Payer/ Buyer* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Complete Address of Transferee/Payer/Buyer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Mobile No.

PIN

Email ID

Whether more than one transferee/payer/buyer (Yes/No)

Permanent Account Number (PAN) of Transferor/ Payee/ Seller

Category of PAN* |

|

Status of PAN* |

|

|

|

|

|

|

|

|

|

Full Name of Transferor/ Payee/ Seller

Complete Address of Transferor/Payee/Seller

PIN

Mobile No. |

|

|

|

|

|

|

|

|

|

Email ID |

|

|

|

Whether more than one transferor/payee/seller (Yes/No)

Complete Address of Property transferred

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PIN |

|

|

|

|

|

|

|

|

||

Date of Agreement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Value of Consideration |

|

|

|

|

|

|

Payment in installment or |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

/Booking** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Amount in Rs.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Amount Paid/Credited (in Rs.) |

|

|

|

|

Date of |

|

|

Rate at which |

|

|

Amount of tax |

|

|

|

Date of Deduction** |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

payment/credit** |

|

|

|

deducted |

|

deducted at source |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Date of Deposit** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mode of payment |

|

|

Simultaneous |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Details of Payment of Tax Deducted at Source (Amount in Rs.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

TDS (Income Tax)(Credit of tax to the deductee shall be given for this amount)

Interest

Fee

Total payment

Total Payment in Words (in Rs.)

Crores

Lakhs

Thousands

Hundreds

Tens

Units

Unique Acknowledgement no. (generated by TIN)

*To be updated automatically ** In dd/mm/yyyy format.”.

http://www.simpletaxindia.net

|

“FORM NO.16B |

|

|

|

|

|

[See rule 31(3A)] |

|

|

|

|

Certificate under section 203 of the |

||

|

|

|

Certificate No. |

|

Last updated on |

|

|

|

Name and address of the Deductor |

|

Name and address of the Deductee |

(Transferee/Payer/Buyer) |

|

(Transferor/Payee/Seller) |

|

|

|

|

|

|

PAN of the Deductor

PAN of the Deductee

Financial Year of deduction

Summary of Transaction (s)

S. No.

Unique Acknowledgement

Number

Amount Paid/Credited

Date of payment/credit

(dd/mm/yyyy)

Amount of tax deducted and deposited in respect of the deductee

Total (Rs.)

DETAILS OF TAX DEPOSITED TO THE CREDIT OF THE CENTRAL GOVERNMENT FOR WHICH CREDIT IS TO BE GIVEN TO THE

DEDUCTEE

S. No. |

Amount of tax deposited in respect of |

|

|

|

deductee |

|

(Rs.) |

Challan Identification number (CIN)

BSR Code of the |

Date on which tax |

Challan Serial |

Bank Branch |

deposited (dd/mm/yyyy) |

Number |

1.

2.

Total (Rs.)

Verification

I,…………….., son/daughter of …………. in the capacity of ……. (designation) do hereby certify that a sum of (Rs.) ………….. [Rs. ………….(in

words)] has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of account, documents,

Place

Date

(Signature of person responsible for deduction of tax)

Full Name:”;