Navigating through the complexities of tax correction procedures, the Form 307 stands out as a critical document for businesses operating within the regulatory framework of the Maharashtra Value Added Tax Act, 2002. Designed to facilitate the rectification of mistakes made in previous tax filings, this application serves as a beacon of relief for entities seeking to amend inaccuracies without navigating through the often cumbersome process associated with tax disputes. By submitting this form, businesses can clearly outline the nature of the mistake, provide detailed contact and registration information, and succinctly argue their case for the necessary adjustments to their tax records. Importantly, the form also allows for the temporary suspension of recovery actions for the amount in question, giving businesses crucial breathing room while their application is under review. Emphasizing accountability and precision, the Form 307 is not only a testament to the system's flexibility but also to its commitment to fairness and rectitude in handling tax matters, as evidenced by the specific guidelines for its submission, including a narrative of the grounds on which the rectification is sought and the option to annex additional pages if the explanation demands further detail.

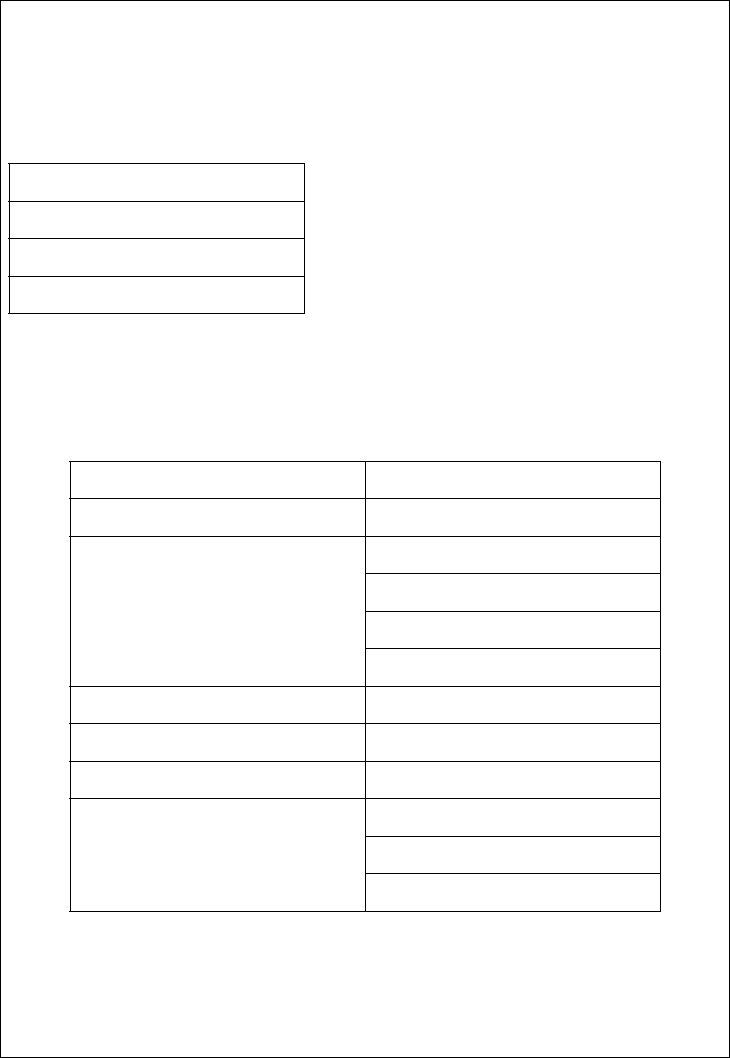

| Question | Answer |

|---|---|

| Form Name | Form 307 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | form 307 mvat online, form 307 mvat in word format, form 307 under mvat in excel, form 307 rectification |

FORM 307

(See rule 28)

Application for the rectification of mistake under

Maharashtra Value Added Tax Act, 2002

To

Subject:- Application under

Sir,

I/We, the undersigned, herewith apply for rectification of the mistake. The details are as follows.

Name of the dealer

M.V.A.T.R.C.No.

Address of the place of business

Order passed by

Order No and Date

The quantum of relief sought

Brief narration of the grounds on which the rectification is sought*

I/We, request you to consider the above mentioned facts and pass the necessary rectification Order and also grant a stay for recovery of amount equal to the quantum of relief sought.

RUSHABH INFOSOFT LTD.

|

Yours faithfully |

Date _______________ |

Signature _____________________ |

Place ______________ |

Designation and Status __________________ |

* Annex a separate page, if necessary |

|

RUSHABH INFOSOFT LTD.