Form 307 is an important document for businesses and individuals alike. This form is used to report taxable income and to claim deductions or tax credits. It's important to understand the contents of Form 307 so that you can accurately file your taxes. In this blog post, we'll provide an overview of Form 307 and explain how to complete it correctly. Stay tuned for more tax-related posts in the coming weeks!

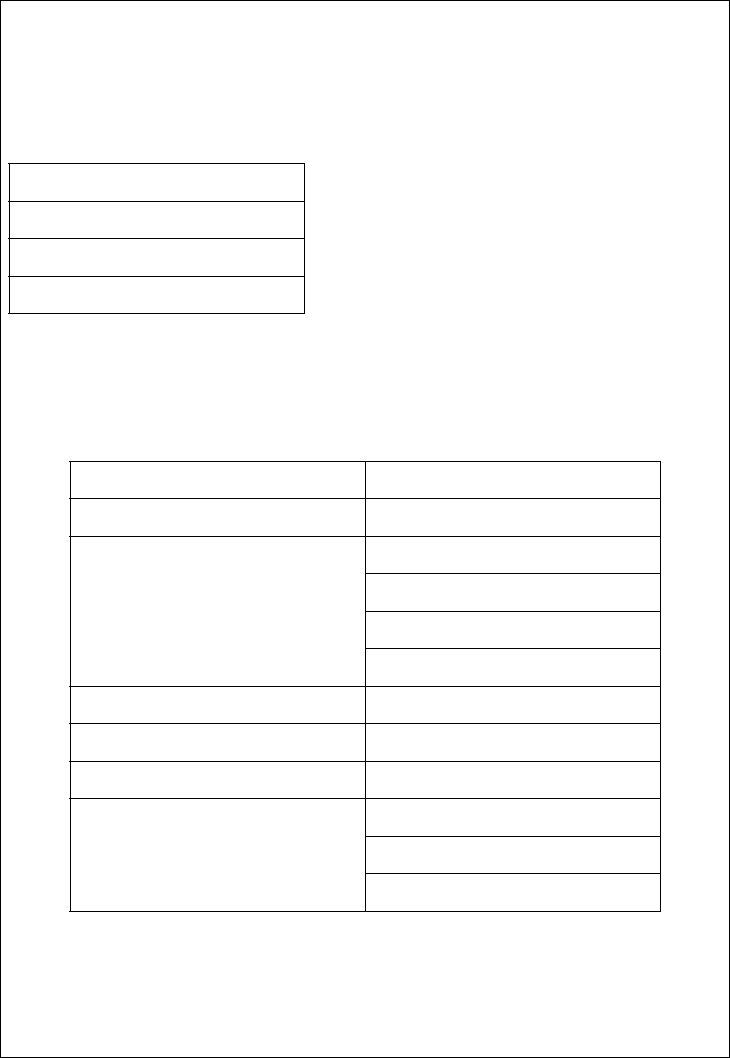

| Question | Answer |

|---|---|

| Form Name | Form 307 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | form 307 mvat online, form 307 mvat in word format, form 307 under mvat in excel, form 307 rectification |

FORM 307

(See rule 28)

Application for the rectification of mistake under

Maharashtra Value Added Tax Act, 2002

To

Subject:- Application under

Sir,

I/We, the undersigned, herewith apply for rectification of the mistake. The details are as follows.

Name of the dealer

M.V.A.T.R.C.No.

Address of the place of business

Order passed by

Order No and Date

The quantum of relief sought

Brief narration of the grounds on which the rectification is sought*

I/We, request you to consider the above mentioned facts and pass the necessary rectification Order and also grant a stay for recovery of amount equal to the quantum of relief sought.

RUSHABH INFOSOFT LTD.

|

Yours faithfully |

Date _______________ |

Signature _____________________ |

Place ______________ |

Designation and Status __________________ |

* Annex a separate page, if necessary |

|

RUSHABH INFOSOFT LTD.