By using the online tool for PDF editing by FormsPal, it is possible to fill out or edit Fillable ... here and now. To make our editor better and more convenient to work with, we constantly implement new features, considering feedback from our users. It just takes a couple of easy steps:

Step 1: Hit the "Get Form" button at the top of this webpage to open our editor.

Step 2: This tool grants the opportunity to customize almost all PDF forms in many different ways. Transform it by adding your own text, adjust what is already in the file, and include a signature - all when it's needed!

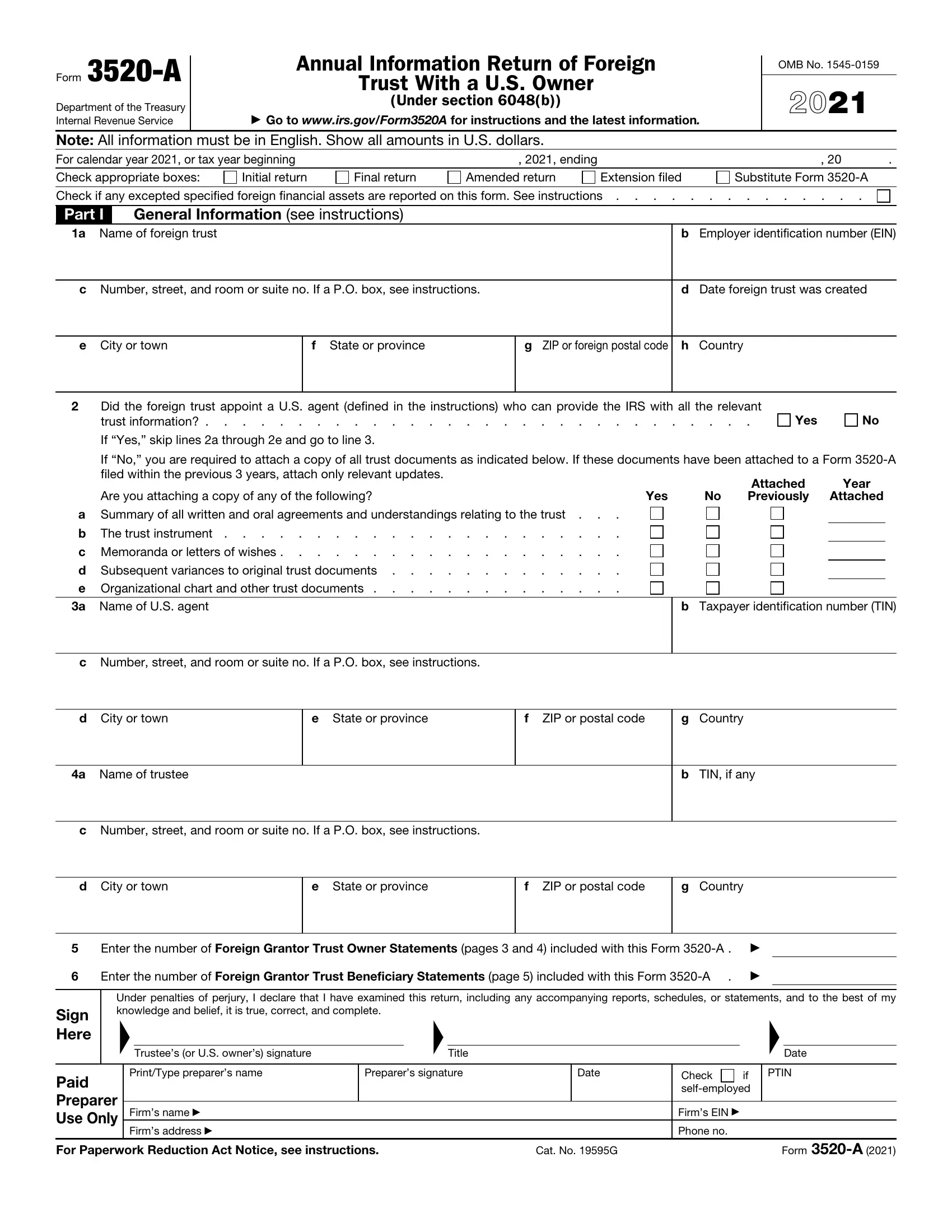

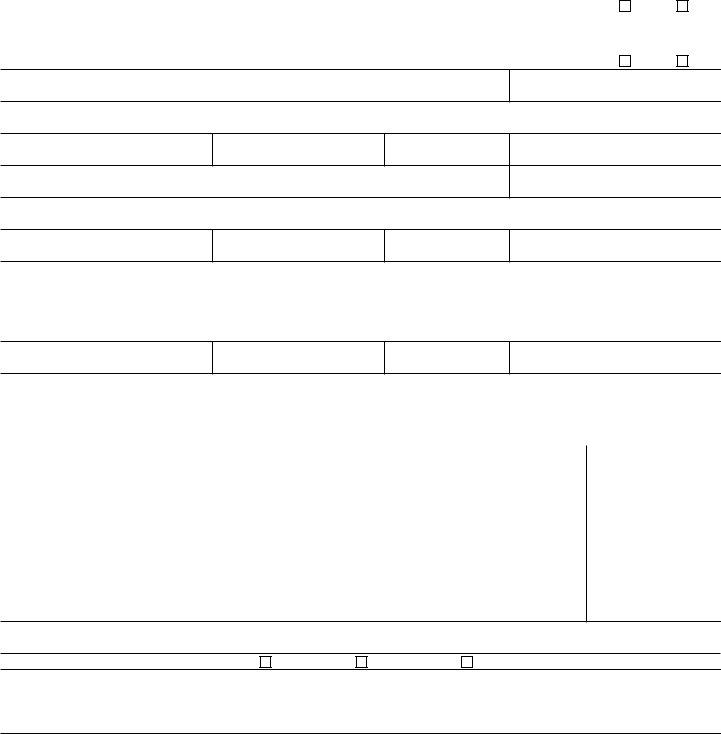

When it comes to blank fields of this specific form, here is what you should know:

1. Before anything else, once filling out the Fillable ..., start with the page that has the following blanks:

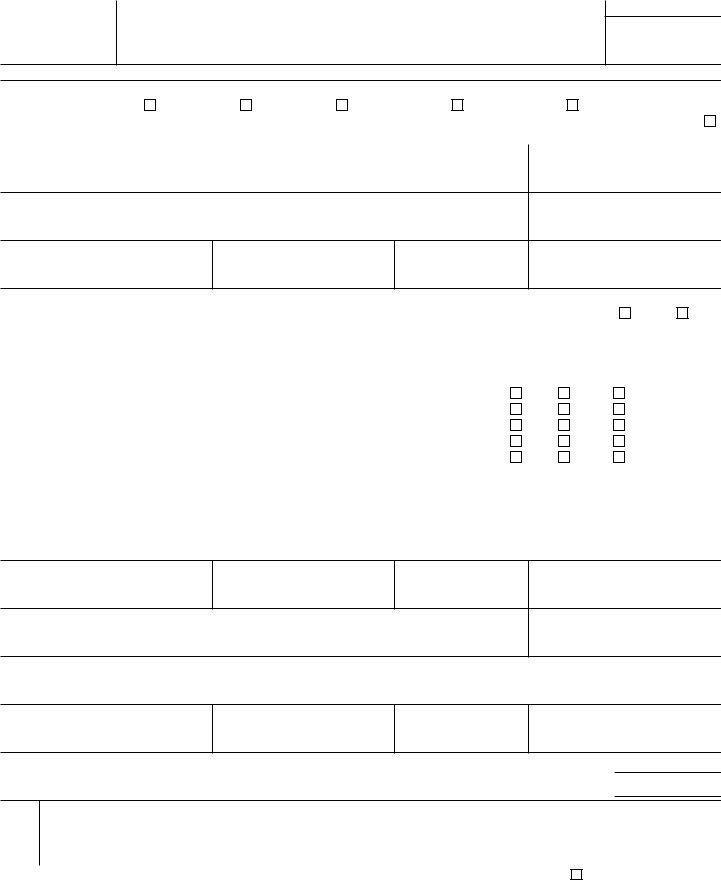

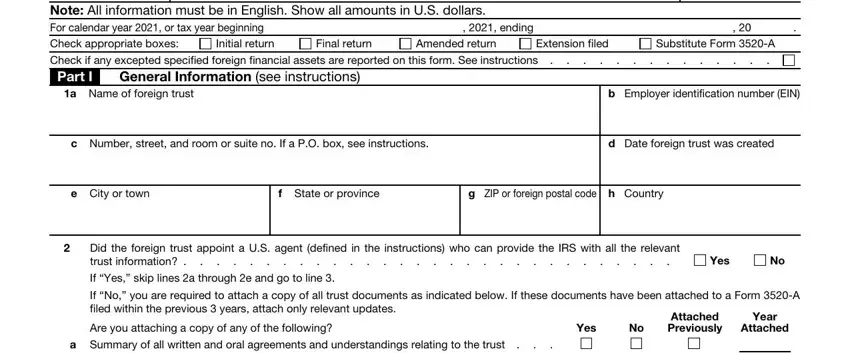

2. Once the previous segment is finished, it is time to insert the necessary specifics in a Summary of all written and oral, a Name of US agent, b Taxpayer identification number, c Number street and room or suite, d City or town, e State or province, f ZIP or postal code, g Country, a Name of trustee, b TIN if any, c Number street and room or suite, d City or town, e State or province, f ZIP or postal code, and g Country in order to go further.

It is possible to get it wrong when filling in the a Name of US agent, for that reason you'll want to take another look before you send it in.

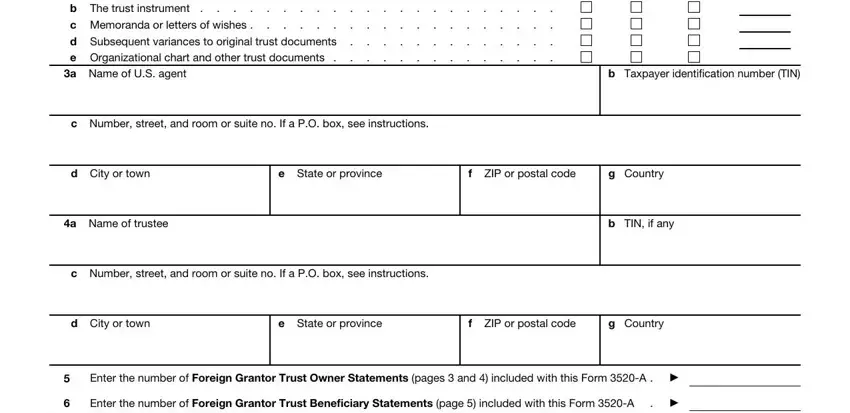

3. Within this part, take a look at Under penalties of perjury I, Sign Here, Trustees or US owners signature, Title, Paid Preparer Use Only, PrintType preparers name, Preparers signature, Date, Firms name Firms address, Date, PTIN, Check if selfemployed, Firms EIN, Phone no, and For Paperwork Reduction Act Notice. Each one of these need to be filled out with greatest attention to detail.

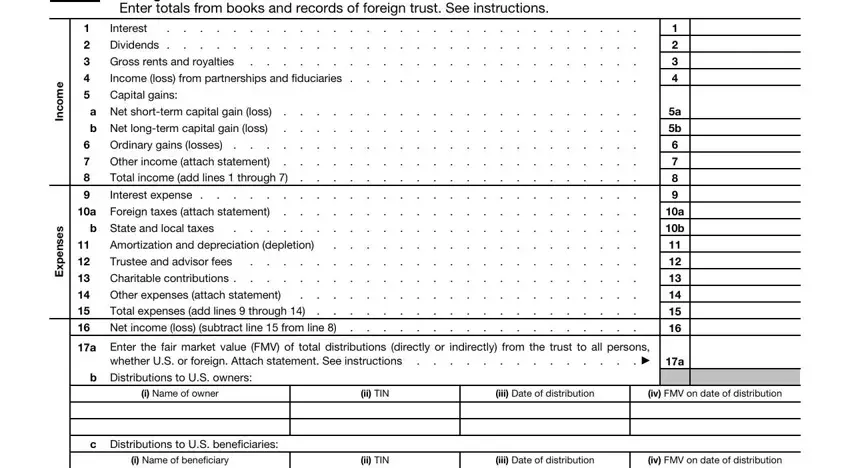

4. To move forward, the next section involves completing a couple of fields. These comprise of Part II, Foreign Trust Income Statement, e m o c n, s e s n e p x E, Interest Dividends Gross, a Net shortterm capital gain loss, b State and local taxes, Interest expense Foreign taxes, Amortization and, a Enter the fair market value FMV, whether US or foreign Attach, b Distributions to US owners, i Name of owner, ii TIN, and iii Date of distribution, which you'll find essential to continuing with this particular PDF.

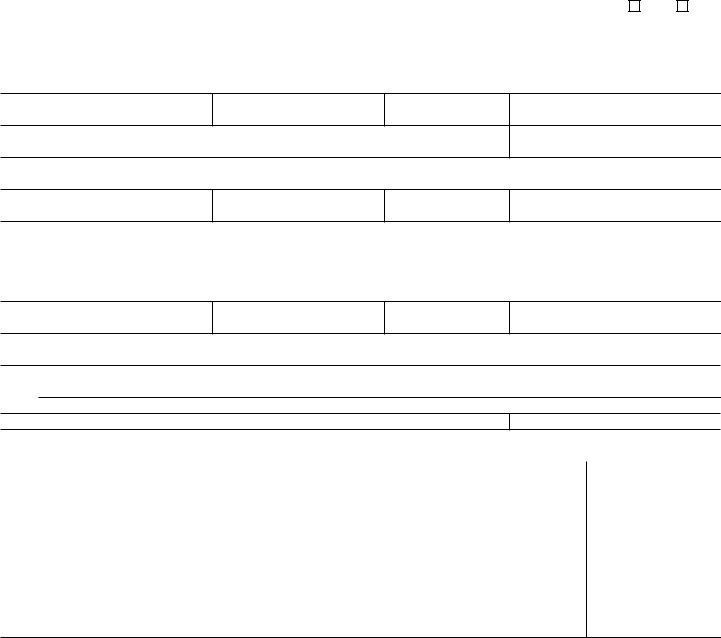

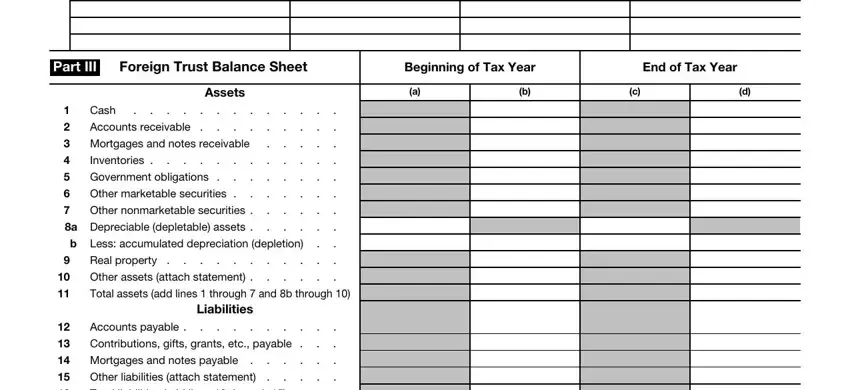

5. Because you reach the end of your file, there are several extra requirements that should be fulfilled. In particular, Part III, Foreign Trust Balance Sheet, Beginning of Tax Year, End of Tax Year, Assets, Cash Accounts receivable, Real property Other assets attach, Liabilities, and Accounts payable Contributions should be filled out.

Step 3: Right after you've looked over the details you filled in, click on "Done" to conclude your document creation. Download the Fillable ... when you sign up for a free trial. Quickly access the pdf form within your FormsPal cabinet, together with any edits and adjustments being automatically synced! If you use FormsPal, you can complete forms without having to be concerned about personal information breaches or data entries getting shared. Our protected platform helps to ensure that your private details are maintained safe.