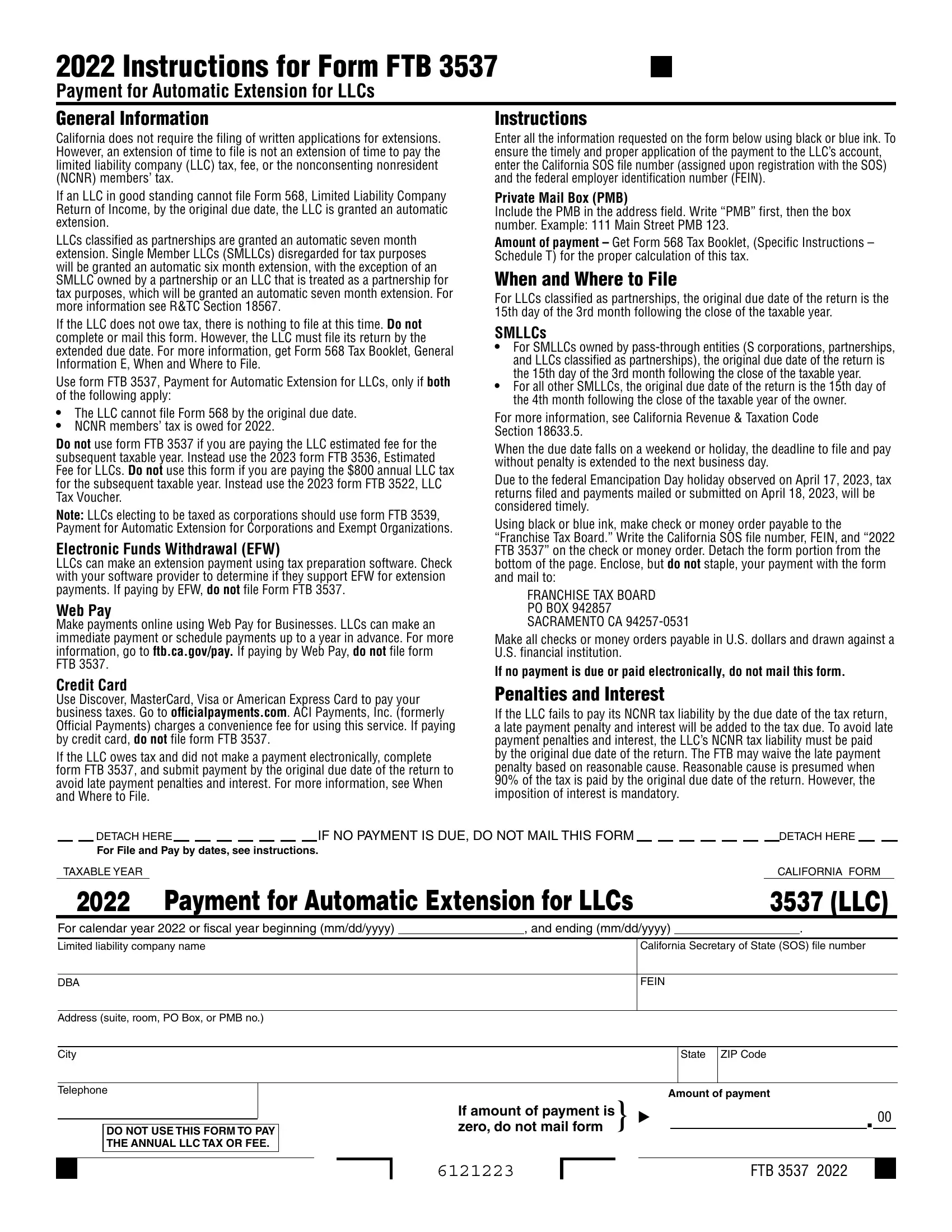

3537 can be filled in online very easily. Just try FormsPal PDF tool to accomplish the job right away. FormsPal is committed to providing you the ideal experience with our tool by consistently adding new functions and improvements. Our tool is now much more user-friendly as the result of the newest updates! Currently, editing PDF forms is easier and faster than ever before. To start your journey, go through these easy steps:

Step 1: Firstly, open the tool by clicking the "Get Form Button" above on this webpage.

Step 2: Using this state-of-the-art PDF file editor, you can actually accomplish more than just complete forms. Express yourself and make your docs seem faultless with custom text added in, or fine-tune the original content to perfection - all that comes along with an ability to add your personal graphics and sign it off.

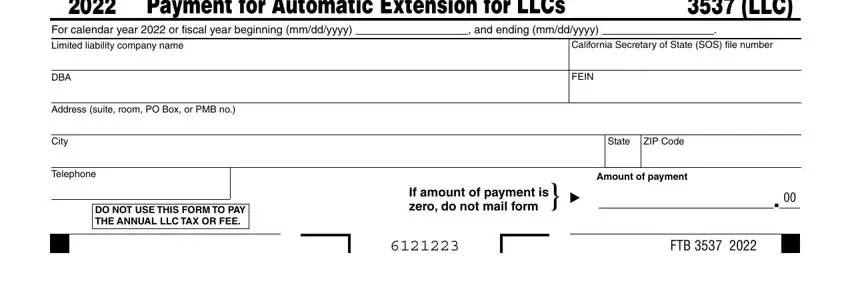

This document will require specific info to be filled in, thus make sure you take the time to type in what is asked:

1. Complete the 3537 with a number of necessary blanks. Note all the information you need and make sure absolutely nothing is missed!

Step 3: Before obtaining the next stage, make sure that blanks were filled in the proper way. The moment you determine that it's good, click “Done." Create a 7-day free trial account with us and get instant access to 3537 - which you'll be able to then work with as you want from your personal account page. We don't share or sell any information that you enter when dealing with documents at our site.