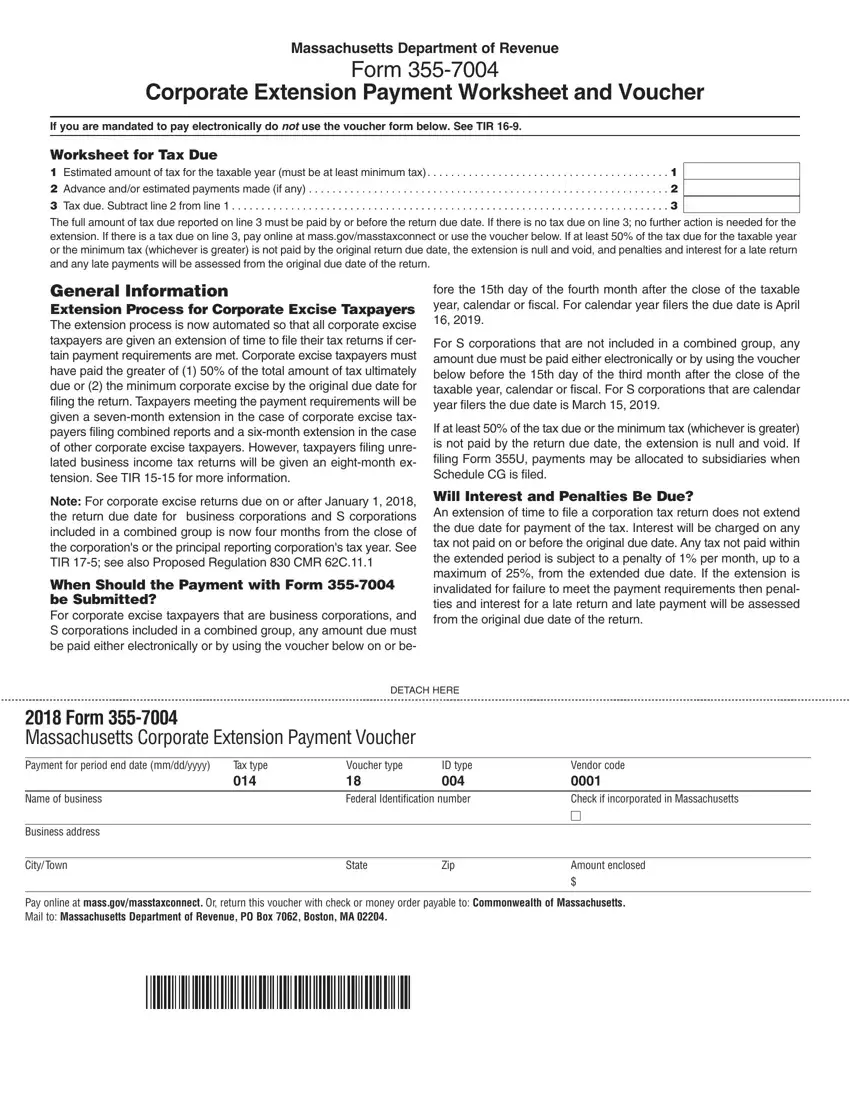

Our PDF editor works to make submitting documents effortless. It is extremely easy to edit the [FORMNAME] document. Follow all of these actions in order to accomplish this:

Step 1: On the following website page, hit the orange "Get form now" button.

Step 2: You can now update the massachusetts corporate extension. This multifunctional toolbar will let you add, remove, modify, and highlight text or perhaps undertake many other commands.

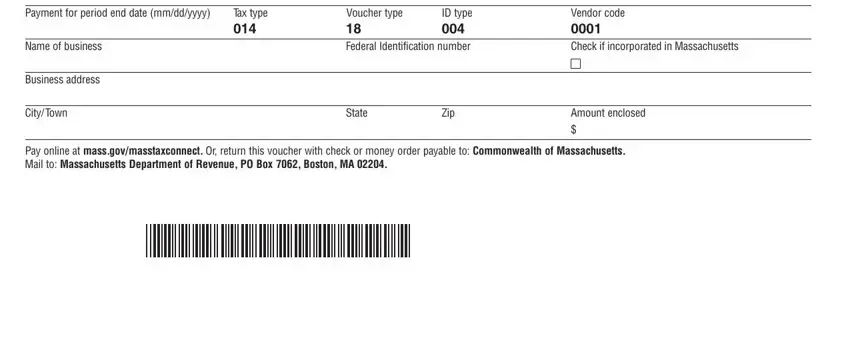

Type in the required information in every single section to complete the PDF massachusetts corporate extension

Step 3: Click the button "Done". The PDF form can be exported. You may save it to your device or email it.

Step 4: Get a copy of any file. It may save you time and help you keep clear of difficulties later on. Also, your details won't be used or viewed by us.